A guide to how mortgage insurance works in Canada (2024)

Mortgage insurance is typically offered by a mortgage lender. The coverage pays off your mortgage debt if something happens to you if your mortgage is still outstanding. Your home is often your most valuable asset, both financially and emotionally, and it’s important it is protected should something unfortunate happen to you. Term life insurance is often a more flexible and cost-effective way to cover your mortgage debt.

What is mortgage insurance?

In Canada, mortgage insurance is a financial protection product otherwise known as creditor insurance. It is typically offered by your mortgage lender. In the unfortunate event of your death, if your mortgage is still outstanding, mortgage insurance pays the debt you owe to your bank for your mortgage loan.

An example of how mortgage insurance works

Let’s say you are purchasing a house for $100,000.

- You pay a 15% down payment ($15,000).

- The amortization period is 25 years.

- Leaving an $85,000 mortgage loan that you need to pay off over the next 25 years.

If you die within this 25-year period, your lender still expects to be paid back. Without this insurance, your family or your estate will need to come up with $85,000 by dipping into their savings or selling the property to settle the mortgage loan.

Mortgage insurance ensures that the mortgage loan is paid off in these circumstances. This kind of insurance is sometimes referred to as mortgage life insurance or private mortgage insurance.

Read our full review of the Best Mortgage Insurance Companies in Canada.

What are the different types of mortgage insurance?

Different kinds of mortgage insurance protect your home in varying ways. In this post, we’ll describe all the options you come across, including:

- Mortgage default insurance

- Mortgage loan insurance

- Mortgage protection insurance

- And many more.

What is mortgage default insurance?

This type of insurance is a completely different coverage. Mortgage default insurance pays the outstanding loan balances if you default on your payments for whatever reason ((not just the event of your death, but also job loss, income loss, etc.). The purpose of this insurance is primarily to protect lenders from borrower default.

There is no payout to you. The payout goes directly to the bank to cover the mortgage. You do not pay monthly mortgage default insurance premiums. The cost of this insurance is paid when you make your downpayment. Your need for it has nothing to do with your credit scores.

You need default insurance to qualify for your mortgage if…

- Your initial down payment for your mortgage is less than 20% of your purchase price (but more than the 5% minimum down payments required)

- Your potential home price is below $1-million

Mortgage default insurance is offered by the Canada Mortgage and Housing Corporation (CMHC) or private a mortgage insurance company like Genworth Financial Canada and Canada Guaranty. It is sometimes referred to as CMHC Mortgage Loan Insurance.

Benefits of mortgage loan insurance include:

- Letting more Canadians enter the housing market (there is less risk of default to the lender with a CMHC backed mortgage)

- Getting a lower mortgage renewal rate with an insured mortgage

To learn more about how mortgage default insurance works and how much it costs, head to our CMHC Mortgage Default Insurance Calculator.

Do I need to buy mortgage insurance?

No, mortgage insurance is not mandatory to qualify for your mortgage. But your lender making it seem like it is. That’s because it protects them—not you.

However, it is smart to consider protecting the outstanding balance of your mortgage. A term life insurance policy that matches your mortgage term is a cost-effective way to protect your mortgage debt.

Read more about if life insurance is mandatory to qualify for a mortgage.

Mortgage insurance alternatives

Term life insurance can provide the same security as traditional mortgage insurance. This alternative is referred to as mortgage protection insurance. It is usually a more affordable option and provides more flexible coverage.

How to cover a mortgage debt with life insurance

Protecting a mortgage with life insurance works by getting term life insurance that is in force during the amortization period of your mortgage.

Your beneficiaries are entitled to a tax-free death benefit that never reduces and can be applied to whatever they choose through mortgage protection insurance.

Private mortgage insurance, as it is sometimes called, offers the same security throughout the riskiest years of your mortgage loan, with several additional benefits not offered by conventional loan:

- You can get coverage well beyond the amount of your mortgage balance

- You get to pick your own beneficiary, instead of paying for insurance to protect the lender

Learn more about mortgage protection through term life insurance.

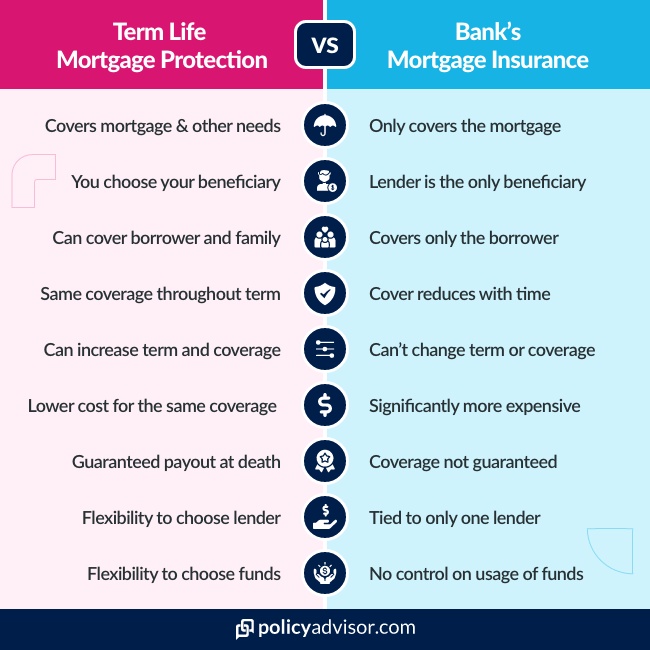

Term life insurance versus mortgage insurance – which is better?

While mortgage insurance pays off one’s mortgage in the event the borrower dies, other products can do a better job at protecting a mortgage debt.

A term life insurance policy can offer you better mortgage protection in a number of ways:

- The policyholder chooses the beneficiary

- In turn, the beneficiary can choose exactly how the benefit is used

- The benefit can go towards paying off the mortgage and/or other uses, like servicing other debts or handling final expenses

Learn more about mortgage insurance versus life insurance.

How much mortgage insurance do I need?

How much mortgage coverage you need depends on the value and cost of your home and several other facts. Unfortunately, you don’t get much of a choice if you go through your lender – the coverage amount is tied to the value and term of your mortgage loan.

However, life insurance allows you to cover your mortgage loan balance and many other financial needs, including:

- child care

- education costs

- your family’s future living expenses

- funeral expenses

- anything your beneficiaries wish

Our insurance calculator can help you find out exactly how much coverage you need.

Learn more about how much life insurance you need.

Why is mortgage insurance expensive?

Lender-provided mortgage insurance is expensive because there is no underwriting. Underwriting is the process an insurance company goes through to determine the appropriate fees for taking on the financial risk of your death.

Without this stringent evaluation process, they are more blindly taking on the financial risk of your policy paying out.

Read more about why mortgage insurance is so expensive.

Why is life insurance cheaper than mortgage insurance?

Term life insurance is cheaper than mortgage life insurance because it goes through full underwriting. If insuring you is less risky, then your monthly premiums are less expensive.

Learn more about the cost of life insurance.

How much does mortgage insurance cost?

The cost of mortgage insurance can be 2-4 times as much as a term life insurance policy. In the below table, you can see just how affordable term insurance can be.

| Coverage | 10-Year Term | 20-Year Term |

|---|---|---|

| $250,000 | $11/month | $14/month |

| $500,000 | $15/month | $22/month |

| $1,000,000 | $24/month | $35/month |

*Premium payments for female, non-smoker, 30-years old

Learn more about how to save money on mortgage insurance.

Frequently Asked Questions

Is mortgage insurance guaranteed?

No, mortgage insurance is not guaranteed. With lender-provided insurance coverage, the claim is evaluated at your death to see if there is any reason why it should not be paid out. For instance, if you had a health condition at the time of getting a policy from your lending institution and it was not disclosed, they will most likely not payout.

Alternatively, term life insurance offers guaranteed coverage. This means a much higher probability of a payout without any hassle.

Do mortgage insurance premiums reduce as you pay off your mortgage?

No, even as your mortgage loan reduces over the mortgage term, you still pay the same original insurance premium. Essentially, the policy’s value diminishes over time. It will never be more valuable than in the first few years of your mortgage, despite you paying the same mortgage insurance premium throughout.

How do I pay for mortgage insurance?

With traditional mortgage insurance provided by your bank or mortgage lender, the premiums are built into your monthly mortgage payment and tied exclusively to your mortgage contract. Although your mortgage and coverage decrease over time as you pay off your mortgage, your premiums will remain the same, if not increase.

But private mortgage insurance (mortgage protection insurance or term life insurance) from a third party is an insurance contract separate from your mortgage. This means you pay your monthly premiums separately from your mortgage payment. Additionally, if you move or change the terms of your mortgage, your policy stays in force. In other words, a private mortgage protection policy is portable.

Can I cancel my mortgage insurance?

Yes, you can cancel mortgage insurance. However, like with all insurance plans, we suggest you don’t cancel it unless you have alternative coverage ready to replace it.

What happens to my mortgage insurance if I sell my house?

If you sell your house, your lender-provided mortgage insurance is tied to the lender. When you sell your house, switch mortgage providers, or do anything else that ends your relationship with that particular lender, the corresponding mortgage insurance policy is cancelled.

Term insurance offers consistent protection throughout your housing situation. The agreement is separate from your property.

Does my beneficiary have to spend the benefit on the mortgage?

With the lender-provided option, you don’t have any say in the matter. Once the policy is activated, all transactions are handled by the suits at the bank or lender’s office until they deliver a deed to your family or estate.

Term life insurance instead gives your beneficiary the freedom to do what they want with the payout. They may want to pay off the mortgage or use the funds on other needs at that time. Ultimately, you are leaving them the choice.

Where do I get mortgage insurance?

You can only get mortgage insurance from the lender who provided your mortgage loan.

However, term insurance is available from several companies nationwide and the expert advisors at PolicyAdvisor have reviewed them all. We can help you find the best provider to protect your mortgage and make insurance part of your financial plan. Contact us below for advice on protecting your foray into the real estate market, or other needs like critical illness insurance or disability coverage.

Learn more about the best life insurance companies in Canada.

1-888-601-9980

1-888-601-9980