Best Group Insurance in Alberta

Get an affordable group health insurance quote within minutes

Comprehensive group health insurance in Alberta

With over 120,324 businesses operating in Alberta, small businesses form the backbone of the province’s economy. Offering group benefits in Alberta helps companies attract skilled employees, improve retention, and provide essential health, dental, and life insurance coverage amid economic fluctuations.

Why offer group benefits in Alberta?

Alberta’s business environment is unique, with fluctuating oil prices and a cost-conscious entrepreneurial mindset. Group benefits allow employers to offer financial protection and healthcare support while remaining flexible to economic changes.

With 92% of employees stating that workplace support for mental wellness is crucial, yet 32% feeling their employer falls short, offering comprehensive group health insurance is essential for attracting and retaining a productive workforce in Alberta. (Source: Benefits Canada Healthcare Survey)

Small business group benefits in Alberta

For Alberta’s small businesses, an effective group benefits plan provides employees with essential coverage while allowing employers to manage costs efficiently.

At PolicyAdvisor, our experts help you compare and customize the best plans starting at just $80 per month, from over 30 top Canadian providers to find coverage that fits your budget and workforce needs.

How to set up employee benefits in Alberta?

Setting up a small business benefits plan is a simple process that includes the following steps:

- Sign-up & setup: Complete and sign documents with your advisor; setup takes up to two weeks

- Employee enrollment: Employees receive an activation email to enroll

- Billing: The first billing statement is issued after employee enrollment

- Plan activation: Employees can start using their benefits

- Administrator access: Credentials provided for the admin portal, with insurer guidance

I need group insurance. Where do I start?

Our calculator gets you the right quotes and the lowest rates.

Average cost of benefits per employee in Alberta

The average cost of an employee benefits package depends on employee demographics, claims history, and plan details. Typical costs vary between:

- $80-$200/month/employee for a very basic plan

- $100-$250/month/employee for a more enhanced plan

- $150-$350/month/employee for comprehensive coverage

Larger groups pay less per employee, while small business group benefits in Alberta depend more on industry type and claims history.

| Factor | Impact on cost |

|---|---|

| Business size | Larger groups benefit from lower per-employee costs |

| Plan type | Basic plans are more affordable; comprehensive plans cost more |

| Employer contribution | Employers typically cover 50% to 100% of premiums |

| Employer demographics | Older or higher-risk employees may increase premium costs |

| Industry risk level | High-risk industries (e.g., construction) often face higher group benefit rates |

Customizable group benefits for Alberta businesses

Alberta’s economy includes industries like energy, agriculture, technology, and retail. A flexible group benefits plan allows businesses to customize coverage to meet industry-specific needs while staying cost-effective.

Many group plans also offer Health Spending Accounts (HSAs), which are a great option for small businesses looking to provide tax-efficient, flexible healthcare benefits without the higher costs of traditional insurance.

| Coverage/Plan | Basic | Standard | Enhanced |

|---|---|---|---|

| Health (Single) | $50/month | $70/month | $92/month |

| Health (Family) | $110/month | $170/month | $195/month |

| Dental (Single) | $30/month | $60/month | $81/month |

| Dental (Family) | $170/month | $200/month | $250/month |

| Life Insurance & AD&D ($25,000/$50,000/$75,000) | $12/month | $18/month | $26/month |

| Total (20 employees) | $3,000/month | $4,100/month | $5,500/month |

| Cost per employee | $150/month | $205/month | $275/month |

What do employee benefits plans in Alberta cover?

Small business employee benefits in Alberta typically cover a range of health-related expenses, including prescription drugs (from 70% up to 100% coverage, depending on the plan), health practitioners like physiotherapists or chiropractors, counselling services, and vision care.

Most plans also include travel insurance with unlimited trips of up to 90 days and $5 million in emergency medical coverage. Coverage levels and monthly premiums vary by plan type and family status, with costs ranging from $35 to $324 per employee each month.

How to get a free group quote?

Looking for a free Alberta group benefits quote? Reach out to our team of licensed group insurance advisors at any time. We’re happy to help walk you through it or find the best plan for you!

Looking for affordable employee benefits?

Call us at 1-800-601-9980 to speak with our licensed advisors right away, or schedule a time with them below.

Who is eligible for small business employee benefits in Alberta?

Businesses of all sizes can access group benefits, even those with just one employee. Group benefits for small business Alberta plans are designed to be flexible and affordable so that every employer can meet their team’s unique needs.

To qualify for small business group benefits in Alberta, businesses typically need:

- At least one full-time employee (owners can often be included)

- A stable source of revenue to maintain contributions

- Employer contribution to premiums (usually 50% or more)

Benefits of group health insurance for small businesses in Alberta

A Canada Benefits survey reveals that 79% of employees prefer benefits over a pay raise! So, as a small business, offering group benefits helps:

- Attract and retain talent

- Save costs due to risk pooling

- Improve employee retention

- Provide financial security

- Save on tax-deductible premiums

- Boost productivity, morale, and overall wellness

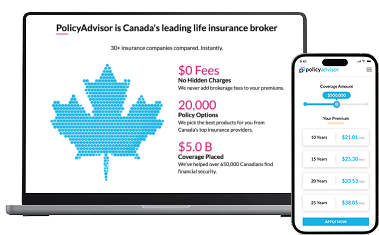

Why PolicyAdvisor?

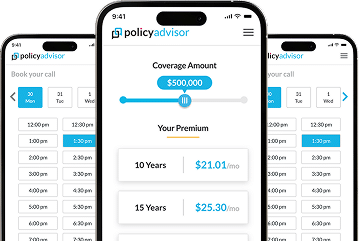

PolicyAdvisor makes finding group health insurance simple. Compare quotes, get expert advice, and find the best policy for your needs-all in one place.

- Save time: Get instant quotes from Alberta’s top group insurance companies

- Save money: Compare multiple quotes to find the best price

- Shop anywhere: Use our online tools to compare quotes from your phone or computer

- Personalized service: Receive expert advice from a dedicated group insurance advisor

Get affordable group insurance, online, and in minutes!

Frequently asked questions