- There are three types of group benefits plans: employer-sponsored benefits, professional association benefits, and government-sponsored benefits

- Employer-sponsored benefits are offered by an employer to employees and their family members

- Professional association benefits are for members of an association or group

- Government-sponsored benefits are provincially administered and usually cover children, elderly, and low-income individuals

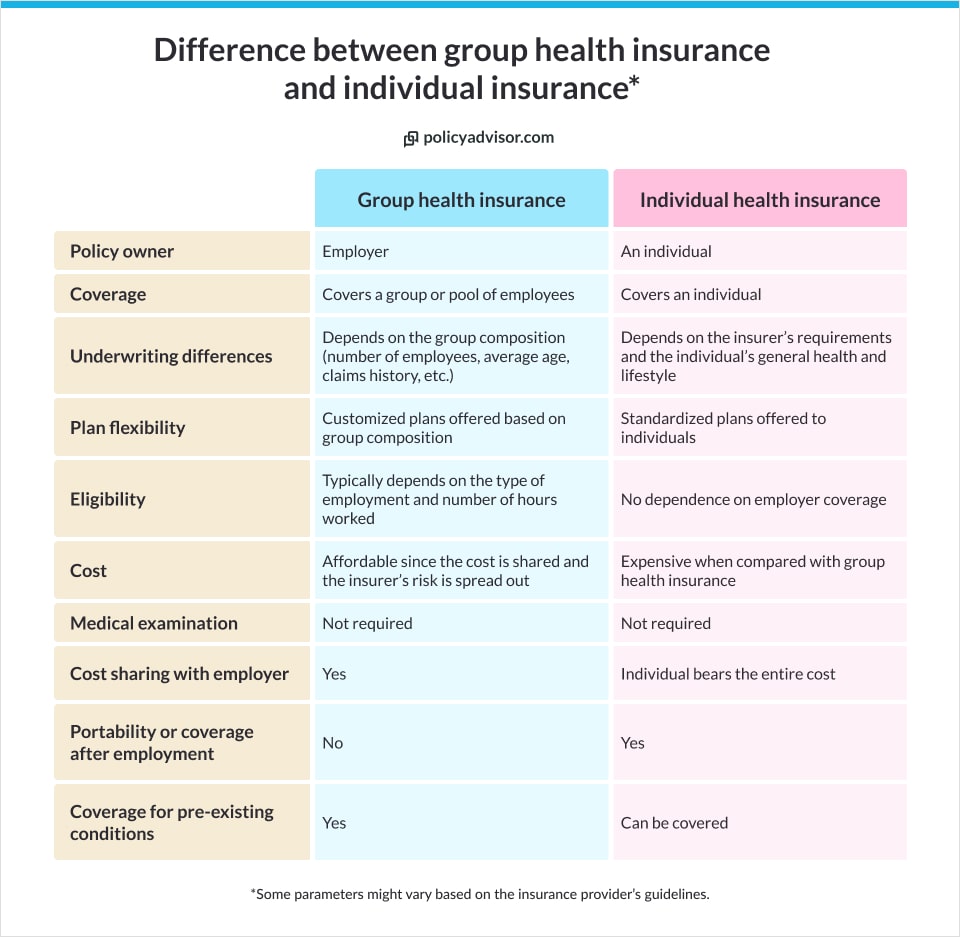

- Difference between group health plan and individual health plan

- Types of group health insurance plans in Canada

- Types of group health benefits

- Provincial health care plans vs employee benefits plans

- Estimating costs of traditional group health insurance

- Cost-sharing options for employee health benefits

- Importance of group benefits plans

- Best health insurance companies in Canada

- Frequently asked questions

An average employee in Canada works for 40 hours a week. That is 40 hours of their time dedicated to working for an organization and helping it grow and achieve its goals. In return they expect their employer to care of their wellbeing. One of the easiest and most effective ways for an organization to do this is by offering them an employee benefits plan.

Employee benefits plans, also known as group benefits, employee insurance plans, or employer-sponsored plans, are offered by an organization to its full-time or part-time workers. In Canada, these plans are available in various forms, customized to meet the unique and diverse needs of an organization and its employees.

In this blog, we’ve explained the different types of group insurance plans that are available. If you’re an employer, looking to attract and retain talent, or an employee who wants to understand group health coverage, this blog is for you!

How is a group health plan different from an individual health insurance plan?

The main difference between a group health plan and an individual health plan is reflected in their respective names—the former covers a “group” of employees in an organization while the latter is purchased by an individual for personal health coverage.

Types of group health insurance plans in Canada

There are three types of group health insurance plans in Canada: Traditional group health insurance plans, Health Spending Accounts (HSAs), and extended group health insurance.

Traditional group health insurance plans

In Canada, traditional group health insurance plans are typically provided by employers to their employees. These plans cover various health-related expenses that may cause financial strain for individuals or their families. The main types of traditional group health insurance plans in Canada include:

1. Extended Health Care (EHC) plans

EHC plans are the most common form of group health insurance plan that employers provide to their team members as an additional perk for their efforts. Most EHC plans cover a comprehensive range of healthcare facilities, such as vision care, physiotherapy, chiropractor visits, prescription drugs, and more.

2. Dental insurance plans

Apart from EHCs, many group health insurance plans also offer dental insurance benefits that protect the individual as well as their dependents from any unforeseen expenses.

Dental plans cover a range of dental care services, including routine check-ups, cleanings, x-rays, fillings, extractions, and more extensive procedures like crowns and orthodontics.

3. Disability insurance

Another form of group health insurance includes disability insurance that may also be offered to employees. Disability insurance protects an individual when their health problem prevents them from working a job and earning a steady income for their family.

Individuals with disability insurance will receive periodic payouts that will help them easily cover basic day-to-day expenses such as groceries, mortgages, children’s education, etc.

4. Employee Assistance Programs (EAPs)

EAPs help with individuals’ overall well-being and can be added as a lucrative perk to a group health insurance plan. They offer support services such as mental health counseling, legal advice, and financial planning for employees dealing with personal issues that might affect their performance at work.

Find out more about how group health insurance can help small businesses in Canada

Health Spending Accounts (HSAs)

HSAs are unique health accounts that provide a mutually beneficial way for employers as well as employees to work with health insurance. Otherwise known as Health Care Spending Account (HCSA) or Health Reimbursement Account, HSA is more of an out-of-the-pocket payment that the employer bears for their employees.

Employers receive high tax rebates from providing HSA facilities for their employees. On the other hand, employees prefer this scheme as it automatically eliminates the burden of copay and deductibles. Most HSAs have a set amount of annual coverage for each employee and their dependents.

Extended group health insurance

Extended group health insurance covers a detailed list of medical complications and illnesses that can be covered under the group health insurance plan as added benefits for employees. With a wide array of features to choose from, employers may provide some or all of the benefits that can be covered under this plan.

Some of the most prominent features of extended group health insurance may include the following:

- Prescription drugs: It may include coverage of prescription drugs such as medications for hypertension, thyroid, kidney problems, or even insulin shots

- Vision care: This covers the cost of regular eye checkups, prescription glasses or contact lenses, eye care essentials, and even surgery if required

- Paramedical services: This covers the cost of paramedical services such as ambulance charges, extensive therapy, additional medical supplies, etc

- Critical illness insurance: This ensures that employees or their dependents receive a lump sum amount of money on being diagnosed with a critical disease such as cancer, heart attack, stroke, etc

- Accident insurance: This safeguards employees as well as their families from financial turmoil in case of an injury or trauma due to an accident

- Travel insurance: This provides complete security to individuals and their dependents in case a medical emergency strikes while they’re traveling

Types of group health benefits

In Canada, group health benefit plans typically fall into three main categories: employer-sponsored plans, benefits provided through professional associations, and government-sponsored benefits.

Employer-sponsored benefits

Employer-sponsored benefits are offered by an employer to the employees of an organization, forming a key part of an organization’s compensation package. Employers work with licensed experts, such as the ones at PolicyAdvisor, to obtain a group health plan that is tailored to meet the needs of the employee pool at the organization.

Employer-sponsored benefits are typically part of an employee’s compensation package and are offered as a perk. This means that the employer pays most or all of the premium for the group health benefits being offered to their employees. Since these benefits are offered to a group of people, the premiums are lower as compared to individual plans since the insurer’s risk is distributed amongst the pool of employees.

In some cases, the cost might be split between the employer and employees, especially if the latter chooses to add family members to their group health benefits plan.

Key features of employer-sponsored plans

Some of the key features of employer-sponsored group benefits plans are:

✅ They can be paid for largely or in entirety by an employer

✅ Smaller organizations usually need 100% participation while larger ones will need 70%

✅ Employees can add family members to their group benefits for an additional cost

❌ Employer-sponsored plans are typically not portable and only last for the term of employment

❌ Employer-sponsored plans have limited customization

❌ Some organizations might exclude part-time workers or employees on unpaid leave from these plans

Learn more about how group health insurance works

Professional association benefits

Professional associations are organizations that offer networking opportunities to a group of people from a certain industry or profession. These associations include financial institutions, retiree organizations, college and university alumni groups, and clubs.

Professional associations offer standardized group benefits to their members and their families. Similar to employee benefits, every member can choose to get coverage for health & dental, vision, prescription medication, and paramedical services. The premiums can either be paid directly by the members or deducted from their membership fees.

Depending on the preference of the association, they might also offer life insurance, disability insurance, and accidental death and dismemberment (AD&D) insurance. For example, an armed forces or army veterans association might choose to offer life, disability, and AD&D insurance to its members while an advocacy group for a trade association might not.

Since a group of people are being insured under professional association benefits, the premiums are going to be lower and the plans will be customizable. It is beneficial to work with licensed experts when figuring out the best group benefits for a professional association.

Key features of professional association benefits

Professional association benefits are a great way to increase and retain members of an organization. Some of the key features of these benefits include:

✅ Highly customizable plans, tailored based on the association’s member composition

✅ Lower premiums since the insurer’s risk is spread

✅ Group benefits extended to family members and loved ones

❌ There is no portability with coverage which ends when a membership expires or is stopped

Government-sponsored benefits

Government-sponsored group benefits are provided by the provincial or federal government. These are specially given to vulnerable demographic groups such as children, seniors (over 65 years of age), and individuals who might not be covered under an employee insurance plan.

The coverage and eligibility for government-sponsored benefits vary depending on the specific program and the province where it is offered. Different provincial plans provide different kinds of coverage.

Provincial benefits plans such as the Ontario Health Insurance Plan (OHIP), Alberta Adult Health Benefit (AAHB), and Medical Services Plan (MSP) for British Columbia are some examples of government-sponsored benefits.

Key features of government-sponsored benefits

Some of the key features of government-sponsored benefits are:

✅ The coverage varies based on the province/jurisdiction where it is offered

✅ Only the citizens of the particular province can be covered under this kind of plan

✅ Low-income individuals, senior citizens, and children are covered under government-sponsored group health plans

❌ Plans are usually not customizable and the province will decide what coverage they offer

❌ These plans are typically not as comprehensive as other group health benefits plans

Provincial health care plans vs employee benefits plans

The Canadian government provides healthcare to all its citizens. So the question that arises is: why are group benefits plans even necessary? It’s because provincial health care plans typically cover essential medical needs such as emergency healthcare and other basic medical care that includes surgeries and doctor visits. Employee insurance plans, on the other hand, provide wider, more extensive supplementary medical coverage.

Estimating costs of traditional group health insurance

Traditional group health plans may come in several different formats with limitless customization options. Hence, it’s safe to say that the cost of this insurance plan will also vary. Although prices may fluctuate across companies depending on employee demographics, here is an estimate:

- Small businesses (up to 50 employees): The cost per employee can range from $1,500 to $4,000 per year

- Medium-sized businesses (50-250 employees): The cost per employee can range from $1,200 to $3,500 per year

- Large businesses (250+ employees): The cost per employee can range from $1,000 to $3,000 per year

Cost-sharing options for employee health benefits

Group health insurance may also be categorized based on how the insurance premium is being paid and who pays for it. Taking a look at the plethora of cost-sharing options, employee health benefits may be as follows:

- Employer pays: In this category, the employer bears the entire cost of the premium on behalf of the employee. The employee usually provides this facility as an added perk to their dedicated workforce

- Employee pays: In this arrangement, the employee bears the entire cost of the premium. However, the employer may provide assistance with the insurance paperwork for a streamlined procedure

- Employer and employee split: This procedure allows the employer as well as the employee to split the cost of the premium. In this way, both parties may receive tax benefits and other mutual perks

- Coverage-based split: In this method, there can be different cost-sharing arrangements for different types of coverage. The cost-sharing procedure can be customized based on the agreement between the employer and the employee

Explore more about employee benefits through our detailed guide

Importance of group benefits plans

Group health benefits or employee insurance plans are crucial to attract and retain talent. For professional associations, they work as an added benefit for the members. The different types of group benefits are important because:

- They attract and retain employees/members of an organization

- They promote employee/member wellbeing and reduce financial burdens when it comes to healthcare

- Government-sponsored benefits are crucial for vulnerable groups such as the elderly and those with lower incomes

Which are the best group health insurance companies in Canada?

There are several insurance companies in Canada that can help build a group benefits plan for your organization. At PolicyAdvisor, we work with 30 of Canada’s top life insurance companies to get you the best rates on the benefits plans you need for your business. While all insurers offer different kinds of coverage, the best health insurance company is the one that understands your unique requirements and builds a customized plan with you.

Frequently asked questions

Is group health insurance taxable for employees?

Apart from Quebec, employer-sponsored benefits like prescription drugs, vision and dental are not taxable.

What is the most common type of group health insurance?

Employer-sponsored group plans are the most common type of group health insurance. They are offered directly from the employer to their employees.

Which are the top three health insurance companies in Canada?

Some of the best health insurance companies in Canada are Desjardins, GMS, and Blue Cross. Our guide to group health benefits will give you more information on what each company offers.

What are health and welfare trusts (HWTs)?

Health and Welfare Trusts (HWTs) were a way for employers to offer group benefits to employees with some tax advantages, but they are now discontinued in Canada. HWTs that were in use previously were converted to a different health insurance scheme.

Which are the best group health insurance companies in Canada?

There are several health insurance companies in Canada from which to choose. Some prominent companies working with group health insurance include Manulife, Sun Life, Desjardins, Canada Life, etc. You may connect with expert insurance brokers (such as licensed experts at PolicyAdvisor) to help you understand the process.

Group insurance plans are offered by organizations to their members or employees. There are three types of group benefits plans: employer-sponsored benefits, professional association benefits, and government-sponsored benefits. They cater to employees of an organization, members of an association or group, and vulnerable demographics such as children, elderly, and low-income individuals, respectively.

1-888-601-9980

1-888-601-9980