- An HSA, also known as a Health Care Spending Account (HCSA), provides tax-free health and dental benefits to Canadian employees

- Employees can submit claims for reimbursement, easing the financial burden associated with healthcare costs

- While HSAs focus on medical and dental expenses, Lifestyle Spending Accounts (LSAs) cover a broader range of lifestyle-related expenses like fitness memberships and childcare

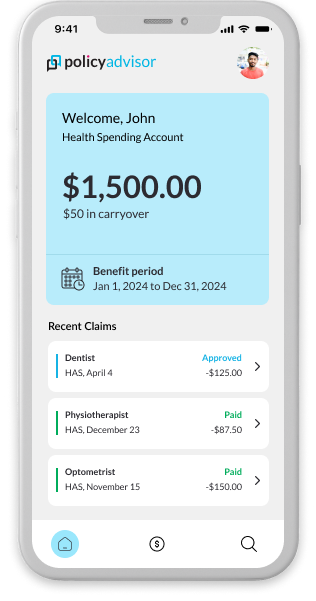

- Employers set coverage limits based on employee titles, contribute funds to the HSA, and employees pay for expenses upfront. After filing a claim, employees receive tax-free reimbursements

A Health Spending Account (HSA) or a Health Care Spending Account (HCSA), is a Canada Revenue Agency (CRA)-approved personal healthcare fund offered by employers for their employees and eligible dependents. An increasing number of employees highlight the importance of workplace benefits. A Health Spending Account ensures that group plans move beyond a one-size-fits-all approach to give employees flexible ways to pay for healthcare.

If you’re a small business looking for ways to make healthcare more affordable and accessible for your team, an HSA might just be the answer you’ve been looking for.

What is a Health Spending Account (HSA)?

A Health Spending Account (HSA) or a Health Care Spending Account (HCSA), is a benefit offered by employers to employees. It acts as a personal healthcare fund for employees and can be used to pay for any health, dental, or paramedical expenses. Health Spending Accounts can be set up for individual business owners, as a standalone plan, or an add-on to a group benefits plan.

The coverage limit of the HSA is set by the employer and contributions can be made according to the employees needs and budget, up to the fixed amount.

Key features of an HSA

| Feature | Description |

| Coverage | HSAs cover a wide range of medical expenses that are often not covered by provincial or personal health plans. Medical, dental, vision, hospitalization, and other services are covered by an HSA |

| Eligibility | HSAs can be set up for individual business owners as part of a group benefits plan or a standalone offering |

| Flexibility | There are no set plan designs for an HSA. Participating employees can choose to use the available funds for any medical expense without co-pays or category-specific limits |

| Tax benefits | The funds deposited in an HSA are 100% tax-deductible for employers and tax-free for the employees |

| Cost-savings | There are no monthly premiums for an HSA |

How does a Health Spending Account work in Canada?

Employers add a pre-set annual deposit in the HSA fund that each employee can use for health expenses. Employers can offer different funds for different employee classes. For example, $10,000 for Senior Managers, $8,000 for Managers, and $5,000 for others.

When the need arises, employees pay for eligible health services out of their own pockets. To get a reimbursement, employees submit their claim online on the insurance company’s platform where it is reviewed and repaid by the insurer.

The insurer bills the employer, who pays an admin charge, usually 10%, plus any claim or account fees.

Can I convert my HSA to cash?

No, the funds from an HSA can only be used for eligible medical expenses and cannot be converted to cash. Employees will get a reimbursement from the insurance company for the medical expenses that they claim. The unused HSA balance at the end of a year cannot be paid out to employees as cash under any circumstances.

Can I transfer HSA to my bank account?

The funds from an HSA cannot be transferred to your bank account. They can only be reimbursed by an insurance company if an employee files an online claim for medical expenses. The Canada Revenue Agency (CRA) has strict guidelines about the use of HSA funds. They cannot be transferred to a bank account even if they remain unused at the end of a year.

Can I withdraw money from HSA at ATM?

While they are technically called “funds”, the money that an employer invests in an HSA is not a form of cash and it cannot be withdrawn from an ATM. Employees can only use an HSA fund for medical, dental, vision, prescription drugs, and other healthcare expenses.

What are the benefits of a Health Spending Account (HSA)?

Offering an HCSA can provide several benefits for both employers and employees:

HSA benefits for employees

- Tax advantages: Contributions to HSAs are tax-deductible for employers, reducing the overall tax burden

- Cost control: HSAs can be paired with high-deductible health plans (HDHPs), which often have lower premiums than traditional health plans, potentially reducing the company’s healthcare costs

- Reduced administrative costs: Compared to more complex health benefits plans, HSAs might have lower administrative costs

HSA benefits for employers

- Tax benefits: Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free

- Savings for future healthcare costs: HSAs can be a savings tool for future medical expenses, including those in retirement. This can be especially useful for high-deductible plans with higher out-of-pocket costs

- Portability: The account belongs to the employee, so it remains with them if they change jobs

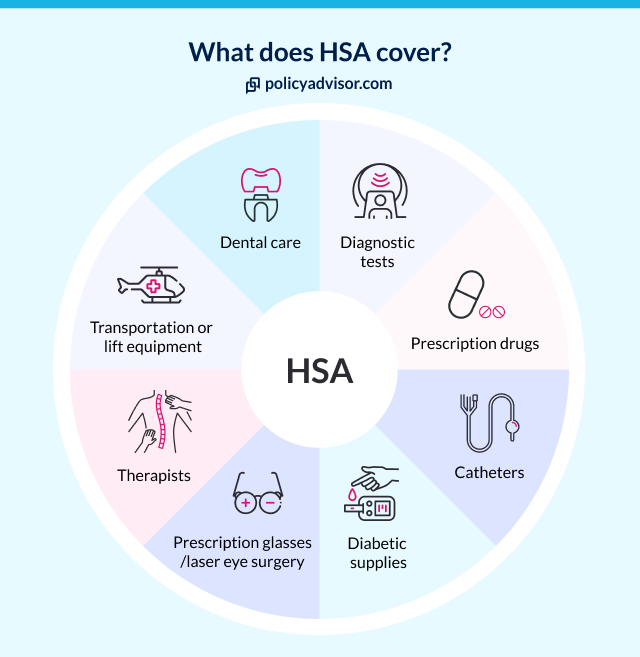

Which expenses are eligible in an HSA?

A Healthcare Spending Account covers a wide range of medical expenses including vision, dental, prescription medication, hospital charges, ambulance, registered medical practitioners, and more. These medical expenses are usually not covered, or are partially covered, under other traditional plans including group benefits, provincial healthcare, and private health insurance.

The list of eligible expenses are based on the specific plan and a complete list of eligible HSA expenses can be found on the CRA website.

List of eligible HSA expenses

| Health services | Medical practitioners | Vision and dental | Medication and hospital |

| Assistive Mobility Device | Acupuncturist (R.Ac.) | Cataract surgery | Any prescription medicine run through a licensed pharmacist |

| Autism treatment | Audiologist & Hearing Aids | Prescription glasses | Drugs and medical devices bought under Health Canada’s Special Access Program |

| Elderly parent & dependent care | Chiropodist | Contact lenses | Vaccines |

| Fertility drugs and treatment | Chiropractor (DC) | Laser eye surgery | Ambulance charges |

| Kinesiology | Dermatologist | Optician, Optometrist, Opthamologist | Hospital bills |

| Dietitian or Nutritionist (Registered) | Dental hygienist | ||

| Medical laboratory services | Gynecologist (Ob. Gyn) | Dental surgeon | |

| Medical radiation treatments | Homeopath (Registered Professional) | Dental technologist | |

| Massage Therapists (Registered) | Dentures, Repair, & Replacement | ||

| Midwife (Registered) | Orthodontic work including braces | ||

| Naturopaths (ND) and Traditional Chinese Medicine practitioner

(TCM) |

|||

| Neurologist | |||

| Nurse – RN, LPN, NP | |||

| Occupational Therapist | |||

| Orthopedist | |||

| Osteopath | |||

| Pharmacist | |||

| Physician (MD) | |||

| Pediatrician | |||

| Podiatrist | |||

| Physiotherapist | |||

| Plastic Surgeon | |||

| Prosthetist | |||

| Psychoanalyst | |||

| Psychologist | |||

| Respiratory Therapist | |||

| Speech Therapist (SLP) | |||

| X Ray Technician |

Can I use HSA for gym membership?

No, you cannot use an HSA for a gym membership. The Canada Revenue Agency does not recognize a gym membership as an eligible medical expense. However, under certain circumstances, if a registered medical professional prescribes a certain type of gym exercise as part of a treatment plan, some insurers may let you claim a reimbursement for the same. You will need a prescription or a letter of medical necessity in this case.

Can I use HSA for dental?

Yes, an HSA can be used for dental expenses such as dentures, braces, dental surgery, and other orthodontic work.

Can HSA be used for spouses?

Yes, your spouse can be covered under your HSA if you have added them as a dependent. Dependents also include your common law partner, parents, children, siblings, and grandchildren.

Health Spending Accounts vs. traditional insurance plans

There are three key differences between a Health Spending Account (HSA) and traditional insurance plans—costs, coverage, and flexibility. HSAs give employers complete cost control and tax benefits while traditional plans may or may not offer these choices.

In terms of coverage, HSAs have the broadest scope since they cover every CRA-approved healthcare service. Traditional plans typically have tiered coverage based on the type of plan a policy holder chooses.

With an HSA, employees have the freedom to spend on the kind of health service that they want to, including preventative care. These are usually not included in traditional plans.

Key differences between Health Spending Accounts and traditional insurance plans

| Feature | Health Spending Account | Traditional insurance plans |

| Tax benefits | Employer contributions and employee reimbursements are tax-deductible and tax-free, respectively | Benefits are usually taxable, premiums could be tax-deductible |

| Premiums | No monthly premiums | Monthly or annual premiums are required |

| Cost control | Employers only pay for the claims submitted by employees | Monthly or annual premiums are required |

| Administration fee | Typically 10% | Not required |

| Unused funds | Can be rolled over | Not applicable |

| Deductibles and co-pays | No deductibles and co-pays required | Deductibles and co-pays are usually required |

How much does it cost to include an HSA in a group plan?

A Health Spending Account in an employee benefits plan is priced depending on the number of employees you want to cover, the amount you want to contribute per employee, and your provider’s pricing structure.

The employer can select the overall coverage limit and also set different amounts for different employee categories such as owners, managers (Class A), and all other staff (Class B).

The cost of HSA account typically includes:

- Admin fee: approximately 8-10% of allotment amount

- Claim fee: approximately $3.95/claim submission

- Annual account fee: typically $100/year

Some companies may only change an admin percentage fee and no annual fee, this can vary with different insurance companies.

Is there an administration fee for HSA?

Administration fees for HCSA usually apply and vary based on the plan and provider. A common way to charge HCSA administration fees is as a percentage of the claims processed. For instance, certain plans might charge an administration fee of 10% of the total number of claims that employees file.

Health Care Spending Account: Setup and coverage

Who can set up an HSA?

To be eligible for HSA, the business has to be incorporated and the employees getting the HSA should be receiving T-4s. Small businesses with two or more employees can also set up an HSA.

Self employed proprietors who are not incorporated as a business would not be eligible to set up an HSA.

Who does an HSA cover?

An HSA covers both employees and their dependents. The eligible dependents covered in HSA are broader than a traditional group plan which only covers spouses and children as dependents.

Eligible dependents for HSA are generally defined as (this may vary depending on the insurance provider):

- Children, grandchildren, parents, grandparents, siblings, uncles, aunts, nieces, or nephews of the plan member or their spouse/common-law partner

- Dependent on the plan member for support at some point during the year

- Residents of Canada at some point during the year

How are HSA benefits taxed?

Health Spending Accounts (HSAs) are taxed differently for employees and employers.

HSA taxation for employers: Contributions to HSAs are generally tax-deductible for employers. Employers can deduct contributions made to employees’ HSAs as business expenses.

HSA taxation for employees: Reimbursements from HSAs for eligible medical expenses are typically 100% tax-free. However, in Quebec, HSAs are considered taxable benefits for provincial income tax purposes.

To ensure non-taxable health benefits, employers must set up a Private Health Services Plan (PHSP) according to Canada Revenue Agency (CRA) guidelines. There are two types of HSA options in Canada:

Stand-alone HCSA (Private Health Services Plan/PHSP): A stand-alone HCSA functions independently of traditional health insurance plans. The employer fully funds the account, determining the amount available for each employee or class of employees. This funding is tax-deductible for the employer, and benefits received by employees are tax-free.

HCSA as part of a group benefits plan: Integrated into a group benefits plan, this option supplements existing health and dental coverage. Employees typically submit claims through their standard group benefits plan first, and any remaining eligible expenses can then be claimed through the HCSA.

How long is an HSA deposit available?

An HSA deposit can cover expenses during the plan year and any applicable carryover period that an employer decides. There are two carryover types: credit and claims. An HSA can have either one type or none at all

Credit carryover: At the end of the benefit year, if a plan member has unused funds in their HCSA, they can carry over this balance to the following year. This transferred balance remains available for use for 365 days after the end of the plan year

Claims carryover: If a plan member has expenses that couldn’t be covered under the current HCSA due to insufficient funds or a zero balance, they can submit these claims to be covered by the deposit made into the HCSA for the following year

No carryover: Some plans don’t permit any carryover of funds or claims to the next benefit year. In such cases, any unused funds in the HCSA at the end of the benefit year are forfeited, and claims must be covered within the same year they occur

Does HSA expire?

Yes, HSAs do expire and usually require an annual renewal by the employer. In case an employee is terminated or resigns, their HSAs end on their last day of employment. Employees usually have 30-60 days to submit any expenses that they want to claim on their HSA.

What happens to HSA money if you don’t spend it?

Unused HSA funds can be carried forward at the employer’s discretion. If they are not used in 24 months, the funds will expire.

Can’t decide which insurer to go with? Our experts will help you pick the best group health plan!

At PolicyAdvisor, we have a team of licensed insurance experts who will guide and help you find the best group plan. With our expertise, we’ll make sure you get the most out of your HSA and are able to offer your employees comprehensive coverage and maximum benefits.

Frequently Asked Questions

What happens to unused HSA funds?

Employers may permit the rollover of unused HCSA into the following plan year. The maximum amount that can be carried over is usually $500, though some plans may have lower or no limits at all. If the employer does not permit carryover, any unused funds at the end of the plan year will be forfeited.

How can I submit an HSA claim?

You can submit an HSA claim either online or offline, depending on your plan provider’s guidelines. Your plan documents will have the details of how you can submit an HSA claim.

Can I use HSA funds for medical expenses abroad?

HSA funds can generally be used for eligible medical expenses incurred abroad, as long as the expenses are medically necessary and meet the criteria outlined by the HSA provider.

What happens to my HSA if I leave my employment mid-year?

If you leave your employment mid-year, you may lose access to their Health Spending Account (HSA) benefits, depending on the employer’s policy. Any unused funds in the HSA may be forfeited, so it’s essential to check with the employer or the policy administrator for specific details. Additionally, the deadline for submitting claims may vary and be 30, 60 or 90 days after the end of the HSA plan year.

Can I purchase an HSA even if my employer doesn’t offer one?

Yes, you can open an HSA independently if your employer doesn’t offer one.

A Health Spending Account (HSA) is a tax-efficient solution for Canadian employers to provide comprehensive healthcare benefits to their employees. It offers tax-free reimbursements for all healthcare related expenses not covered in the employer sponsored group plan. With the flexible usage options and the tax benefits, HSAs provide a win-win solution for both the employers and the employees.

1-888-601-9980

1-888-601-9980