- Canada Life, Manulife, and Sun Life remain the dominant life insurance providers in Canada, each excelling in different areas such as total assets, and international presence.

- LICAT ratios across top insurers reveal a high level of financial resilience, which is critical in ensuring policyholders' long-term security.

- Choosing the right insurer involves more than just size—smaller or niche companies may offer better value through competitive rates and personalized service.

- Which are the Biggest Life Insurance Companies in Canada?

- Full List: 40 Biggest Life Insurance Companies in Canada

- Ranking the biggest insurance companies: our methodology

- Things to consider when choosing an insurance company

- Impact of IFRS 17 on Canada’s largest life insurance companies

- Company profiles

- Is it better to choose a bigger insurance company?

- Pros of choosing a bigger insurance company

- Pros of choosing a smaller insurance company

- Get help

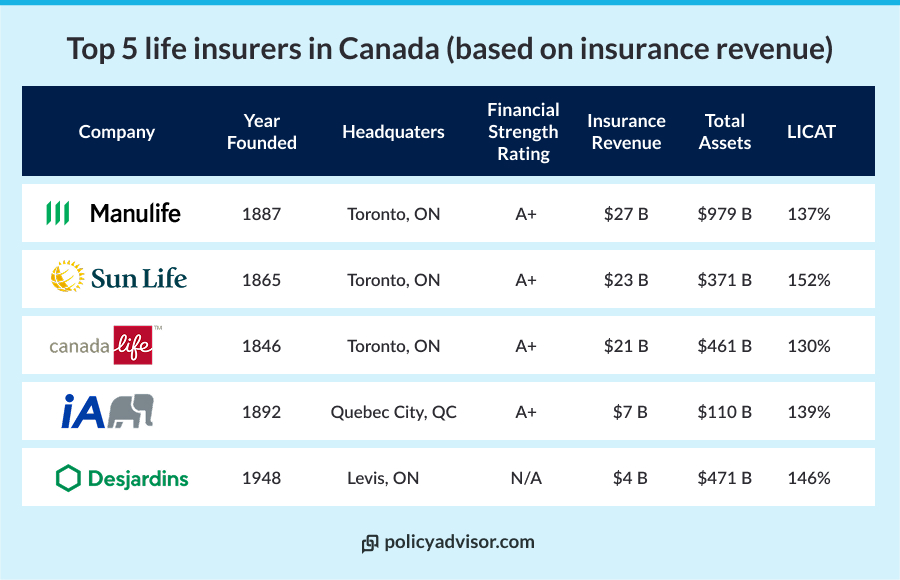

Top 5 biggest life insurance companies in Canada

Canada’s life insurance industry is dominated by several major players that have established themselves as the biggest insurance companies in Canada. Here are the top 5 insurance companies in Canada based on total assets and market presence:

- Manulife

- Sun Life

- Canada Life

- Industrial Alliance (iA)

- Desjardins

Complete list: Top 40 life insurance companies in Canada

The top 40 biggest life insurance companies in Canada represent the most comprehensive coverage options available to Canadian consumers.

40 Largest life insurance companies in Canada

| Company | Founded / HQ | Rating | Total Assets | LICAT Ratio |

| Manulife | 1887, Toronto, ON | A+ | $978.8B | 137% |

| Sun Life | 1865, Montreal, QC | A+ | $370.7B | 152% |

| Canada Life | 1847, Hamilton, ON | A+ | $461.2B | 130% |

| Industrial Alliance | 1892, Quebec City, QC | A+ | $109.9B | 139% |

| Beneva | 2020, Quebec City, QC | – | $27.5B | 150% |

| Desjardins | 1900, Lévis, QC | – | $470.9B | 146% |

| RBC Insurance | 1864, Toronto, ON | – | $28.6B | 135% |

| Empire Life | 1923, Kingston, ON | – | $19.7B | 151% |

| BMO Life | 1817, Toronto, ON | – | $20.1B | 130% |

| The Co-operators | 1945, Guelph, ON | – | $10.5B | 168% |

| Securian Canada | 1955, Toronto, ON | – | $1.2B | 153% |

| Equitable Life | 1920, Waterloo, ON | – | $10.2B | 169% |

| ivari | 1927, Toronto, ON | – | $14.6B | 131% |

| Blue Cross Canada | 1939, Montreal, QC | – | $2.3B | 135% |

| Brookfield/Blumont Annuity Co. | Toronto, ON | – | $7.5B | 147% |

| Primerica | 1977, Duluth, GA, USA | – | $4.1B | 191% |

| Chubb Life | 1882, Toronto, ON | – | $0.3B | 163% |

| Metropolitan Tower | New York, NY, USA | – | $2.3B | 171% |

| Wawanesa | 1896, Wawanesa, MB | – | $11.5B | 165% |

| Foresters | 1874, Toronto, ON | – | $1.8B | 200% |

| Combined of America | 1922, Chicago, IL, USA | – | $1.1B | 176% |

| UV Insurance | 1889, Drummondville, QC | – | $2.4B | 172% |

| Humania | 1874, Saint-Hyacinthe, QC | – | $0.7B | 185% |

| TD Life | 1855, Toronto, ON | – | $0.3B | 200% |

| Assumption | 1903, Moncton, NB | – | $2.3B | 165% |

| TruStage Life | 1902, Toronto, ON | – | $2.4B | 165% |

| CIGNA Life | 1982, Bloomfield, CT, USA | – | $0.1B | 245% |

| British Insurance (Cayman) | Cayman Islands | – | $0.5B | 176% |

| Knights of Columbus | 1882, New Haven, CT, USA | – | $30.3B | 274% |

| American Income | 1951, Waco, TX, USA | – | $0.7B | 169% |

| New York Life | 1845, New York, NY, USA | Aaa / AA+ | $0.7B | 353% |

| CIBC Life | 1961, Toronto, ON | – | $0.2B | 494% |

| Aetna Life | 1853, Hartford, CT, USA | A3 / A | $0.1B | 496% |

| Teachers Life | 1939, Toronto, ON | – | – | 234% |

| Serenia Life | 1972, Waterloo, ON | – | $0.4B | 177% |

| American Health & Life | 1954, Fort Worth, TX, USA | – | $0.06B | 576% |

| AWP Health & Life SA | Paris, France | – | $0.04B | 271% |

| Connecticut General Life | 1957, Bloomfield, CT, USA | – | $0.2B | 223% |

| Reliable Life | 1887, Hamilton, ON | – | $0.02B | 310% |

| Jackson National Life | 1961, Lansing, MI, USA | – | $0.01B | 458% |

Source: Company annual reports, OSFI financial data, A.M. Best Company

** Financial metrics displayed for life insurance businesses of the respective companies. Founding dates of respective parent companies.

Methodology: How we rank the biggest insurance companies

Our methodology for ranking the biggest insurance companies in Canada in 2025 includes multiple factors to provide a comprehensive analysis.

Financial strength: We assess each insurer’s ability to meet policyholder obligations based on their total assets, capital reserves, and industry credit ratings

- Total assets under management: Measures the financial size and investment capacity of the insurer

- Capital adequacy ratios (LICAT): Indicates the insurer’s solvency and ability to absorb financial shocks

- Credit ratings from AM Best, S&P, Moody’s: Reflects independent evaluations of the insurer’s long-term financial stability

Product offerings: Evaluates the range, flexibility, and innovation of insurance products available to Canadian customers

- Breadth of insurance products: Analyzes how many types of life, health, and supplemental insurance products are offered

- Coverage limits and options: Assesses the level of customization and financial protection available in each product line

- Innovation in product development: Rewards insurers introducing new features, riders, or digital-first insurance solutions

Customer satisfaction: Focuses on the overall client experience from onboarding to claims settlement

- Customer service ratings: Examines third-party reviews and feedback on service responsiveness and quality

- Claims processing speed: Tracks how quickly and efficiently claims are reviewed and paid out

- Digital experience quality: Measures the usability and performance of web portals, apps, and digital communication

Choosing the best insurance company for you

When comparing the top life insurance companies in Canada, it’s important to go beyond size and brand recognition. Choosing the right provider means assessing financial strength, coverage options, premium affordability, and regional relevance.

Whether you’re a young family, business owner, retiree, or high-net-worth individual, matching your needs with the right insurer can lead to better protection and long-term value.

Key selection criteria for top Canadian life insurance companies

| Category | What to look for |

|---|---|

| Financial strength | – AM Best rating of A- or higher – LICAT ratio above 120% – Over 100 years in business – Strong capital reserves |

| Coverage needs | – Term life (10, 20, or 30 years) – Whole or universal life – Critical illness and disability options |

| Premium affordability | – Competitive quotes from multiple providers – Annual vs. monthly premium choice – Stable premiums over time – Dividend potential for permanent life |

| Digital & human support | – Online comparison tools – Access to licensed advisors – Transparent educational resources |

Our licensed advisors give you expert tips on how to choose the best insurer in this video.

Impact of IFRS 17 on Canada’s largest life insurance companies

Since January 1, 2023, IFRS 17, a new global accounting standard, has reshaped how Canada’s largest life insurance companies, such as Manulife, Sun Life, and Canada Life, report their financials.

Replacing IFRS 4, this standard shifts the focus from premium receipts to the value of insurance services delivered, offering greater transparency for policyholders and investors.

Here’s what has changed and what it means for Canada’s insurance giants.

Key changes under IFRS 17

- Revenue recognition shift: Unlike IFRS 4, where premiums and profits were recognized upon receipt, IFRS 17 ties revenue to service delivery. “Insurance service revenue” reflects the value of coverage provided as obligations are fulfilled, reducing mismatches between cash inflows and actual services. For instance, Manulife’s 2025 premiums dropped to $26.6 billion from ~$44 billion pre-IFRS 17, aligning with services rendered.

- Contractual Service Margin (CSM): The CSM represents unearned profit from insurance contracts, recognized systematically over the coverage period rather than upfront. This smooths profit recognition, lowering volatility. For e.g., Sun Life’s premiums fell from ~$29 billion to $22.6 billion in 2025, reflecting CSM release.

- New terminology: “Premiums” are replaced by “insurance service revenue” in financial statements, calculated based on expected coverage, adjusted for investment components. This change ensures a truer exchange value for services.

- Measurement models: The General Measurement Model uses risk-adjusted, discounted, probability-weighted cash flows to value contracts, with profits recognized as services are provided. The Premium Allocation Approach (PAA) simplifies this for short-term contracts, allowing revenue recognition over time or expected service patterns.

- Disclosure and transparency: IFRS 17 mandates detailed reporting, enhancing comparability across insurers like Canada Life ($21 billion in 2025 premiums) and global peers.

Impact on accounting premiums

IFRS 17’s shift excludes savings or investment components from premiums, explaining lower reported figures in 2025 data. For example, Canada Life’s $21 billion (down from ~$58 billion) reflects only insurance service revenue, not total cash inflows.

This adjustment stabilizes earnings but may make insurers appear smaller, though their financial health, measured by LICAT ratios (e.g., Manulife: 1.37), remains robust.

What it means for policyholders

For policyholders, IFRS 17 doesn’t affect premiums paid or benefits. Your coverage stays the same. However, it offers a clearer view of an insurer’s performance, aiding comparisons.

Investors benefit from smoothed profits and better risk insights, though they must adjust to new KPIs like CSM growth. This standard ensures Canada’s life insurance leaders, like those in our top 40 list, remain competitive and transparent in a global market.

Compare the largest insurance companies in Canada: company profiles

Our list shows much more than the most prominent large insurance companies in Canada. Some of these brands are amongst the largest insurers in the entire world.

You may recognize many of the companies that top the list, but others may not be so familiar. For example, an insurance company like Beneva, which was formed when SSQ Insurance and La Capitale merged together. Or a company like Wawanesa.

Not a lot of people in Ontario may know them, but they are some of the top Canadian life insurance companies. Both of these providers and others collect billions of dollars in premiums every year.

Read on for an overview of each company that made the list.

The Canada Life Assurance Company

Canada Life is one of the oldest and most stable life insurers in the country. Up until recently, it came second to Manulife in number of annual premiums — which was no surprise given that Manulife is one of the largest companies in the world.

But, in 2020, Great West Life merged with its sister companies London Life and Canada Life into the single Canada Life Assurance Company brand. That merger pushed Canada Life to the top of the charts.

Canada Life Insurance product offerings:

Canada Life offers a wide range of insurance products and other financial solutions, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Health & dental insurance

- Creditor insurance

- Business insurance & workplace benefits

- Investments and savings: segregated funds, annuities, retirement planning, etc.

- Mortgages

What sets Canada Life apart

- Canada Life possesses $568 million in assets, making it one of the largest life insurance companies in Canada

- The company aims to provide accessible healthcare and affordable medication through its mobile application called DrugHub

- Canada Life is known for its CSR initiatives, such as the Health and Homelessness Fund, where it raised $500,000 in a donation drive for the homeless in London, Ontario

The Manufacturers Life Insurance Company (Manulife)

Manulife started in 1887 as the Manufacturers Life Insurance Company. They were the largest insurance company in Canada until just a few years ago. But they still have the most assets out of any other Canadian insurer.

Manulife Canada is a subsidiary of Manulife Financial Corporation, a Canada-based multinational insurance company and financial services provider.

They do a lot of business in South East Asia and also in the United States, where they operate through a brand called John Hancock.

Manulife product offerings:

The Manulife insurance company offers several types of policies and investment plans, including:

- Term life insurance

- Permanent life insurance

- Mortgage protection insurance

- Critical illness insurance

- Disability insurance

- Travel insurance

Manulife also operates Manulife Bank, which offers chequing and savings accounts, credit cards, and mortgages.

What sets Manulife apart

- Manulife was the first Canadian life insurer to utilize artificial intelligence in its underwriting process. This allows the company to approve up to $2 million in coverage without requiring medical exams

- Manulife boasts over $1 trillion in assets under management, making it one of the largest life insurance companies in Canada

- Manulife was the first company to provide insurance to people with diabetes and also offered rates to non-smokers. Even recently, Manulife has become a pioneering company in offering life insurance to patients suffering from HIV

- Manulife Vitality lets users accrue points and rewards, such as premium discounts, gift cards, and even an Apple Watch, by participating in healthy activities like exercise, visiting the doctor frequently, and eating a balanced diet

Sun Life Assurance Company of Canada

Sun Life Financial, Inc. is one of the largest life insurers in the world, and also one of the oldest, with a history spanning back to 1865.

Apart from Canada, they have a presence in the US and in seven Asian markets, including China and India.

Sun Life Insurance product offerings:

The Sun Life Assurance Company of Canada offers a wide variety of products, including:

- Term life insurance

- Permanent life insurance

- Mortgage protection insurance

- Critical illness insurance

- Disability insurance

- Health & dental insurance

- Travel insurance

- Long-term care insurance

- Investments and savings: retirement income plans, asset management, etc.

- Financial advice

What sets Sun Life apart

- Sun Life has introduced a large number of digital projects. One such project is Prospr by Sun Life which assists Canadians with their financial goals. With Prospr, clients can connect with a licensed advisor, assess their financial needs, and track their financial goals

- Sun Life’s Lumino Health Virtual Care platform gives users round-the-clock access to medical and mental health professionals

- Sun Life actively engages in community initiatives and partnerships, focusing on building healthier communities

Industrial Alliance Life Insurance

iA Financial Group is one of the largest insurance and wealth management groups in Canada. They also have operations in the United States. It was founded in 1892 and offers both individual and group benefits products.

iA is more than an insurance company — they also work in property management and real estate. They rent out many office spaces in major cities across Canada.

iA Financial Group product offerings:

Industrial Alliance offers a wide variety of products, including:

- Term life insurance

- Permanent life insurance

- Mortgage protection insurance

- Critical illness insurance

- Disability insurance

- Travel insurance

- Car & RV insurance

- Home insurance

- Investments and savings: registered savings plans, annuities, loans, etc.

What sets Industrial Alliance apart

- Industrial Alliance has a strong financial foundation, serving over 4 million clients with the help of over 25,000 representatives

- Dialogue, a wellness application by iA, provides direct access to a team of healthcare professionals 24/7, along with telemedicine and stress and wellness management programs

Desjardins Financial Security

Desjardins is well known across Canada, offering a wide variety of financial services and insurance products.

The company mainly focuses on life, health, and home insurance, and wealth management services. But they also offer business services like point-of-sale payments and cash management.

Desjardins product offerings:

Desjardins offers a full suite of insurance and finance products and services, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Health & dental insurance

- Travel insurance

- Auto & RV insurance

- Home insurance

- Pet insurance

- Group insurance

- Creditor insurance

- Business insurance

- Investments and savings: guaranteed investment accounts, wealth management, loans, etc.

- Mortgages

What sets Desjardins apart

- Desjardins is a cooperative financial institution, meaning it is owned and governed by its members rather than a corporate setup. Its Melodia portfolio helps users invest in diversified assets such as stocks and bonds

- Desjardins has invented the “caissassurance” model, enabling customers to obtain insurance products through their neighborhood caisse populaire ( member-owned financial institution that provides insurance services) directly

Beneva Inc.

Beneva became the 6th largest insurance company in Canada in 2023 after a major merger between Quebec-based companies SSQ Insurance and La Capitale.

SSQ Insurance was founded in 1944 while La Capitale was founded just a few years earlier, in 1940. Both companies were founded and operated on mutualist values, which have carried on with their merger into Beneva. This makes it one of the biggest mutual insurance companies in the country.

Beneva Insurance product offerings:

Beneva offers the same high-quality products and services as its parent companies, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Auto & RV insurance

- Home insurance

- Group insurance

- Creditor insurance

- Business insurance

- Investments and savings: segregated funds, annuities, registered savings, etc.

What sets Beneva Inc. apart

- Benevas’s online platform, called Client Centre, lets customers monitor and manage their investment portfolio without any hassle. This platform allows for 24/7 access to policies, claims submissions, and tracking to ensure complete transparency and enhanced user experience

- Beneva’s Assistance Benefit service can help individuals during an emergency as it connects users to the top three doctors in the area whose expertise matches the ailment

- Beneva actively supports student-athletes and has funded over 200 young sports enthusiasts

RBC

The Royal Bank of Canada (RBC) is one of the most well-known financial companies in North America. RBC Insurance is the part of RBC that sells insurance to people and businesses.

They offer an enormous range of products and financial services, and even reinsurance. They also have an added option of RBC Private Insurance, which is a thorough and customizable package designed to give you the most protection against risks.

RBC Insurance product offerings:

RBC Insurance’s extensive list of offerings includes:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Health insurance

- Travel insurance

- Auto insurance

- Home insurance

- Group insurance

- Creditor insurance

- Business insurance & reinsurance

- Investments and savings: wealth management services, annuities, loans, etc.

- RBC Private Insurance — a comprehensive risk protection package

What sets RBC apart

- RBC insures the risks of other insurance and reinsurance companies through its innovative Reinsurance Business solutions, which cover life, longevity, disability, and accident.

- The company provides business clients with specific insurance options, such as business loan insurance and group benefits programs

- RBC Insurance enjoys robust financial stability as a part of the Royal Bank of Canada, one of the biggest banks globally

Wawanesa

Wawanesa Mutual is the parent company of Wawanesa Insurance, which sells life insurance and other products. It was founded in 1896 and is based in Winnipeg, Manitoba.

They also operate as Wawanesa General in the US. They mostly sell P&C insurance in California and Oregon.

Wawanesa product offerings:

Wawanesa Insurance offers a good selection of products, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Auto insurance

- Home & renters insurance

- Pet insurance

- Group insurance

- Commercial/business insurance

- Farm insurance

- Investments and savings: registered savings plans, guaranteed investment accounts, annuities, etc.

What sets Wawanesa apart

- Wawanesa is a mutual insurance company, meaning that policyholders own the company instead of stockholders. This structure enables Wawanesa to match its objectives with its customers’ demands, giving priority to their interests and offering more individualized service

- Customers looking for value without sacrificing coverage quality will find the company appealing because of its reputation for offering competitive rates on insurance products

BMO Insurance

BMO Financial Group is one of the largest financial institutions in Canada, if not the world. It was founded in 1817 as Bank of Montreal.

BMO Insurance is the part of BMO that sells insurance policies and similar services.

BMO Insurance product offerings:

BMO offers a few different types of insurance policies and financial services, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Travel insurance

- Investments and savings: income annuities, guaranteed investment funds, etc.

What sets BMO Insurance apart

- As of late 2023, BMO Life Insurance was one of Canada’s top ETF insurers, managing more than $95.53 in ETFs nationwide

- BMO Life Insurance has made investments in digital tools, such as online policy management and claims submission, to improve the customer experience

Equitable Life product offerings:

Equitable Life Insurance Company offers insurance products such as:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Health & dental insurance

- Group insurance

- Investments and savings: retirement income protection, segregated funds, etc.

What sets Equitable Life apart

- Customers of Equitable Life Insurance can handle their policies online, completing tasks like requesting policy loans, transferring investments, and altering beneficiaries. Policyholders benefit from the ease and flexibility of this digital access

- With the recently introduced First Home Savings Solution (FSHA) from Equitable Life, first-time homeowners will be able to get maximum coverage amounts and attractive home insurance benefits at a reduced premium cost

- The organization places a strong emphasis on providing individualized service, and committed insurance advisors are on hand to offer direction and assistance throughout the insurance process

The Empire Life

Empire Life was founded in Kingston, Ontario, in 1936. They have services, sales, and marketing centres throughout Canada.

They sell a wide range of financial products and services. But they are most well known for their permanent participating life insurance policies.

Empire Life Insurance Company product offerings:

Empire Life offers a wide variety of products and services for personal finance needs, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Health & dental insurance

- Group insurance

- Investments and savings: RRSPs, annuities, etc.

What sets Empire Life apart

- Empire Life has a strong financial position, evidenced by its Life Insurance Capital Adequacy Test (LICAT) ratio, which is significantly above the minimum requirements

- Their Retirement and Savings Tool helps users check if they are on track to meet their savings goals and plan for retirement

Foresters Financial

Foresters Financial is a company that offers financial services in Canada, the US, and the UK. It was founded over 140 years ago, in 1870.

Many of Foresters’ life insurance products help charities. When you buy these products, the company donates to a charity you choose.

Foresters underwrites the insurance policies offered by Canada Protection Plan.

Foresters Life Insurance product offerings:

Foresters offers a limited range but strong quality of products and services, including:

- Term life insurance

- Permanent life insurance

- Mortgage protection insurance

- Critical illness insurance

- Investments and savings: retirement income plans, annuities, etc.

What sets Foresters Financial apart

- As a fraternal benefit society, Foresters Financial offers unique member benefits to policyholders, such as competitive academic scholarships, grants for volunteer activities, and discounts on everyday expenses

- Foresters also offers many complimentary fun events for their insured members and families, such as baseball games and amusement park outings

Co-operators Insurance

The Co-operators Group Limited is a leading Canadian co-operative company that sells multiple lines of insurance. They have more than $41.7 billion in assets and many subsidiary companies.

They mostly offer life insurance, home insurance, asset management, and brokerage services. Most of their products are sold through a network of financial advisors and insurance brokers.

Co-Operators product offerings:

The Co-operators Insurance Group offers a wide range of financial services and insurance products, including:

- Term life insurance

- Permanent life insurance

- Mortgage protection insurance

- Critical illness insurance

- Travel insurance

- Auto & RV insurance

- Home insurance

- Property & casualty insurance (P&C)

- Group insurance

- Business insurance

- Farm insurance

- Investments and savings: asset management services, segregated funds, etc.

- Brokerage services

What sets Co-operators Insurance apart

- Co-operators Insurance collaborates with all tiers of government as well as with research organizations, municipalities, non-profits, and investors to create climate-resilient communities

- Co-operators Insurance has set net-zero targets for their operations and investments in order to contribute to a healthier future

ivari

Ivari used to be called Transamerica Life Canada. It is now owned and operated by the Canada Pension Plan Investment Board (CCPIB).

They have been operating for more than 80 years, offering a variety of insurance policies and investment products.

ivari Insurance Company product offerings:

ivari offers insurance and investment solutions such as:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Investments and savings: annuities, segregated funds, guaranteed interest accounts, etc.

What sets Ivari apart

- ivari actively engages in community support through charitable giving and partnerships, such as its collaboration with United Way Centraide Canada

- ivari’s My Insurance View is an easy-to-use interactive tool that provides clients with a personalized insurance solution based on their budget and premium-paying capacity

- ivari provides its users with excellent virtual healthcare through its mobile application called Maple, which has access to the best online practitioners in each province

Blue Cross

There are many different Blue Cross member plans in Canada. The Canadian Association of Blue Cross Plans is the group that represents all of them independently.

Blue Cross is best known for group insurance and travel insurance. Canadians who are Blue Cross members can save money on insurance for things like vision, medical, and more through their Blue Advantage program.

Blue Cross product offerings:

The Blue Cross insurance company offers insurance products such as:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Disability insurance

- Health & dental insurance

- Travel insurance

- Group insurance

What sets Blue Cross apart

- Blue Cross has a unique “Young Adults Benefits Package” that helps young working individuals get health and dental coverage at a minimal coverage

- Blue Cross actively engages in programs that promote wellness and preventive care, reflecting their dedication to creating healthier communities and addressing public health challenges

Securian Canada

Most people know Securian Canada by its old name, Canadian Premier Life. It is a company that offers financial management services and several insurance products.

Securian Canada product offerings:

Securian offers several insurance products for individuals and businesses, including:

- Term life insurance

- Permanent life insurance

- Mortgage protection insurance

- Critical illness insurance

- Group insurance

- Creditor insurance

- Business insurance

- Asset management services

- Customized products for financial institutions

What sets Securian Canada apart

- Securian Canada focuses on providing insurance solutions specifically tailored for financial institutions and affinity groups, allowing them to create products that meet the unique needs of these markets

- CPA makes an effort to add value to memberships in order to increase their value. This includes offering “group” pricing through the CPA insurance program, which assists people in taking care of their families and finances

Primerica

The Primerica Canada Insurance Company was started in 1986. It’s a subsidiary of Primerica Life Insurance Company, offering insurance and other financial services.

Primerica Canada Insurance Company product offerings:

Primerica offers products and services such as:

- Term life insurance

- Disability insurance

- Auto insurance

- Investment management services

- Pre-paid legal services

- Financial Needs Analysis (FNA) services

What sets Primerica apart

- Primerica helps families make financial security by offering easily accessible financial products that are tailored to their needs and specifically target those making between $30,000 and $100,000 annually

- Primerica also offers Primerica Representative, a unique application that allows individuals to gain a better understanding of where they stand with their personal finances and design an improved financial goal within 30 minutes

Chubb Life

Chubb Life Insurance Company was founded in 1882. Now, they’re a trusted and reliable provider of insurance in Canada. They have offices in Ontario, Quebec, Alberta, and British Columbia.

Chubb Insurance Co. of Canada product offerings:

Chubb Life offers many standard insurance products, including:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Travel insurance

- Auto insurance

- Home insurance

- Property & casualty insurance

- Group insurance

- Business insurance

What sets Chubb Life apart

- Through Chubb Life’s unique platform, Chubb Studio, insurance products can be seamlessly integrated into a variety of ecosystems, making it simple and effective for customers to obtain coverage via digital channels

- Chubb Life offers a special client benefits program that gives policyholders access to extra help, such as career, legal, financial, and mental health counseling

TruStage Life (Assurant Life)

The insurance company known as Assurant Life rebranded into TruStage in 2022 after it was bought by CUNA Mutual Group.

Assurant first began in 1902 as a family-owned funeral business. As an insurance company, they specialized in selling insurance for end-of-life planning, like funeral insurance and executor protection insurance. They also offer services like assessing and handling final documents — wills, trusts, etc.

Now, TruStage sells its products through a network of more than 300 insurance brokers across Canada.

TruStage product offerings:

TruStage Life sells insurance policies and offers financial services including:

- Term life insurance

- Permanent life insurance

- Cancer, heart attack, and stroke insurance coverage

- Auto insurance

- Home insurance

- Business insurance

- Investments and savings: annuities, wealth management services, etc.

- Funeral pre-planning services

What sets TruStage Life apart

- With TruStage, coverage limits for term life insurance range from $5,000 to $300,000, and for whole life insurance, they range from $5,000 to $100,000

- Credit unions and TruStage collaborate to provide life insurance options to their members. By taking advantage of these alliances, the business can offer clients who already do business with their credit union

Combined Insurance Company of America

Combined Insurance Company of America is owned by Chubb Insurance Company in the US. It was founded in 1922 and sells insurance to people and businesses.

Combined of America Company product offerings:

Combined Insurance, a Chubb company, offers mostly supplemental insurance products, including:

- Supplemental life insurance

- Critical illness insurance

- Disability insurance

- Supplemental health insurance

- Combined Insurance Worksite Solutions, comprehensive insurance coverage to complement group insurance

What sets Combined Insurance apart

- Combined Insurance Company places a high priority on providing accessible and easily understood supplemental insurance. They offer a wealth of information and assistance to clients in weighing their options

- For numerous years, Combined Insurance Company has been acknowledged as one of the best military-friendly employers, demonstrating its dedication to hiring veterans and assisting military families

UV Insurance

UV Insurance, formerly known as UL Mutual, was founded in 1889 in Quebec. They are the 5th oldest insurance company in Canada.

UV Insurance product offerings:

UV’s product offerings include:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Group insurance

- Investments and savings: retirement products, guaranteed investments, etc.

What sets UV Insurance apart

- In 2020, UV Insurance contributed more than $620,000 to the community through sponsorships and donations

- UV Insurance has added a century-worth of great accomplishments, which resulted in them earning the distinction of being the second most sustainable SME in Quebec

- The company aims to collaborate with other ventures that closely share their value on the sustainability and innovation front

Assumption Mutual Life

Assumption Life is best known for its no-medical term life plans. They were founded in 1903 in New Brunswick, Canada. But they were originally a fraternal society in Massachusetts, USA, before they decided to start selling insurance.

Assumption Mutual Life Insurance product offerings:

Assumption Life offers the following products:

- Term life insurance

- Permanent life insurance

- Critical illness insurance

- Group insurance

- Commercial mortgage insurance

- Investments and savings: retirement products

What sets Assumption Mutual Life apart

- Assumption Life provides a Registered Investment Account (RIA) that features low management fees and high-performing funds. This product is designed for fee-conscious clients, offering competitive returns while minimizing costs

- Assumption Mutual Life provides high-performing, pre-packaged funds that are professionally managed and tailored to each client’s risk tolerance and time horizon

Knights of Columbus

Knights of Columbus is a Catholic fraternal organization. It started in 1882 as a mutual benefit society for Catholic people who moved to the US. The company sells insurance and financial services, but also does a lot of charity work.

Knights of Columbus Insurance product offerings:

Knights of Columbus offers several insurance and personal finance products, including:

- Term life insurance

- Permanent life insurance

- Disability insurance

- Long-term care insurance

- Investments and savings: investment management, annuities, etc.

What sets Knights of Columbus apart

- The Knights of Columbus is deeply rooted in charitable work, having donated over $185 million and contributed 49 million volunteer hours in 2022 alone

Humania Assurance Inc.

Humania Assurance was founded in Quebec in 1874 as a mutual society. They offer a lot of no-medical life insurance options and are best known for how quickly they issue policies.

Humania Assurance product offerings:

Humania Life Insurance offers insurance products including:

- Term life insurance

- Mortgage insurance

- Critical illness insurance

- Disability insurance

- Health insurance

- Travel insurance

What sets Humania Assurance Inc. apart

- Prioritizing a human-centric strategy, Humania Assurance Inc. makes sure that customer interactions are marked by empathy and understanding, which improves the customer experience as a whole

- Humania Assurance recently completed 150 years of serving clients and building a network of policyholders, advisors, and trusted clients in Canada, which is a huge achievement

American Income

American Income Life was founded in 1951. The company now sells insurance in Canada, the US, and New Zealand. They focus on helping working families and members of credit unions, labour unions, and other associations get insured.

American Income Life Insurance product offerings:

American Income offers the following insurance products:

- Term life insurance

- Permanent life insurance

- Supplemental health insurance

What sets American Income apart

- American Income Life’s no-cost Legacy Will Kit helps users decide who will take care of their family, leaving all they’ve worked for to those they love, and secure their future wishes

- The company believes in upfront and honest pricing, with no hidden fees or commission

- America Income is dedicated to empowering clients through financial education, offering seminars, workshops, and resources to help them make informed decisions

Serenia Life

Serenia Life is a US fraternal benefit society that sells insurance in Canada. It was founded in 1972 and used to be called Faithlife Financial up until 2008. Their company is inspired by Christian values.

Serenia Life Insurance Company product offerings:

Serenia Life offers the following insurance products and financial services:

- Term life insurance

- Permanent life insurance

- Investments and savings: investment management, annuities, etc.

What sets Serenia apart

- Serenia Life emphasizes one-on-one financial guidance, ensuring that each member receives tailored advice suited to their needs

- The company operates on the belief that prosperity and generosity go hand in hand, encouraging members to engage in charitable activities and community support

CIBC

CIBC Insurance is a part of CIBC (the Canadian Imperial Bank of Commerce), one of Canada’s biggest banks. The bank itself was formed in 1961 after two older Canadian banks merged into one. They later started selling insurance products too.

CIBC Life Insurance product offerings:

CIBC offers insurance products such as:

- Term life insurance

- Critical illness insurance

- Travel insurance

- Auto insurance

- Home insurance

- Creditor insurance

What sets CIBC apart

- CIBC prioritizes environmental, social, and governance (ESG) principles, actively supporting sustainable financing initiatives and investments in renewable energy

- CIBC is committed to enhancing customer experience through advanced technology, such as mobile banking apps and digital tools, making insurance less complicated for users

Reliable Life

Reliable Life has been helping Canadians with insurance since 1887. They’re also part of a company called the Old Republic International Corporation, which is listed on the New York Stock Exchange. Reliable Life mostly sells travel insurance and accident insurance for students.

Reliable Life Insurance Company product offerings:

Reliable Life offers insurance products such as:

- Travel insurance

- Accident insurance

What sets Reliable Life apart

- Reliable Life offers annuity products that provide a steady stream of income for life

Is it better to choose a bigger insurance company?

Buying a policy from one of the biggest insurance companies in Canada may not always be the best choice. Just because a company is the biggest, it doesn’t mean that it’s the right company for your needs. Sometimes, going with a smaller company may be to your advantage.

This is why it’s best to speak with our licensed advisors. They have intimate knowledge of the Canadian insurance market and can recommend the best provider for your specific needs.

Choosing a bigger versus a smaller insurance company

Whether you would be best served by choosing a large or a small insurance company as your provider comes down to what matters most to you and your family. There are advantages and disadvantages for each one, so the right choice will depend on you.

Below, we’ve provided some tips to help you choose. But you can also book a call with us if you need one-on-one help with deciding.

Why choose a bigger insurance company?

There are many reasons to choose a large company for your financial security needs, such as knowing you’ll be working with experienced professionals who have been in the field for a long time. Here are some of the major benefits.

Scalability

Most of Canada’s largest insurance companies have been in business for decades — some from as long ago as the mid-1840s ′s. When a company has been around for that long, you can trust that they know how to do business in the industry very well.

Big providers like this know the ins and outs of Canadian insurance, and their history of meeting long-term financial obligations means it’s not risky to do business with them. There’s a good chance they know how to manage your policy well and that they’ll be around for years to come.

Flexibility

The largest life insurance providers can offer you the most choice for the type of product you buy and how much you’ll be covered for.

For example, you can get more than just term insurance and will probably have options to convert your policy into a permanent plan. It can be convenient to get all of your different insurance policies in one place.

And, you can get higher coverage amounts for life insurance. While a smaller insurer may only be able to cover you for up to $500,000, a bigger provider can probably offer you millions — if you need that much.

Operating hours

Bigger insurance providers are usually open later and longer and are available on the weekends too. Because they’re so large, they usually have offices all over Canada, employ a lot more people, and have brokers selling their products on their behalf.

This means you, the customer, can speak to an agent faster, whether over the phone, online, or in person.

Technology

Another huge advantage of choosing a bigger insurance company is that they have more money to spend on upgrading their technology.

They can improve the way their customers do business and make it easier to do things like get quotes, buy a policy, change your plan, submit a claim, get help, or anything else you need.

Why choose a smaller insurance company?

Working with a smaller insurance company can be a good thing, too. A lot of them are just as stable as the bigger providers, and they can give you more specific products and personalized service. Here are some of the major benefits.

Price

Smaller insurance companies may not charge you as much for some insurance products as the bigger ones in Canada do.

This can be for a lot of different reasons. For example, bigger companies may have to meet certain government requirements or they may need more funds to upgrade their technology like we talked about earlier in this article.

But just be aware that although you can save some money if you choose to work with a smaller insurance company, the cost of term life insurance policies is about the same for all the top insurance providers in Canada. So, you may not want to choose on price alone.

Features

Canada’s largest life insurance companies can be slow to decide what products or services to introduce. However a smaller insurance company can be quicker and more easily offer tailored solutions.

Many Canadian insurers of all sizes offer extra options called life insurance riders that can help you make a custom plan. However smaller companies may have unique features that fit your needs better.

Customer service

Life insurance is a long-term agreement, so you’ll want to choose a company that knows how to value its customers. A small or medium-sized company can often give you personalized service that a bigger company may not be able to.

They may not have as many clients or hundreds of spread-out employees and representatives, so their service may have more of a personal touch.

And, they can quickly make changes to their products or services based on what customers want. For example, if you want an e-policy or if you don’t want to answer too many health questions, a smaller company may be able to give you those options.

Personal preference or ethics

Some Canadians choose to work with smaller companies just because of their own principles. Some want to support a smaller, local company as much as they can.

Others may choose a mutual insurance company. Some may also want to work with a company that shares their ethical beliefs, like Christian-based companies.

Still looking for the top insurance companies in Canada?

If you’re still not sure whether one of the largest Canadian insurance companies is right for you, our advisors are happy to help you out! Schedule a call and let our experts answer your questions about what is offered by Canadian insurance companies — big and small.

Online insurance brokers like PolicyAdvisor.com let you compare insurance quotes from 30 of the country’s best insurance companies. Schedule a call or try out our instant insurance quoting tools to see how much you can save by comparing quotes online.

Frequently asked questions

How often do rankings of life insurance companies change?

Rankings can change annually or even more frequently, depending on factors like financial performance, customer service ratings, innovation, and regulatory changes. A company’s solvency, claims handling, and market share can all influence its position in industry reports or consumer rankings.

What factors affect the financial stability of life insurance companies?

Financial stability is typically measured by solvency ratios, capital reserves, investment performance, and underwriting profits. Companies with diverse investment portfolios, strong risk management practices, and consistent profitability are generally more stable and reliable over the long term.

Can I buy life insurance from a company not based in Canada?

You can only purchase life insurance from international companies that are licensed to operate in Canada. These insurers must comply with Canadian regulations and are monitored by federal or provincial insurance regulators. Buying from an unlicensed foreign insurer could leave you unprotected or unable to enforce your policy.

What are the benefits of choosing a large life insurance company over a smaller one?

Large insurers often offer a wider range of products, stronger digital platforms, and greater financial stability. They may also have more streamlined claims processes and better access to additional services, such as financial planning tools or wellness programs. However, smaller insurers may provide more personalized service or competitive pricing.

How do consumer ratings affect life insurance companies?

Consumer ratings influence a company’s reputation and can guide potential customers during their decision-making process. Positive reviews can enhance trust, while repeated complaints may raise concerns. While not the sole factor, consumer feedback is a helpful indicator of service quality and client satisfaction.

What should I do if I am not satisfied with my life insurance provider?

You should begin by reviewing your policy and identifying specific concerns and contacting your insurer’s customer service to discuss your issue. If the problem persists, you can file a complaint with your provincial insurance regulator. If you’re considering switching providers, ensure your new policy is active before cancelling the old one to avoid any coverage gaps.

Which are the best insurance companies in Canada for 2025?

The best insurance companies in Canada for 2025 are determined by their financial strength, customer satisfaction, product innovation, and digital capabilities. Leading providers include:

- Sun Life, for strong client satisfaction and wellness-focused products

- Manulife, for innovation and global reach

- Canada Life, for scale and comprehensive coverage options

- Industrial Alliance, for regional expertise and competitive pricing

- Desjardins, for cooperative structure and personalized service

How do I choose between the largest insurance companies in Canada?

Choosing the right insurer involves assessing several factors such as financial strength (AM Best ratings and LICAT ratios), product suitability based on your needs, pricing competitiveness, quality of service and claims experience, and access to digital tools for convenience and support.

Are bigger insurance companies always better?

Larger insurance companies offer advantages such as financial stability, broad product availability, and extensive support networks. However, they may not always be the best fit. Smaller or regional insurers can provide more competitive pricing, personalized service, and flexible options tailored to specific needs.

What is the difference between the top 10 and top 20 insurance companies in Canada?

The top 10 insurers are typically national leaders with large-scale operations and diversified offerings. The top 20 includes regional and specialized insurers that may excel in niche markets or offer unique advantages in pricing, service, or policy design.

How often do rankings of the biggest insurance companies change?

Rankings among Canada’s top five life insurers tend to remain consistent year over year. However, changes can occur due to mergers, premium growth, or shifts in market strategy. Notably, Canada Life’s position strengthened following its merger with Great-West Life and London Life.

Can I trust the financial ratings of Canada’s largest insurance companies?

Yes. Canada’s major insurers are rated by independent global agencies such as AM Best, Moody’s, S&P Global, and DBRS Morningstar. These ratings reflect a company’s financial strength, claims-paying ability, and long-term stability, and are reviewed regularly.

Do the top Canadian life insurance companies operate nationwide?

Yes, all top life insurance companies in Canada are licensed to operate nationwide. While some have stronger regional footprints such as Desjardins and Industrial Alliance in Quebec or Wawanesa in the West. They serve clients across the country either directly or through licensed advisors.

What makes the best insurance companies in Canada in 2025 different from previous years?

Top insurers in 2025 are distinguished by their investment in digital transformation, faster underwriting through AI, integrated wellness and health features, ESG investment practices, and personalized insurance solutions using data and analytics. These enhancements improve both accessibility and client experience.

Canada’s life insurance market is led by a handful of longstanding, well-capitalized companies whose dominance is defined either by the size of their annual premiums or the scale of their total assets. The definition of “biggest” can vary depending on whether you’re measuring by the volume of policies sold, client base, revenue, or investments managed. Among the giants, Canada Life, Manulife, and Sun Life consistently top the rankings, each with distinct strengths—Canada Life leads in total premiums, while Manulife is unmatched in assets. The list also covers iA Financial Group, Desjardins, and Beneva, the latter formed through the strategic merger of SSQ and La Capitale, demonstrating how consolidation continues to shape the market. However, the biggest company isn’t always the best choice for every individual. Depending on a client’s needs, smaller or niche insurers may offer more competitive rates or tailored customer service.

Canadian Life and Health Insurance Association (CLHIA). Canadian Life & Health Insurance Facts, 2024 Edition. Toronto: CLHIA, 2024.

International Financial Reporting Standards Foundation. IFRS 17 Insurance Contracts: Fact Sheet. London: IFRS Foundation, 2023.

1-888-601-9980

1-888-601-9980