- You are allowed to pay for Canadian super visa insurance either monthly or yearly

- Only a select number of Canadian insurance providers offer monthly payment options for super visa health insurance

- The process to get super visa insurance is very easy and usually approved instantly

- What is Super Visa insurance?

- Can I pay for Super Visa insurance monthly?

- What are the benefits of paying for Super Visa insurance monthly?

- Did the rules about Super Visa insurance payments change?

- Will the new Super Visa insurance rules affect me?

- Can I switch to monthly Super Visa insurance payments?

- Which Canadian providers offer monthly payment plans for Super Visa insurance?

- How can I apply for the Super Visa monthly plan?

- How to get the best Super Visa insurance deals

- Frequently asked questions

Since 2011, the Canadian Super Visa program has helped to connect Canadian citizens and residents with their foreign parents and grandparents. The unique health insurance plan for visitors to Canada on this kind of visa, also known as Super Visa insurance, has helped keep them covered in case an emergency happens during their stay.

In 2023, Canada received 91,417 Super Visa applications, with an impressive 81% approval rate. The demand for affordable, accessible insurance options continue to grow in 2025.

However, there has been some confusion about Super Visa insurance payment options. The government has changed the rules about how you can pay for it several times since the program began. In this article, we’ll clarify the issue and provide some details on what kind of payment options are available.

What is Super Visa insurance?

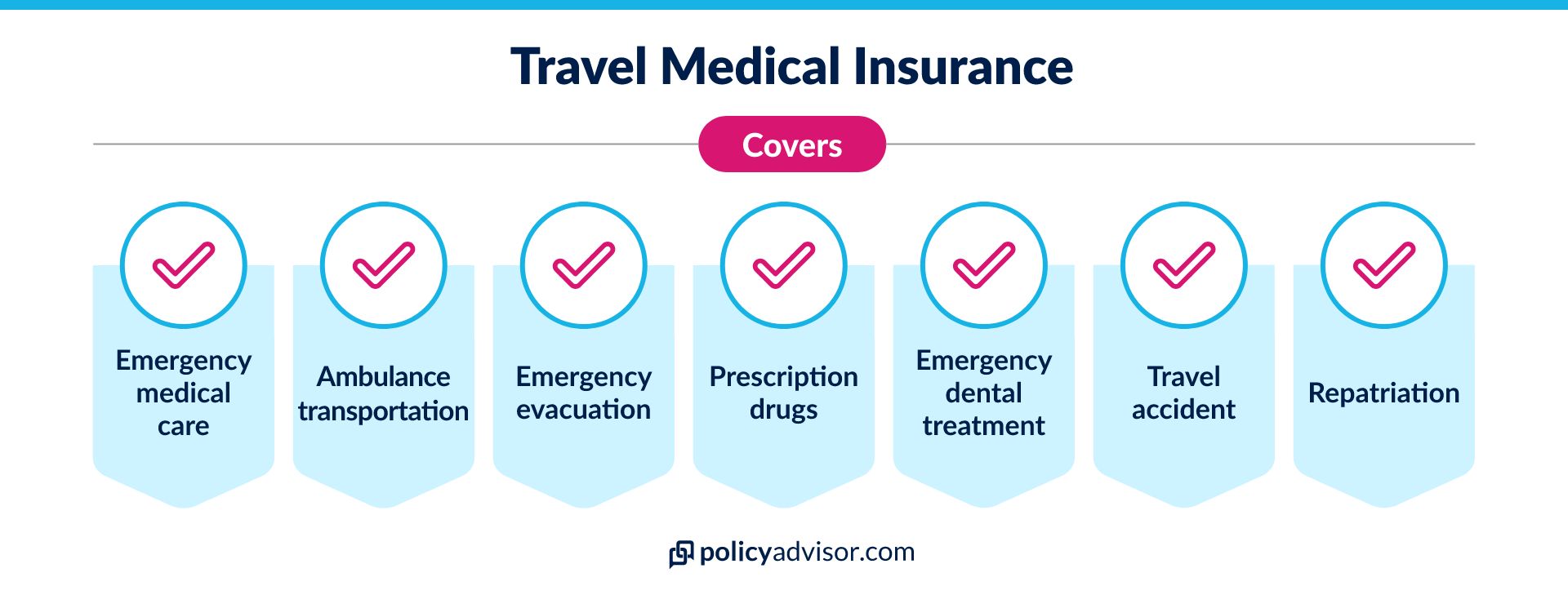

Super Visa insurance is a specialized travel medical insurance policy required for parents and grandparents visiting Canada under the Super Visa program. This insurance provides financial protection against unexpected healthcare expenses during their stay and is a key part of the Super Visa application process.

The Canadian government mandates strict coverage requirements to ensure that visitors do not burden the public healthcare system. A valid Super Visa insurance policy shows that the applicant is prepared for medical emergencies and meets all immigration health coverage standards.

Key features of Super Visa insurance:

- Minimum emergency medical coverage of $100,000: Every Super Visa insurance policy must offer a minimum of $100,000 in emergency medical coverage per person. This coverage includes doctor visits, ambulance services, hospitalization, prescription drugs during emergencies, and more

- Policy valid for at least one year: The insurance must be valid for a minimum of one year from the date of entry into Canada, regardless of the actual travel duration. This ensures coverage throughout the intended long-term visit

- Must include repatriation and hospitalization: Coverage must specifically include hospital care, health services, and repatriation (the cost of returning the insured person’s remains to their home country) in case of death

- Proof required for visa approval: Applicants must submit proof of Super Visa insurance at the time of visa application. The Super Visa insurance must include key details such as coverage amount, duration, and specific inclusions

- May offer coverage for pre-existing conditions: Many policies offer optional add-ons for pre-existing medical conditions, provided they are stable for a certain period (usually 90–180 days) prior to the policy’s effective date

- Refunds and policy cancellations available: Most Canadian insurers provide partial or full refunds if the government denies the Super Visa or if the visitor returns home earlier than expected. However, refund eligibility varies by provider and must meet specific terms and conditions

- Monthly payment options may be available: Some insurers allow monthly payment plans rather than requiring a lump-sum payment, though these options may come with administrative fees or slightly higher premiums

Can I pay for Super Visa insurance monthly?

Yes, you can pay for Super Visa insurance either monthly or yearly. Just be aware that only certain providers offer monthly payment plans right now. Most providers only allow you to pay annually.

The Canadian government accepts both payment options. They only require that the medical insurance plan for visitors with this kind of visa be paid by the time that person arrives in Canada, either:

- Paid in full for a 12-month period

- Deposit paid for a monthly payment plan

Note that the government will not accept just quotes for a payment plan. You must pay the insurance policy premiums according to the requirements listed above.

What are the benefits of paying for Super Visa insurance monthly?

There are several benefits of paying for Super Visa insurance on a monthly basis, including affordability, flexible coverage, easy renewal options, lesser upfront costs, and more. Find more about these benefits:

- Affordability: Monthly payments make it easier for families to budget and manage their finances, avoiding the large upfront cost for insurance

- Flexible coverage: The ability to adjust coverage based on the duration of stay allows families to tailor their insurance to fit specific needs and circumstances

- Cash flow management: Spreading the cost over several months helps maintain cash flow, making it more manageable for families with varying financial situations

- Renewal options: If you need additional coverage, many monthly plans allow for renewals, ensuring continued protection for extended visits without the hassle of reapplying for new policies

- No large upfront costs: Families can avoid the financial strain associated with paying the full insurance premium upfront, which can be particularly beneficial for those on a fixed budget

Is Super Visa insurance mandatory for entry into Canada?

Yes, you must purchase Super Visa insurance to enter Canada under the Super Visa program. Immigration, Refugees and Citizenship Canada (IRCC) requires every applicant to show proof of private medical insurance before they approve a Super Visa. Without valid insurance, you cannot receive approval or enter the country.

To meet the Super Visa insurance requirement, your visitor insurance policy must:

- Cover emergency medical care, including hospitalization and repatriation (the cost of returning your remains if you pass away in Canada)

- Offer at least $100,000 in coverage per person, as required by IRCC

- Remain valid for at least 12 months from the day you arrive in Canada

- Remain active on your arrival date, and you must include proof of coverage in your visa application

What are the new Super Visa insurance changes in 2025?

In January 2025, IRCC introduced two major changes that impact how Super Visa applicants can pay for and source their insurance coverage. These updates aim to provide families with more affordable options while ensuring policies still meet Canada’s strict regulatory standards. Some of the key changes to Super Visa insurance rules in 2025 include:

- IRCC now allows foreign insurance providers: As of January 28, 2025, Super Visa applicants can purchase private medical insurance from select foreign insurance companies, not just Canadian providers. This change helps families access more competitively priced plans, especially in countries like India and the Philippines

- Foreign policies must meet all IRCC coverage requirements: If a foreign company wants to issue Canadian Super Visa, the insurance plan must abide by a few rules, including:

- Offer a minimum of $100,000 CAD in emergency medical coverage, including hospitalization and repatriation

- Remain valid for at least one year from the planned date of entry

- Come from an insurer that meets Canadian regulatory standards

- Only OSFI-approved foreign insurers are eligible: To ensure consumer protection, IRCC requires that foreign insurers appear on the OSFI (Office of the Superintendent of Financial Institutions) list of federally regulated financial institutions. These foreign companies should also operate directly in Canada, not just through brokers or intermediaries

Did the rules about Super Visa insurance payments change in 2025?

No, the Canadian government did not introduce any new changes to Super Visa insurance payment rules in 2025. However, earlier updates in 2022 and 2023 significantly impacted how applicants can pay for their medical insurance.

In August 2022, IRCC briefly required Super Visa applicants to pay the full annual premium upfront. During that period, if an applicant didn’t pay in full, border officers could deny entry. This created stress for many families who found it financially burdensome to make large, lump-sum payments.

Fortunately, by December 2022, IRCC reversed that policy. You can now pay for Super Visa insurance in monthly installments, as long as your insurer offers that option. This change remains in effect and continues to benefit families who prefer more flexible and affordable payment plans.

How much does a Super Visa insurance cost monthly in Canada?

The cost of affordable Super Visa insurance depends on factors like the applicant’s age, health status, deductible amount, and the chosen coverage level. For a 12-month policy with $100,000 in coverage and a $1,000 deductible,the monthly cost of visitor insurance premiums typically range from $92 to $226. Older applicants pay significantly more due to increased health risks.

Monthly cost of Super Visa insurance in Canada

| Age | Monthly Premium |

| 55 | $92.5/month |

| 60 | $103.4/month |

| 65 | $132/month |

| 70 | $182.3/month |

| 75 | $226/month |

*Monthly quotes based on a 365-day Super Visa insurance policy with $100,000 in coverage and a $1,000 deductible

Can I switch to paying for Super Visa insurance monthly?

Yes, you can change from a yearly to a monthly payment plan for your Super Visa medical insurance coverage, if your provider has that option. Remember, only a few providers offer monthly payment options.

If you’ve already paid in full for the full year of health insurance for your Super Visa, you may have to wait until your current plan ends before you can switch to a monthly payment plan.

Or, if you’re already in Canada and you want to stay longer by extending your visa, you can ask for a monthly payment plan when you renew your health insurance.

Which Canadian visitor insurance companies offer Super Visa plans with monthly payment options?

Several reputable Canadian insurers, such as 21st Century, Travelance, and Secure Travel, provide monthly payment plans for Super Visa insurance, offering flexibility and affordability for families.

- 21st Century: 21st Century offers a monthly payment plan for Super Visa, visitor, and work/student visa types. Applicants pay a two-month deposit plus a $50 policy fee upfront. The policy remains “pending” until the arrival date in Canada is confirmed. Coverage limits range from $100,000 to $200,000, with policies valid for 365 or 730 days

- Travelance: Travelance provides a monthly payment option for Super Visa insurance policies with a minimum coverage of $100,000 and a duration of 90 days or more. The upfront cost includes two months’ premium plus a $60 policy fee. Monthly installments are then charged for the remaining balance

- Secure Travel: Secure Travel offers a monthly premium payment option for Super Visa insurance. The policy’s start date can be adjusted as needed, providing flexibility for applicants awaiting visa approval. A 100% refund is available if the visa is not granted, and partial refunds are offered if the insured returns home early

Can I switch from an annual to a monthly Super Visa insurance payment plan mid-policy?

You generally cannot switch from an annual to a monthly Super Visa insurance payment plan once the policy is already in effect. Most insurance providers lock in the payment structure at the time of purchase, meaning if you choose to pay annually, you must complete the full term under that plan.

However, if your policy is nearing renewal, some insurers may allow you to change the payment frequency for the next term. If you want to explore this option, you must contact your insurance provider directly to understand their cancellation and reissue process, any administrative fees involved, and whether prorated refunds are possible.

What happens if I cancel my Super Visa insurance before the policy term ends?

If you cancel your Super Visa insurance before the policy term ends, you may be eligible for a partial refund, depending on the insurer’s cancellation policy. Most Canadian insurance providers allow cancellations if the policyholder leaves Canada early, switches to provincial health coverage, or if the insured person is denied a visa.

In such cases, insurers typically refund the unused portion of the premium, minus an administrative fee. However, if you’ve already made a claim or if the policy has certain non-refundable terms, you may not qualify for a refund. To cancel your Super Visa policy, you must usually submit a written request and provide documents like proof of departure or new coverage.

How can I apply for the Super Visa monthly plan?

Applying for the Super Visa monthly plan involves several steps including eligibility criteria, filling up documents, choosing the right insurance provider, and requesting a quote. Here’s a guide on how to do it:

- Check eligibility: Ensure you meet the eligibility requirements for a Super Visa, which is available for parents and grandparents of Canadian citizens or permanent residents

- Gather required documents: Prepare necessary documents including proof of relationship to the Canadian citizen or permanent resident, evidence of sufficient income from the sponsor in Canada, and medical insurance coverage details with a minimum of $100,000 in coverage

- Choose an insurance provider: Research and select a Canadian insurance provider that offers a Super Visa monthly plan. Look for reputable companies that provide adequate coverage for medical emergencies

- Request a quote: Visit the chosen insurance provider’s website or contact them directly to request a quote. Provide information such as your age, duration of stay in Canada, and any specific coverage needs

- Review policy options: Evaluate the policy options presented, including coverage limits, premiums, and additional benefits. Ensure that the policy meets the Super Visa requirements

- Complete the application: Fill out the insurance application form provided by the insurer. This can often be done online. Provide necessary personal information and documentation

- Make monthly payments: After approval, set up your payment plan to cover the insurance premium on a monthly basis. Ensure you understand the payment terms and conditions

- Obtain policy documents: Once the application is approved and payments are set up, you will receive your insurance policy documents. Keep these handy, as they may be required for the Super Visa application

How to get the best Super Visa insurance quotes in Canada?

To get the best Super Visa insurance quotes in Canada, you need to actively compare plans based on premiums, coverage, deductibles, and refund flexibility. PolicyAdvisor streamlines this process by providing access to quotes from over 30 top Canadian insurers. You can compare plans side by side, filter based on your preferences, such as monthly payments or pre-existing condition coverage, and choose the one that fits your family’s needs.

Our licensed insurance experts guide you through the entire purchase process, answer your questions, and help you clearly understand policy details. Even after you buy a plan, our dedicated after-sales support team remains available to assist with cancellations, claims, or changes, ensuring peace of mind throughout your stay in Canada. Schedule a call with us today to lock in affordable visitor insurance prices!

Frequently Asked Questions

Can a relative buy Super Visa insurance for me?

Yes, Canadian citizens and permanent residents can buy a policy on behalf of their visiting parents or grandparents. In fact, many people choose to do just that.

With this program, Canadian citizens and residents are considered the sponsors of their visiting family members. Since they are financially responsible for the visit, most people will buy the necessary Super Visa coverage on behalf of their visiting relatives.

Is Super Visa insurance refundable?

Yes, you can get a refund if you need to cancel your insurance coverage. But we don’t recommend that you cancel your policy except in a few rare circumstances.

Your Super Visa insurance has to remain active for the entire duration of your stay for your visa to remain valid. If you cancel it, your visa might be revoked.

The few exceptions would be:

- If the insured person leaves Canada earlier than expected

- If the Super Visa application is denied

In either of these cases, or similar situations, it may be necessary to cancel the policy. At that time, the insurance provider would give you a partial refund.

How long does it take to get Super Visa insurance?

In most cases, you’re approved as soon as you complete the application process. It’s quite fast and simple to get the coverage you need. Getting approved for the actual visa itself is much more complex and takes far more time.

You can apply for Super Visa insurance in a matter of minutes with PolicyAdvisor. We give you the option to apply online or over the phone with one of our expert advisors. So, you’re free to apply however is easiest for you.

Are monthly payment options available for Super Visa insurance from foreign providers?

Yes, some foreign insurance providers approved by the Canadian government may offer monthly payment options for Super Visa insurance. However, this depends entirely on the individual insurer’s policies and whether they operate in compliance with Canadian regulations.

While Canadian insurers commonly offer monthly plans, not all foreign insurers provide the same flexibility. Applicants should verify payment terms directly with the foreign insurer before purchasing a policy.

Why is super visa insurance so expensive?

Super visa insurance can be expensive due to the following reasons:

- Age: Super visa insurance premiums tend to increase with age. For example, if you’re 60-65 years old, premiums for minimum coverage of $100,000 would cost you $1,200-$1,500. However, if you’re 70-75 years old, the same coverage would cost $2,100-$2,700

- Length of stay: The duration of your stay in Canada also contributes to your premiums. Longer stays usually result in higher premiums since there’s a greater potential for health risks

- Deductibles: Choosing a lower deductible for your insurance also results in higher premiums, as you’re shifting more responsibility to the insurer

- Chronic illnesses: If you have diabetes, heart disease, or any chronic condition, your premium will be higher, as it represents a greater risk to the insurer

The IRCC is accepting super visa insurance paid in monthly instalments. Right now, that is limited to certain insurance providers only. But it’s expected that monthly payment policies from other providers will soon be accepted too. This is welcome news for families who want more flexibility with how they pay for their super visa insurance policy.

Government of Canada. Report to Parliament on the Super Visa Income Requirement, and the Appeal Process and Special Circumstances for All Temporary Resident Visas. Ottawa: Immigration, Refugees and Citizenship Canada, October 2024.

1-888-601-9980

1-888-601-9980