Travel medical insurance vs. trip interruption insurance

Travel medical insurance and trip interruption insurance provide coverage for different parts of your trip. Travel medical insurance covers costs for medical emergencies that may happen during your trip, while trip interruption insurance reimburses a portion of your trip if it’s interrupted.

As border restrictions ease, Canadians are travelling again. In March 2022, the number of Canadians visiting countries abroad increased over 500% from the previous year (source: Statistics Canada).

While it’s becoming safer to travel, we need to remember the other risks that were present before the pandemic. For example, what if you’re hospitalized while in another country? Or, what if an unexpected situation forces you to cut your vacation short?

Travel medical insurance and trip interruption/cancellation insurance are policies that can protect you before and during your travels abroad. They can reimburse you for non-refundable trip expenses and unexpected medical or non-medical incidents in another country.

We dive deeper into travel medical and trip interruption coverage and their differences in this article.

What is travel medical insurance?

Travel medical insurance can cover emergency medical treatment when you’re in another country. Otherwise, a sudden illness could lead to a hospital bill in the hundreds of thousands of dollars if you’re in the U.S. or another destination.

Not every country has free health coverage. Even if a country does, you might only be eligible for a free medical visit if you’re a resident of that country. Travel medical coverage prevents the need to pay unforeseen medical expenses out of pocket while travelling.

Learn more about travel insurance.

Do I need travel medical insurance?

Travel medical policies provide peace of mind when you travel. You’re able to relax knowing that an accident or bout of nausea won’t result in an out-of-country doctor visit that is not covered by government health plans.

Having sufficient travel medical insurance also means you don’t need to delay a hospital visit if something goes wrong. Remember, you’re covered, so there’s no need to endure an illness or injury you have until you return home.

You can also look into multi-trip annual plans if you frequently leave the country. Some yearly plans provide travel medical coverage for unlimited trips throughout the year so you’re always protected. In short, you wouldn’t have to worry about purchasing insurance every time you hop on a plane.

Learn more about annual multi-trip travel insurance.

Who can benefit the most from travel medical insurance?

Those who may be travelling for longer periods of time than normal or who may plan to participate in certain sports (like recreational or professional athletes) can benefit from travel medical insurance. For this type of traveller, having enough coverage for emergency situations can be especially critical.

Additionally, annual plans with medical coverage are great for “snowbirds” who regularly leave the country during the winter months. Snowbirds also tend to be retirees in their later stages of life. As a result, they are more likely to require medical care, especially in an unexpected emergency.

Foreign workers and work permit holders who are new to Canada can also benefit from travel medical coverage. They usually have to wait at least three months before they are eligible for “free” healthcare, so having a private travel insurance plan can come in handy.

But, anyone travelling for extended periods will find benefits in emergency medical coverage. These extended excursions can lead to a greater likelihood of foreign hospital visits. And you don’t want to be caught off-guard by emergency medical expenses.

Do I need travel medical coverage for trips within Canada?

Travel medical coverage has its benefits even when taking a quick trip within Canada. Your provincial or territorial health plan may not pay all your medical fees if you’re outside your province of residence and suffer a medical emergency.

Services like an air or ground ambulance, emergency dental procedures, or prescription drugs might lead to out-of-pocket expenses unless you have some form of private coverage. As such, having some form of additional health insurance for your travels is recommended.

Is travel insurance different from travel medical insurance?

Travel insurance refers to a broad category of policies that aim to absorb unexpected extra costs while you’re travelling.

It includes travel medical insurance, but also policies like trip interruption and cancellation insurance. It also covers potential damages to personal effects/equipment and car rentals, baggage loss, and unforeseen events related to the COVID-19 pandemic, like emergency quarantine — barring any government travel advisories.

Learn more about COVID-19 travel insurance coverage.

Essentially, you can expect travel insurance policies to mitigate losses whenever you trek outside your home province or country.

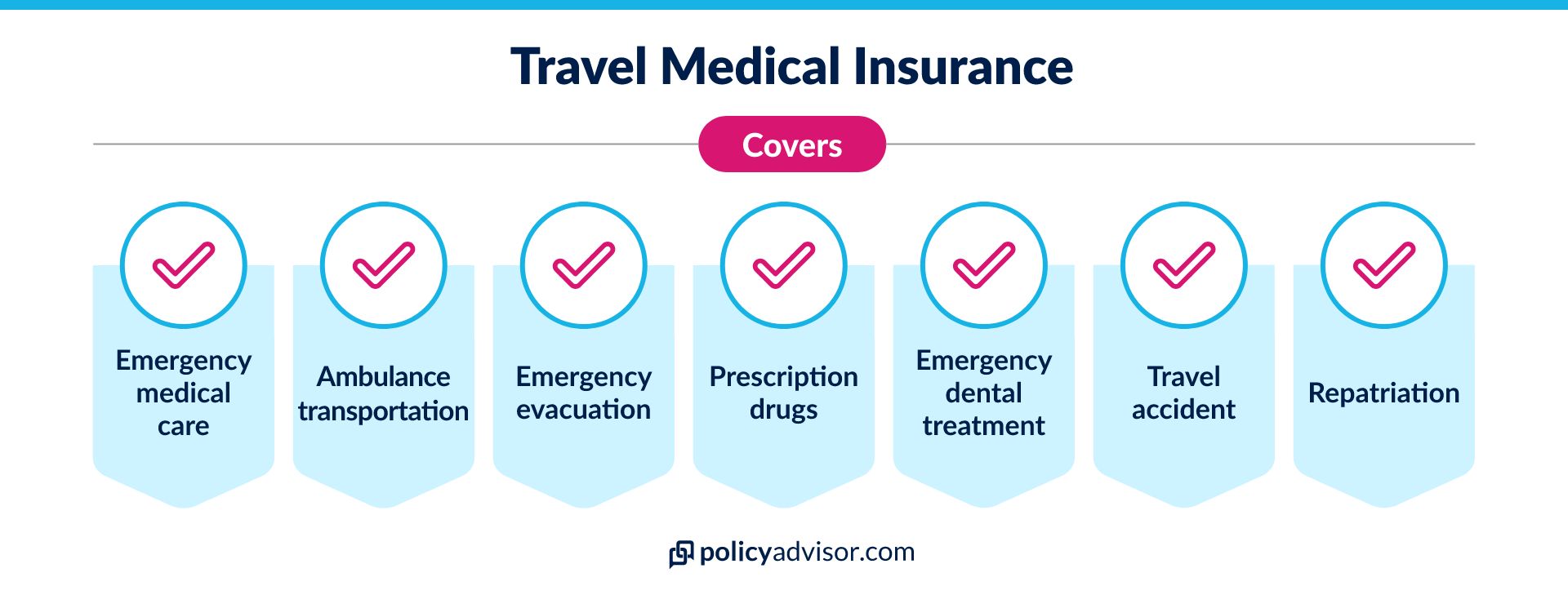

What does travel medical insurance cover?

Most travel medical policies cover issues such as:

- Motor vehicle accidents resulting in broken bones or other injuries

- Heart attacks or strokes

- Emergency dental treatment

- Travel accidents

- Emergency transport like ambulances or helicopters

- Medical evacuation

- Prescription drug expenses

- Emergency in-patient hospital care

- Repatriation (returning your remains to your home country in a worst-case scenario)

Numerous other situations could also count as a medical emergency, and your insurance company can cover these incidents up to your travel policy’s limit.

But travel medical insurance won’t cover planned medical treatments during a trip abroad. For example, a travel medical policy won’t cover the costs of a planned root canal procedure in Mexico. Most policies require that the medical procedures be unexpected.

What is trip interruption insurance?

Trip interruption insurance reimburses you for the unused portion of your trip if an unexpected event forces you to return home early, as well as some related extra expenses.

For example, you book a seven-day trip to Hawaii. But on day three, a family member ends up in the hospital and you must return home. In this case, your trip interruption policy may reimburse you for the cost of days three to seven of your trip as well as your flight home.

Depending on your policy, your insurance plan could cover 100% to 200% of your trip’s cost. This covers not only your pre-paid expenses like hotel and flights but also any related additional cost to rush home or cancel the remainder of your vacation.

What does trip interruption insurance cover?

There are two main types of fees that trip interruption travel plans cover:

- Non-refundable travel expenses. This could include flight tickets, hotel accommodations, activities, and more. If you could otherwise receive a refund, you can’t receive compensation from the policy.

- Additional costs. An unforeseen scenario might mean additional meal expenses, hotel stays, transportation, and more. Your policy could cover these fees on your behalf, up to the policy limit.

Here’s a breakdown of some scenarios that are covered and examples of what they can look like.

- Personal medical emergency or injury: Let’s say you suddenly faint and get rushed to a nearby hospital during your stay in Barcelona, so you don’t make it to your itinerary in Lisbon, but you’re unable to receive a refund on your accommodations at your destination.

- The emergency of a family member: This could be a scenario where your child is seriously injured in an accident and you book last-minute plane tickets to get home.

- Missed connecting flight: For instance, if your plane arrives late and causes you to miss your flight to Santorini, but you’re unable to receive a refund for the night you missed there.

- Travel host’s hospitalization or death: In this example, it could be that you plan to visit and stay with your friend in Peru. However, he suddenly ends up in the hospital and you need to change or cancel your travel plans.

Your trip interruption insurance would cover these scenarios so you won’t need to worry about emergencies cutting your trip short. These travel insurance plans let you focus on what’s essential, claim compensation from your policy, and rebook the remainder of your trip for another day.

Limitations

However, you should understand the limitations of any travel policy you purchase. Your travel coverage may be void or limited if you have a pre-existing medical condition, are at a certain age, or visit certain destinations that have government travel advisories issued against them.

Having a pre-existing condition may affect whether you’re eligible for certain travel medical insurance plans. A particular illness may mean you don’t qualify at all or only qualify for a certain amount of coverage. Additionally, pregnancy-related healthcare may be excluded if you were already pregnant before you got the policy.

Additionally, travellers over 60-65 years old will likely be asked to complete a medical questionnaire or exam. Those medical results could impact how much coverage you can get and how much insurers will charge you. But most policies do not have an official age limit for when you can apply for travel insurance.

Another thing to note is that passport and travel visa delays can be excluded from coverage under trip interruption insurance. For example, let’s say you’re travelling to Japan but service delays mean you won’t have your passport or visa ready by your departure time and your plane tickets are non-refundable. This would not be covered under most trip interruption travel insurance policies. But some trip cancellation policies may cover it under an optional add-on called “cancel for any reason”.

Travel insurance specialists (like the ones at PolicyAdvisor) can shed some light on the eligibility requirements and other fine print of your policy and help find the coverage that works best for you.

Frequently asked questions

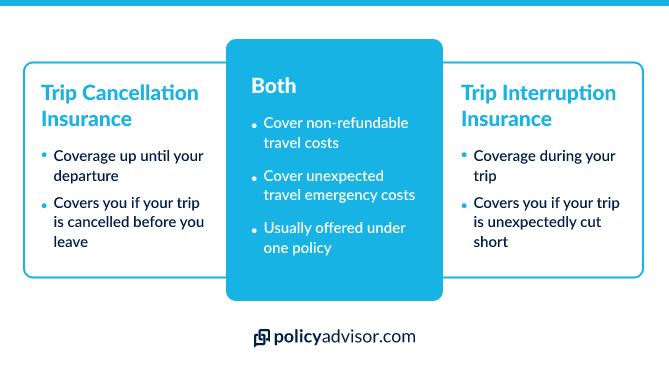

What is the difference between trip interruption insurance and trip cancellation insurance?

Trip cancellation insurance reimburses the non-refundable parts of your prepaid travel arrangements if unforeseen events prevent you from going on your journey. In contrast, trip interruption coverage reimburses you if your trip is cut short.

Cancellation coverage typically starts the day after you buy it and covers your trip before departure. But once you’ve departed for your flight, your coverage ends. From that point, your trip interruption plan takes hold instead.

Many insurance companies provide both these types of coverage together under one policy. In both cases, your individual policy determines the amount your insurer reimburses you and the situations that result in coverage. You can generally expect qualifying events to include medical emergencies affecting you or your family members, a death, or other tragedies.

Where can I get travel insurance?

You can typically obtain travel insurance coverage through the following outlets:

- Insurance broker (like PolicyAdvisor)

- Travel agent

- Employee or group insurance provider

- Credit card travel coverage

Is there a package that includes every type of travel insurance coverage?

Comprehensive travel insurance plans can provide travel medical, trip cancellation, and trip interruption insurance in one purchase. They’re a great option if you’re looking for a one-stop-shop for all your travel insurance needs.

Though note, comprehensive travel coverage is more expensive than any one individual policy. You are getting three forms of coverage after all!

The sum of these three insurance products — trip interruption, trip cancellation, and travel medical insurance — covers you from multiple angles so you can travel with peace of mind.

Speak with an expert insurance advisor from PolicyAdvisor today to learn more about your travel insurance options.

- Travel medical insurance covers health emergencies that may happen during your trip

- Trip interruption insurance covers you if your trip has to be cut short

- Trip cancellation insurance covers non-refundable costs if you have to cancel your trip before leaving Canada

- The sum of these types of travel insurance can provide coverage for unexpected costs that may arise during your travels

1-888-601-9980

1-888-601-9980