- Visitors to Canada can get health insurance coverage through a travel medical insurance plan

- Travel medical insurance can cover doctor's visits, hospital stays, emergency transportation, and prescription medication

- Visitors health insurance can cover an individual or a family

- Can visitors to Canada get health insurance?

- What are the types of health insurance plans available for visitors to Canada?

- What does visitor medical insurance cover for visitors to Canada?

- Does visitor insurance cover pre-existing conditions?

- Why should you buy visitor health insurance when visiting Canada?

- Are there any exclusions or limitations to visitor health insurance?

- Does visitor health insurance cover families visiting Canada?

- How much does Canadian medical insurance for visitors cost?

- How much visitor insurance coverage can visitors to Canada get?

- Which Canadian providers offer emergency medical insurance for visitors to Canada?

- FAQs about visitor medical insurance

When people think of Canada, they usually think of three things: maple syrup, hockey, and “free” healthcare. Visitors to Canada can enjoy two of these, but free government healthcare coverage is not one of them. Instead, travellers will need visitor to Canada insurance to cover their healthcare needs while in Canada.

In this article, we’ll answer all of your questions about what kind of insurance visitors to Canada can get, and what they can be covered for.

Why should visitors to Canada get health insurance?

If you visit Canada, you won’t be eligible for a Canadian government health insurance plan since it only covers residents.

Instead, a visitor insurance plan that covers medical costs is the best option for tourists, visitors, and non-residents in Canada. Visitor medical insurance for visitors to Canada can help pay for emergency care if something happens while you’re here.

What are the types of health insurance plans available for visitors to Canada?

Visitor insurance in Canada generally offers three key types of coverage: medical insurance for visitors, trip cancellation and interruption insurance, and Super Visa insurance.

- Medical insurance for visitors to Canada: This provides coverage for eligible emergency medical situations that non-residents may face during their stay in Canada, helping protect against the high costs of medical care

- Trip cancellation and interruption insurance: This type of insurance offers financial protection by covering trip costs if travel plans are cancelled or disrupted due to unforeseen events

- Super Visa insurance: Specifically designed for parents and grandparents of Canadian citizens and permanent residents, Super Visa insurance provides coverage for a minimum of 12 months, with a required coverage limit of at least $100,000

What does health insurance for visitors to Canada cover?

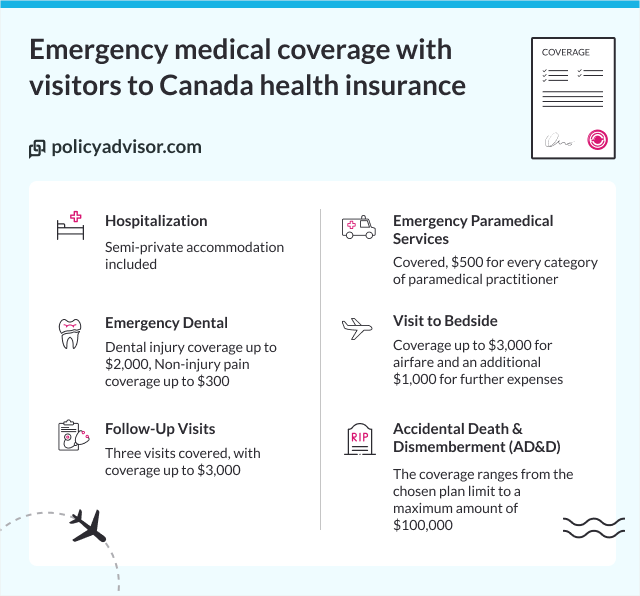

Most visitor medical plans cover emergency medical treatment due to illness or injury, prescription medications, and emergency dental services.

Visitor to Canada insurance also covers essential medical equipment, such as crutches or wheelchairs, diagnostic procedures like X-rays and bloodwork, and ambulance services by ground, air, or sea.

Additional benefits often include follow-up medical appointments and medical evacuation to the nearest hospital if needed.

Do visitor health insurance plans cover pre-existing conditions?

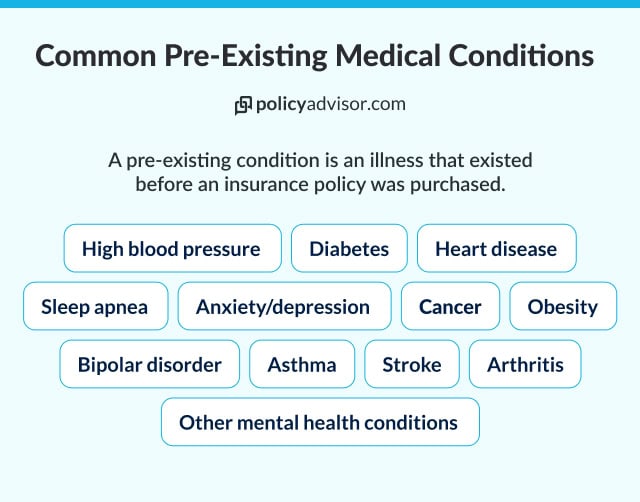

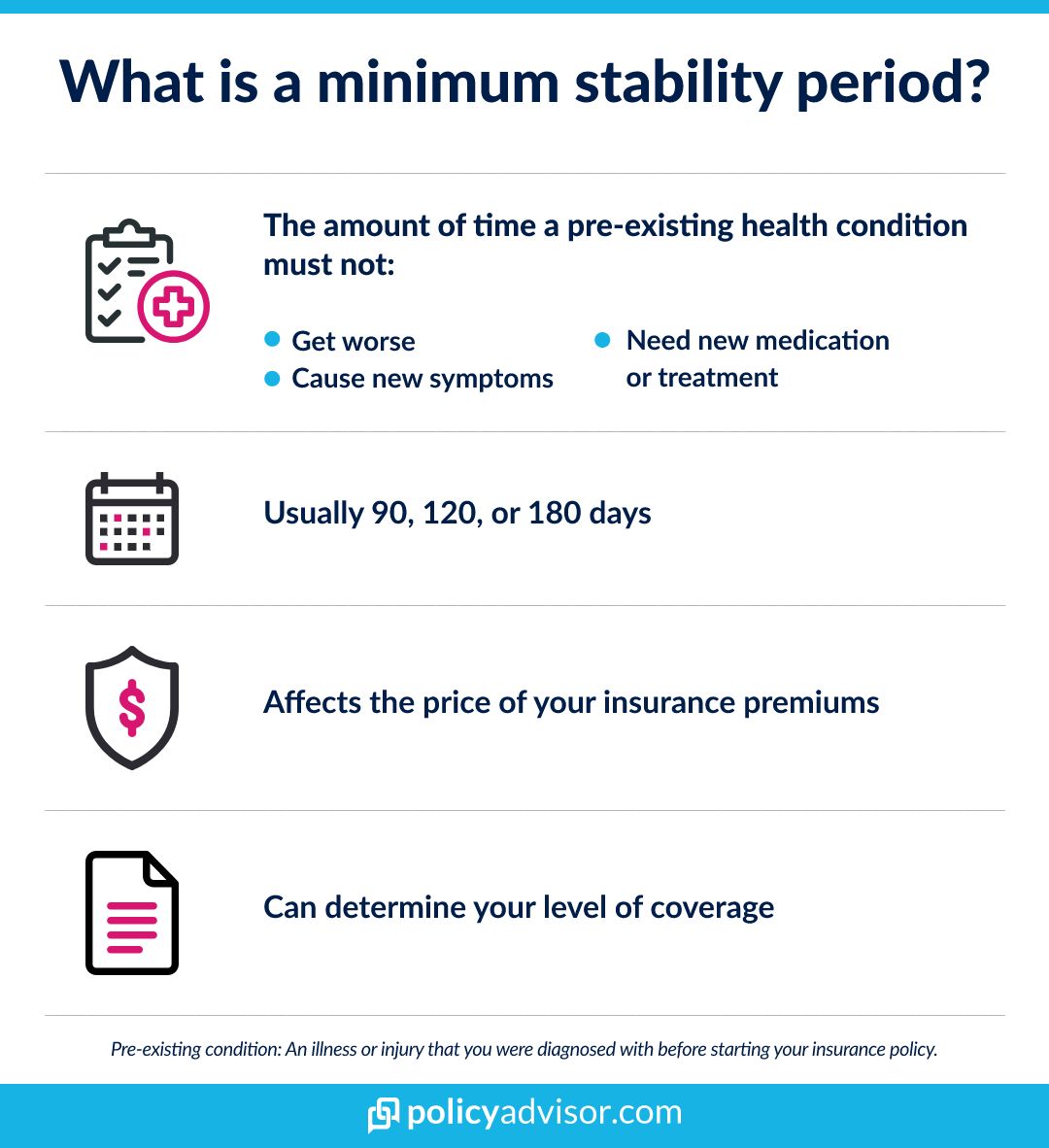

No, most visitor visa insurance plans won’t pay for a health problem that you already had before you got the insurance. This health condition is considered a “pre-existing condition.”

Some common pre-existing conditions include cancer, heart disease, diabetes, etc. that are not covered. However, if your medical condition is stable, then some insurance companies will cover related complications at an additional cost. The table below shows the criteria for a condition to be considered stable.

How does visitor health insurance help those visiting Canada?

Travel health insurance can help protect tourists against enormous fees if they need to see a doctor or get medical care during their trip to Canada.

Everyone wants to kick back and have a great time on vacation. But a sudden emergency can cost you thousands of dollars per day in medical expenses. Remember, visitors aren’t covered by Canada’s healthcare. And your home country’s health insurance won’t cover you in foreign countries either.

Visitor medical coverage can help pay some of those costs and give you peace of mind knowing you’re financially covered if anything happens.

Are there any exclusions or limitations to visitor health insurance in Canada?

Most visitor insurance plans in Canada typically exclude unstable pre-existing conditions, non-emergency procedures such as elective surgeries or routine check-ups, and diagnostic tests like MRIs or CAT scans, which are usually only covered in extreme emergencies.

Pregnancy and maternity care are also exclusions, although some insurers may offer coverage in critical situations. Mental health services, including therapy and psychiatric care, are generally not included, as well as any illnesses or injuries related to chronic drug or alcohol use.

High-risk activities like extreme sports, self-inflicted injuries, and treatments exceeding the Usual, Customary, and Reasonable (UC&R) costs are also commonly excluded.

Does visitor medical insurance cover families visiting Canada?

Yes, visitor health insurance can cover a family visiting Canada. If you need to cover more than one person at a time, you can get a family policy that will include everyone. But note that there are rules about who can be included in that policy.

Generally, anyone travelling with you will fall under one of two categories:

- Dependents

- Non-dependents

Dependents: Canadian insurance companies usually include your family members as dependents. This includes:

- Your spouse

- Your minor children

- Anyone legally or financially dependent on you

Anyone who falls into one of these categories can be included in your travel insurance plan.

Advisor’s advice: Pregnancy while travelling will require special attention to your policy wording. Unborn babies aren’t treated the same as dependent children. If someone visiting Canada gives birth, their baby will not be covered under their travel insurance plan. However, some companies (like our partner Tugo Travel) may let you add a newborn baby to your insurance starting from as early as 15 days of age.

Non-dependents: If you want to get visitor insurance for a family member who is not a dependent, you will have to buy them a separate policy.

This means that if you want to buy Canadian health insurance for your parents visiting Canada, they would not be included in your family plan. They would need to get their own separate visitors insurance, although you could buy that policy for them.

How much does health insurance for visitors to Canada cost?

The average cost of visitor health insurance for travellers to Canada typically ranges from $50 to $400 per month, depending on factors such as age, duration of stay, and the amount of coverage.

For instance, younger travellers (under 40 years) may pay between $50 and $100 monthly, while those aged 70 years and older may see costs rise between $200 and $400 per month.

Average coverage and premiums for different age groups

| Visitor’s age | Premiums |

| 25 years | $72.30/mo. |

| 35 years | $90.90/mo. |

| 45 years | $101.70/mo. |

| 55 years | $110.70/mo. |

| 65 years | $133.20/mo. |

| 75 years | $240.0/mo. |

| 85 years | $405/mo. |

*The above premiums are for $100,000 in coverage for an individual visiting Canada for a 30-day period. Premiums vary based on your health condition.

What is a deductible?

Most visitor insurance policies have something called a deductible. It’s the amount of cash you choose to pay out of pocket before your insurance coverage kicks in and covers the rest of the medical bill.

Deductible options also change how much you pay for your policy. The higher the deductible, the cheaper the policy.

Some deductibles start at zero, meaning you don’t have to pay anything upfront when you have a medical bill—the insurance covers the cost right away. But lower deductible options mean you pay more for your insurance premiums.

Deductibles can also be as high as thousands of dollars, meaning you pay those thousands before insurance helps with the rest. But higher deductible amounts also mean you pay less for your insurance policy.

How much health insurance coverage can visitors to Canada get?

Tourists and other visitors in Canada can get coverage amounts of $10,000 to $1 million in health insurance coverage for their trip. Most Canadian visitors choose $100,000 in coverage.

Insurance companies will cover up to a certain dollar amount in unexpected medical costs. How much they cover depends on what kind of medical procedure it is.

How to choose the right health insurance plan for visitors to Canada?

Choosing the right health insurance plan is essential for visitors to Canada, as they are not covered by provincial healthcare. Start by considering the visitor’s age, health needs, and trip length.

You must always consider a plan with at least $100,000 in emergency medical coverage, including hospital stays, doctor visits, and ambulance services.

If the visitor has pre-existing conditions, choose a plan that offers coverage for stable conditions. Always review exclusions, deductibles, and policy limits. Finally, pick a reputable insurer with 24/7 support and an easy claims process to ensure peace of mind during the trip.

Which Canadian providers offer emergency medical insurance for visitors to Canada?

You can get visitors health insurance from the best Canadian visitor insurance providers like:

- Manulife

- Canada Life

- Desjardins

- GMS (Group Medical Services)

- Equitable Life of Canada

We work with all of these travel insurance providers and more to bring you the best visitor insurance options. Save time and find the lowest rates in minutes by comparing them on PolicyAdvisor.

Frequently asked questions

Do I need medical insurance for a Canadian visitor visa?

No, medical insurance is not mandatory for a visitor visa unless you’re applying for a Super Visa, which requires compulsory coverage of $100,000.

Can non-residents get health insurance in Canada?

Non-residents cannot get Canadian government healthcare, but they can get coverage for medical emergencies with visitor medical insurance.

Is emergency healthcare free in Canada for tourists?

No, emergency healthcare is not free for tourists visiting Canada. Visitors to Canada can get emergency healthcare coverage through a travel medical insurance plan.

Can I get visitor health insurance if I’m already in Canada?

Yes, it is possible to get visitor health insurance if you’re already in Canada but there will be a waiting period and some health events may be excluded.

Visitors to Canada can get travel medical insurance if they need emergency healthcare while they’re in Canada. This isn’t the same as health insurance, which usually only covers you in your home country. Emergency travel medical can cover things like doctor’s visits and other urgent health care needs for people visiting Canada.

1-888-601-9980

1-888-601-9980