- The top five VTC insurance companies in Canada with top ratings are Manulife, Tugo, Allianz, 21st Century and Alberta Blue Cross.

- We have rated the top 11 Canadian insurers based on their coverage, trip-related features, pre-existing conditions, round the clock support, etc.

- When choosing a VTC insurance company, consider their plans, premium costs, emergency medical expenses, assistance offered, medical and non-medical conditions as well.

- What is visitors to Canada insurance?

- Why do visitors to Canada need travel insurance?

- The best visitors insurance in Canada

- Manulife - Best for Comprehensive Coverage

- Tugo - Best for Pre-Existing Conditions

- Allianz - Best for International Students

- GMS - Best for Super Visa Insurance

- Travelance - Best for Monthly Payment Plans

- 21st Century - Best for Long Stays

- Destination Canada - Best for Convenience

- MSH - Best for Side Trips

- 21st Century - Best for Companion Discounts

- Secure Travel - Best for Customizable Deductibles

- Alberta Blue Cross - Best for Medical Coverage

- RBC Insurance - Best for Travel Delays

- Common exclusions in visitor insurance policies

- How to choose the best travel insurance policy?

- What is the cost of visitor insurance?

- Who should buy Visitors to Canada (VTC) insurance?

- Frequently asked questions

Travel insurance is an important part of staying protected on any trip, and people visiting Canada have a lot of choice! When deciding what kind of travel plan you need, it can be tricky to know where to start. Which Canadian provider is reliable? Who has the best rates? Who has the most choice? How’s someone who’s never been to Canada supposed to know?

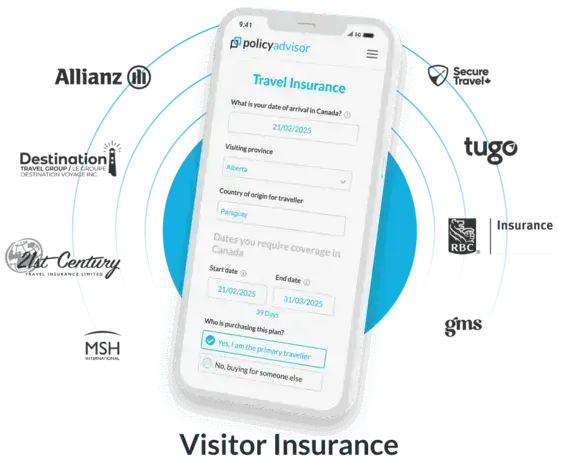

Worry not! Your trusty friends at PolicyAdvisor are experts in travel insurance and we put together a list of the 10 best travel insurance for visitors to Canada just for you! We rank the top choices, list the pros and cons of each, and provide some useful product information to help you choose the plan that would best cover you and your family.

What is insurance for visitors to Canada?

Visitors to Canada insurance refers to travel insurance you can get for a trip to Canada. It helps to pay for unexpected costs that you might have before or during your trip.

There are several different types of travel insurance, but most people get visitors health insurance or travel medical insurance to pay for health care costs if they need medical care while they’re in Canada.

What does visitor insurance cover?

Visitor insurance in Canada can cover medical expenses, non-medical expenses, and meets the requirements for the Super Visa program for parents and grandparents.

Medical expenses

Visitor insurance can cover emergency doctor or hospital visits, emergency dental care, prescription drugs, travel accidents, ambulance transportation, and repatriation.

Non-medical expenses

It also includes coverage for trip cancellations, trip interruptions, flight delays, hotel/accommodation costs, extra meal expenses, and adventure sports.

Super Visa

For those applying under the Super Visa program, visitor insurance is a compulsory requirement for parents and grandparents.

Which are the best visitors insurance companies in Canada?

The best visitor insurance companies in Canada include Manulife, TuGo, GMS, Destination Canada, Travelance, and more.

At PolicyAdvisor.com, we work closely with more than 30 of Canada’s best insurance companies to provide customized travel insurance options for visitors. After careful research, our expert insurance advisors have created a list of the best companies for visitor insurance in Canada.

Top visitors insurance companies in 2025

The best visitor insurance company depends on your unique needs, including coverage limits, pre-existing condition coverage, policy duration, and budget.

Here is a list of our advisors’ recommendations for the best visitors insurance companies in Canada:

Best visitor insurance companies in Canada

| Company | Best for… | Rating (out of 5) |

| Allianz | International students | 5 |

| Manulife | Comprehensive coverage | 5 |

| Tugo | Pre-existing medical conditions | 5 |

| 21st Century | Companion discounts | 4 |

| Alberta Blue Cross | Medical coverage | 4 |

| Destination Canada | Super visa insurance | 4 |

| GMS | Convenience | 4 |

| MSH International | Travel delays | 4 |

| RBC Insurance | Side trips | 4 |

| Travelance | Monthly payment plans | 4 |

| Secure Travel+ | Customizable deductibles | 3 |

Choosing the right visitor insurance company

Choosing the right visitor insurance company involves more than just comparing prices; it’s about finding a policy that offers the right balance of coverage, reliability, and affordability.

Considering protection for medical emergencies, pre-existing conditions, or trip interruptions, evaluating providers based on their benefits, claim process, and customer reviews can help you make an informed decision.

Understanding policy exclusions and coverage limits also ensures you get the protection you need for a worry-free stay in Canada.

Why do visitors to Canada need travel insurance?

Visitors to Canada should get travel insurance to avoid having to pay a lot of money if something unexpected happens on their trip. It helps you travel with peace of mind and enjoy your time up north without worrying about what would happen in an emergency.

Think of it this way: a flight delay could cost you hundreds in hotel fees and meal expenses that you didn’t expect to pay. One trip to the doctor in Canada could cost you thousands — Canada’s government health insurance plan won’t cover any bills for visitors, and insurance from your home country won’t cover you either. But visitors insurance doesn’t cost a lot and can help make sure you don’t get stuck with any unexpected bills.

Most visitors to Canada aren’t required to get travel insurance to come to Canada, except for Super Visa holders. But we strongly recommend that you get visitors insurance for your trip — it’s well worth the peace of mind!

Detailed ratings and reviews of the top visitors insurance companies in Canada

Best for comprehensive coverage: Manulife

Company Overview: With Manulife, you can get travel medical insurance as a standalone policy or as part of a package with trip interruption protection. They’re one of the only Canadian insurance companies that lets visitors do this. You can also use their travel insurance for your Super Visa. Plus, all of their plans cover things like stable pre-existing health conditions, side trips, travel accidents, and more.

There’s a reason why Manulife usually gets high ratings from us. They’re one of Canada’s oldest and biggest insurance companies, and they have really good insurance plans to fit people’s needs!

PolicyAdvisor rating: ★★★★★ (5/5)

Key features of Manulife:

- Product name: Emergency Medical Plan for Visitors to Canada

- Types of coverage: Emergency medical + Super Visa + optional trip interruption

- Maximum amount of coverage: $150,000

- Age range: 30 days to 85 years

- Pre-existing conditions covered: Yes, if stable

- Deductible Range: $0 – $5,000

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Comprehensive coverage: Covers emergency medical expenses, including stable pre-existing conditions

- Travel accident coverage: Includes travel accident coverage with benefits up to $50,000 for accidental death or serious injury

- Refund options available: Get a full refund if your plans change or are canceled before the policy start date

- Trip coverage: Covers side trips up to 30 days and allows trip breaks with coverage suspension during time outside Canada

- Automatic plan extension: Automatically extends Visitors to Canada insurance coverage beyond the scheduled return date in emergencies

- Additional benefits: 24/7 emergency assistance offered by the insurance provider

- Digital e-policy: Through this feature, you can receive digital VTC policy documents quickly

Things to consider:

- No dedicated coverage: No dedicated coverage for international students

- Adventure sports not included: Does not cover adventure or extreme sports such as skydiving, bungee jumping, mountain climbing, etc.

Best for pre-existing conditions: Tugo

Company Overview: If you’re coming to Canada and you already have a pre-existing health condition, we strongly suggest that you get an insurance plan with Tugo. A pre-existing medical condition is a health issue that you already had before you got travel insurance. It refers to things like cancer, heart conditions, high blood pressure, obesity, and others.

Tugo offers additional travel plans for visitors that can cover unstable pre-existing conditions as well. This is an extremely rare insurance option for visitors to Canada. The insurer also offers coverage for trip cancellation, flight delays, side trips, etc..

PolicyAdvisor rating: ★★★★★ (5/5)

Key features of Tugo:

- Product name: Visitors to Canada Emergency Medical Insurance, Visitors to Canada Trip Cancellation & Trip Interruption Insurance, Visitors to Canada Trip Interruption Insurance

- Types of coverage: Emergency medical + Super Visa + trip cancellation/interruption + trip interruption + optional sports & adventure activities, accidental death & dismemberment, and unstable pre-existing conditions

- Maximum amount of coverage: $500,000 or $2,000,000 for international students

- Age range: 15 days to 90+ years

- Pre-existing conditions covered: Yes + optional coverage for unstable conditions

- Deductibles: $0 – $10,000

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Multiple coverage options: Choose from several non-medical coverage options

- Comprehensive coverage: Covers stable & unstable pre-existing conditions

- Side trips covered: Include trip cancellation and interruption insurance, and coverage for side trips

- Trip breaks covered: Covers trip breaks if they are due to a covered reason

- Automatic plan extension: Plan coverage can automatically extend in case of emergencies or travel delays

- Digital wallet & e-claims: Unique digital wallet to access policy and an online platform for claims submission and tracking.

- MyFlyt service: Offers instant lounge access or cash payout for flight delays of 2+ hours

Things to consider:

- Extra Cost: May have to pay additional cost for travel accident coverage

Best for international students: Allianz Global Assistance

Company Overview: Allianz travel insurance is a great choice for international students in Canada who wish to get their own travel medical insurance policy to cover anything their school’s health plan doesn’t cover.

The insurer offers up to $5 million for medical emergencies. Their plans include multiple features like emergency medical transportation, baggage cover, trip cancellation and interruption benefits, making it well-suited for students traveling to Canada.

PolicyAdvisor rating: ★★★★★ (5/5)

Key features of Allianz Global Assistance:

- Product name: Visitors to Canada Plan, International Students to Canada Travel Insurance

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $100,000 or $5,000,000 (international students)

- Age range: 15 days to 84 years

- Pre-existing conditions covered: Limited; up to age 59 only, if stable

- Deductibles: $0

- Free look: Yes, 10-day

- Family plans: No

Why PolicyAdvisor recommends:

- Trip Protection: Can cover side trips, trip interruptions, cancellations as well as trip breaks

- Medical Assistance: Offers emergency medical benefits

- Travel accident coverage: Covers accidental injuries arising during the covered trip.

- 24/7 emergency assistance: Availability of 24-hour assistance team to handle travel emergencies.

Things to consider:

- Costly: VTC plans can be expensive

- Limited deductible: Offers limited but flexible deductible options

- Limited coverage: Offers limited coverage for pre-existing conditions as well as non-medical coverage options

- No adventure sports: Adventure sports not included

- No emergency extension: No automatic extension in emergencies

Best for Super Visa: Group Medical Services (GMS)

Company Overview: GMS is our top recommendation for people who are travelling to Canada on a Super Visa. The insurer’s plans meet the requirements of the program, and it has well-rounded coverage options.

Their Immigrants & Visitors to Canada Insurance covers stable pre-existing conditions and has excellent coverage for seniors. It also has a fair range of deductible options and decent coverage amounts if you need something a bit more than the $100,000 limit.

PolicyAdvisor rating: ★★★★ (4/5)

Key features of Group Medical Services:

- Product name: Immigrants & Visitors to Canada Insurance

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $150,000

- Age range: 0 to 80 years

- Pre-existing conditions covered: Yes, if stable

- Deductibles: $0 – $1,000

- Free look: Yes, 10-day

- Family plans: No

Why PolicyAdvisor recommends:

- Stable pre-existing conditions: Offers coverage for stable pre-existing conditions

- Side-trip travel coverage: Covers side trip outside Canada for up to 30 days

- Automatic plan extension: Automatically extend coverage for up to 48 hours

- No medical questions: Requires no medical questions or exam for visitors under 55

- Around-the-clock support: Offers 24*7 multilingual support

Things to consider:

- Limited coverage: Limited travel accident and non-medical coverage options

- International Students: No dedicated coverage for international students

- Adventure sports not included: Excludes coverage for adventure and extreme sports

- Availability issue: Limited availability in some provinces

Best for monthly payment plans: Travelance

Company Overview: Travelance is one of the few Canadian companies that lets you pay for Super Visa insurance monthly instead of paying for everything at once.

Travelance lets you get 3 follow-up doctor visits within a 30-day period, covering up to $3,000 worth of related costs. It also has great coverage for prescription drugs and really high deductible options. This is fantastic health insurance for visitors to Canada if you do end up needing medical attention during your trip.

PolicyAdvisor rating: ★★★★ (4/5)

Key features of Travelance:

- Product name: Visitors to Canada Emergency Medical Insurance (VTC) Essential Plan or Premier Plan, International Student Travel Insurance (ISP) Smart Plan or Smart-Plus Plan

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $150,000 (visitors) or $2,000,000 (international students)

- Age range: 14 days to 86 years

- Pre-existing conditions covered: Limited; up to age 69 and only with premium plans, if stable

- Deductibles: $0 – $10,000

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Cover side trips: Coverage includes side trips outside Canada

- Monthly payment option: Option to pay premiums monthly is also offered

- Automatic plan extension: Available if the travel is delayed due to emergencies

- Coverage for international students: Offers special coverage for international students

- Emergency medical coverage: Offers an extensive emergency medical coverage

Things to consider:

- Limited coverage: Coverage for pre-existing conditions is limited

- Non-medical coverage: Limited non-medical coverage options

- Adventure sports: Adventure and extreme sports are not covered

Best for long stays: 21st Century

Company Overview: If you plan to stay in Canada for long periods of time, we recommend that you get a visitors insurance plan with 21st Century. They have a rare upgrade feature that lets you extend your insurance plan for up to 2 years while keeping the exact same price.

Their 2-year extension is perfect for people who apply for the 2-year extension for their Super Visa. Plus, 21st Century is another one of the few providers who lets you pay for Super Visa insurance monthly. They offer different levels of insurance to cover your trip, and you can choose higher or lower deductibles.

PolicyAdvisor rating: ★★★★ (4/5)

Key features of 21st Century:

- Product name: Visitors to Canada Insurance Basic Plan, Standard Plan, or Enhanced Plan

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $200,000

- Age range: 0 to 111 years

- Pre-existing conditions covered: Yes, if stable (Enhanced Plan only)

- Deductibles: $0 – $10,000

- Free look: No

- Family plans: Yes

Why PolicyAdvisor recommends:

- Pre-existing conditions: Offers coverage for stable pre-existing conditions

- Covers side trips: Side trip coverage is included. Also covers trip breaks

- Travel accident coverage: Covers accidents arising at the time of traveling

- 24/7 assistance: Offers round-the-clock emergency assistance

- Monthly payment options: Option to pay the premium monthly

- Two-year upgrade: Two-year upgrade option on a monthly payment plan

Things to consider:

- Refund: Offers partial refunds only

- Coverage limited: Offers limited coverage for pre-existing conditions as well as non-medical options

- International students: Does not offer any dedicated coverage for international students

- Adventure sports: Does not cover risky or adventurous sports

Best for convenience: Destination Canada

Company Overview: Destination Canada is another convenient option for visitors to Canada insurance.The insurer covers basics for emergency medical — stable pre-existing conditions, Super Visa insurance, etc. It can even cover travellers who are over 86 years old.

On the downside, it doesn’t have the most comprehensive travel insurance policies. So, if you’re looking for things like trip cancellation insurance or coverage for extreme sports, this isn’t the best choice for you.

PolicyAdvisor rating: ★★★★ (4/5)

Key features of Destination Canada:

- Product name: Canada Visitors to Canada Plan, International Student Insurance

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $300,000

- Age range: 0 to 86+ years

- Pre-existing conditions covered: Limited; up to age 79 only, if stable

- Deductibles: $0 – $500

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Pre-existing conditions: Covers stable pre-existing conditions

- Trip coverage: Cover side trips as well as the trip coverage

- Travel accident coverage: Offers coverage for accidental injuries during travel

- Trip-related benefits: Coverage for baggage loss, trip interruption, and flight delays is offered

- Emergency extension: Offers automatic plan extension in emergency situations

- Simple application: No medical questionnaire required for application

Things to consider:

- Deductible options: Deductibles offered are limited

- Pre-existing conditions: Only covers stable pre-existing conditions

- Non-medical coverage: Fewer benefits for non-medical conditions

- Adventure sports: Does not cover adventure or extreme sports

Best for side trips: MSH

Company Overview: An MSH plan is the perfect travel insurance for international frequent flyers. Many Canadian insurance companies cover side trips once most of your time is spent in Canada. But they won’t cover trips outside of Canada for more than 30 days at most. MSH doesn’t have this limit.

MSH doesn’t have restrictions on outside trips, so even if you spend an extended period of time in countries outside of Canada, you can still get coverage.

PolicyAdvisor ratings: ★★★★ (4/5)

Key features of MSH:

- Product name: Discover Canada Insurance, Patriot Travel Plan

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $1,000,000

- Age range: 15 days to 90 years

- Pre-existing conditions covered: Limited; up to age 80 only, if stable

- Deductibles: $0 – $25,000

- Free look: No

- Family plans: Yes

Why PolicyAdvisor recommends:

- Side trip coverage: Covers worldwide side trips for an extended period

- Trip breaks: Also offers coverage for trip breaks

- Emergency transportation: Covers economy airfare in case of emergency transportation

- Pre-existing conditions: Offers coverage for pre-existing conditions

- Large deductible options: For 85 and younger, deductibles of $0, $100, or $1,000 are offered; for 86+, a $500 deductible is offered

Things to consider:

- Pre-existing conditions: Coverage is limited for pre-existing conditions

- Limited non-medical benefits: No coverage for non-medical options like baggage loss, trip cancellation

- International students: No dedicated coverage offered for international students

- Sports excluded: No professional sport covered

Best for companion discounts: 21st Century

Company Overview: The 21st Century travel insurance is a good choice if you’re not travelling alone. In Canada, many insurance companies offer plans for families, which means you can get lower prices if you’re going on a trip with your close family or other dependents. 21st Century also gives discounts if your travel companion might not a member of your family. So, if you and a few friends want to visit Canada and save money while making sure you’re protected, their insurance plan would be a smart option.

PolicyAdvisor ratings: ★★★★ (4/5)

Key features of 21st Century:

- Product name: Visitors to Canada Insurance Basic Plan, Standard Plan, or Enhanced Plan

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $200,000

- Age range: 0 to 111 years

- Pre-existing conditions covered: Yes, if stable (Enhanced Plan only)

- Deductibles: $0 – $10,000

- Free look: No

- Family plans: Yes

Why PolicyAdvisor recommends:

- Pre-existing conditions: Offers coverage for pre-existing conditions

- Covers side trips: Side trip coverage is included. Also covers trip breaks

- Travel accident coverage: Covers accidents arising at the time of traveling

- 24/7 assistance: Provides round-the-clock emergency assistance

- Monthly payment options: Provides the option to pay premiums monthly

- Two-year upgrade: Offers a unique two-year upgrade option on a monthly payment plan

Things to consider:

- Refund: Offers partial refunds only

- Coverage limited: Offers limited coverage for pre-existing conditions as well as non-medical options

- International students: Does not offer any dedicated coverage for international students.

- Adventure sports: Does not cover risky or adventurous sports

Best for customizable deductibles: Secure Travel

Company Overview: Visitors to Canada who want more deductible choices can choose a travel insurance policy from Secure Travel. A deductible is the amount you pay upfront before insurance pays for the rest. A higher deductible makes your insurance premium cost less, and vice versa.

You can get all of this plus good standard coverage for things like Super Visa insurance, pre-existing conditions, side trips, travel accident coverage, and more.

PolicyAdvisor ratings: ★★★(3/5)

Key features of Secure Travel:

- Product name: Visitors to Canada Insurance Standard or Enhanced Plan, Super Visa Insurance, International Student Insurance Standard, Enhanced, or Premium Plan

- Types of coverage: Emergency medical + Super Visa

- Maximum amount of coverage: $1,000,000 or $2,000,000 for international students

- Age range: 15 days to 89 years

- Pre-existing conditions covered: Yes, if stable

- Deductibles: $0 – $3,000

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Pre-existing conditions: Offers coverage for stable pre-existing conditions

- Side trips: Can cover side trips and trip breaks

- Dental coverage: Offers emergency dental coverage

- 24/7 support: Offers 24/7 emergency claims support

- High coverage limit: Coverage offered up to $1,000,000

- Automatic plan extension: Automatically extends coverage for up to 72 hours

Things to consider:

- Partial refunds: Has limited refund flexibility options

- Non-medical coverage: Offers limited non-medical coverage options

- Adventure sports: Excludes high-risk activities like extreme sports

Best for medical coverage: Alberta Blue Cross

Company Overview: Alberta Blue Cross offers one of the best health insurance for visitors to Canada with emergency medical coverage, including hospital stays, physician services, prescription drugs, and emergency dental services. It also covers medical evacuation, trip interruption due to medical reasons, and 24/7 travel assistance.

PolicyAdvisor ratings: ★★★★(4/5)

Key features of Alberta Blue Cross:

- Product name: Travel Insurance

- Types of coverage: Emergency medical care, medical expenses if you test positive for COVID-19 during your trip, Accidental death and dismemberment, Baggage loss coverage

- Maximum amount of coverage: $5,000,000

- Age range: 31 days to 74 years

- Pre-existing conditions covered: Yes, if stable 90 days before departure

- Deductibles: $0 – $1,000

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Emergency medical coverage: Offers extensive emergency medical care of up to $5 million

- COVID-19 coverage: Includes coverage for COVID-19-related expenses

- Accidental death coverage: Provide financial benefits in case of accidental death and dismemberment

- Baggage loss: Offers coverage for baggage loss

- Automatic coverage extension: Provides automatic coverage extensions in emergencies

Things to consider:

- Not comprehensive: May not offer as comprehensive medical evacuation coverage compared to other companies

- Baggage loss: Coverage for baggage loss may have some limitations

Best for travel delays: RBC Insurance

Company Overview: RBC Insurance provides a range of visitors’ travel insurance plans suited for different types of travelers, including international students, senior citizens, and those traveling within Canada.

The insurance company offers extensive coverage including travel delay coverage, reimbursing expenses incurred due to delays, including accommodation, meals, and transportation.

PolicyAdvisor ratings: ★★★★(4/5)

Key features of RBC Insurance:

- Product name: TravelCare, Travel with Canada

- Types of coverage: Unlimited emergency medical care, trip cancellation and interruption, baggage loss, damage and delay, flight and travel accidents, hotel/motel burglary insurance, auto rental collision/loss damage waiver insurance

- Maximum amount of coverage: $5,000,000

- Age range: 31 days to 74 years

- Pre-existing conditions covered: Yes, if stable

- Deductibles: $0 – $1,000

- Free look: Yes, 10-day

- Family plans: Yes

Why PolicyAdvisor recommends:

- Travel coverage: Strong coverage for travel delays, including accommodation and meals

- Trip cover: Includes trip cancellation and interruption coverage

- Baggage loss: Offers comprehensive baggage loss and damage coverage

- Emergency coverage: Offers emergency dental and travel accident coverage

Things to consider:

- Not high coverage: May not have as high coverage limits for emergency medical expenses compared to other providers

- Travel focus: More focus on travel delays rather than medical emergencies

Common exclusions in visitor insurance policies

While visitor to Canada insurance provides essential medical coverage for those travelling to the country, it does have certain exclusions including treatment of pre-existing health conditions, non-emergency procedures, pregnancy care, and more.

- Pre-existing conditions: Any pre-existing condition that a visitor has been diagnosed with prior to getting medical insurance for visitors to Canada is usually not covered under VTC plans. Certain insurers do offer coverage for pre-existing conditions but with a waiting period and at an increased cost

- Non-emergency procedures: Cosmetic procedures, planned surgeries, routine check-ups, alternative/holistic treatments, and preventative medication are not covered under visitor to Canada insurance plans

- Anything outside the “Usual, Customary, and Reasonable”: “Usual, Customary, and Reasonable” also known as UC&R refers to the standard amount that hospitals commonly charge for a particular service within a specific geographic area. Any visitor to Canada insurance claim that far exceeds the UC&R is not covered by insurers

- Pregnancy care: Maternity and pregnancy care is generally not covered by visitor to Canada insurance

How to choose the best visitor’s travel insurance policy in Canada?

Choosing the best VTC (Visitor to Canada) insurance involves a detailed review of your travel needs and insurance options. To ensure you’re fully protected during your stay, follow these steps:

1. Assess your needs

- Determine the length of your stay and select a policy that covers the entire period

- Consider any pre-existing medical conditions and verify that the policy covers them

- If you plan to engage in high-risk activities (like skiing or scuba diving), make sure they’re included

2. Compare coverage options

- Ensure the policy provides ample coverage for emergency medical expenses, hospitalization, and outpatient care

- Verify medical evacuation coverage to the nearest facility or home if necessary

- Look for reimbursement for non-refundable expenses if your trip is cancelled or interrupted for covered reasons

- Ensure coverage for lost, stolen, or delayed baggage.

- Check for compensation for expenses incurred due to travel delays

- Opt for policies that offer 24/7 assistance for emergencies and travel issues

3. Check policy limits and exclusions

- Review the maximum payout limits for various types of coverage

- Understand exclusions, such as certain medical conditions, activities, or regions not covered

4. Speak to our advisors

- Compare quotes from multiple insurers to evaluate premiums and coverage details

- Ensure you’re comparing policies with similar coverage levels and features

5. Read the fine print

- Carefully read through policy documents to understand all terms and conditions

- Ask questions about unclear terms to ensure full clarity on your coverage

How much does visitor insurance cost?

Visitors’ health insurance in Canada costs between $70 to $450, depending on your age, health status, coverage amounts, and the duration of the trip. Here is an example of a cost breakdown of different age groups with and without pre-existing health conditions:

| Visitor’s Age | Premiums without Pre-existing Condition Coverage | Premiums with Pre-existing Condition Coverage |

| 25 years | $72.30/mo. | $92.70/mo. |

| 35 years | $90.90/mo. | $100.20/mo. |

| 45 years | $101.70/mo. | $115.50/mo. |

| 55 years | $110.70/mo. | $129.60/mo. |

| 65 years | $133.20/mo. | $168.60/mo. |

| 75 years | $240.00/mo. | $328.80/mo. |

| 85 years | $405.00/mo. | $453.92/mo. |

*Cost of $100,000 in coverage for a visitor travelling to Canada for a 30-day period

What affects travel insurance costs?

Several factors influence travel insurance costs:

- Age: Older travellers typically pay higher premiums due to increased health risks

- Destination: Countries with higher healthcare costs or greater travel risks may result in higher premiums

- Trip duration: Longer trips generally incur higher costs

- Coverage limits: Policies with higher coverage limits for medical expenses and trip cancellations may cost more

- Health condition: Pre-existing medical conditions may increase premiums or limit coverage

- Activities: Engaging in high-risk activities like skiing or scuba diving may raise premiums

- Policy type: Comprehensive policies covering more aspects of travel tend to be more expensive

Who should buy Visitors to Canada (VTC) insurance?

Visitors to Canada insurance is essential for several groups of people to ensure they have adequate coverage for medical emergencies and other unforeseen events while in Canada. Here are the primary groups who should consider purchasing VTC insurance:

- Tourists and vacationers: To cover medical emergencies, trip cancellations, and other travel-related issues

- International students: To cover healthcare costs not included in their school’s insurance plan

- Parents and grandparents: Especially those under the Super Visa program, which requires proof of medical insurance

- Business travellers: To cover any medical emergencies during their stay

- New immigrants: To cover the interim period before provincial health coverage takes effect

- Returning Canadians: If not immediately eligible for provincial health coverage

- Temporary foreign workers: To cover medical expenses and protect against high healthcare costs

- Event attendees: To cover medical emergencies while attending conferences, sports tournaments, or cultural festivals

Choosing the best visitor health insurance policy in Canada

When preparing for a visit to Canada, securing medical insurance for visitors is a crucial step to protect yourself from the high costs of healthcare. It not only serves as a financial safety net against inflated medical bills but also guarantees access to necessary medical care when needed, offering peace of mind throughout your trip.

However, choosing the right visitor health insurance for your unique needs can be tricky! This is where PolicyAdvisor and our vast array of experience and grip over the market comes in. Speak with licensed advisors at PolicyAdvisor to explore budget-friendly plans tailored to your needs, so you can enjoy your trip to Canada stress-free and focus on creating memorable experiences.

Frequently asked questions

Is travel insurance essential for visitors to Canada?

Yes, travel insurance is essential for visitors to Canada as it covers potential medical emergencies, trip cancellations, and unforeseen events, ensuring financial protection during your stay.

When does travel medical insurance coverage begin and end?

If you purchase travel insurance before arriving in Canada, coverage begins immediately upon arrival. However, if you buy insurance after arriving, there’s typically a waiting period of 48 hours to 8 days before coverage takes effect. Coverage ends on the return date when you are back in your home country.

Can you extend your Visitors to Canada insurance coverage?

Yes, most insurers allow you to extend coverage if the request is made before the original policy expires, often subject to certain conditions.

What is a waiting period?

A waiting period is the initial time after the policy start date during which certain medical conditions or treatments are not covered.

Can a tourist see a doctor in Canada?

Yes, tourists can see a doctor in Canada. However, without visitor insurance, it can cost them up to $300. An emergency room visit can be significantly more expensive, ranging from $1,000 to $2,000, depending on the treatment required.

How do you submit a travel insurance claim?

To submit a claim, contact your insurer, complete the claim form, and provide all necessary documentation, such as medical reports and receipts.

Can I travel to Canada without travel insurance?

Yes, you can enter Canada without travel insurance but it’s not recommended. Canadian healthcare is expensive for visitors, who are not covered by the public health system, and the cost of any medical emergency, whether it’s a doctor’s visit or a stay in the hospital, can be substantial.

How do you apply for travel insurance to visit Canada?

You can apply online through an insurer’s website or via an insurance broker by providing your personal details, travel information, and payment.

Which company offers the best medical insurance for travel to Canada?

Manulife, TuGo, Destination Canada, and RBC offer comprehensive and affordable medical insurance for travel to Canada. However, we advise speaking with our advisors to choose the best visitor’s travel insurance policy for you.

If you’re planning a trip to Canada, visitors insurance will help you avoid having to pay out-of-pocket if something unexpected happens, like if you need medical care or if you need to return home early. But it can be hard to know which insurance policy you should buy. So, we did the research for you to find the top 10 Best Travel Insurance For Visitors to Canada.

1-888-601-9980

1-888-601-9980