- Purchasing critical illness insurance in your 20s or 30s ensures lower premiums and broader coverage, as younger individuals are generally healthier and have fewer pre-existing conditions

- Critical illness insurance payouts in Canada are entirely tax-free, offering financial flexibility to cover medical expenses, lost income, or other needs without tax implications

- Major milestones like marriage, starting a family, or buying a home are ideal moments to reassess and secure coverage tailored to your financial responsibilities

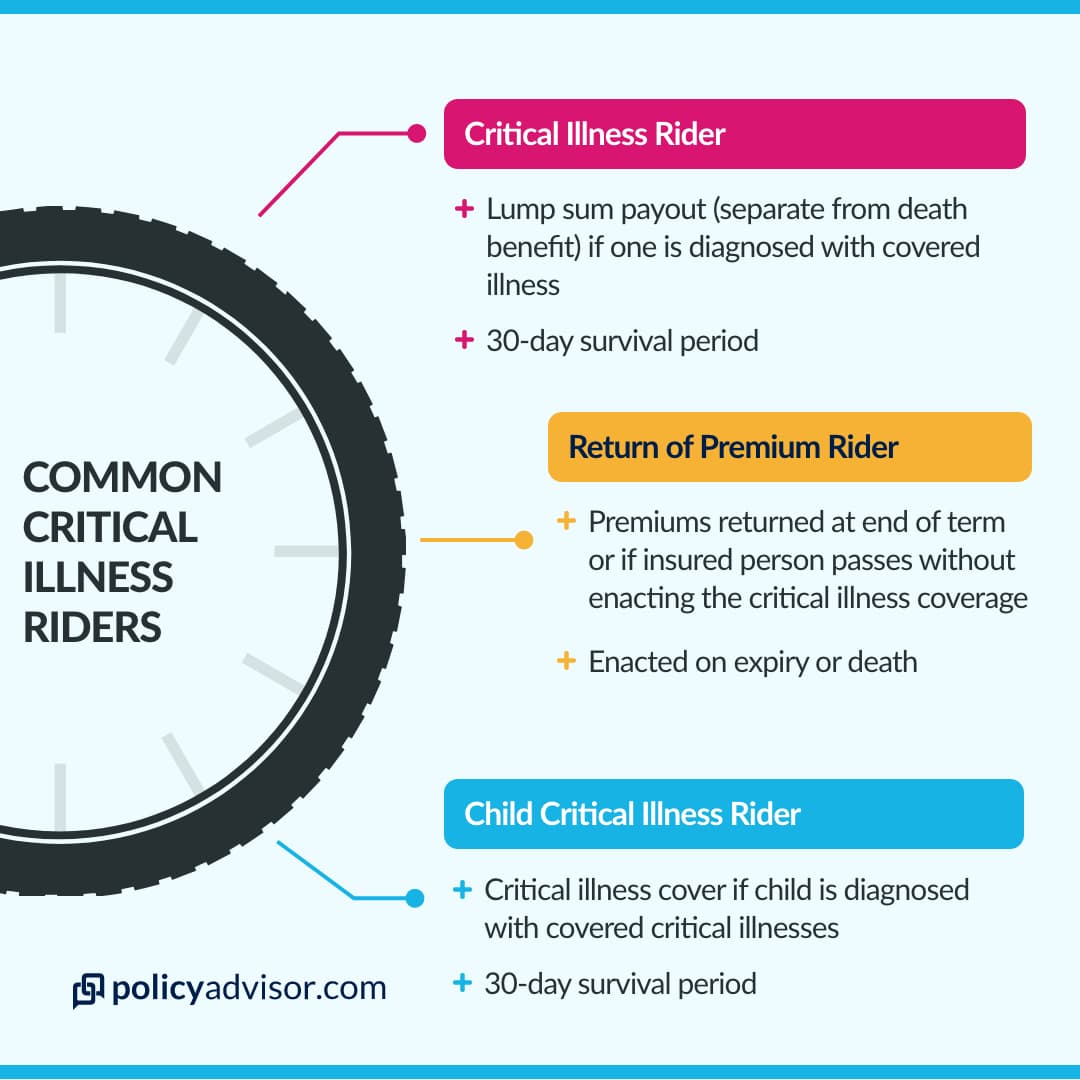

- Review coverage details, including exclusions, waiting periods, and options like child coverage or return-of-premium riders, to ensure the policy meets your unique needs

- What is critical illness insurance?

- Is critical illness insurance worth it in Canada?

- When is the best time to buy critical illness insurance?

- What age should you get critical illness cover?

- What is the age limit for critical illness insurance?

- When can you buy critical illness insurance for your child?

- What factors should you consider before purchasing critical illness insurance?

- How to buy critical illness insurance?

You should buy critical illness insurance in Canada as early as possible, ideally in your 20s or 30s, when premiums are lower, and you’re more likely to qualify for coverage without health complications.

Purchasing coverage early ensures financial protection if you’re diagnosed with a severe illness later in life, offering a lump-sum payout to cover medical costs, lost income, or other expenses.

In this article, we’ll explore the best time to buy critical illness insurance in Canada and why acting early can greatly benefit you.

What is critical illness insurance?

Critical illness insurance is a type of policy that provides a lump-sum payout if the insured person is diagnosed with a covered critical illness. It helps people financially when facing serious health conditions.

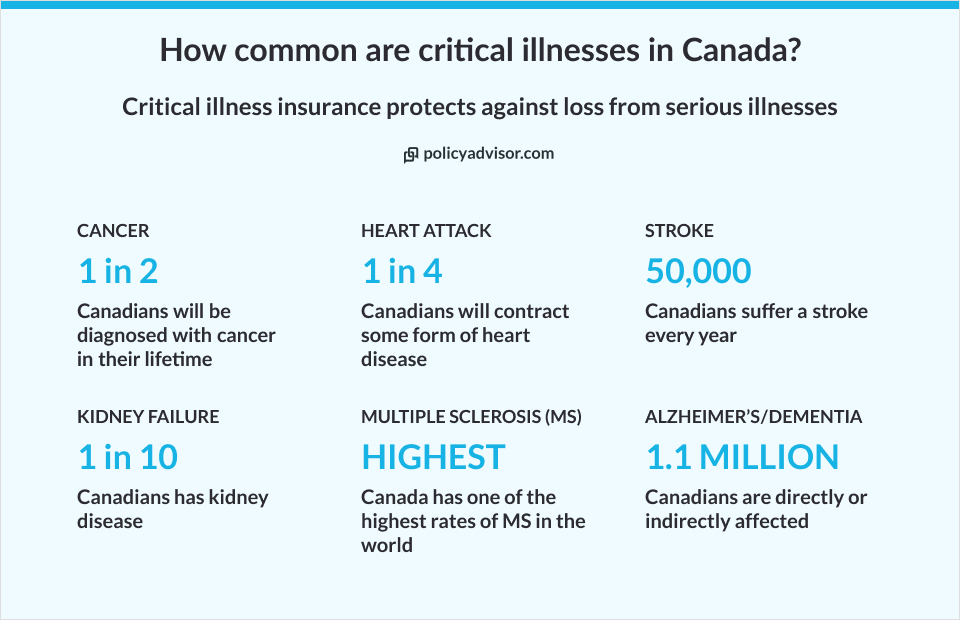

Commonly covered illnesses include cancer, heart attack, stroke, and organ failure. This coverage can assist in managing medical costs, living expenses, or other financial burdens during a difficult time.

Is critical illness insurance worth it in Canada?

Yes, critical illness insurance is worth it in Canada because provincial healthcare only covers basic medical needs, such as hospital stays and essential treatments.

It doesn’t cover lost income, specialized treatments, or private care, leaving gaps that can cause financial strain during a serious illness.

Critical illness insurance helps fill these gaps through a lump-sum payout. Given the high prevalence of serious illnesses like cancer, heart attacks, and strokes, critical illness insurance ensures that if you’re diagnosed with a life-threatening illness, you won’t have to bear the financial burden alone.

Here are a few situations where critical illness insurance can play a crucial role in saving your financial life:

- Your spouse needs to take time off work and does not have allowances for paid extended leaves of absence; the critical illness insurance can be used to replace all or part of their income (depending on how much coverage you purchase)

- You are self-employed and do not qualify for disability insurance, critical illness insurance can be used to replace your income

- Your medical expenses are not covered by your extended medical or universal health care. This might include adapting your home for any new physical disability you may have or physio appointments

When is the best time to buy critical illness insurance?

The best time to buy critical illness insurance is when you’re young and healthy. Early purchase ensures lower premiums, broader coverage, and fewer restrictions based on pre-existing conditions.

Life milestones, health changes, or shifts in financial responsibilities are also key moments to consider buying a policy.

Buying critical illness insurance in your 20s or early 30s has distinct advantages like lower premiums, easier chances of approval, and a solid financial foundation for your future.

Additionally, major life events like marriage, starting a family, or purchasing a home are ideal times to assess your insurance needs.

Lastly, and importantly, if you’ve experienced a recent health diagnosis or learned of medical conditions in your family history, it’s crucial to get critical illness insurance sooner.

What age should you get critical illness coverage?

The younger you are when you get critical illness insurance, the better it is. Younger people are generally healthier, which means your premiums will be lower. Insurance companies base premiums on factors like age, health, and lifestyle, so securing coverage while you’re younger helps lock in more affordable rates.

By purchasing critical illness insurance early, you also ensure that you’re covered before any pre-existing conditions develop.

Pre-existing conditions such as high blood pressure, diabetes, or heart problems can make it harder to qualify for coverage or result in exclusions from your policy.

Parents can also buy critical illness insurance for their children right after birth up to the age of 25. The premium costs for children’s critical illness insurance are substantially lower and the coverage is guaranteed.

What is the age limit for critical illness insurance?

The age limit for critical illness insurance typically varies by insurer and policy, but most Canadian insurers offer coverage up to the age of 65. Once you reach this age, some policies may offer renewal options but may not allow new applications.

However, there are exceptions where certain policies may provide coverage beyond age 65. These extended policies may come with adjusted terms or premium rates. For example, Manulife’s Lifecheque® Basic critical illness insurance plan covers individuals till the age of 75.

As you age, you may face higher premiums or limitations on the types of illnesses covered. In some cases, insurers might impose restrictions or exclusions for certain pre-existing conditions or health risks that become more common as you get older.

When can you buy critical illness insurance for your child?

You can purchase critical illness insurance for your child from birth until they turn 25, depending on the provider. Some companies even offer extended coverage for additional conditions if the child is under 17 years of age.

While you can apply for coverage as early as one day after your child is born, most insurers require the policy to be issued when the child is at least one month old.

What factors should you consider before purchasing critical illness insurance?

Before purchasing critical illness insurance, it’s important to assess factors such as the affordability of premiums within your budget, and whether existing coverage like life or disability insurance meets your needs.

Consider your age, health, and financial responsibilities, as these affect premiums and coverage options. Additionally, reviewing policy details, including exclusions, is crucial. Here’s what you must bear in mind:

Budgeting for premiums: Ensure premiums align with your financial plan and are affordable long-term

Evaluating existing coverage: Review current insurance policies, such as life or disability insurance and Identify gaps that critical illness insurance can fill, such as covering medical costs or lost income

Health status: Purchase while you’re in good health to secure lower premiums and broader coverage

Age and eligibility: Younger applicants often benefit from lower premiums and better terms

Coverage needs: Consider the conditions covered and whether they align with your family’s medical history, and check for add-ons or riders, like return-of-premium or child coverage, to enhance protection

Policy terms and exclusions: Ensure you check waiting periods, claim limits, and exclusions specific to the policy

Financial responsibilities: Assess current and future financial obligations, such as loans, mortgages, or dependents

How to buy critical illness insurance?

You can purchase critical illness insurance through individual policies, group plans, or special-purpose plans, depending on your needs.

- Individual policy: Can be purchased through an agent or online, and usually requires medical underwriting to determine your eligibility and premium costs

- Group plan: Available through your employer or association you’re enrolled with. These plans are either partially or fully paid for by the entity providing them (as they’re considered the policyholders). Coverage usually ends when you leave the employer or association

- Special purpose plan: This type of critical illness insurance covers your loan payments for a specific period, if you’re diagnosed with a critical illness. You can apply for a special purpose policy by checking a box on your loan application or submitting an insurance application after your loan’s approval

Note that you can have multiple types of critical illness insurance simultaneously. To determine the right coverage for your needs, schedule a free consultation with our licensed advisors.

Frequently asked questions

Are the benefits from critical illness insurance taxable?

No, critical illness insurance payouts in Canada are entirely tax-free. This means the lump sum you receive can be used for any purpose—medical bills, living expenses, or even recovery-related travel without any tax deductions or implications.

What happens if I recover quickly from a critical illness?

Yes, you will still receive the benefits as long as you meet the policy criteria. Critical illness insurance is designed to provide a payout based on the diagnosis of a covered condition, not your recovery status.

Once you are diagnosed with a listed illness and survive the waiting period (typically 30 days), the payout is issued, even if you make a full recovery soon after. This flexibility ensures financial support regardless of your recovery timeline.

What is the rule of thumb for critical illness coverage?

The general rule of thumb is to aim for coverage that lasts at least five years. This timeframe accounts for the average recovery period from a critical illness, allowing time to recuperate, return to work, and adapt to any lifestyle changes. Additionally, consider the types of illnesses and treatments you may need, as these factors will influence the amount of coverage required.

Purchasing critical illness insurance at the right time can save you money and offer peace of mind. By securing coverage early in life, you benefit from lower premiums and better eligibility. Critical illness insurance provides a tax-free lump sum, covering medical costs, lost income, and lifestyle adjustments. It’s especially crucial during major life events or health changes. Evaluate factors like budget, existing coverage, health status, and financial obligations to make an informed decision.

1-888-601-9980

1-888-601-9980