Whole life insurance is a type of permanent insurance that offers coverage for your entire life. As long as premiums are paid, the insurance company pays out a tax-free death benefit to your beneficiary, when you pass away.

Unlike term life insurance, whole life policies do not have an expiry date. That means you get lifelong coverage. The premiums (the money you pay) for whole life policies are guaranteed and stay the same over your entire life.

Whole life insurance policies also have a savings or investment component. A part of the premiums you pay are invested by the insurance company and the investment returns are available for you to use as cash value.

The accumulation of cash value from a whole life policy can be used to supplement your retirement income, pay for children’s education, or for any other purposes you may want to use it for.

There is no catch or gotcha with whole life insurance in Canada. While there are lower-cost alternatives for financial protection, whole life insurance delivers great value as the death benefit is guaranteed. Because of this guaranteed payout, whole life policies are often used for estate planning and covering funeral expenses.

Whole life insurance has many advantages. It provides you with guaranteed, lifelong protection and a death benefit for those you leave behind to cover end-of-life expenses or outstanding loans. Additionally, your policy accrues a cash surrender value that you can access while the policy is in force (or borrow against) after a certain number of years. Lastly, the premiums stay level, so you can budget your monthly insurance premiums accurately for the life of the policy.

One disadvantage of whole life insurance is the elevated premiums. Because this type of insurance protects you for your entire life and retains a cash value, the premiums you pay for coverage are much higher than other types of life insurance.

When you purchase a whole life insurance policy in Canada, it requires payment of a guaranteed level (or fixed) premium based on your chosen coverage amount and other personal factors such as your age, gender, smoking status, etc. The premiums can be paid monthly or annually. Some whole life policies also allow you to pay off the entire premium within a limited period.

The premiums paid by you go toward three components:

Once you pass away, the insurance company will pay the death benefit to the beneficiary.

Learn more about how whole life insurance works

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

Term life insurance and whole life insurance are different ends of the protection spectrum. A term life insurance policy is temporary in nature, whereas whole life insurance is the opposite. It is insurance coverage that offers a lifelong policy term as long as your policy premiums are paid.

While term policies provide coverage for temporary needs like diminishing mortgage debts and providing for dependents, whole life or permanent life insurance policies can provide for permanent needs. This can include providing for final tax expenses, funeral arrangements, or leaving a tax-advantaged legacy behind for children or grandchildren.

Learn more about whole life versus term life insurance

Yes, you can convert term life insurance to a whole life insurance policy that provides coverage for life, though there may be some restrictions.

Convertibility is a feature many insurance providers offer on their term insurance policies. It lets you convert your term life insurance into a whole life policy before you reach a certain age (like 65 years old).

While it may be less expensive to get a brand new whole life insurance policy, it’s great to have a fallback plan, like convertibility options, in case you don’t qualify for the new insurance plan of your choice.

Learn more about life insurance convertibilityHow much whole life insurance coverage you need depends on how you plan to use it. If it's your sole life insurance coverage, you may need a policy that covers hundreds of thousands of dollars, if not more. If you are using it as part of a ladder strategy or simply to cover end-of-life expenses, that number could reduce significantly.

Determining your overall insurance needs is a bit simpler. A common rule of thumb for how much life insurance you need in Canada is to choose 8-10 times your yearly income as your death benefit. However, for a more precise answer, take into account any debts you have, your family's living expenses, future education needs of your children, plans for end-of-life expenses and any other allocations (e.g. charitable donations) you may want to make.

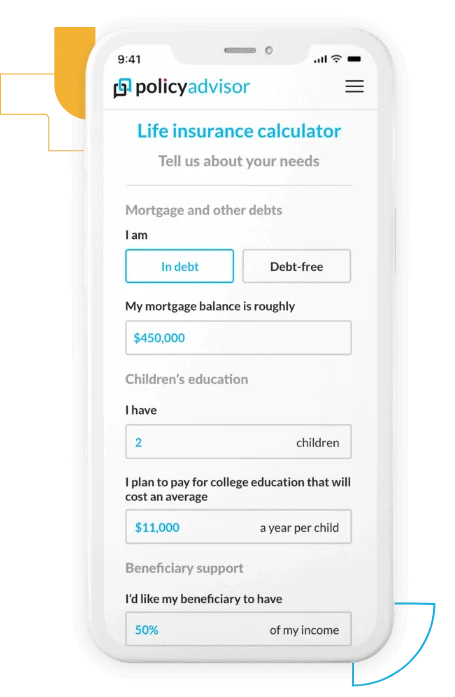

Our life insurance needs calculator takes your financial situation and allocation preferences into account and helps you determine the right amount of coverage for your needs.

Life Insurance Calculator

Get the most accurate estimate for your life insurance needs.

Whole life insurance rates tend to be more expensive than term life insurance for two reasons: the payout is guaranteed at the end of your life and there is a savings (or investment) component to the policy.

Additionally, as with other types of insurance, the older you are, the more whole life coverage costs. As we know, humans don’t live forever, so the risk of passing away gets higher as we age. This creates a financial risk for the insurance company as they have less time to collect premiums from you if you’re older before making the guaranteed death benefit payment to your beneficiaries. Because of this financial risk, they make premiums higher than if they had years to collect policy premiums.

Relative costs for whole life insurance at different ages can be found at the link below, or use our quoting tool for a more accurate estimated price.

Whole life insurance costs in your 30s, 40s, 50s, and seniors.

Whole life insurance policies can be customized – whether you want to leave money for your children or grandchildren, have the flexibility to access cash value for a business, or provide coverage for final expenses. The size of the policy and its use can affect the average premium. Below are some examples with average prices for whole life insurance.

And don't forget this pro tip: you can often save on the cost of life insurance by switching from monthly to an annual premium. PolicyAdvisor helps find the best whole life insurance quotes and policies in Canada that are customized for you, and we provide money-saving tips along the way!

Learn more about the cost of whole life insurance| $50K | $100K | $200K | |

| 30 year old | $32.45/mo | $53.55/mo | $102.60/mo |

| 40 year old | $42.57/mo | $74.16/mo | $143.82/mo |

| 50 year old | $61.79/mo | $114.66/mo | $224.82/mo |

Life-pay policy premiums for healthy, non-smoker female

Yes, you can cash out a whole life insurance policy.

As we mentioned before, your whole life insurance policy accrues cash value as you pay your premiums over the years. After a certain amount of time has passed, you can surrender the policy for a predetermined amount of money. This sum is called the cash surrender value. So, yes, you can cash out a whole life insurance policy.

While every insurer is different, it generally takes at least 10 years before your whole life insurance policy builds enough cash value for you to be able to take advantage of it.

If an insured person dies while there is outstanding cash value associated with their whole life policy, those additional funds are also distributed to the beneficiary.

There are two subsets of whole life insurance:

Whole life insurance premiums can be paid monthly or annually. But beyond that, there are alternative payment structures for whole life insurance coverage:

A 20 pay whole life policy is a limited pay whole life insurance product where you pay the entirety of the premiums within the first 20 years of your policy.

Similarly, a 10 pay whole life policy is a limited pay whole life insurance policy where you pay the entirety of the premiums within the first 10 years of your policy.

Depending on the insurance provider, limited pay whole life insurance policies can also be structured as 15 pay or have the policyholder pay premiums until the age of 65.

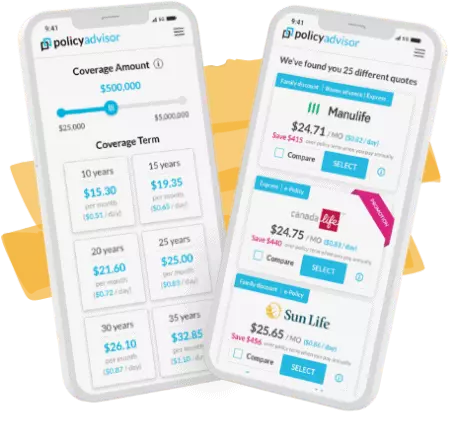

PolicyAdvisor helps Canadians find the best lifelong insurance coverage for their needs. But let’s be frank. There is no best whole life insurance provider. There is – however – the best provider for you.

The country’s top insurance companies offer unique policies to fit every Canadian's individual whole life coverage needs. What helps is having the choice and knowledge to pick the policy and provider that’s right for your situation.

That’s why PolicyAdvisor partners with 30+ of Canada’s top insurance companies – the most compared to any online broker. We make sure you have the complete details and greatest number of options when choosing an insurance company for permanent insurance protection.

We can help you obtain permanent life insurance plans from Assumption Life, BMO Insurance, Canada Life, Canada Protection Plan, Empire Life, Equitable Life, Foresters, iA Group, Manulife, RBC Insurance, SSQ, Wawanesa, and more trusted Canadian insurers.

Learn more about the best whole life insurance companies in CanadaThe short answer is yes, whole life insurance is a good investment. In addition to providing financial security for your loved ones when you no longer can, all types of life insurance can be considered an excellent investment option.

Used strategically, certain types of life insurance can help further build wealth, such as participating whole life insurance policies. Participating whole life insurance can generate and pay out money over the course of the policy in the form of future dividends. These dividends come from the earnings generated by the investment that the insurance company made using the premiums that the policyholder paid.

Additionally, the tax-free nature of life insurance death benefits makes whole life insurance an effective tool to plan for estate taxes and passing on wealth to future generations.

There are other life insurance products with separate investment components, like universal life insurance, though many Canadians are better served concentrating on traditional investments before exploring this life insurance product.

The cash value portion of a whole life policy represents a stable, high-yielding savings or investment account that grows tax-deferred with interest, as determined by the type of policy. Once you have accumulated a sizable cash value, you can use it to:

Take out a loan or borrowing against your policy: You can draw down some of your cash value in the form of a policy loan, which you'll have to pay back at a prespecified rate of interest. If you don't pay back the loan, the loan amount will be deducted from the total death benefit of your policy, at the time of claim.

Partially or fully withdraw money from your policy: You can withdraw money from cash value less any fees. When you withdraw money, it also reduces the death benefit available to the beneficiaries.

As Canada’s leading online life insurance broker, we make buying life insurance simple, easy, and accessible for the Canadian consumer. We have simplified the process for comparing whole life quotes in Canada. We ask you a few basic questions, and then let our algorithms do all the work. They scan through hundreds of products from Canada’s top life insurance companies to identify the best whole life insurance products and prices for you.

Head here to start your search for online whole life insurance quotes or check out our life insurance calculator if you need help figuring out how much you need first.

You can buy whole life insurance through PolicyAdvisor - Canada’s best online life insurance broker! You can start the application process online. Or if you have questions, our licensed insurance experts are available to help you choose the best lifetime coverage for your needs. We have made the whole life insurance purchase process easy by combining our online tools with real-world expertise offered by our in-house licensed whole life insurance advisors.

Start your search for quotes right away or book some time with PolicyAdvisor LIVE: a free service allowing you to speak to one of our licensed advisors about all your insurance needs.