- The average cost for a $500,000 life insurance policy for a 40-year-old male non-smoker starts at roughly $50/month for a 20-year term.

- A healthy person in their 40s has many policy and rate options when it comes to life insurance.

- If you bought life insurance in your 20s or 30s, you might need to reevaluate your coverage in your 40s depending on your situation or renewal date.

Wondering about the cost of life insurance in your 40s? Like most Canadians your age, changes in lifestyle might have you thinking about what your family’s financial future will look like. If you are in your 40s and contemplating life insurance, or looking to update your existing policies, there is no time like the present.

The younger you buy, the cheaper it is—so there’s no better time than now!

Read on to find out the monthly cost for life insurance in your 40s, and why you should either buy your first policy or upgrade your existing policy to match your lifestyle.

What is the average cost for life insurance costs for a 40-year-old

Term life insurance costs about $50 per month for $500,000 in coverage for the average male, non-smoking, 40-year-old.

As we’ve explained before, insurance premiums depend on various risk factors such as your age, gender, smoking status, lifestyle, and overall health. These factors are taken into account to determine your life expectancy and the chances the life insurance company will have to pay out your death benefit. If you partake in high-risk activities, your life expectancy statistically decreases and the cost of life insurance is adjusted accordingly. For example, smoking more than doubles (and almost triples) your life insurance rates in your early forties, and keeps that trend going by age 49.

That being said, we’ve crunched the numbers from over different Canadian life insurance companies to give you the average cost of life insurance in your 40s. See the charts below that have term life insurance quotes by age for a 20-year term life insurance policy, divided by gender and smoking status.

Life Insurance Premiums – Male, 20-Year Term

| Age | $250K | $500K | $1MM |

|---|---|---|---|

| 40 | $29 | $48 | $88 |

| 41 | $32 | $53 | $98 |

| 42 | $34 | $59 | $109 |

| 43 | $38 | $64 | $119 |

| 44 | $41 | $69 | $130 |

| 45 | $45 | $75 | $141 |

| 46 | $50 | $84 | $159 |

| 47 | $55 | $93 | $176 |

| 48 | $60 | $102 | $195 |

| 49 | $66 | $112 | $213 |

*Representative values, based on regular health

The story is similar for women, initial rates are lower than men’s at this age, and smoking continues to have a meaningful impact on premiums. See the chart below that has quotes for 40-year-old women, both smoking and non-smoking, for 20-year term life policies.

Life Insurance Premiums – Female, 20-Year Term

| Age | $250K | $500K | $1MM |

|---|---|---|---|

| 40 | $22 | $36 | $65 |

| 41 | $24 | $39 | $72 |

| 42 | $26 | $42 | $78 |

| 43 | $28 | $46 | $86 |

| 44 | $30 | $50 | $93 |

| 45 | $32 | $54 | $100 |

| 46 | $36 | $59 | $113 |

| 47 | $39 | $65 | $123 |

| 48 | $43 | $72 | $135 |

| 49 | $47 | $79 | $149 |

*Representative values, based on regular health

These average life insurance rates will still vary depending on personal factors like your health and medical exam results, smoking status, location, and more. You may also feel you need a higher death benefit or a longer year term depending on your financial situation, life insurance coverage needs, and all the other life stuff that accompanies your forties.

Looking for a more exact monthly rate? Get a quote in seconds from some of the best life insurance companies in Canada. Get the lowest rates on the market by shopping over 30 insurance providers in seconds! Fill out the quote form below!

Yes, you should get life insurance in your 40s. Buying life insurance in your 40s means financial protection for your family at low rates because your health history is good. You are still relatively young in middle age and can secure a good monthly premium.

There are some clear signs of whether you need life insurance in your forties:

- You and your partner plan on spending the rest of your life together

- You have children of any age

- You have a mortgage, or plan on buying or upgrading your home soon

- You have other forms of debt such as credit card debt or a line of credit

- You are the main earner for your family, with dependents like your children, partner, or parents relying on your annual income

- You are continuing to accumulate assets that will someday be transferred to your beneficiaries

- You want to make sure your family can cover your final expenses, like funeral costs

You may have coverage through a group plan at your work, but at this age career changes and promotions are more and more likely – you could find yourself with a gap in coverage or no coverage at all depending on that next role. Additionally, with a work policy, the type of coverage and policy options are limited. Find out why you shouldn’t just rely on your group life insurance plan.

Not to mention, as you age, health conditions start to creep up, and having a pre-existing condition while you’re applying for coverage can make your monthly cost increase.

You may already have life insurance you purchased when you were younger, but the plan, benefits, and options may no longe work with your current lifestyle. As you take the escalator up in your career and glide towards your peak earning potential, your growing nest egg will need more protection. Be it marriage, children, mortgages, or pets, your financial and protection needs can change drastically in 5 to 10 years. Your forties may, therefore, be a good time to revisit your existing coverage.

How much life insurance does a 40-year old need?

A Canadian in their forties, with a mortgage, children, and a partner who earns an income would need at least $500,000 in coverage. That amount would cover their house payments and child-care expenses, cost of living, and children’s education costs in the next 20 years. However, this isn’t one-size-fits-all.

To check your coverage needs, try out our easy-to-use life insurance calculator.

What is the best life insurance for someone over 40?

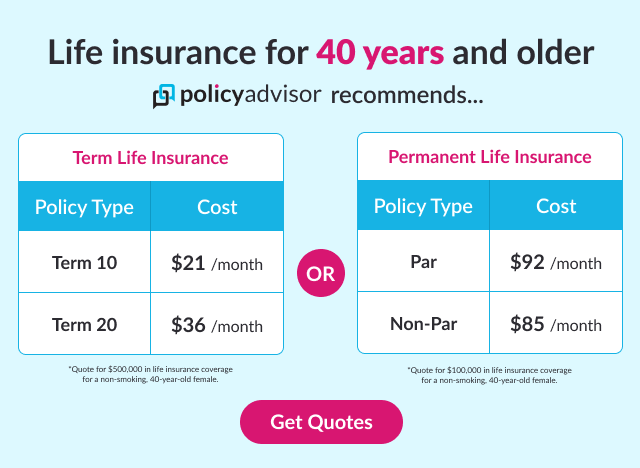

At 40-years-old, term life insurance policies are likely your best option. However, the type of policy you choose ultimately depends on your personal circumstances and financial goals. At this relatively young age, you have your options wide open.

To find out which life policy is best for you when you’re in your 40s, check out our article that breaks down all the different types of life insurance available in Canada.

How do I buy life insurance in my 40s?

You now have an idea of what term life insurance might cost during mid-life – but everyone’s situation is different. The cost of life insurance is as unique as you! If you have 5 minutes, you can get customized term life insurance quotes in minutes through PolicyAdvisor’s online tool.

Still not quite sure how much coverage you need? We’re always here to chat! Book a call with one of our licensed insurance agents to make sure you 40 is your year to make great financial decisions!

Life insurance for a 40-year-old costs around $50 per month for $500,000 in coverage. Term life insurance is a good option if you are looking for coverage to last until your mortgage is paid or you retire. Whole life insurance also has benefits when you’re in your 40s, including lifelong coverage and a cash value component that has time to grow as you age.

1-888-601-9980

1-888-601-9980