- No-medical life insurance is an option for those with health concerns that may disqualify them for traditionally underwritten life insurance.

- If you’ve survived a recent critical illness or suffer from chronic illness (like diabetes), no medical life insurance may be your only option

- No medical life insurance is more expensive than traditionally underwritten insurance policies because the insurance company takes on more risk without doing full medical underwriting

- Definition of no-medical life insurance

- How do I know if I should get no-medical life insurance?

- Should I get no-medical life insurance if I have underlying health conditions?

- Should I get no-medical life insurance if I have diabetes?

- Should I get no-medical life insurance if my previous application was denied?

- Should I get no-medical life insurance if I am healthy and want to save time?

- Should I get no-medical life insurance if I don’t like the doctor’s office?

- Who can I talk to?

There are many factors one must consider when contemplating who should get no-medical life insurance. Time commitment, health issues, iatrophobia (the fear of doctors) – the list goes on. Before you start your search for no-medical life insurance, find out if it’s the right fit for your needs at this time.

Definition of no-medical life insurance

No-medical life insurance is just that. Life insurance issued to an applicant without the need for medical underwriting; a process that typically entails a medical exam by a paramedical service employed by the insurance company you’ve chosen to work with. The medical exam typically includes a blood test, a urine test, and a check of your vitals (blood pressure, and height and weight) in addition to a medical questionnaire. On the other hand, no-medical exam policies exclude the body fluid sample collection and rely solely on the questionnaire.

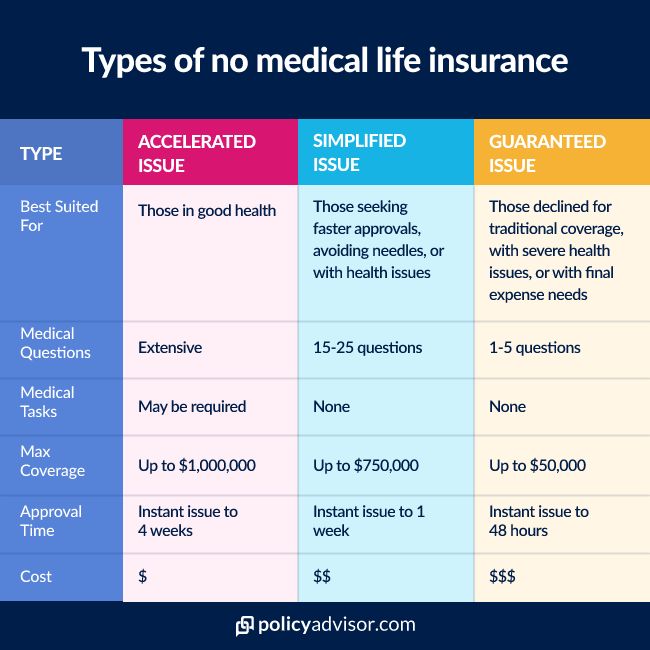

Digging deeper, no-medical life insurance comes in three different varieties: accelerated issue, simplified issue, and guaranteed issue. Each policy type requires a different level of scrutiny into your health and medical history, and their premiums reflect this. Typically, accelerated issue life insurance will have the lowest premiums due to its more in-depth, dynamic medical questionnaire, while guaranteed issue life insurance has the highest premiums as it asks for virtually no-medical history from its applicants.

How do I know if I should get no-medical life insurance?

Whether for one of the reasons stated above, or another concern you have when it comes to medical underwriting, you have many factors to consider whether you want to go forward with no-medical life insurance. As we mentioned, no-medical life insurance policies are priced differently than those that are medically underwritten. And by different, we mean more expensive.

Thus, keep that in mind when contemplating the following scenarios. You can save a substantial amount of money by going through medical underwriting for term life insurance if you have that option. Before proceeding with any life insurance policy, speak with your broker. Licensed experts – like ours at PolicyAdvisor – are specially trained to help you navigate insurance questions like these. We have years of experience helping Canadians pick the right life insurance for their needs and their budgets, all while saving them time completing their applications digitally.

Should I get no-medical life insurance if I have underlying health conditions?

no-medical life insurance is certainly an option for those with health concerns. If you’ve survived a recent critical illness (like cancer, heart disease, etc), or suffer from a chronic illness, your number of traditional insurance options may be slim Not only that, but coverage could be denied once you apply or prohibitively expensive once you are provided with the final price after a medical exam.

In some of these cases, your best option may be no-medical life insurance. However, speak with a licensed broker. They will have the best idea of whether no-medical life insurance or a traditional option is best for you. Keep in mind that CLHIA statistics show only a small number of life insurance applications are denied each year.

Read More: Can I Get Life Insurance With Pre-existing Health Conditions?

Should I get no-medical insurance if I have diabetes?

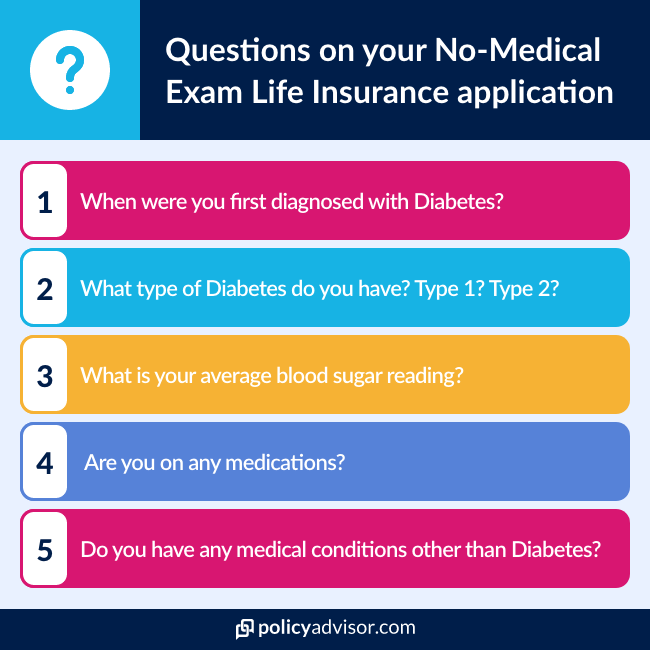

The above answer is also sound advice for diabetics applying for life insurance or contemplating no-medical life insurance. While, as a diabetic, you may have assumed you won’t qualify for traditionally underwritten life insurance, that’s simply not the case.

Diabetics with demonstrably consistent, tight control of their blood sugar, and in general good health can qualify for the same insurance pricing as anyone else applying for underwritten life insurance.

However, perfect control is not a reality for many of the millions of Canadians living with diabetes. Even a hemoglobin A1C above 7 can result in an increased rating from an insurance company. If your diabetes control is at a point where it results in an incredibly high insurance rating or outright decline of an application, then you may consider no-medical life insurance.

Should I get no-medical life insurance if my previous application was denied?

Having your life insurance application denied is not ideal, but it does not mean you have no choice when it comes to protecting your income for your family or beneficiaries. An application denial is a scenario where you may instantly choose to navigate the different no-medical life insurance policies – like simplified and guaranteed issue – to ensure you get coverage. Before you do so, speak with your broker and find out why your insurance was denied. You may have the chance to reassess your application, reapply with a different insurance company, or have it insured with exclusions for the specific issue that triggered its denial.

Either way, having an experienced broker by your side will help you find the right policy for you on your new search or modify your previous application so that it works for your situation.

Should I get no-medical life insurance if I am healthy and want to save time?

The short answer: yes.

The long answer? There are many ways to save time when comparing and buying life insurance. First and foremost, a digital life insurance broker can help you through the insurance buying process. They can provide you with quotes in minutes and guide you towards the best choices that can save you money; all in a fraction of the time a traditional mortgage broker would take to get you covered.

What’s even better is – thanks to their years of experience – our brokers can guide you to accelerated issue life insurance options that don’t require face-to-face medical exams, yet offer comparable pricing to other medically underwritten insurance policies. Companies like Assumption Life, Canada Protection Plan, Desjardins, Empire Life, Manulife, Industrial Alliance (iA), RBC and others offer a substantial amount of term life coverage to those in good health without the need for a medical exam. Depending on your age, some of these companies can offer coverage of as much as $5 million dollars to healthy applicants without requiring a medical exam.

While there is nothing better than instant – our licensed brokers can do the time-consuming leg-work involved in finding you the best policy while avoiding the higher premiums of some no-medical options. no-medical life insurance is not the sole choice if you want to save time AND money.

Should I get no-medical life insurance if I don’t like the doctor’s office?

You certainly can, but there are other options if you want to get life insurance without entering your doctor’s crowded waiting room. All insurance companies offer a paramedical appointment to collect your health information. A nurse can visit you at home or your place of work and collect bloodwork, blood pressure, and the other information required by underwriters.

But, as alluded to previously, there are some providers that offer accelerated issue term life insurance policies. Depending on your health and how you answer the initial medical questionnaire, you may qualify for coverage without ever having to do a medical.

I’m not sure if I need no-medical life insurance. Who can I talk to?

We thought you’d never ask! PolicyAdvisor’s mission is to help Canadians save time and money as they seek out life insurance coverage. We work with 20 of Canada’s biggest and best insurance companies. Our experience with these providers grants us the ability to find the right, custom coverage for your needs. And that means saving you time and recommending no-medical insurance that fits your budget and needs when appropriate. Reach out and we’ll help you start comparing life insurance quotes online. In the mean time, check out our life insurance calculator so you have an idea of how much coverage you may need.

The reasons you may need no medical life insurance include not qualifying for traditionally underwritten life insurance, a need for quick coverage that doesn’t require medical underwriting, an aversion to needles or bloodwork, and more. No medical life insurance is an alternative for those that don’t qualify for fully medically underwritten life insurance for whatever reason.

1-888-601-9980

1-888-601-9980