- A critical illness insurance is a type of insurance policy that provides a one-time lump-sum payment if you're diagnosed with a covered condition, such as cancer, heart attack, or stroke

- A critical illness rider is an optional add-on to a life insurance policy that also pays a one-time benefit upon diagnosis of a covered condition

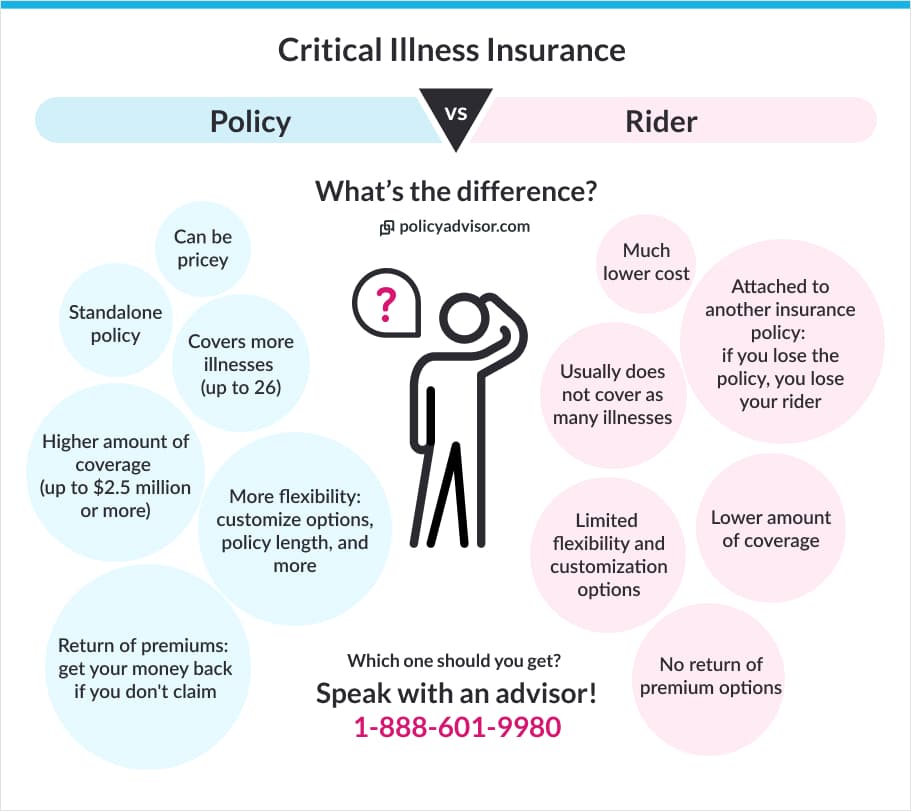

- A standalone policy has better coverage options but costs more

- Riders are cheaper and do not have extra underwriting, but come with a lot more limitations

- What is a critical illness rider?

- What is a critical illness insurance policy?

- What is the difference between critical illness riders vs critical illness insurance?

- Critical illness riders vs critical illness insurance: pros and cons

- Is it better to get a critical illness insurance rider or a full policy?

- How to buy critical illness insurance: rider vs full policy

- Frequently asked questions

There are multiple ways to get critical illness insurance coverage. A critical illness rider is often a less expensive option, but whether it’s better for you than a full policy depends on your health risks, financial obligations, and personal and family needs.

This article examines the key features and differences between both options to help you decide which is right for your situation.

What is a critical illness rider?

A critical illness rider is an optional add-on for your main insurance policy. In Canada, most people add it onto their life insurance as a way to get additional coverage. But you can add it to other policies too, like mortgage insurance or disability insurance.

Riders will still cover you for major illnesses, but they won’t have all the same features a full policy can give you. A rider may also not cover you for as many health issues or for as much money as a full-scale critical illness policy will.

But, it does cost less than a full, separate policy does. And it can be convenient to buy multiple coverages at the same time like this. Critical illness is one of the most common riders Canadians get for their life insurance coverage.

How does a critical illness insurance rider work?

With a critical illness rider, if you get a serious illness that your insurance provider has agreed to cover, they will pay you out a portion of your life insurance death benefit early.

They will give this to you as a one-time, lump sum payment that’s tax-free. But only once, and only for qualifying illness — which could be as little as 3 or 4.

Does a critical illness rider cover the same things critical illness insurance does?

It depends. Most CI riders cover fewer conditions than a full-scale policy will. It depends on the company, though. Some life insurance companies have riders that cover the same number of illnesses as a regular plan. And some of those can cover as many as 26 health conditions. But that’s rare for riders.

What is a critical illness insurance policy?

Critical illness insurance is a form of insurance that pays you a lump sum if you are diagnosed with a serious illness. The critical illness benefit money can be used for anything you need, like covering costs for:

- At-home or specialty medical care

- Prescription medication

- Other treatment costs

- Home modifications

- Debt

- Lost income

- Daily living expenses

- Other financial obligations

Most standalone CI policies will cover at least the major health conditions that are most common in Canada, like cancer, heart disease, multiple sclerosis, and more.

If you get a critical illness diagnosis and you have a standalone policy, you get a full lump-sum payment to use however you need to.

What is the difference between critical illness riders vs critical illness insurance?

A critical illness rider is like a smaller version of a critical illness insurance policy. They’ll both give you a payout if you’re diagnosed with a serious, life-altering illness. But a full policy will normally give you better coverage. An optional rider will be cheaper, but will have more coverage limits.

Think of it like a donut vs a mini donut. They’re both the same thing in a way, but on different scales. Let’s look at the different features of each below.

Critical illness riders vs critical illness insurance: pros and cons

Let’s look at the pros and cons of both critical illness insurance and critical illness riders to determine which offers more benefits and flexibility.

Pros and cons of critical illness riders

Critical illness riders offer several benefits, including no medical underwriting and lower costs compared to full policies. However, they also have some limitations:

Critical Illness Insurance Rider: Pros and Cons

| Pros | Cons |

|---|---|

| Lower cost | Limited flexibility — you can’t customize it as much as a full policy |

| No underwriting — it comes with an insurance policy so underwriting has already been done | Attached to another policy — if you lose that coverage, you also lose this rider |

| You can cancel it without losing the insurance policy it’s attached to | You can only get it when you buy a new insurance policy — it can’t be added to an existing policy |

| Can be convenient to get multiples types of insurance coverage at the same time | No options to get your money back if you don’t submit a claim (return of premium) |

| Limited coverage amount | |

| May not cover you for as many medical conditions as a full policy would | |

| May not give partial payments for some conditions — check with your advisor | |

| Can decrease your payout for other insurance — if you have to make a claim, the money will be taken from the payout of the insurance policy it’s attached to |

Pros and cons of critical illness insurance

Critical illness insurance offers coverage for 26+ serious health conditions. However, it requires thorough medical underwriting and can be expensive for people with pre-existing conditions like diabetes and arthritis. Here are the key benefits and limitations of critical illness insurance:

Critical Illness Insurance Policy: Pros and Cons

| Pros | Cons |

|---|---|

| Full coverage — can cover up to 26 major illnesses | Premium rates can be more expensive than riders and other types of insurance policies |

| Higher amount of coverage — up to $2.5 million | Thorough underwriting process |

| More customization options and flexibility | |

| Return of premium options — get your money back if you don’t end up having to make a claim | |

| Many plans pay out for partial conditions — such as early-stage cancers | |

| Some plans can give more than one lump sum payout if you get the same illness more than once |

Is it better to get a critical illness insurance rider or a full policy?

Whether you should get a rider or a stand-alone policy will depend on you and your family’s needs. Both have their pros and cons. It could come down to whether it’s most important that you have a lot of coverage, that you save as much as possible, that you have more flexible options, or more.

You should get a critical illness rider if:

- You are about to buy life insurance and you want to get critical illness coverage at the same time

- You want the lowest cost for coverage possible

- You want to be approved very quickly

- Optional features and high coverage amounts aren’t as important to you

- You just want basic coverage

You should get a standalone critical illness insurance if:

- You need to have a lot of coverage — such as if you’re a high-income earner or if you have a lot of debt

- It’s important to you to have flexibility to change or customize your policy to fit your exact needs

- You want critical illness coverage but you already have an existing life/mortgage/disability insurance policy

- You don’t want to diminish your life insurance payout if you happen to become ill with a life-threatening illness in the future

- You’re not on an extremely tight budget

How to buy critical illness insurance: rider vs full policy

You can only buy a critical illness insurance rider when you’re buying a new policy At PolicyAdvisor, we have a range of insurance products with the option to add this type of insurance as a rider.

If, however, you want to buy a standalone critical illness insurance policy, you can get the lowest rates from Canada’s top insurers using our online tool or schedule a free consultation with our licensed advisors, who can help you choose a plan more suitable for your requirements.

Frequently asked questions

Is a critical illness insurance rider worth it?

It depends on you and your needs. A critical illness rider may be worth it if you just want something basic and are willing to sacrifice flexibility for a low cost.

In our opinion, though, most people are better off getting more comprehensive protection if it can fit in their budget.

Does a regular critical illness plan have the same survival period as a rider?

Yes, critical illness insurance coverage usually has the same survival period whether you buy it as its own policy or as an optional life insurance rider.

The survival period is the amount of time after a diagnosis that you have to live before the insurance provider will give you a claim payout. Most insurance companies have a 30-day survival period.

Does a critical illness (CI) rider have exclusions a stand-alone policy does not?

Yes, critical illness riders often have exclusions that a standalone policy does not. Here are some differences between the two in terms of exclusions:

- Coverage amount: Most CI riders will only cover up to $25,000 for a critical illness. Full coverage could get you up to $2.5 million.

- Covered conditions: Many riders won’t cover more than a handful of major illnesses. In our experience, most will cover just the basic 3 — life-threatening cancer, heart attack, and stroke. Some may cover up to 26 like a full policy does, but these are pretty rare.

- Can’t be retained upon cancellation of main policy: You can cancel a rider and keep the policy it’s attached to, but not the other way around. If your main policy is canceled, you also lose your rider. Or, if your base policy is only for a 10-year term, your critical illness cover will also only last for those 10 years.

- Limited conversion options: With term insurance plans, some companies let you convert to permanent life insurance down the line — or to a different type of policy. But, if you had a critical illness insurance rider attached to that term life insurance, you may not have the same options to bring it over to your permanent plan.

What’s the difference between a critical illness rider and a terminal illness rider?

A critical illness rider is an optional add-on, which can be added to a life insurance policy for a small extra cost. It pays a one-time lump-sum amount iff you’re diagnosed with a covered illness.

A terminal illness rider is also an optional benefit that is usually included for free in life insurance plans. It pays a one-time lump-sum benefit (typically 50%-75% of the insured amount) if you’re diagnosed with a terminal illness and have two years or less to live.

What does life insurance with critical illness cover?

Life insurance with a critical illness rider in Canada combines death benefits and living benefits. If you are diagnosed with a covered critical illness, you receive a tax-free lump-sum payout. This money can help cover medical expenses, lost income, or other costs associated with recovery, ensuring financial support during a challenging time.

If no claim is made during the term of the policy and you pass away, your beneficiaries will receive the death benefit, which helps cover funeral costs, and outstanding debts, and provides financial support for your family after your passing.

What is the difference between critical illness insurance and life insurance?

Critical illness insurance offers a living benefit designed to support you while you’re alive. Life insurance offers a death benefit to your beneficiaries in the event of your demise.

Critical illness insurance offers a lump-sum payout if you’re diagnosed with a life-threatening illness like cancer, heart attack, or stroke. On the other hand, life insurance is meant to protect your loved ones after your passing. If you die, life insurance pays out a death benefit to your beneficiaries, helping them cover funeral expenses and debts, and maintain their lifestyle without the burden of financial uncertainty.

Does life insurance cover critical illness?

No, life insurance and critical illness insurance are separate products that serve different purposes. Life insurance covers you for a set period (or in the case of permanent life insurance, your entire lifetime) and only pays a benefit upon your passing. It does not cover conditions like heart attack, cancer, and stroke, nor does it provide benefits upon diagnosis.

Critical illness insurance, on the other hand, is a living benefit policy that covers these conditions and pays a lump-sum benefit upon their diagnosis.

A critical illness rider is like a smaller version of a full-scale critical illness insurance plan. It still gives you some coverage in case you become seriously sick with one of the covered illnesses. But it has a lot more limitations than a full plan does. Understanding the pros and cons of a rider vs a full policy is the best way to determine which one to choose.

1-888-601-9980

1-888-601-9980