Life Insurance for Seniors in Canada (2024) – Types, Benefits & Costs

Life insurance is beneficial for any senior who wishes to leave tax-free money for their loved ones or estate. There are many term life insurance options available up to age 75. Or, permanent life insurance is a great option to cover funeral expenses and medical bills. Seniors with poor health can still qualify for life insurance coverage if they apply for no-medical plans that don’t ask for a medical exam.

- Can seniors get life insurance in Canada?

- Why do seniors need life insurance?

- What types of life insurance can seniors get in Canada?

- How much does life insurance for elderly people in Canada cost?

- What is the best life insurance for older people in Canada?

- When is it not a good idea for a senior to get life insurance?

- Where can I get affordable life insurance for older people in Canada?

- How to buy life insurance for seniors in Canada

- FAQs on Life Insurance for Seniors

Most people assume that life insurance for seniors is either not worth it or impossible to get approved – but, it is not true! Even those aged 60 or over can take comfort in knowing they can still get life insurance coverage.

Read on to find out what your coverage options are and how you can secure the protection you need in retirement age.

Can seniors get life insurance in Canada?

Yes! The maximum age seniors can apply for life insurance in Canada is 85 years old. Your age will affect whether you are approved, the type of coverage you can get, and how much your yearly or monthly premiums will cost. But rest assured, you still have options.

Why do seniors need life insurance?

Seniors need life insurance to give their family financial security and peace of mind, especially as they approach retirement. Some of the major reasons seniors buy life insurance are:

- To pay off the mortgage: Not every Canadian has paid off their mortgage by the time they’ve reached their 50s or 60s. A death benefit payout from the insurance policy would enable surviving loved ones to handle it

- To pay off any outstanding debts: Similarly, beneficiaries can use the payment to cover any other leftover debt such as credit card bills, personal or business loans, and more

- To cover funeral arrangement expenses: Life insurance can also give surviving loved ones the space to grieve without worrying about how they can afford to pay for burial costs

- To cover medical debt: Some life policies come with benefits you can use now, to help pay for costs like long-term care and prescriptions, or to give an advance on the payout in the event of a terminal illness

- To provide for a surviving spouse: Life insurance can help a surviving spouse maintain their same standard of living and keep up with daily expenses and bills

- To provide for dependents: Seniors who take care of family members with special needs can make sure the money from their life insurance is used to keep providing for those loved ones

- To supplement retirement savings: Many older Canadians use the money they get from a whole life policy’s cash value to supplement their pension and help give them some extra cash

- To leave an inheritance for children and grandchildren: Life insurance is a fantastic estate planning tool that helps seniors leave money behind for children, grandchildren, and other family members

- To leave a legacy for a charity of choice: Similarly, life coverage gives seniors a way to leave a gift behind for a charity or cause they care deeply about

- To ensure protection: In Canada, there is no government life insurance for seniors. Any older people who want this kind of protection must buy it themselves

What are the benefits of Canadian life insurance for seniors?

Life insurance can give seniors:

- Peace of mind

- Financial protection

- Access to extra savings through cash value

- A reliable way to transfer assets and cover end-of-life expenses

What types of life insurance can seniors get in Canada?

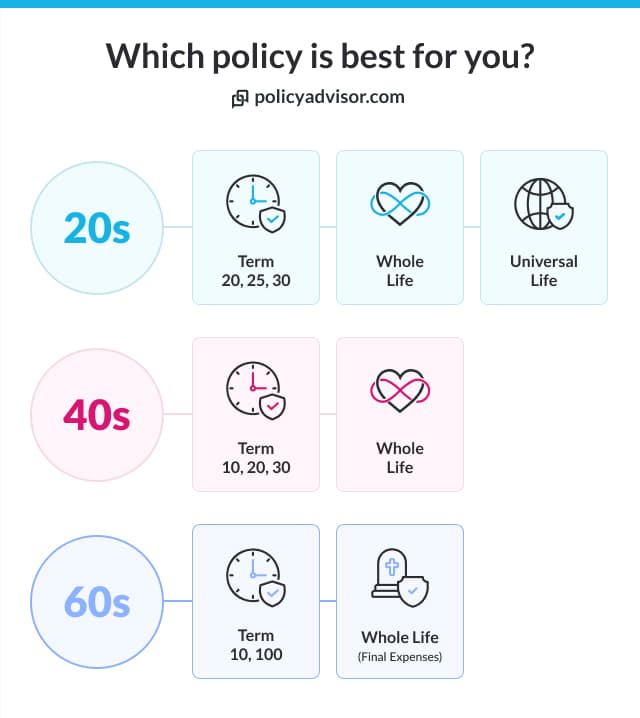

Depending on their individual health and coverage needs, seniors have many life insurance types to choose from.

- Traditionally underwritten life insurance

(usually requires a medical examination)- Term life insurance

- Whole life insurance

- No-medical life insurance

(usually doesn’t require a medical examination)- Simplified issue life insurance

- Guaranteed issue life insurance

Learn more about the different types of life insurance in Canada.

Term life insurance for seniors

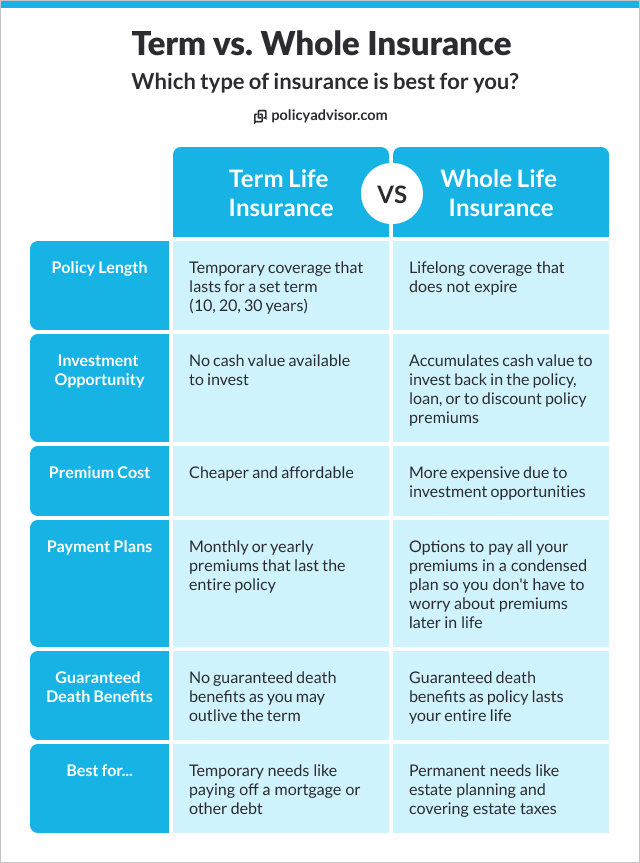

Term life insurance policies cover you for a specific length of time, called a term. It pays a tax-free, lump-sum payment called a death benefit to your beneficiaries if you die within the term.

A healthy 60-year-old who needs life insurance for a temporary need like paying off their mortgage will find that a term policy is the best choice. It’s the most affordable type of policy and can take care of their needs.

Whole life insurance for seniors

Whole life insurance is a type of permanent insurance that covers you for your entire life. It’s best for final expenses like funeral costs, outstanding debts, and end-of-life medical costs. It also has the living benefit of a cash value component. This cash value may be accessed during your lifetime either by withdrawing or borrowing against it.

Whole life policies are generally more expensive than term. It’s also just one type of permanent insurance policy, aside from universal life insurance and Term-to-100.

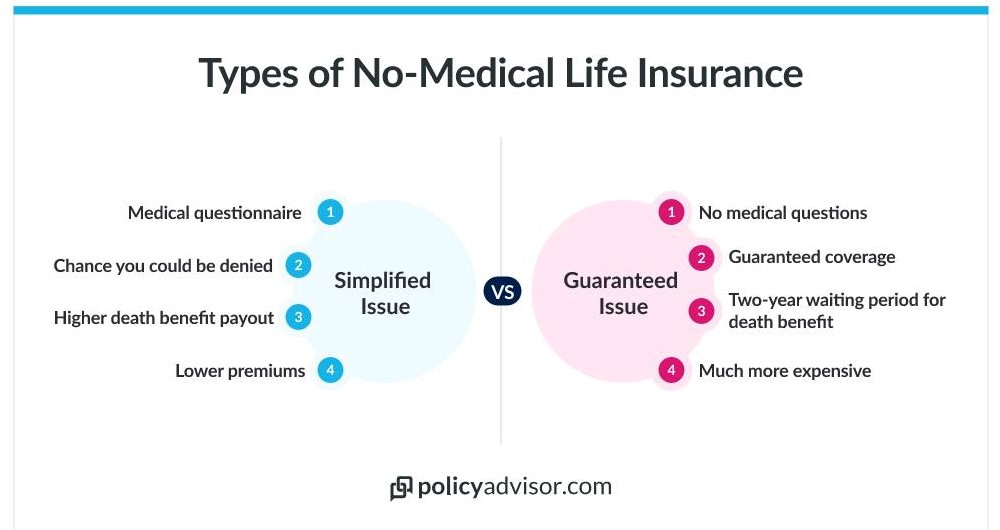

Simplified life insurance for seniors

Simplified issue life insurance asks you a few questions about your medical history when you apply, instead of a full exam. But they tend to be more expensive and usually have limitations like:

- A lower death benefit

- Can have a waiting period of 1-2 years before coverage starts

Guaranteed life insurance for seniors

Guaranteed life insurance has NO health questions at all, so you’re guaranteed to get approved. But it comes with a lot of limitations, like:

- Maximum death benefit amount of $50,000

- Almost always has a waiting period of 1-2 years before coverage starts

This is a last-resort insurance plan. It’s there for those who aren’t able to get traditional life insurance policies or simplified issue policies.

How much does life insurance for elderly people in Canada cost?

It depends on factors like age, type of policy, and more. Life insurance for seniors over 65 can be anywhere from $55 to over $100 a month for term life insurance. Or, life insurance for seniors 65 and over can be around $100 to start.

Life insurance for seniors over 50 in Canada

For those in their 50s, life insurance tends to be more affordable and accessible. Policies can be structured to offer a balance of coverage and cost, with the potential for both term and whole life insurance options.

| Policy Type | Cost (Approx.) |

| 10-year term | $35/MO |

| 20-year term | $61/MO |

| Whole life | $111/MO |

| Term-to-100 | $179/MO |

Life insurance for seniors over 60 in Canada

Seniors over 60 see an increase in premiums due to age-related health risks. There is a wider range of policy options available, including term, whole life, and term-to-100 policies.

| Policy Type | Cost (Approx.) |

| 10-year term | $55/MO |

| 20-year term | $108/MO |

| Whole life | $149/MO |

| Term-to-100 | $241/MO |

Life insurance for seniors over 70 in Canada

For those in their 70s, premiums are higher, reflecting increased health risks. Policies like term-to-100 are designed to provide lifetime coverage, albeit at a higher cost.

| Policy type | Cost (Approx.) |

| 10-year term | $94/MO |

| 20-year term | N/A |

| Whole life | $99/MO |

| Term-to-100 | $313/MO |

Life insurance for seniors over 80 in Canada

Life insurance options for those over 80 are limited and come with high premiums due to the higher mortality risk. Policies mainly focus on final expense coverage rather than extensive financial planning.

| Policy type | Cost (Approx.) |

| 10-year term | $205/MO |

| 20-year term | N/A |

| Whole life | $131/MO |

| Term-to-100 | $441/MO |

*Quote for $100,000 in life insurance coverage for a non-smoking female resident of Ontario in good health. 20-year coverage not available past age 65.

What affects the cost of life insurance for older adults?

For seniors, just like for everyone, the cost of life insurance premiums depends on factors like:

- Age: The older you are, the higher the premiums due to increased health risks and shorter life expectancy

- Health status: Current health and medical history heavily influence premiums; chronic conditions can lead to higher costs or denial of coverage

- Type of policy: Term life insurance generally costs less than permanent policies like whole life, which offer lifelong coverage and additional benefits

- Smoking status: Smokers pay significantly more for life insurance due to the increased health risks associated with tobacco use

- Gender: Women typically pay lower premiums than men because they have a longer life expectancy

- Coverage amount: Higher death benefits mean higher premiums, as larger coverage amounts represent a greater financial risk for the insurer

Health is a major contributing factor for seniors especially, just because our health generally declines the older we get. Age and health are two of the biggest factors that will affect your cost, and whether you can get coverage at all as a senior.

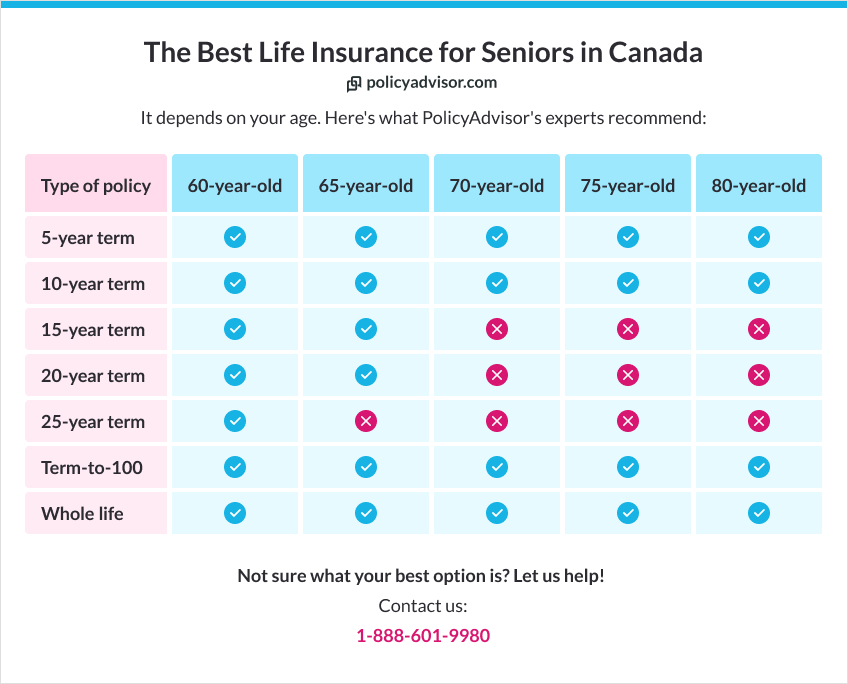

What is the most affordable type of Canadian life insurance for seniors?

Term life insurance is the cheapest type of life insurance for seniors and for Canadians in general. But be aware that seniors have limited options for term insurance, depending on your age. And, depending on your needs, it may not be the best option for you.

What is the best life insurance for older people in Canada?

The best life insurance policy for seniors varies based on each person’s unique needs and circumstances.

In general, here’s a list of what our insurance experts might suggest for you based on how old you are.

When is it not a good idea for a senior to get life insurance?

Having life insurance in old age can be useful, no matter what stage of life you’re at. Knowing that your family will be well-off financially brings peace of mind that is priceless, especially as we get older.

Here are some common circumstances where someone should or should not get insurance coverage as a senior.

You should get life insurance if you:

- Have a lot of savings

Even wealthy seniors who have a lot of savings and assets should still consider getting life insurance. Savings are not as reliable as a life policy is.

- Have no children and no debt

Seniors who do not have a lot of financial obligations can still benefit from a small life insurance policy. It can cover their funeral costs and any outstanding debt. And, they can leave some money behind for a special child, person, or charity in their life.

- Have severe health concerns

Someone with severe health issues should make sure they have plans in place to take care of their family should the worst happen. Your life insurance options will be more limited than if you were healthy, but it’s still not too late.

You should rethink life insurance if you:

- Have limited funds or savings

A senior with limited savings has all the more reason to buy life insurance to help their surviving loved ones. But, it will be important to rethink your budget and prioritize your daily living needs first.

Life insurance may not be for you if you:

- Are older than 85

As we’ve noted above, most Canadians cannot get life insurance coverage past age 85. If you’re already that advanced in age, life insurance may be off the table for you. But there are other ways you can provide for your family, such as with a will or other estate planning tools.

Where can I get affordable life insurance for older people in Canada?

You can find the most affordable life insurance for older people by comparing quotes from top insurance providers on our website. Here are some of our senior clients’ top choices for life insurance companies.

How to buy life insurance for seniors in Canada

Seniors can easily buy life insurance in Canada by following these simple steps:

FAQs on life insurance for seniors

It depends on their needs. Normally, experts say you should get 10-15x your annual income in coverage. But Canadian life insurance for seniors is different — many are already retired and only want to help pay for final expenses or leave inheritance for their family.

There are two easy ways you can find out how much life insurance you need as a senior:

- Use our free online insurance needs calculator to do the math in seconds

- Book some time with our licensed insurance experts to let them help you think it over

Pre-existing conditions affect:

- What kind of life insurance you can get

- Whether you will be approved for coverage

- How much your life insurance rates will be

Many seniors in Canada already have health issues like cancer, high blood pressure, diabetes, and more. These are all considered pre-existing health issues that will affect their insurance options.

But, there are still options for seniors with health issues to coverage through no-medical policies. Seniors can still get insurance coverage even if they have bad health and even without taking a medical exam.

While most term life policies can be renewed or converted into a permanent policy at the end of the term, not every senior may have these options. In general, most Canadian insurers will only let seniors renew or convert up until age 70 to 75.

Read more about what to do when your term life insurance ends.

If your senior life insurance application is denied, you should contact our licensed insurance agents to help discuss how to move forward. We can help you take a look at why you may have been denied and see what the alternative options are.

Read more about what to do if your life insurance application is denied.

The main downsides about life insurance are:

- Rates for seniors can be costly because of their age and health

- You may not be able to qualify for all types of life insurance policy

- Coverage amounts may be limited

- If you don’t use your cash value before you pass away, you will lose it

But, seniors can avoid some of these issues by working with a life insurance advisor.

Life insurance for seniors tends to be more expensive and can have less coverage than other types of insurance. Because of their advanced age and likely health issues, their policies cost more. And because most seniors are only focused on end-of-life expenses, they may not need as much coverage as a 30-year-old with a mortgage and two young kids.

Typically, people who are 50 years old and over are seen as seniors in the life insurance industry in Canada.

Yes. You can get a life insurance policy for your parents. You just need to meet requirements like:

- Consent — They have to be aware that you are taking out a policy on them

- Age restrictions — They have to be within the eligible age range, so you can’t apply for them just because they are 90 and you are younger

- Insurable interest — You have to prove that if they pass away, you would be affected financially

- Personal details — You will need to submit information like their health and financial details

No. There is no government life insurance for seniors in Canada like there are programs for health insurance. To get coverage, a senior must purchase life insurance privately. To find an affordable life insurance option for your financial goals, contact an advisor today!

- Life insurance is a way for seniors to leave a tax-free sum of money to their loved ones or estate

- Term life insurance is not typically available for seniors past the age of 75

- Permanent insurance is a great option for seniors who want to cover funeral expenses or medical debt

- Seniors with health issues can still get coverage through no-medical insurance

1-888-601-9980

1-888-601-9980