A Comprehensive Guide to Understanding Group Critical Illness Insurance in Canada

With rising cases of critical illnesses in Canada, a group critical illness insurance plan gives a financial safety net to an employee who needs it. Depending on the insurer and plan that an employer chooses, group critical illness insurance plans can cover 25+ critical illnesses.

- What is group critical illness insurance?

- How does group critical illness coverage work?

- What does group critical illness insurance cover?

- Who receives critical illness coverage?

- Group critical illness policy details

- Importance of group critical illness insurance

- Choosing the right policy for your organization

- Additional support services

- Frequently asked questions

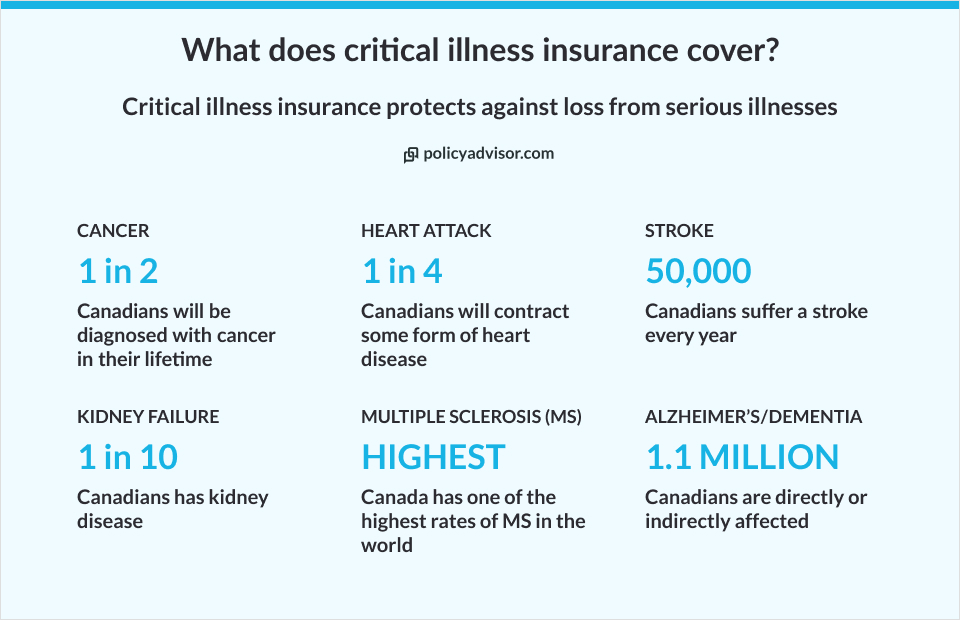

The bad news is that critical illness is on the rise in Canada. The good news is that survival rates are also increasing. Canadians who have a heart attack are more likely to survive it with the right kind of medical intervention. In fact, the survival rate for cancers is also on the rise—again, due to medical advances and interventions. And that’s where a group critical illness insurance comes in. It gives employees the opportunity to get the right kind of medical help when they truly need it.

We know that employees’ health can have a major impact on their work. We also know that with advancement in medicine, treating critical illnesses has become easier than ever before. Both these factors make group critical illness insurance an integral part of an employee benefits plan. Let’s find out more about it.

What is group critical illness insurance?

Group critical illness insurance is a lump sum benefit paid to an employee who has been medically diagnosed with a qualifying critical illness. Insurers will typically list the illnesses covered under a group critical illness insurance plan in the policy document.

As mentioned above, critical illnesses are on the rise. But so are survival rates. This means that there is a growing need for help in covering the costs associated with a critical illness recovery process. And this is precisely what employee critical illness insurance does.

How does group critical illness insurance work?

With group critical illness insurance, an employee will get a one-time lump sum payment if they receive a medical diagnosis for a critical illness after the policy comes into effect. Most employers offer group critical illness insurance to all their employees who have successfully completed a waiting period that can vary between 30-45 days.

Unlike life insurance, the payout for critical illness doesn’t happen after an insured employee’s death. It’s a benefit that is given to them to help with the immediate financial burdens of a critical illness. Most insurers will offer plans that cover serious illnesses such as cancer, heart attack, stroke, paralysis, kidney failure, and more.

What does group critical illness insurance cover?

Every insurer has a fixed list of serious ailments that an employee critical illness insurance covers. Employees can either get basic coverage with 3-4 illnesses covered or enhanced coverage with 25+ conditions.

Basic group critical illness coverage includes:

Enhanced employee critical illness insurance coverage includes:

Learn more about critical illness insurance cover

Who is covered?

Group critical illness health insurance plans in Canada typically cover the following people from any unprecedented critical health condition:

- Employees or members of an association: The primary individuals covered under the plan are the employees of an organization or members of an association. This coverage is part of an employee benefits package, and part-time freelancers or contractual employees cannot avail the benefits of a critical care plan, unless otherwise specified in the policy documents

- Dependents: Many group plans also extend coverage to the dependents of employees, which can include spouses and children. The specifics can vary based on the employer’s policy and the insurance provider’s terms

Find out the difference between critical illness rider and insurance here

Eligibility requirements for group critical health insurance

Although the eligibility requirements for group critical care plans can vary, here are some common eligibility criteria:

- Active work requirement: You usually need to be actively at work when the coverage begins. If you are not working due to illness or disability, you may need to return to work and enroll in your organization’s group benefits plan

- Minimum service period: Some insurance companies or organizations may require an employee to complete a certain period of service before availing critical care benefits. The period may range from a few weeks to several months

- Relationship with dependents: If the policy covers dependents, they must be the legal spouse or children (biological, adopted, or stepchildren) of the employee. Age limits for children might apply in the case of certain companies

- Age restrictions: Some plans have minimum and maximum age limits for coverage, and eligibility might be restricted to individuals with a certain age range

- Health requirements: While group plans are generally more lenient than individual plans, some insurers may require health questionnaires or medical exams, especially for higher coverage amounts

Policy details

Policy details contain comprehensive information on the insurer’s policy, some of which are:

- Benefit amount

Policy details may contain the benefit or coverage amount that the insured can expect to receive for a critical illness diagnosis and treatment. Having knowledge about the coverage can help an individual plan their finances accordingly.

- Survival period requirements

Policy details may also contain information on specific survival period requirements. Most critical illness policies require the insured to survive a certain period after the diagnosis of a covered illness to be eligible for the benefit. This period is typically 30 days but can vary from one policy to another.

- Exclusions

Policy details can also help the insured understand the limitations of their policy. Some policies do not cover specific pre-existing diseases, lifestyle-related critical disease care, the payout for individuals above 65 years of age, etc. Being aware of a policy’s limitations may help the individual come up with suitable treatment alternatives.

Are employee critical illness insurance plans a taxable benefit?

Any premium for group critical illness coverage that is paid by the employer will be a taxable benefit for the employee. Since the employer is paying the premium, it will be considered to be additional income for the employee. This means that the employee will have to report it on their tax return.

However, if an employee is diagnosed with a critical illness, the benefit that they will receive will be tax-free. The tax liability is only on the premium amount.

Importance of group critical illness insurance for employees

Canada has a well-defined and regulated healthcare system. But provincial healthcare plans are not comprehensive and might not cover some of the costs associated with an illness. That is where a group critical illness insurance plan plays an important role.

Apart from being relatively inexpensive when compared with individual critical illness insurance plans, employee critical illness insurance also doesn’t require a medical examination. Employee critical illness insurance benefits can help with:

Is group critical illness insurance worth it?

Employees are arguably the most important factor to an organization’s success. Employers who value their workers should absolutely offer group critical illness insurance as part of employee benefits. Employee critical illness insurance will add to an organization’s hiring and retention strategy and will help them stand out as an employer of choice for top talent.

Most people who are diagnosed with cancer might have to stay home or in a hospital leading to wage losses. Keeping this in mind, offering employee critical illness insurance is the right step for any empathetic employer.

Integrating group critical illness insurance in an employee benefits plan

A critical illness can be a mentally and emotionally difficult time for an employee and their family. Navigating the process to recovery—from hospital visits, to medication, and recovery—can take a toll on the employee and their loved ones. At such a time, offering a group critical illness insurance cover can make all the difference.

Our licensed and expert advisors will help you understand how to integrate a group critical illness insurance plan to your employee benefits package. Speak to us today to get started.

Choosing the right policy for your organization

Employers need to take a lot of things into consideration while choosing the best group critical illness plan for their workforce. Here are a few common factors to look at:

- Accessing the needs of employees through a detailed questionnaire

- Comparing different insurance plans of various companies and understanding their offerings thoroughly

- Deciding upon the coverage amount and coming up with the right premium payment plan

- Understanding if the chosen insurance plan offers flexibility and customization options

- Checking out the compliance and regulatory requirements before making the purchase

- Choosing specific add-ons such as dependent coverage, disability rider and more

Check out the different types of group health insurance plans in Canada through our detailed blog

Getting a quote and setting up the policy

If you’re looking for the most affordable group health insurance quotes but don’t know where to begin, it’s best to seek help from industry experts. Speak to a licensed insurance expert such as our advisors at PolicyAdvisor to understand the features of each plan and get the best quotes.

Once you’ve finalized a policy, go ahead and set it up with the help of insurance agents. This includes the underwriting of the policy, any additional rider inclusion, setting up the requirements for the policy and more.

Communicating the benefit to employees

Once the plan has been set up, employers can communicate about the insurance policy with their employees. A thorough orientation meeting wherein the employers provide a walkthrough about the insurance policy, its features and benefits to the employees can be beneficial.

Employers can also answer common doubts and queries and help the employees understand their policies better and figure out how to make the claims. This can streamline the process for both parties in the future.

Additional support services

Apart from providing group critical care insurance, employers can extend their employee benefit package to include a plethora of additional perks, such as:

- Mental health and wellness packages

- Access to dental care subscriptions and applications

- Out-patient consultation claim support

- Second-opinion reimbursement support

- Disability benefits and rider add-ons

Frequently Asked Questions

How is group critical illness insurance different from individual critical illness cover?

The main difference between group critical illness insurance and individual critical illness cover is that the former offers coverage to all the employees of an organization while the latter is only for the individual who purchases the policy. Other differences include the premium amount which is inexpensive when it comes to group cover.

How does group critical illness insurance provide financial security to employees during critical health crises?

Group critical insurance cover can help replace the lost income for the duration of the illness. It can help families take care of immediate costs such as for rent, mortgage, and even everyday things like groceries. The payout from a group critical illness insurance plan can also help with the treatment and recovery process of the employee.

Are there disadvantages to an employee critical illness insurance plan?

A group critical illness insurance plan can have lower coverage when compared to the amounts available under an individual plan. In group critical illness plans the premiums can increase with age.

- A group critical illness insurance gives employees the opportunity to get the right kind of medical help when they truly need it

- Group critical illness insurance is a lump sum benefit paid to an employee who has been medically diagnosed with a qualifying critical illness

- With group critical illness insurance, an employee will get a one-time lump sum payment if they receive a medical diagnosis for a critical illness after the policy comes into effect

- Employees can either get basic coverage with 3-4 illnesses covered or enhanced coverage with 25+ conditions

1-888-601-9980

1-888-601-9980