The Cheapest Life Insurance Quotes in Canada – Updated 2024

In general, term life insurance policies are the cheapest type of life insurance. But life insurance prices can vary a lot with so many different providers and policy types. Still, there are several things you can do to lower your premiums and make sure you get the cheapest life insurance policy possible.

- What is the cheapest life insurance policy?

- The lowest term insurance quotes in Canada

- How to get cheap life insurance premiums

- Does life insurance ever go on sale?

- How to apply for the cheapest life insurance?

- How are life insurance costs determined?

- The cheapest policy may not be the BEST policy

- FAQs

Many Canadians want the cheapest life insurance policy that still has the most coverage. We do love our bargains, after all! And in this inflating economy, everyone wants to do their best to get the best deal we can!

Insurance is no different. But getting a cheap life insurance policy depends a lot on each person’s current situation. In this article, we’ll show you some real quotes of how affordable life insurance can be. And, we’ll give you insider tips on how to get the lowest rates possible.

What is the cheapest life insurance policy?

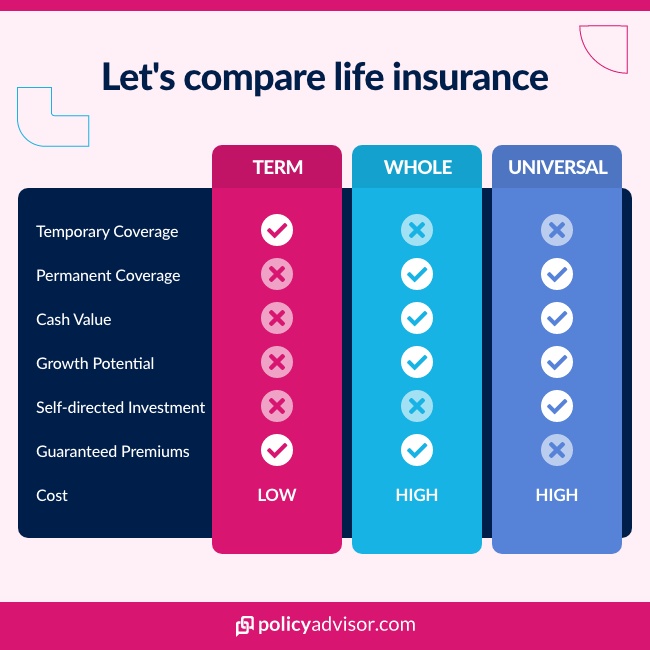

In general, the cheapest life insurance is term life insurance. The way term life insurance works is that you get coverage for a specific period of time. This is different from other types of policies that can cover you for your entire life or come with investment options.

Term life insurance premiums are cheaper:

- The shorter the length of time you’re covered for

- The lower amount you’re covered for

- The younger you are

- The healthier you are

For example, a 20-year-old who doesn’t smoke and buys only a basic policy will have some of the cheapest life insurance quotes in Canada.

The average cost for term life insurance is around $22 to $25 for a young, healthy Canadian under 40 years, says Senior Life Insurance Advisor Jason Goveas. The cost depends on age, so prices increase the older you get. But even a 40-year-old can expect to pay around $28 for a 10-year policy.

What are the lowest term insurance quotes?

Term insurance in Canada can cost as little as $20 or less for a basic plan. It depends on your age and other details. But, generally, life insurance in Canada is a lot more affordable than most people realize.

As Canada’s best online insurance broker, we work with more 30 of Canada’s best insurance companies. We’ve gathered real-time quotes from leading life insurance providers to show you how low rates can get. Check out the chart below to see some of the cheapest quotes for term life insurance in Canada.

Cheapest Life Insurance Quotes in Canada (2024)

| Age | Quote 1 | Quote 2 | Quote 3 |

|---|---|---|---|

| 20 | $5.73/mo (Manulife Vitality) |

$10.13 (Empire Life) |

$10.80 (BMO) |

| 30 | $6.09/mo (Manulife Vitality) |

$10.58 (Empire Life) |

$11.25 (Desjardins) |

| 40 | $9.81/mo (Manulife Vitality) |

$13.50 (Empire Life) |

$13.73 (UV) |

| 50 | $27.00/mo (Empire Life) |

$28.13 (Desjardins) |

$28.13 (Foresters) |

*Real-time quotes gathered on February 27, 2024. Rates based on a non-smoker in average health.

Six ways to get cheap life insurance premiums

There are ways you can also make sure you get the lowest insurance rates possible — it’s not just up to the insurance company alone. Our experts have put together 6 insider tips on how you can get the cheapest insurance premiums:

- Talk to an expert

- Reconsider renewing

- Get alternatives to lender’s mortgage insurance

- Get term instead of permanent insurance

- Say yes to underwriting

- Get healthy (quit smoking, lose weight, etc.)

Does life insurance ever go on sale?

No, life insurance companies don’t have sales in the same way a $20 shirt at the mall might cost $15 the next time you see it. For most standard insurance policies, your premiums will stay the same for the entire duration of your term.

But, Canadian insurers do offer deals on insurance products from time to time. For example, they may drop prices for certain products if you’re buying a new policy. Or, as is the case with Desjardins, they may give you certain discounts if you buy more than one type of insurance with them.

If you’re looking for the latest life insurance deals, you don’t have to look far! We’ve listed them on our website so you can see them at a glance. Click below to take a look!

How to apply for the cheapest life insurance rates?

Easily find Canada’s cheapest life insurance quotes on PolicyAdvisor.com. Get instant online quotes so you can compare the cheapest prices in less than a minute. Then, apply online when you find the plan that fits your needs.

You can also contact us directly to speak with a licensed advisor and get tailored advice. We scan the market for you and find you cheap rates from trusted insurance providers in Canada.

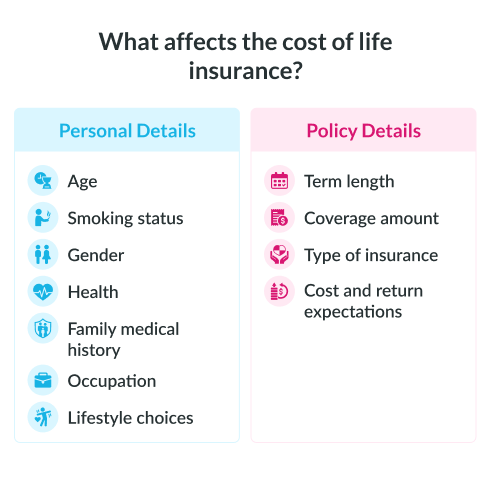

How are life insurance costs determined?

The cost of life insurance depends on two major factors:

- Your personal details, like age and health

- Policy details, like what kind of plan you are buying and whether you get any add-ons

For your personal history, an insurance company will look at a wide range of details such as your:

- Age

- Smoking status

- Health status

- Mental health

- Family health history

- Occupation

- Gender

- Lifestyle choices

Insurance cost is based on life expectancy. So, companies look at these factors to assess how long a person will likely live.

Young women in excellent health who don’t smoke get the lowest life insurance quotes. On the other hand, someone with serious health issues who smokes or enjoys high-risk activities like extreme sports will see higher prices.

When you apply for a term plan, you get to decide your policy details, like:

- Term length — how many years your term insurance will last

- Death benefit amount — how much money would be paid out if a claim is made

- Type of insurance policy

- Life insurance riders

This also affects your price. In general, policies with a short term length and low coverage amount will give you the most affordable premiums.

You can also choose to add life insurance riders to your policy. These are like optional, mini-policies that you can add to your policy to give you more coverage. They usually don’t cost a lot, but will make your premiums go up a bit.

Why the cheapest policy may not be the best policy

While we want to help you get the best possible life insurance deals, we have to note — sometimes the cheapest policy is not the best option for you and your family.

And, the price difference between the cheapest policy and one that gives you fantastic value is often not that big. Compare the term insurance quotes below to the cheapest ones we showed you above, for example.

Sometimes, getting better coverage for just a few dollars more makes more sense, especially the younger you are.

Canadian Term Life Insurance Quotes — $500K, 20-year term

| Age | Female | Male |

|---|---|---|

| 20 | $15.65 | $23.34 |

| 30 | $16.65 | $23.75 |

| 40 | $29.39 | $38.25 |

| 50 | $82.20 | $123.75 |

*Real-time quotes gathered on February 27, 2024. Rates based on a non-smoker in average health.

What to look out for when buying life insurance?

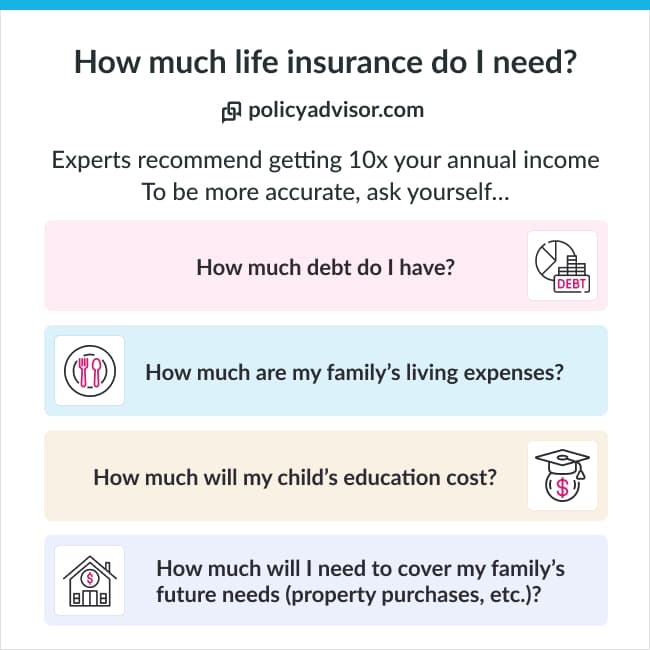

With life insurance, you want to make sure your family would have enough coverage for whatever their needs might be. That may be paying off the mortgage, settling any outstanding debts, or making sure their child’s college expenses are paid.

Remember, the point of life insurance is to give your family financial protection. A life insurance payout acts like a safety net they can rely on if something suddenly happens to you.

Cutting costs doesn’t always pay off. Saving a few dollars now may mean not giving your loved ones the best tomorrow. And, you can get great security for your family while still saving on costs.

🌟 Not sure how much life insurance your family would need? Our life insurance needs calculator can help you figure out. Check it out below!

Frequently asked questions

The cheapest form of life insurance is a term policy. The shorter the term, the cheaper the policy. But the cost is also dependent on other factors as well, such as your personal health history, family history of medical conditions, your coverage amount, and more.

Term insurance is the most basic form of life insurance. The insurance company agrees to pay your family a death benefit if you die within a specified amount of time (a term).

It’s easy to understand, doesn’t cost a lot, and the application process is simple. You can see why term coverage is such a popular type of policy in Canada.

Canada’s biggest insurance companies will give life insurance coverage amounts as low as $50,000. Whole life insurance policies can go as low as $10,000 because most people use them for end-of-life expenses or estate planning instead of short-term needs.

But, you should compare online insurance quotes before buying just the minimum. In a lot of cases, policies that give you more coverage can cost less.

A 1-year life insurance policy is a term life insurance product where your term is for one year. If you die within that year, the insurance company will pay your beneficiaries a tax-free death benefit.

You may also see them called an annual renewable term policy. These kinds of policies usually seem great at first glance because their premiums are extremely cheap.

But, read the fine print before you buy. Every year you renew this policy, your premiums will increase. Over time, you’ll end up paying a lot more than if you just got a policy with a longer term.

Take it from our experts — it’s usually better for you, your family, and your wallet if you get a policy that lasts 5+ years instead. At least then, your rate is locked in for a longer time.

Permanent insurance and no-medical insurance are the most expensive types of insurance policy.

A permanent policy gives you lifelong coverage and has something called a cash value component. You can use this cash value to access growth and build wealth during your lifetime. These are the main reasons why it costs more.

No medical insurance is usually an option for people with severe medical issues. It guarantees you’ll be approved for a policy. But the insurance company also takes a bigger risk to do that, so the cost is higher.

- In general, term life insurance rates are the cheapest in Canada

- Premiums also cost less if you are young, healthy, and don't smoke

- The cheapest policy may not always give you the best value for your dollar

- You should work with a licensed life insurance broker who can help you with strategies to save on premium costs

1-888-601-9980

1-888-601-9980