Can I get life insurance if I’m overweight?

Life insurance companies will ask a variety of health and lifestyle questions to decide what to charge for premiums. If you are overweight or have a high BMI, the company may either give you a high price or deny coverage altogether if your weight is affecting other aspects of your health.

- How underwriting works for weight

- Do life insurance companies look at BMI?

- Will being overweight impact life insurance rates?

- Does sleep apnea affect your life insurance rates?

- Is it better to lose weight before getting life insurance?

- What if you're denied life insurance due to your weight?

- What life insurance policy is best for an overweight person?

Life insurers consider many factors to determine whether to approve your insurance application and what premiums to charge for coverage. Prior illnesses, age, family health, and more are all considered.

Underwriters also examine your weight.

It’s rare for an insurance company to reject your application for being overweight or even obese. But, being overweight can result in several related illnesses, which can lower your chance of scoring the best insurance premium. It can also mean that you have to consider no-medical insurance options.

How underwriters decide the price of life insurance based on your weight

In most circumstances, when you apply for life insurance, the insurance company asks about your medical history to determine your mortality risk. During the application process, your insurer asks you a series of medical questions, requests you take a medical exam and may ask for an Attending Physician’s Statement. They can also check other documents such as:

- Prescription history

- Motor vehicle reports

- Insurance records

- Previous life insurance applications

After the review, the underwriter makes a determination. Depending on the information you provide, you will face one of four outcomes:

- You will receive a standard or preferred rate

- You will receive a rated policy resulting in a higher premium

- You will face a deferral or postponement pending further information

- You will be denied and possibly deemed uninsurable

Your health records (including your weight) could categorize you as preferred, standard, or rated. This categorization is a starting point for underwriters to determine your life insurance premiums.

Do life insurance companies look at BMI?

Yes, life insurance companies consider your Body Max Index (BMI) to determine your risk of certain diseases or medical complications. Those with high BMIs are susceptible to health complications such as:

- Type-2 diabetes

- Hypertension (high blood pressure)

- Heart attack

- Coronary heart disease

- Cardiovascular disease

- Gallbladder disease

- Liver disease

- Kidney disease

- Certain cancers

- Sleep apnea

What is BMI?

Your BMI is based on your weight in kilograms divided by your height in metres squared (kg/m2). BMI is effectively a height-to-weight ratio.

The average Canadian BMI for a males is 27.4 and 26.7 for females.

BMI scores are generally categorized into 4 groups:

| CANADIAN BMI CHART | |

|---|---|

| Body Mass Index (BMI) | Category |

| Under 18.5 | Underweight |

| 18.5 – 24.9 | Healthy Adult |

| 25 – 29.9 | Overweight Build |

| 30 and over | Obese |

Will being overweight impact life insurance rates?

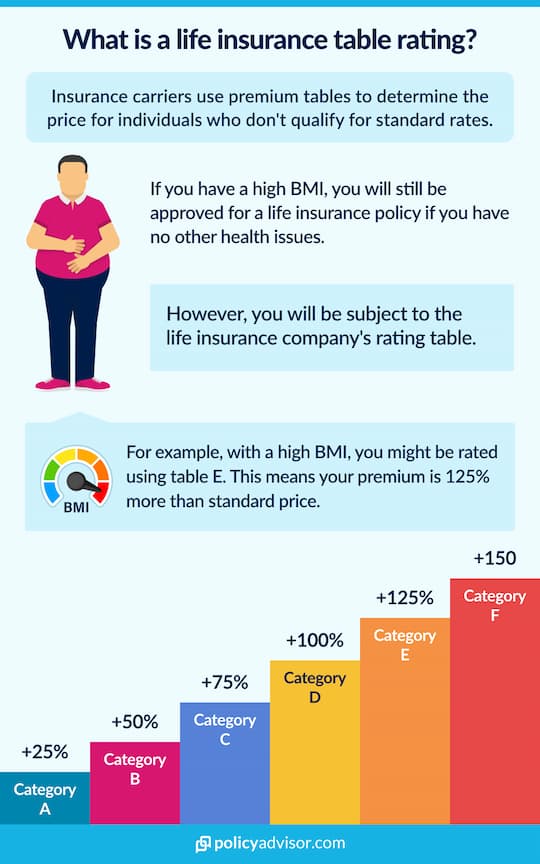

Life insurance companies use your BMI information to determine your monthly premiums or life insurance rates. For example, a BMI over 25 or even over 30 won’t automatically disqualify you from coverage. But you may expect higher premiums.

In most cases, each individual insurance company will have its own rating weight table depending on height, weight, and sometimes gender.

For example, someone who is 5’6” and is 230 lbs would be rated 50% higher than the standard rate due to their BMI ratio using the following Canadian BMI chart.

Life insurance rate chart for BMI |

|||||

|---|---|---|---|---|---|

| How much you pay over the standard rate | |||||

| Height | Canadian Average Weight | 125% | 150% | 175% | 200% |

| 5’0” | 130lbs | 180lbs | 195lbs | 205lbs | 220lbs |

| 5’2” | 140lbs | 190lbs | 205lbs | 220lbs | 230lbs |

| 5’4” | 150lbs | 200lbs | 220lbs | 230lbs | 243lbs |

| 5’6” | 160lbs | 210lbs | 230lbs | 245lbs | 260lbs |

| 5’8” | 165lbs | 220lbs | 240lbs | 260lbs | 270lbs |

| 5’10” | 175lbs | 230lbs | 255lbs | 275lbs | 285lbs |

| 6’0” | 185lbs | 245lbs | 270lbs | 290lbs | 300lbs |

| 6’2” | 190lbs | 260lbs | 280lbs | 300lbs | 320lbs |

Is there a life insurance weight limit?

Due to the number of illnesses associated with being overweight, insurers ultimately see those on the heavier side as a greater risk.

But insurers also consider your body mass in the context of other additional factors such as:

- How overweight are you?

- Do you have underlying health risk or medical condition related to your weight?

- Is your BMI the result of muscle mass? (Insurers often provide leeway if you’re above-average weight because you’re an athlete or otherwise fit person.)

Being overweight or obese can also affect your mental health – another factor in your insurance premiums. How illnesses like depression or anxiety change your insurance costs is complex.

Each insurer considers mental illness differently in their underwriting.

Can I lie about my weight on my life insurance application?

Lying about your weight, age, or health is considered insurance fraud and could void your life insurance policy.

So, while it’s tempting to lie about how much you weigh and pay a lower premium, the consequences could be disastrous. Your life insurance provider might deny your beneficiaries your death benefit if they discover your application misrepresented your health status (including your weight).

Many life insurance applications also require a medical examination. This exam includes recording your body weight. So, misrepresenting your current weight or BMI won’t get you anywhere—your doctor is obligated to share accurate measurements with your potential insurance provider.

Alternatively, you can purchase no-medical life insurance, which doesn’t require a medical exam. No medical (simplified or guaranteed) life insurance only asks a few, basic medical questions for its underwriting process. However, if you’re opting for no-medical coverage in the hopes of getting cheaper rates, you’ll be disappointed. These types of life insurance policies are usually more expensive than standard policies and often have limits on how much coverage they provide. They are most beneficial for high-risk applicants who have exhausted their options with traditional life insurance applications.

Frequently Asked Questions

Is it better to lose weight before getting life insurance?

Losing weight before your life insurance application could lower premiums depending on your insurer. But there are drawbacks.

If you delay your life insurance purchase until you reach an ideal weight range, you increase your family’s financial risk as they’re not protected while you work off those extra pounds.

Alternatively, you could purchase your life insurance policy and reapply once you lose the weight. This provides you with a lower monthly premium in the long term but covers your family as you grind it out in the gym or curb your caloric intake.

Insurers may also investigate your medical history and see your previous weight. If they notice you only recently lost weight, they may consider your application based partially on your prior BMI. This is to ensure you can keep the pounds off. Additionally, if they see drastic fluctuations in your BMI, this may point to other health complications for underwriters to investigate.

Maintaining a healthy, consistent BMI for approximately twelve months is usually enough for insurers to ignore your prior weight.

What if you’re denied life insurance for having a high BMI?

If an insurer denies you coverage based on your weight, speak to an expert insurance broker. They can help you find other insurance companies that may be more lenient with their rating and underwriting guidelines about weight.

However, insurance companies don’t often reject applicants due to BMI. You likely need to be significantly over the obesity threshold or suffer from a major illness to be denied.

If you are declined from all standard life insurance policies, you may consider applying for no-medical life insurance. This type of policy usually doesn’t require you to disclose your weight.

What life insurance policy is best for an overweight person?

The best life insurance policy for overweight people is the one they can comfortably afford that offers them the life insurance coverage they require (or as close to it as they can get). With that said, some Canadian insurance companies have a much higher risk tolerance for medical conditions than others, and this can include weight and obesity conditions.

iA Financial Group (Industrial Alliance) is a Canadian financial services and insurance company with much more flexible weight classifications. If you have applied for life insurance with another insurance and your application was rejected on the basis of weight, one should certainly check their life insurance options with iA before moving on to a simplified life insurance application or forgoing coverage altogether.

No-medical life insurance for obese people

No-medical life insurance means you skip the thorough health examination that is usually required in the underwriting process. This is a great option for obese people as the insurer doesn’t consider your weight when determining whether you qualify.

This type of life insurance also has faster approvals — you won’t need to schedule and attend a medical appointment or wait for results.

But, it comes at the cost of a higher monthly premium and limited coverage options. Your insurer may not offer obese applications the same variety of payout amounts or insurance riders if you choose to forego a paramedical exam.

If you’re concerned about your weight affecting your life insurance eligibility or premiums, our expert advisors can help. We can determine how your lifestyle, health history, and more influence your life insurance application approval. We can also suggest an insurer that best fits your needs.

Schedule a call with one of our team of life insurance advisors today and learn more about competitive rates and coverage options.

- Life insurance companies consider height and weight on your insurance application

- If your BMI is high you may be subject to rate increases

- If your BMI is high, but you have no other health conditions, you may get standard rates

- If you are morbidly obese, you may be denied standard life insurance coverage, but could qualify for no-medical coverage

1-888-601-9980

1-888-601-9980