- You can buy travel insurance for parents or anyone else coming to visit you in Canada

- Regular visitors insurance is great if your parents are staying short-term, while super visa insurance is for long-term stays

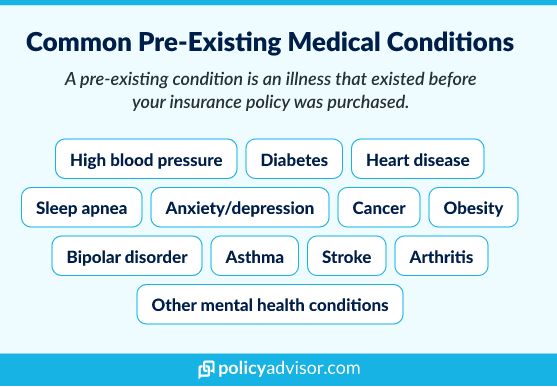

- Pre-existing medical conditions can impact travel insurance coverage and cost

- Can I buy insurance for my visiting parents?

- What kind of travel insurance do my parents need to come to Canada?

- Why should I buy travel insurance for my parents?

- What do I need to get a travel insurance policy for my parents?

- What are the best insurance providers in Canada for visiting parents?

- What does visitors travel insurance cover?

- How can I find the best Canadian visitors insurance for my parents?

- FAQs

Having family come to see you in Canada from abroad can be exciting, especially if you haven’t seen them in a long time. The last thing you’d want is for your family members to incur costly and unexpected expenses during their visit.

People can forget about this during the excitement of travelling, but it’s important that your guests have adequate insurance coverage for their trip before they hop on a plane. You can help them out by making sure they have the travel insurance plan they need.

Can I buy insurance for my visiting parents?

Yes, you can buy insurance for parents visiting Canada or for anyone else coming to see you. A lot of people do this to make sure that the people coming to visit won’t have to pay extra, unexpected costs in the event of an emergency. And most travel insurance plans are so affordable that it’s well worth the peace of mind.

What kind of travel insurance do my visiting parents need?

The kind of travel insurance you should get for your parents depends on their unique needs. They may just need something for medical emergencies, or you may want to get them something more comprehensive that also covers trip interruption. If they have a Canadian super visa, they’ll need a special type of insurance to cover that.

Take a look at some of the most common types of travel insurance below to learn more.

The most common types of travel insurance

There are many different types of insurance policies that can cover different aspects of a trip. Here are six of the most common types of travel insurance.

- Emergency medical. This helps to pay for medical expenses if an emergency happens during a trip.

- Super visa. This is a special type of travel insurance for people who have a super visa. It’s only available to the parents or grandparents of people who live in Canada.

- Trip cancellation. This will help pay for non-refundable costs associated with cancelling a trip, such as those from airlines or hotels.

- Trip interruption & delay. This will reimburse you for the unused part of a trip if you have to go home early, or help cover additional expenses for things like hotel stays or food if your flight is delayed.

- Baggage loss. This helps to cover any mishaps that may happen to luggage during a trip, such as if it’s lost in transit, damaged, or stolen.

- Annual multi-trip. This can be comprehensive travel insurance that includes coverage for many of the options given above, and for more than one trip. It will cover any trips taken within a year, so it’s great for people who travel a lot.

Some foreign visitors to Canada also need special types of travel insurance, like plans for adventure sports or athletes. Super visa insurance is another special kind of travel insurance for parents. But whether your parents need it will depend on things like how long they are staying and if they have a super visa.

What is a super visa?

A super visa is a unique visitor’s visa that is only available to the parents or grandparents of Canadian citizens and permanent residents. It lets them visit Canada multiple times in 10 years, and stay for as long as five years at a time — or extend their stay by another two years if they want. The super visa helps families stay together for long periods of time.

What’s the difference between super visa insurance and visitors insurance?

The main difference between visitors insurance and super visa insurance is the length of stay. Your parents can stay for up to 6 months on a visitors visa. But with a super visa, they can stay up to 5 years or more.

Also, regular visitors do not have to get travel insurance — even though it would help them a lot. On the other hand, super visa insurance is mandatory for anyone who has a super visa.

Super visa insurance is also more strict than normal travel insurance for visitors to Canada. There’s a few reasons for this:

A Super Visa insurance must:

- Cover emergency medical care, hospitalization, repatriation, and more

- Have at least $100,000 in coverage

- Be purchased from a Canadian insurance company

- Be valid for one year

- Be active before the traveller arrives in Canada

Why should I buy travel insurance for my parents?

Travel insurance is an easy, affordable way to make sure your parents don’t have to pay out of pocket for any unexpected issues that may happen when they come to see you in Canada. It’s a way for you to help give them financial protection and ensure they enjoy their trip with peace of mind.

A major reason to get travel insurance for visitors to Canada is to cover unexpected healthcare. A lot of people say that Canada has “free healthcare”, but that’s not true. Visitors aren’t covered by Canadian government health insurance plans. If your parents need to see a doctor while they’re here, they could be stuck paying a huge medical bill. A visitors health insurance plan, or travel medical insurance, helps them avoid that. Other types of travel insurance also help make sure they don’t have to pay for things like flight delays or baggage issues.

Travel insurance will help your parents AND you feel at ease knowing they’ll be covered if anything happens.

How much would it cost to buy travel insurance for my parents visiting Canada?

The cost of travel insurance depends on several factors, but you can expect it to cost around 5% of the cost of the trip.

Travel insurance for a week-long visit to Canada can cost as low as $20-$30. But some kinds of coverage are more expensive than others. For instance, super visa insurance costs more than travel medical insurance. That’s because it gives you more coverage for a longer time.

To find a policy that fits your needs and budget, speak with a PolicyAdvisor expert who can give you the best quote for travel insurance for your parents or other visitors to Canada.

What are the best insurance providers in Canada for visiting parents?

In Canada, there are several insurance providers such as Manulife, Blue Cross Canada, TuGo, Travelance, etc who can take care of your unique insurance needs when travelling to the country.

1. Manulife

Manulife is one of the largest insurance providers in Canada, offering comprehensive travel insurance plans that cater to the needs of visitors, including parents coming to Canada. Their coverage typically includes emergency medical expenses, trip interruption, and accidental death.

One of the standout features is the ability to cover pre-existing medical conditions, provided they meet certain stability requirements. With 24/7 assistance and options to top up coverage, Manulife is a reliable choice for ensuring your parents are well-protected during their stay in Canada.

2. Travelance

Travelance specializes in insurance for visitors to Canada, offering tailored coverage options that focus on emergency medical expenses.

Their plans are flexible, allowing you to customize coverage based on your parents’ health conditions and the length of their stay. Notably, they provide coverage for stable pre-existing conditions, which can be an important consideration for older parents.

3. TuGo

TuGo is another prominent travel insurance provider in Canada, offering a range of solutions for visitors, including coverage for parents coming to the country. Their emergency medical insurance is comprehensive, covering hospital stays, doctor visits, and other medical services.

TuGo also offers flexibility, allowing you to extend or top up coverage if your parents’ stay is extended. Additionally, they provide a straightforward online claims process and access to global travel assistance services, which can be crucial in case of an emergency.

4. Blue Cross Canada

Blue Cross is a well-established name in Canadian health and travel insurance, known for offering a variety of plans for visitors. Their visitor insurance includes emergency medical coverage, trip cancellation, and trip interruption, making it a comprehensive solution for visiting parents.

With access to a large network of healthcare providers across Canada, Blue Cross ensures that your parents receive quality care wherever they are.

What do I need to get a travel insurance policy for my parents?

To buy a travel insurance policy for your parents, you will need basic details like:

- Name

- Age

- Gender

- Destination

- Trip duration

- Address

- Medical history

You will have to tell the insurance company about any pre-existing medical conditions your parents may have, like a heart condition or a lung condition for instance. If you don’t know, it’s best to ask your parents.

Once you get the travel insurance policy for your parents, family members, or any other visitor, be sure to provide them with a copy of the policy and proof of purchase. They will need both if they have to make a claim.

Be clear with your loved ones as to what is covered by their policy and how long they’re covered for. If you’re purchasing online, you will likely receive an email confirmation containing all of this information and a copy of the policy. Be sure to save the email just in case.

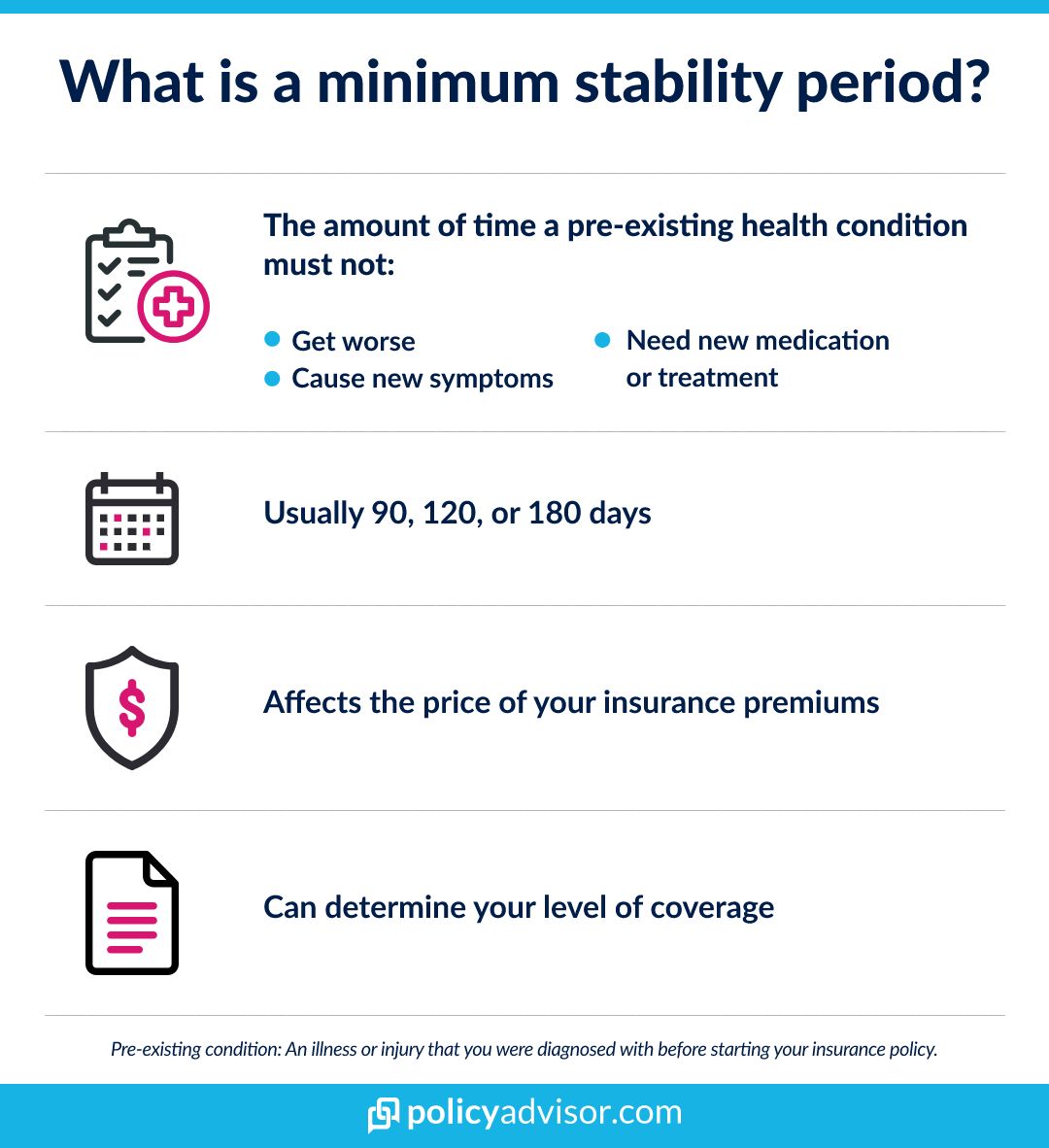

Does travel insurance cover pre-existing conditions?

Most standard travel insurance plans do not cover pre-existing conditions unless they are stable — meaning that they have not gotten worse, caused new symptoms, or needed a new diagnosis in 90-120 days. If a preexisting health condition is NOT stable, it may not be covered by travel insurance at all. And some providers can also exclude certain conditions even if they are stable.

The best way to know whether a specific health condition will be covered is to check the policy for details before going ahead with travel plans. Or you can always speak with one of our advisors for expert guidance.

You should tell the insurance company the truth about any health issues your parents have. Otherwise, the plan could be cancelled, leaving your parents without the travel protection they need.

What does visitors travel insurance cover?

If you buy visitors travel insurance for your parents, it can help cover medical costs, non-medical costs, or a combination of both.

Read more about the difference between travel medical vs trip interruption insurance.

Travel medical coverage

Most Canadian travel medical insurance policies will cover:

- Emergency medical treatment for illness or injury

- Prescription drugs

- Emergency dental treatment

- Essential medical equipment (crutches, wheelchairs, slings, braces, etc.)

- X-rays and other diagnostic laboratory procedures (bloodwork, ultrasounds, etc)

- Ground, sea, or air ambulance services

- Follow-up post-medical appointments

- Medical evacuation

- Ambulance travel to the nearest hospital

Policies can also cover more, depending on the plan and insurance provider you choose.

Travel medical insurance can offer anywhere from $20,000 to up to $250,000 in medical expenses. It covers specific amounts for different health events. The chart below shows more.

A typical travel medical insurance policy for a visitor could cover:

| Medical event | Amount covered |

| Accidental death & dismemberment | Up to the full amount |

| Emergency hospitalization | Up to the full amount |

| Emergency medical (including follow-up visits) | Up to the full amount |

| Emergency transportation expenses | Up to the full amount |

| Return of deceased | Up to $10,000 |

| Accidental dental | Up to $4,000 |

| Emergency return home (repatriation) | Up to $3,000 |

| Emergency return home (repatriation) | Up to $3,000 |

| Transportation of family/friend (to be with you in hospital) | Up to $1,500 |

| Out-of-pocket expenses | Up to $500 |

| Chiropractor, osteopath, chiropodist/podiatrist, physiotherapist or acupuncturist | Up to $500 per profession |

| Dental emergency | Up to $500 |

Non-medical travel coverage

This coverage include things like if your flight is delayed, if your trip is interrupted, if your bags are lost, and more. It helps cover unexpected expenses like:

- Trip cancellation or delay due to:

- Medical emergency or death

- Travel visa complications

- Change in work schedule

- Missed connections

- Jury duty

- Delayed or cancelled flights

- COVID-19-related illness or quarantine

- Trip interruption due to:

- Family emergency

- Medical emergency

- COVID-19-related medical emergency or quarantine

- Travel host’s hospitalization or death

- Baggage loss or delay

If you’re not sure about what’s covered under your parents’ travel insurance, or if they have the right coverage, contact us. Our travel insurance specialists would be happy to help you make sure your parents have a travel policy that meets their needs.

How can I find the best Canadian visitors insurance for my parents?

You can find the best visitor insurance for your parents right here on PolicyAdvisor! We work with dozens of Canada’s top insurance providers to give you the best options and most affordable rates for coverage. Browse quotes online for free in minutes, or book a call with one of our expert advisors to find your best travel insurance match.

Frequently asked questions

What’s the maximum age someone can get travel insurance?

Most Canadian travel insurance policies will cover anyone between 15 days old and 90 years old. Rest assured, your parents are likely able to get travel insurance. Their age will affect the cost, though.

The reason why insurance premiums are based on age is that the older someone is, the riskier it is to give them insurance. The price should not be that high for regular travel insurance, but super visa insurance will likely be more costly for an older adult.

How can I pay for travel insurance for my parents visiting Canada?

Most travel insurance premiums are charged per person for a single trip, but not always. For example, a regular plan might charge $21 to cover a 55-year-old for just one week-long trip to Canada. This would be a one-time cost for that specific trip.

A super visa insurance policy might charge $1,110 to cover a 55-year-old for one year, no matter if they are making a single trip or multiple trips to Canada in that time frame. This fee also could be paid all at once, or it could be paid in monthly installments.

Does travel insurance in Canada cover my entire family?

Yes, travel insurance in Canada can cover your entire family if you choose a family plan. These plans typically provide coverage for you, your spouse, and dependent children under one policy. Family travel insurance often includes emergency medical coverage, trip interruption, and lost baggage protection.

However, coverage limits and terms may vary by provider, so it’s important to review the policy details to ensure it meets your family’s needs.

What if my parents already have travel insurance through their job or credit card?

If your parents already have travel insurance through a group provider, you should compare coverage to make sure they have everything they need. Travel insurance through a job or credit card is usually limited, and might not cover things like pre-existing health issues. It may also have a low coverage amount.

You should read through their travel policies to find out the complete coverage details or speak with one of our agents to make sure your parents travel to Canada with complete protection.

You can buy insurance for parents visiting Canada or for anyone else coming to see you, and doing so will help put everyone’s minds at ease. You will just need some of their personal details like name and age, length of stay, and whether they have any medical conditions.

1-888-601-9980

1-888-601-9980