Best Health Insurance in Ontario

Get an affordable personal health insurance quote within minutes

Comprehensive private health insurance in Ontario

Private health insurance in Ontario bridges the gap between what the Ontario Health Insurance Plan (OHIP) covers and the healthcare services you might need. Whether it’s prescription drugs, dental care, vision, or specialist services, a private health and dental insurance plan keeps you financially prepared for unexpected healthcare costs.

Why do I need health insurance in Ontario?

Personal health insurance is a necessity because while OHIP (Ontario Health Insurance Plan) covers many essential healthcare services, it has significant exclusions that leave individuals and families financially vulnerable.

For instance:

- Prescription medications (outside hospitals)

- Dental services

- Vision care (e.g., glasses or contact lenses)

- Paramedical services (e.g., physiotherapy, chiropractic care)

- Private hospital rooms

Without private health insurance to supplement OHIP, Ontarians face significant out-of-pocket expenses for these vital services, which could lead to delayed care, financial strain, or both.

How much does private health and dental insurance cost in Ontario?

Affordable private health and dental insurance plans in Ontario start at approximately $61 per month for an individual, $110 for a couple, and $175 for a family of four. These costs may vary depending on coverage level, plan details,

| Age/Family type | Approximate cost (Monthly) |

|---|---|

| 35 years, Single Male | $61.32 |

| 28 years, Couple | $110.38 |

| Family of four (45M, 35F, 10C, 5C) | $175.89 |

| 25 years, Male (Pre-existing conditions) | $99.10 |

| 35 years, Female (Pre-existing conditions) | $99.10 |

| 55 years, Male (Pre-existing conditions) | $129.90 |

| 75 years, Female (Pre-existing conditions) | $115.30 |

I need insurance. Where do I start?

Our calculator gets you the right quotes and the lowest rates.

Types of health insurance coverage

Health insurance plans in Ontario offer a variety of coverage options designed to meet different healthcare needs. From essential prescription drugs to specialized services like dental, vision, and paramedical care, these plans fill the gaps left by provincial health programs.

| Benefit | Description |

|---|---|

| Prescription drugs | Coverage for medications prescribed by your doctor, including life-saving drugs and treatments for chronic conditions |

| Dental care | Plans may include regular cleanings, fillings, root canals, and orthodontics for adults and children |

| Vision care | Coverage includes routine eye exams, glasses, and contact lenses |

| Specialist services | Access to paramedical practitioners like physiotherapists, massage therapists, chiropractors, and more |

| Travel medical insurance | Provides coverage for emergency medical care while traveling outside Ontario or abroad |

How to get health insurance If I don’t have OHIP?

If you are a visitor in Ontario or have recently moved to the province and are waiting for OHIP coverage to begin, you can get health insurance for visitors to Canada.

Visitor insurance covers emergency medical care such as prescription drugs, dental, vision services, and more.

Many insurance providers offer visitor insurance plans, so it’s important to compare coverage options, including factors like emergency medical coverage and any exclusions related to pre-existing conditions. You can easily get a quote and purchase a plan online or through an insurance broker, ensuring you have continuous coverage for the entire duration of your stay in Ontario.

| Benefits covered by OHIP | Benefits not covered by OHIP |

|---|---|

| Visits to doctors | Vision care (glasses, contact lenses, eye surgery) |

| Hospital visits and stays | Hearing care |

| Laboratory testing in community labs or hospitals | Certain drugs administered outside of hospital (e.g., some cancer drugs) |

| Medical or surgical abortions | Ambulance transportation services not deemed medically necessary |

| Eligible dental surgery in hospital | Dental services (except complex surgeries in hospital) |

| Eligible optometry (eye-health services) | Physiotherapy (unless over 65 or meet specific criteria) |

| Podiatry (foot-health services) | Private or semi-private hospital rooms |

| Ambulance services | |

| Travel for health services if you live in Northern Ontario |

What does the Ontario Health Insurance Plan (OHIP) cover?

The Ontario Health Insurance Plan (OHIP) provides coverage for many essential medical services like doctor visits, hospital care, and diagnostic tests. However, it leaves out several important areas of healthcare, such as prescription medications, dental and vision care, etc.

Do I need private health insurance if I have OHIP?

Yes, private health insurance is still beneficial even if you have OHIP. While OHIP covers many essential healthcare services, it doesn’t include key areas such as prescription medications (outside of hospitals), routine dental care, vision care (e.g. glasses or contact lenses), and paramedical services like physiotherapy, chiropractic treatments, and massage therapy.

Need insurance answers now?

Call 1-800-601-9980 to speak to licensed advisors right away, or book some time with them below.

Best health and dental insurance companies in Ontario

Choosing the best health insurance provider in Ontario depends on your individual healthcare needs. Different insurance companies specialize in various areas, ensuring you get the coverage that fits your priorities.

| Company | Best for.. | PolicyAdvisor rating |

|---|---|---|

| Manulife | Customization |      |

| Canada Life | Vision coverage |      |

| Blue Cross | Prescription medication & dental coverage |      |

| Green Shield | Paramedical coverage |      |

| Sun Life | Travel medical coverage |      |

| GMS | Multiple plan options |     |

| Desjardins | Bundling with other products |     |

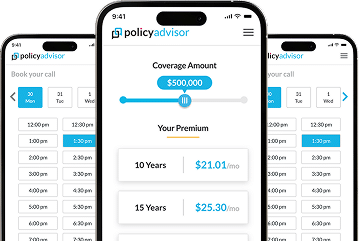

Why PolicyAdvisor?

PolicyAdvisor makes finding life insurance simple. Compare quotes, get expert advice, and find the best policy for your needs-all in one place.

- Save time: Get instant quotes from Ontario’s top life insurance companies

- Save money: Compare multiple quotes to find the best price

- Shop anywhere: Use our online tools to compare quotes from your phone or computer

- Personalized service: Receive expert advice from a dedicated insurance advisor

Other insurance options

Disability insurance

Disability insurance replaces your income if you’re unable to work due to a disability. This coverage ensures that you can continue to meet your financial obligations, such as mortgage payments and daily living expenses, even if an illness or injury prevents you from working.

Group insurance

Group insurance covers medical expenses not included in Ontario’s provincial health plan, such as prescription drugs, dental care, vision care, and

Critical illness insurance

Critical illness insurance provides a lump sum payout if you’re diagnosed with a covered critical illness, such as cancer, heart attack, or stroke. This payment can help cover medical bills, pay off debts, or make necessary lifestyle changes, such as modifying your home or taking time off work to focus on recovery.

Visitor insurance

Visitor insurance protects against unexpected costs, including medical emergencies, trip cancellations, lost luggage, and other unforeseen events while traveling. This coverage ensures you’re financially protected during your stay in Ontario or

Make better insurance decisions, online, in less time, for less money

Frequently asked questions