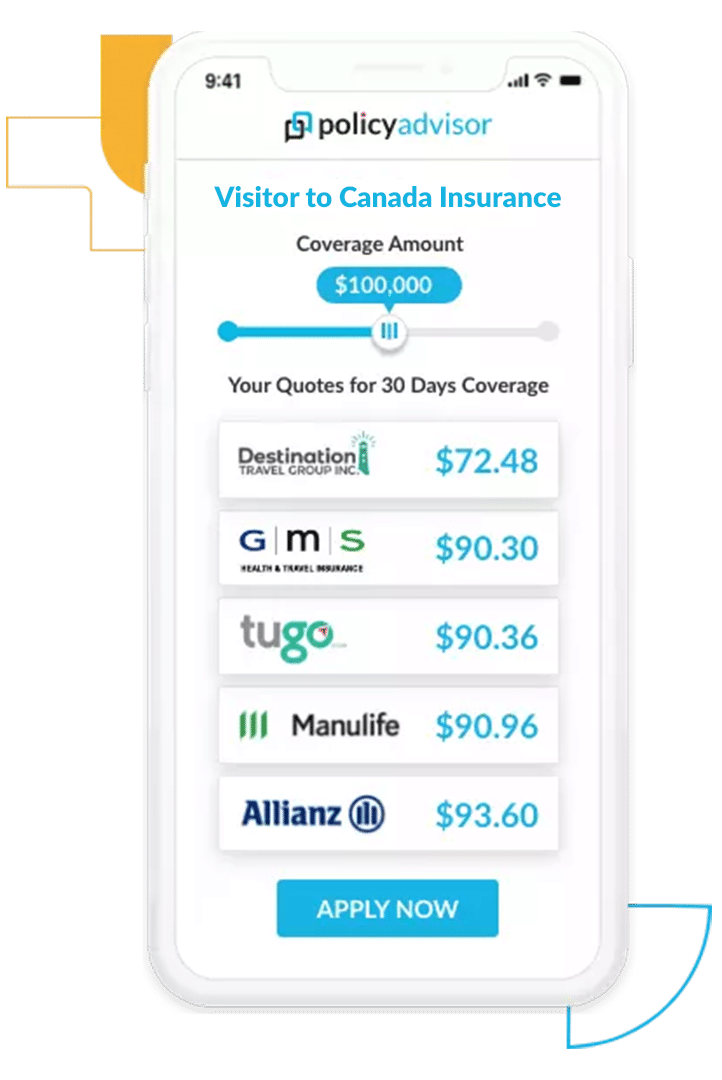

Get Affordable Visitor to Canada Insurance Quotes

Compare top visitor insurance plans for Canada and choose the coverage that fits you best.

Top Insurance Providers

We partner with Canada's leading insurance companies to bring you a wide range of affordable and reliable travel insurance plans. Our platform helps you quickly compare prices and features, ensuring you find the best coverage for your journey with complete peace of mind.

What is visitor to Canada insurance?

Visitor to Canada insurance is short-term health coverage for people not eligible for provincial plans. It is designed to cover emergencies and essential care during a temporary stay.

- Available to tourists, super visa applicants, international students, and workers

- Covers medical emergencies, hospitalization, and urgent care

- Can include dental emergencies and prescription drugs

- Offers optional coverage for stable pre existing conditions

In 2024, total health care spending in Canada was projected at nearly 374 billion dollars, showing how large and costly the system has become for both residents and visitors.

Why visitor insurance matters in Canada

Visitor insurance shields travelers from the high costs of medical treatment while in Canada. Without it, even basic hospital care can become unaffordable. In 2024, hospital spending in Canada reached over 100 billion dollars, making it the single largest component of national health expenditures.

Here’s why visitor to Canada insurance matters:

- Visitor insurance provides coverage for hospitalization and emergency care, which can be very expensive in Canada

- It protects you against the cost of ambulance services and diagnostic tests such as X-rays or lab work

- It helps meet visa requirements, including the mandatory coverage needed for the Super Visa program

- It gives peace of mind to visitors and their Canadian hosts by ensuring financial protection in case of medical emergencies

What does visitor insurance in Canada cover?

Visitor to Canada insurance is essential for protecting yourself against unforeseen medical expenses during your stay. It covers emergency medical care, tests, ambulance transportation, and more. With private health insurance spending reaching nearly $59 billion in 2024, it’s clear that visitors rely on this coverage to fill potential gaps in care. Here’s what a comprehensive visitor insurance plan typically includes:

- Doctor Consultations: Coverage for reasonable and customary fees charged by physicians, whether the care is provided in a hospital or outpatient setting

- Prescription Drug Benefits: Many plans include coverage for necessary prescription medications during your stay in Canada

- Diagnostic Tests and Procedures: Coverage may include lab work, X-rays, ultrasounds, CT scans, MRIs, and other diagnostic services

- Paramedical Practitioners: Access to services from licensed professionals such as physiotherapists, chiropractors, podiatrists, and registered massage therapists

- Pre-existing Condition Coverage: Some plans offer protection for declared pre-existing medical conditions, depending on eligibility and policy terms

- Emergency Medical Evacuation and Repatriation: Coverage for the high costs of emergency transport or returning the insured to their home country for treatment or in the event of death

- Accidental Death & Dismemberment (AD&D): A lump-sum benefit may be provided if the insured suffers a serious accident resulting in death or the loss of limbs

- Emergency Dental Services: Certain plans cover urgent dental treatment or surgery needed due to an accident or sudden injury

- Ambulance Transportation: Costs of ground or air ambulance services to transport the insured to the nearest medical facility in case of an emergency

- Accommodation and Meals: If treatment requires extending a stay in Canada, some plans reimburse expenses for hotels, meals, and local transportation (such as taxis)

- Childcare Support: If a dependent child is left without care because the insured is hospitalized, temporary childcare costs may be covered

- Trip Interruption or Side Trip Coverage: Some visitor medical insurance plans allow temporary travel to another country or a short return home without cancelling coverage

Cost of visitor insurance in Canada

The cost of visitor health insurance in Canada can range anywhere from $50 to $400 per month. Premiums vary based on age, trip length, medical history, and whether the traveler requires coverage for pre-existing conditions.

- Younger travelers (under 30 years) usually pay between $50 and $100 per month

- Seniors (70+ years) often pay between $200 and $400 per month, as premiums rise significantly with age

- Adding coverage for pre-existing medical conditions can further increase costs, particularly for older visitors

Other factors that influence premiums include the amount of coverage selected, deductibles, and whether you add benefits such as trip interruption or baggage loss.

Frequently asked questions