Critical illness insurance is a form of financial protection known as a living benefit. A critical illness policy pays out a lump sum payment of tax-free cash if you get diagnosed with a serious, life-threatening medical condition covered by the plan.

Like life insurance, critical illness insurance is also available in term or permanent options. Term critical illness insurance covers you for a fixed period or “term” and permanent critical illness insurance covers you until death (though you can pay the monthly premium for the policy upfront, typically over a duration of 10 or 20 years).

The benefit payment is called a living benefit because it does not depend on whether you have recovered or not. It is paid out while you are living, once it is established you have contracted a covered illness or gone through certain health incidents.

Depending on the condition and the insurance provider, you may have to survive for a certain amount of time (known as the survival or waiting period) before you are eligible for the payout.

Coverage can vary according to the severity of the condition you are diagnosed with. For example, some non-life-threatening cancers may not be covered, but more serious cancers might be.

It is important to read your policy carefully. Be sure to ask an advisor to provide you with a complete explanation of your coverage.

Cancer

50%

Nearly 50% of Canadians are likely to develop some form of cancer in their lifetime (statscan)

Critical Illness

80%

80% of working Canadians have either suffered from a critical illness themselves or known someone who has a critical illness (Great West Life)

Stroke

400,000+

400,000+ Canadians are still living with the after-effects of stroke (StrokeBestPractices.ca)

Critical illness insurance works by providing you with a financial cushion. In the unfortunate circumstance that you are diagnosed with one of the critical illnesses listed on the policy, you are given a lump sum cash payment.

You have the flexibility to use the cash any way you want to help you cope with the financial and emotional stress associated with a serious illness. In exchange, you pay a periodic sum of money to the insurance company, usually monthly, called a premium.

Critical illness insurance, sometimes called heart attack insurance, stroke insurance, or cancer insurance, can be purchased as a stand-alone policy, or as a rider on your existing life insurance policy.

Critical illness insurance can help with medical costs, which include:

Critical illness insurance can also help with non-medical expenses like:

Return of Premium (ROP) insurance riders grant a refund of the premiums you paid and have three distinct types:

Critical illness insurance provides a different type of financial security than other insurance plans like term life or whole life insurance.

If you worry about your quality of life after a health scare, how sickness could affect your family’s financial stability, or having to work through common illnesses (which could delay or hamper your recovery) then a critical illness plan is worth it.

Critical illness insurance policies cover a wide spectrum of circumstances. The coverage starts from as low as $10,000 and may go up to as high as $2.5 million.

In Canada, the average life expectancy is 83 years. Healthcare is free in Canada and is considered some of the best in the world. Despite this, one can not deny the financial toll that lengthy treatment takes.

Recovery from life-threatening diseases involves extended care – usually involving multiple hospital visits beyond the initial hospital stay. Critical illness insurance alleviates some of the financial burdens for recovery, so you can focus on getting healthy, not worrying about receding income or additional expenses.

Critical illness insurance protects against loss from serious illnesses

CANCER

1 in 2

Canadians will be diagnosed with Cancer in their lifetime.

HEART ATTACK

1 in 4

Canadians will contract some form of heart disease

STROKE

50,000

Canadians suffer a stroke every year

KIDNEY FAILURE

1 in 10

Canadians has kidney disease

MULTIPLE SCLEROSIS (MS)

HIGHEST

Canada has one of the highest rates of MS in the world

ALZHEIMER'S / DEMENTIA

1.1 MILLION

Canadians are directly or indirectly affected

Critical illness insurance can cover a long list of life-threatening diseases and medical conditions.

The number of conditions covered under the policy may start from one specific condition and go up to more than 25. Some policies allow a zero-day survival period, while most critical illness insurance policies require a 30 day survival period. Policies may cover a 10-year term or last for a lifetime.

The number of covered conditions varies from company to company. So if you’re looking to cover a specific illness, it’s worth exploring products from a variety of providers. Some of the most common covered conditions include brain tumours, blindness, cancer, coronary artery bypass surgery, deafness, dementia, heart attacks, kidney failure, loss of limbs, other organ failures, multiple sclerosis, and more.

Learn more about what critical illness insurance coversWhile health insurance and Canadian health care typically have some coverage for recovery from critical illnesses (hospital stays and employment insurance), the coverage is nowhere near as extensive as an individual critical illness policy. Furthermore, if your health insurance is provided through your workplace benefits, your coverage is contingent on your employment.

Even then, your extended healthcare coverage may only cover up to a certain percentage for medications and rehabilitation materials and adjustments you may need. For example, if you need to retrofit parts of your home to recover, critical illness insurance may help with this whereas regular health insurance coverage may only cover a certain percentage of these home modifications or it may not cover it at all.

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

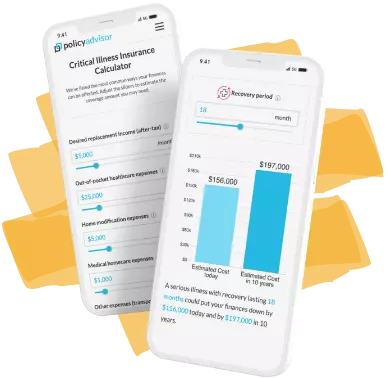

A serious illness with recovery lasting 6 months could impact your finances by $72,000 if it happened to you today and by $95,000 if it occurred in 10 years time (when you earn more, and may require more recovery resources).

Reasons you need critical illness insurance:

There are many personal variables that go into determining how much critical illness insurance you should buy, including how much of your income you may need to replace, healthcare and home modification expenses, plus anything else that comes up on your road to recovery.

To determine how much insurance you may need, take a look at your current expenses—your mortgage payments, car payments, potential out-of-pocket medical expenses, travel costs, etc. If you can afford to cover that in the short term, then critical illness insurance may not be worth it for you. However, most Canadians have not saved enough to cover these costs without steady employment—and most critical illnesses will force you to stop work.

Our critical illness calculator considers the different variables that go into determining critical illness coverage needs. Play around with the numbers and figure how much protection you need. But remember, you should only buy what you can afford. A lapsed policy due to insufficient funds protects no one!

If you don’t have it already, NOW is the best time to buy critical illness insurance.

Like other forms of insurance, critical illness insurance is less expensive when you are young and healthy.

Critical illness plans get more expensive as you grow older. You are at a higher risk of sudden illness such as heart attack, stroke, or cancer.

Critical illness insurance comes in terms, similar to term life insurance, and can cover you up to the age of 75. When you purchase a critical illness policy, you lock in your rate for the rest of that term.

Learn more about when to get critical illness insurancePolicyAdvisor helps Canadians find the best critical illness insurance policy for their needs. But let’s be frank. There is no best critical illness insurance provider. There is – however – the best provider for you.

The country’s top insurance companies offer unique policies to fit every Canadian’s individual critical illness coverage needs. What helps is having the choice and knowledge to pick the policy and provider that’s right for your situation.

That’s why PolicyAdvisor partners with 30+ of Canada’s top insurance companies – the most by any online broker. We make sure you have the greatest number of options when choosing an insurance company for protection from major illnesses.

We can help you obtain a critical illness insurance policy from Assumption Life, BMO Insurance, Canada Life, Desjardins, Empire Life, Equitable Life, Foresters, Humania, iA Group, ivari, Manulife, RBC Insurance, and SSQ.

Compare Life Insurance Quotes

30 Companies, 20,000 Options,

1 Way to Compare and Save

Different CI policies have different coverage criteria: basic coverage policies can cover up to 4 critical illnesses; enhanced policies can cover over 25 or more illnesses. Just some of these include benign brain tumour, bacterial meningitis, muscular dystrophy, some forms of prostate cancer, and many more amongst a range of illnesses.

Check out our online quote comparison tool that helps you compare critical illness insurance quotes and find the differences between illnesses covered under various policies.

Learn more about what critical illness insurance coversWe built an online critical illness insurance comparison tool that lets you compare critical illness quotes across companies and products. It also lets you compare financial indicators and the financial strength of an insurance company, and the product features that are best suited for you.

Several factors determine how much a critical illness insurance policy costs. Some relate to the individual seeking coverage, such as their age, smoking status, gender, health, lifestyle and more.

Other factors are policy-dependent, such as the amount of coverage one seeks, the term length, and the number of illnesses covered.

For example, a 30-year-old individual who is a non-smoker and in good health, the cost of $100,000 of critical illness cover for a period of 20 years will be in the region of $25 per month. At age 40, this will probably increase to $47 per month and will be over $105 per month at age 50.

Our simple online critical illness quote comparison tool can help you compare the lowest quotes in minutes.