- Group disability insurance generally replaces about 60 to 70 percent of your base salary before tax, but when considering taxes and excluded income components like bonuses or commissions, it may effectively replace only 35 to 50 percent of your actual take-home pay

- Employer plans usually cover base salary only and exclude bonuses or commissions

- Benefits are typically taxable when the employer pays the premium

- Coverage ends when employment ends and cannot always be converted

- Individual disability insurance strengthens income protection with better definitions, guarantees, and tax-free benefits

Many Canadians assume employer disability insurance will replace their income if they are unable to work for several months or years. In reality, group disability insurance often covers only part of your base salary, excludes bonuses and commissions, and is frequently taxable. Most workers do not realize their real replacement income could drop to 35 to 50 percent of their usual earnings.

Surveys show that more than half of working Canadians rely solely on group benefits provided through their employer. Most do not know what their plan actually covers. Group disability plans are helpful, but they are not designed to be comprehensive protection for higher-income earners, commissioned sales professionals, or anyone whose compensation extends beyond a basic salary. If your employer offers disability insurance, the next question is whether it is enough to protect your lifestyle if you are off work for a year or longer.

In this article, we’ll explain how employer disability insurance works in Canada, how individual coverage compares, and how to evaluate your true income gap.

What is the difference between individual and group disability insurance

Individual disability insurance is a policy you buy and own yourself. It is underwritten based on your health, income, and occupation, and it lets you customize how much income you want to protect, how long the benefit lasts, and how quickly payments start. Since you pay the premiums personally, benefits are usually tax-free. The coverage follows you throughout your career, even if you change employers or become self-employed.

Group disability insurance is provided through your employer or association. Enrollment is usually automatic and requires little to no medical underwriting, which makes it easier to qualify. However, the plan design is fixed: benefit amounts, maximums, waiting periods, and definitions are predetermined. Benefits are typically taxable when the employer pays the premiums, and coverage ends when your employment ends unless the plan offers a rare conversion option.

| Feature | Individual disability | Group disability |

| How it’s obtained | Purchased personally through an advisor or insurer | Employer or association provides an off-the-shelf benefit; sometimes mandatory |

| Ownership and portability | You own the contract and it usually stays with you if you change jobs or become unemployed | Employer or association owns the master policy; coverage typically ends when you leave the group |

| Underwriting | Full medical and financial underwriting; can be declined or rated, but guaranteed once issued | Minimal or no medical evidence up to a non-evidence limit; medical evidence only for higher amounts |

| Premium cost | Higher per dollar of benefit because it is tailored and individually underwritten | Lower cost per dollar because risk is pooled and design is standardized |

| Who pays premiums | You personally; benefits are generally tax-free if premiums are paid with after-tax dollars | Employer, employee, or both; if employer pays, benefits are usually taxable |

| Benefit level | Customizable amount and period, with higher maximums (for example, up to $10,000 per month) | A fixed percentage of salary (for example, 60 to 70 percent) up to a plan maximum |

| Definition of disability | Stronger “regular occupation” definitions and better partial or residual disability features | Often shifts to “any occupation” after a set period (for example, 2 years) and may pay only total disability |

| Tax treatment of benefits | Usually non-taxable when you pay with after-tax dollars | Taxable if employer pays; can be non-taxable if employee pays with after-tax dollars |

| Contract guarantees | Terms and premiums can be guaranteed (for example, non-cancellable or guaranteed renewable) | Employer or insurer can change or cancel plan; terms are not individually guaranteed |

| Riders and customization | Many optional riders (COLA, own-occupation extensions, partial disability, future insurability, etc.) | Limited or no individual riders; features are built into the group plan |

| Coordination with other income | Designed to stack up to a maximum income-replacement limit; less offsetting | Often offsets CPP-D, WSIB, EI, and individual DI so the benefit may be reduced |

| Stability if employer changes | Unaffected by job changes, layoffs, or plan redesigns | Coverage can change if employer switches carriers, reduces benefits, or if employment ends |

| Ideal for | High-income earners, self-employed individuals, business owners, professionals seeking strong guarantees | Employees wanting basic, lower-cost income protection included within a benefits package |

How employer disability insurance works in Canada

Group disability insurance is an employer-sponsored benefit that provides income replacement if you become unable to work because of illness or injury. Coverage is tied to your employment. When you leave the company, your protection usually ends.

Before reviewing your plan, it is important to understand what employer disability insurance typically includes and what it does not.

What group disability insurance usually covers:

- Short-term disability (STD) that replaces income for the first weeks or months of disability

- Long-term disability (LTD) that begins after a waiting period and can last for years

Types of disability coverage in Canada

There are two types of disability coverage Canadians rely on: employer-provided benefits and government programs. Understanding how both work helps you see whether your group plan is enough or if you may need additional, individual protection.

Short-term disability (STD)

- Short-term disability provides income when a new illness or injury prevents you from working

- It typically pays benefits for 15 to 26 weeks, depending on the employer’s plan design

- It may be funded directly by the employer or administered through an insurance provider

Long-term disability (LTD)

- Long-term disability begins once STD or EI benefits end and the waiting period is satisfied

- It can continue paying income replacement until age 65 if the disability persists

- It serves as the main source of protection against long-term or permanent health-related work loss

Individual disability insurance

- Individual disability insurance offers personally owned coverage that strengthens or replaces employer-provided benefits

- It uses stronger definitions of disability, which can make qualifying for benefits easier than under group plans

- It remains fully portable, ensuring that your coverage stays in place even when you change employers

Government programs

- EI sickness provides short-term income support for up to 26 weeks for qualifying medical conditions

- CPP/QPP disability offers benefits only for disabilities that are both severe and prolonged

- Workers’ Compensation (WSIB) provides support exclusively for injuries or illnesses that occur at work

- Provincial disability programs offer basic income assistance for individuals with long-term severe disabilities

- These programs provide helpful support, but they do not replace full earnings for most Canadians

Is employer disability insurance enough coverage?

Group LTD provides a useful foundation, but it has structural gaps that often result in a lower net income replacement than employees expect. Understanding these limitations helps you see where additional individual protection may be necessary.

Income-based gaps

- Group LTD calculates coverage on base salary only, which means variable compensation is excluded

- Bonuses, commissions, and incentive pay are not protected under most plans

- Monthly maximums can significantly reduce benefits for higher-income earners

Tax-related gaps

- If your employer pays the LTD premium, any benefits you receive will be taxable

- After tax, your actual replacement income often drops to only 35 to 50 percent of your usual take-home pay

Contract and definition gaps

- Most group LTD plans provide own-occupation protection for only the first two years of a claim

- Some plans place duration limits on mental health–related disabilities

- Pre-existing condition clauses may restrict coverage for new employees during the initial period

- Benefits are reduced if you qualify for CPP-D, WSIB, or other government programs

Employment-related gaps

- Group LTD coverage ends immediately when you leave your job

- Many employer plans cannot be converted into individual coverage when employment ends

- If your health declines later in life, you may no longer qualify for private disability insurance at standard rates

How individual disability insurance helps Canadians

Individual disability insurance offers stronger, more reliable protection because it is tailored to your income, occupation, and long-term financial requirements. With individual disability insurance, you can:

- Choose the benefit amount or income percentage that reflects your real earnings

- Select a waiting period such as 30, 60, 90, or 120 days based on your savings and risk tolerance

- Choose a benefit period of 2 years, 5 years, or to age 65 for long-term protection

- True own-occupation coverage is available as a rider on some individual DI policies, but not all policies include it by default

- Add partial or residual disability benefits to protect against reduced income

- Include future insurability options to increase coverage as your income grows

- Add a cost of living adjustment (COLA) to keep benefits aligned with inflation

- Access specialized riders designed for professionals and business owners.

Additionally, when you pay the premiums personally, disability benefits are generally tax-free, which provides a higher true income replacement even at the same coverage percentage.

Can I supplement a group disability plan with individual disability insurance?

Yes, you can supplement a group disability plan with individual disability insurance. First, we recommend starting by reviewing the details of your existing group disability plan, including benefit amounts, waiting periods, and how long payments last. Once you know the baseline, compare the cost and value of adding an individual disability policy,especially if your group coverage requires employee-paid premiums.

Group plans can appear cost-efficient, but their limitations often become clear only when you look closely at benefit caps, restrictive definitions of disability, or shorter coverage durations. In some cases, pairing group and individual policies can end up costing more than replacing the group plan entirely with a fully tailored individual policy.

An individual policy offers the advantage of stronger contractual guarantees, broader definitions, and coverage designed around your income and occupation. For professionals with higher or variable earnings, individual disability insurance can provide more reliable protection and long-term stability.

How to check your group disability coverage at work?

Most employees assume their workplace disability plan will replace a large share of their income during a serious health event. In reality, group plans vary widely, and the actual benefit you would receive can be far lower than expected once caps, exclusions, and taxes are applied. A careful review of your plan details is the only way to understand your true level of protection and decide whether you need additional individual coverage.

Here are a few things you can check to assess the strength of your current plan:

- Confirm whether your workplace plan includes short-term disability, long-term disability, or both

- Check the percentage of income the plan replaces and determine whether bonuses, commissions, or variable pay are excluded

- Review the monthly maximum benefit to see whether it limits your eligible coverage, especially if you have higher earnings

- Examine the definition of disability and identify when it transitions from own occupation to any occupation

- Verify whether LTD benefits would be taxable based on how premiums are paid

- Look at the waiting period and the length of the benefit period to understand how long support would continue

- Review the offsets that apply if you receive EI sickness, CPP-D, WSIB, or similar government benefits

- Check for mental health limitations, duration caps, or pre-existing condition restrictions that could affect eligibility

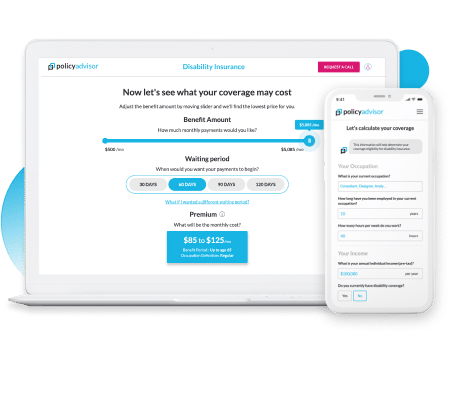

How PolicyAdvisor helps you understand your real disability coverage

Most Canadians do not know how much income they would receive if they were unable to work for a year or longer. At PolicyAdvisor, we can analyze your workplace plan, calculate your true after-tax replacement income, and identify any gaps that could affect your financial security. Our advisors compare individual disability policies across major Canadian insurers and help you build a coordinated strategy that protects your long-term earning potential.

Schedule a call today, and get quotes from the best disability insurance providers in Canada!

Frequently asked questions

How much disability insurance do I need if I am covered through work in Canada?

Most Canadians need 60 to 70 percent of their total income to maintain their lifestyle during a disability. Employer plans usually insure only base salary and the benefits are taxable, which reduces the real replacement amount. Adding an individual policy can help you reach the level of protection you actually need.

What is the difference between short-term and long-term disability through work?

Short-term disability replaces income during the first weeks of an illness or injury. Long-term disability begins after the waiting period and can continue paying benefits for several years or until age 65, depending on the plan.

Does CPP disability mean I do not need private disability insurance?

No, CPP-D has very strict medical and contribution requirements, and the monthly benefit is modest. It is not designed to replace employment income and is often deducted from group LTD payments.

Is disability insurance taxable in Canada?

Disability benefits are taxable when the employer pays the premiums for the plan. When you personally pay the premiums for an individual disability policy, the benefits are generally tax-free.

Can my employer change or cancel my disability coverage?

Yes. Employers can change insurance carriers, reduce the scope of benefits, or cancel coverage entirely. Individual disability insurance remains stable because the contract is owned by you, not your employer.

Workplace disability insurance provides basic income protection but usually covers only base salary, applies taxable benefits, and has strict contractual limitations. These factors create a lower net replacement income than most employees expect. Individual disability insurance offers customizable, tax-free benefits and stronger definitions of disability, making it a valuable supplement to employer coverage. The key differences between group and individual plans help identify where income gaps are likely to occur.