- Group insurance conversion in Canada enables individuals to switch from group to individual health and dental, life, critical illness, and disability insurance policies post-employment

- Medical exams are not mandatory for conversion, but age may influence premium adjustments

- Converted plans typically offer coverage for pre-existing conditions and waive waiting periods for dental and vision care benefits

- Employees transitioning to retirement, part-time status, self-employment, or experiencing layoffs can benefit from group conversion

- The process entails eligibility verification, coverage selection, premium calculation, and application submission

- Converted individual policies extend essential benefits like vision care, medical services, accidental dental, and survivor benefits

- What is group insurance conversion?

- What does converting a group plan mean?

- Who does a group plan conversion benefit?

- What is the process of converting a group plan?

- What benefits will you get after converting to an individual policy?

- Factors to consider when converting to an individual plan

- How are premiums calculated?

- What is the difference between porting and converting group benefits?

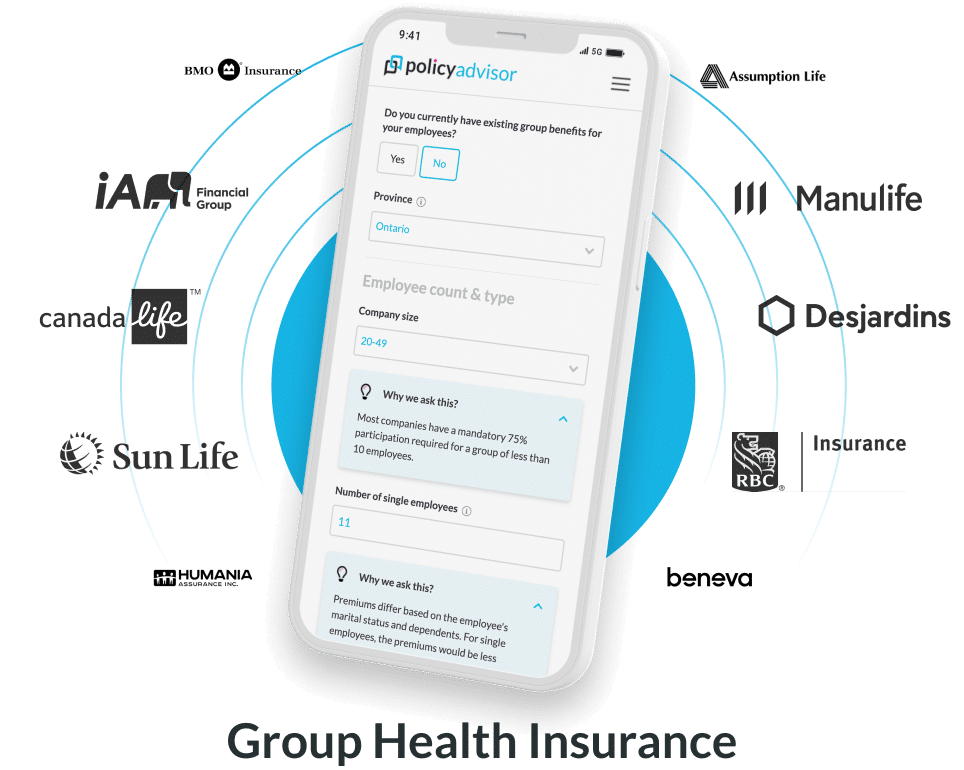

A job instantly becomes attractive when your new or existing employer offers you a group health insurance plan. However, it’s natural to worry about letting go of your coverage if you decide to switch jobs.

The silver lining here is that it is possible to convert group insurance into individual insurance, meaning you stay secure even when you choose to leave your job. Wondering what this means? This article takes you through all you need to know about converting your group plan.

What is group insurance conversion?

Group insurance conversion in Canada is the process of converting a group policy into an individual insurance policy when you leave a job, retire, or are terminated. So, as an employee, you can maintain insurance coverage outside of your employment, and get continued financial protection for yourself and your dependents.

Converting group medical insurance to individual coverage typically does not make it compulsory for you to undergo medical examinations. However, the regulatory body does assess your age as a factor in calculating your new premium post-conversion, which may either increase or decrease the annual cost of individual coverage after the conversion. Conversion applies to health, dental, life, and disability insurance, providing you with continued coverage outside of the group setting.

What does converting a group plan mean?

Group conversion lets you convert a group plan into an individual policy. Although the coverage may differ slightly from your previous group plan, it assures you similar care at a reasonable cost.

Unlike alternative individual plans, group conversion covers pre-existing conditions and does not need a medical questionnaire. Additionally, waiting periods for dental and vision care benefits are waived. Here, 80% of eligible expenses are covered, up to a lifetime maximum of $250,000 per covered individual.

Who does a group conversion plan benefit?

A group insurance plan is ideal for those who are:

What is the process of converting a group plan?

You can convert your group coverage into an individual insurance policy by following the process below:

An employee must be eligible for conversion as per the group policy terms. Usually, there is a limited window of time ranging between 31 to 60 days after leaving the group to exercise the conversion option. The conversion window can vary based on the policy terms.

You can convert a portion or all of your group insurance coverage into an individual policy. However, there may be limitations on the maximum amount that can be converted based on a percentage of the original coverage amount.

The premium for the individual policy is calculated based on your age at the time of conversion and the coverage amount that you opt for. Individual policies are typically priced based on risk factors like age, health, and lifestyle.

A major advantage of conversion is that you don’t need to undergo medical underwriting, meaning your health status at the time of conversion does not impact your eligibility or premium rate for the individual policy.

You must notify the insurance carrier of your intention to convert your coverage within the specified timeframe and submit a conversion application along with any required documentation and premium payments.

Once the conversion application is processed and approved by the insurance carrier, you will be issued an individual life insurance policy, giving you continued coverage regardless of your employment status.

What benefits will you get after converting to an individual policy?

If you opt for a basic health plan after converting to an individual policy, insurance providers calculate premiums based on factors like age, and lifestyle, and offer the following benefits:

- Vision care

- Registered therapists and health practitioners

- Hospital accommodation

- Hospital daily cash benefit

- Local ambulance

- Private duty care nursing

- Out-of-province, in-Canada travel

- Medical services and supplies

- Accidental dental

- Accidental death and dismemberment

- Final expense benefit

- Survivor benefit

If you opt for additional dental coverage, you may get the following benefits:

- Diagnostic expenses (oral examinations, x-rays)

- Preventive treatments (polishing, fluoride treatments)

- Restorative treatments (fillings)

- Periodontal cleaning (scaling and root planing)

- Prosthodontic services (repairs & minor services only)

- Oral surgery (routine extractions)

Depending on your policy terms, 50-80% of your expenses would be covered under your conversion plan.

What are the advantages of converting to an individual plan?

- Portability: Individual insurance plans offer you the advantage of portability to maintain coverage even if you switch jobs or experience changes in employment status

- Customization options: Individual insurance plans give you greater flexibility and customization options compared to group plans. You can tailor your coverage to suit specific needs and preferences by selecting from a range of coverage levels, optional benefits, and deductible options

What factors should I consider when converting a group plan to an individual plan?

Whether or not you should convert to individual insurance depends on your specific needs and circumstances. Here are some factors you should consider:

- Health needs: Assess your current and anticipated health needs and see if an individual insurance plan can meet those requirements. You should also consider existing medical conditions, potential future healthcare needs, and the level of coverage you need.

- Finances: Calculate the cost implications of converting to an individual insurance plan compared to maintaining coverage under a group plan. Take into account premiums, deductibles, co-payments, and out-of-pocket expenses and see if the individual plan is more affordable.

- Policy options: Compare different policy options available in the individual insurance market to find a plan that aligns with your healthcare needs. You can choose from different options like whole life or term life insurance, mortgage insurance, non-convertible to term life, and convertible to term life, etc.

- Long-term planning: Consider your long-term healthcare needs and financial goals when deciding whether to convert to an individual insurance plan.

- Consultation: Seek advice from our licensed insurance professionals to know more about converting to an individual insurance plan.

What information do I need to provide to convert my group plan into an individual plan?

To convert your group plan into an individual plan in Canada, you’ll need to provide specific information to your insurance provider. Here’s what you’ll typically need:

- Personal details: Name, address, date of birth, contact information

- Group plan information: Policy number, coverage dates, benefits to convert

- Health history: Details on pre-existing conditions, and recent medical treatments

- Underwriting: Assessment of risk profile for determining premiums

What is the difference between porting and converting group benefits?

When it comes to changing group benefits in Canada, it’s helpful to know the difference between porting and converting. Porting means moving benefits to a new plan, usually linked to life events. Converting means switching group benefits to an individual plan, often when leaving a group setting.

Here’s a comparison table that’ll help you understand the differences between porting and converting group insurance better.

| Aspect | Porting Group Benefits | Converting Group Benefits |

| Coverage continuity | Maintains continuous coverage | Maintains continuous coverage |

| Eligibility | Typically available for specific life events | Generally available upon leaving the group (e.g., job loss, retirement) |

| Employer role | Involves coordination with employer | Can be initiated independently of the employer |

| Flexibility | Options may vary based on insurer and plan | Options may vary based on insurer and plan |

| Customization | Limited customization potential | Potential for more customization to individual needs |

| Underwriting | May involve underwriting for a new plan | May involve underwriting for an individual plan |

| Premiums | Premiums may change based on the new plan | Premiums may change based on the individual risk profile |

| Coverage scope | May offer similar or different benefits | May offer similar or different benefits |

What are the benefits of converting a group policy to an individual policy?

Converting a group policy to an individual policy offers several benefits:

- Continued coverage: Ensures uninterrupted coverage after leaving a group, such as due to job loss or retirement

- Customization: Provides the opportunity to tailor the policy to individual needs, potentially offering more suitable coverage options

- Independence: Removes dependence on employer-sponsored coverage, giving individuals more control over their insurance

- Portability: Allows individuals to maintain coverage regardless of changes in employment or group affiliations

- Long-term stability: Provides the potential for stable coverage over the long term, even if switching jobs frequently or during career transitions

- Underwriting flexibility: Depending on the insurer, underwriting for individual policies may consider individual health factors, potentially resulting in more favourable terms

- Additional benefits: Some individual policies may offer additional benefits or riders not available through group coverage, such as enhanced coverage for specific medical conditions or higher benefit amounts

Frequently Asked Questions

Should I convert group life insurance to an individual plan?

Converting group life insurance to an individual policy is a personal decision that depends on your needs and circumstances. Individual policies offer flexibility and portability, ensuring coverage continuity beyond employment changes.

How long do I have to convert a group policy to an individual policy?

Typically, conversion options are available within a specified window after leaving the group, ranging from 31 days to 60 days. It’s crucial to act promptly within this timeframe to avoid losing coverage options.

Do I need to restart my coverage plan after changing the group policy?

Converting from a group policy to an individual policy does not require restarting coverage. Instead, it ensures seamless transition and continued coverage outside of employment.

Should I convert group life insurance to an individual policy?

Yes, group life insurance can be converted to an individual policy in Canada. This conversion option allows you to maintain coverage beyond your employment tenure, ensuring ongoing financial protection for yourself and your dependents.

What is the Autorité des marchés financiers?

The Autorité des marchés financiers is the organization that oversees financial regulation in Quebec, Canada. It governs the province’s financial markets and offers support to consumers of financial services and products.

Converting group life insurance to an individual plan allows employees to maintain insurance coverage outside of employment, ensuring continued financial protection for themselves and their dependents. In this article, you will learn how to convert group insurance to individual coverage in Canada.

1-888-601-9980

1-888-601-9980