- Students are usually covered under their parent’s extended health plan until they are 25, or they are covered through their school’s group benefits plan

- Students can opt out of their school’s group plan if they have coverage elsewhere

- Health insurance is cheaper when you’re a student because you’re generally young and healthy and starts at just $61 per month!

- You can get health insurance as a student with pre-existing conditions starting at $99 per month

Have you ever reviewed the breakdown of your student fees? Among the long list of expenses like tuition, books, gym memberships, and student building improvement fees, you’ll likely find a charge for your student health insurance plan.

While the premium for these group plans is usually affordable compared to other costs, every expense adds up. Naturally, many students wonder: Should I opt out of my student health insurance plan?

The answer depends on your circumstances. You might think being young and healthy means you don’t need health insurance. But that’s not entirely true!

Health insurance for international students is essential for more than just managing unexpected illnesses or injuries—it also helps you access preventive care and other critical health services.

Whether you’re covered by your parents’ plan, enrolled in your school’s plan, or exploring options to buy health insurance for international students, this article will help you make the most of your coverage.

How does student health insurance work?

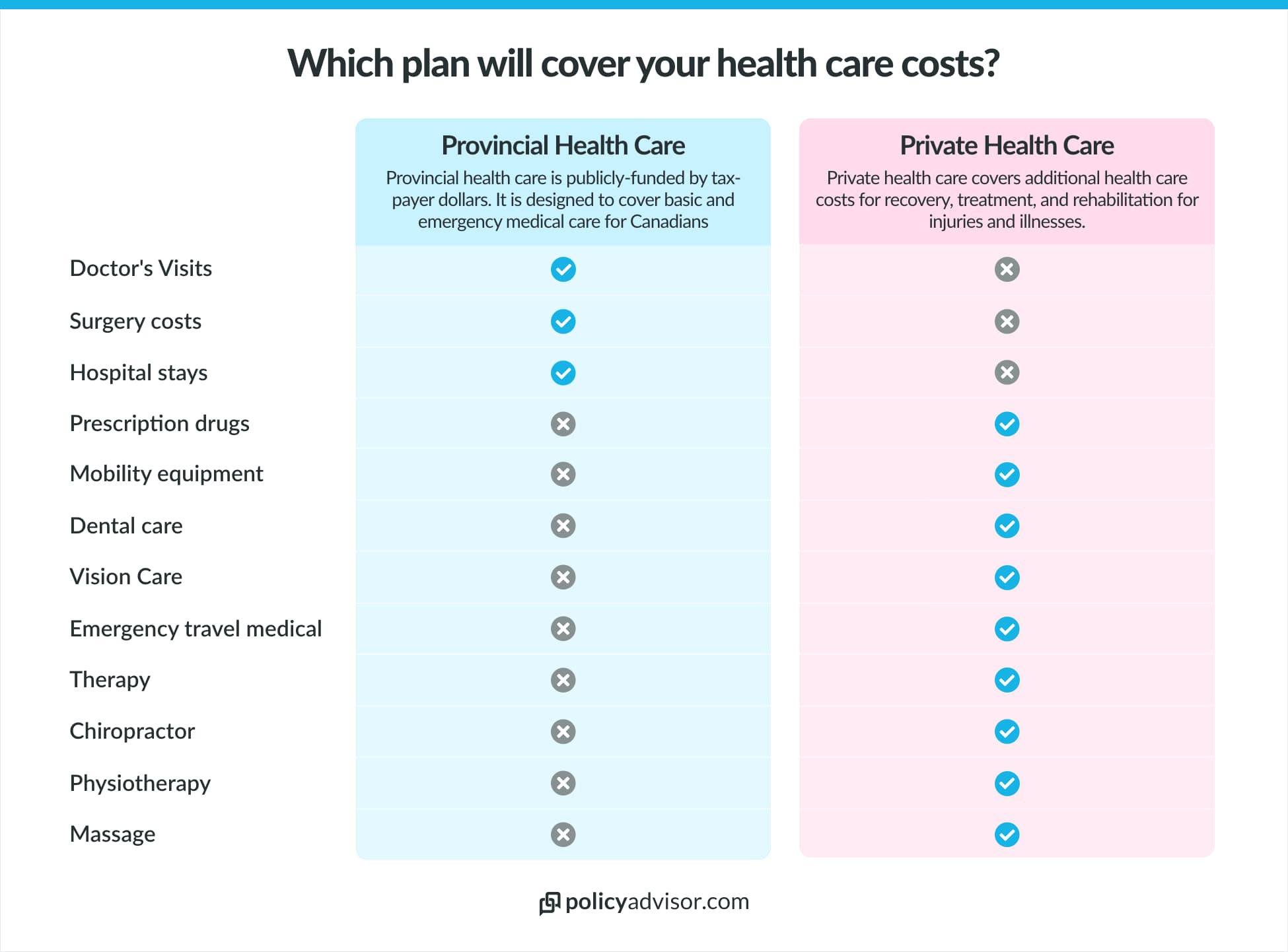

Student health insurance typically combines provincial health care (for Canadians) with private health insurance to provide comprehensive coverage for medical needs. Here’s how it works:

Provincial health care

- Provincial plans are funded by tax dollars and provide “free” basic healthcare services

- Coverage includes essential medical care such as hospital stays, surgeries, and doctor visits

Private health insurance

- Private insurance supplements provincial plans by covering additional medical services like prescription medications, dental care, and vision care

- These plans require payment of a monthly or yearly premium, with coverage varying based on the insurer, policy details, and personal health history

What does health insurance cover?

Private health insurance typically covers medical expenses not included in public or provincial health care plans. Common areas of coverage include:

- Prescription medications – Costs for prescribed drugs not covered by provincial health plans

- Dental care – Services like cleanings, fillings, and orthodontics

- Vision care – Eye exams, prescription glasses, or contact lenses

- Paramedical services – Coverage for physiotherapy, chiropractic care, massage therapy, and mental health counselling

- Medical equipment – Expenses for crutches, wheelchairs, or hearing aids

- Emergency medical coverage – Costs for medical treatment during travel or outside your home province or country

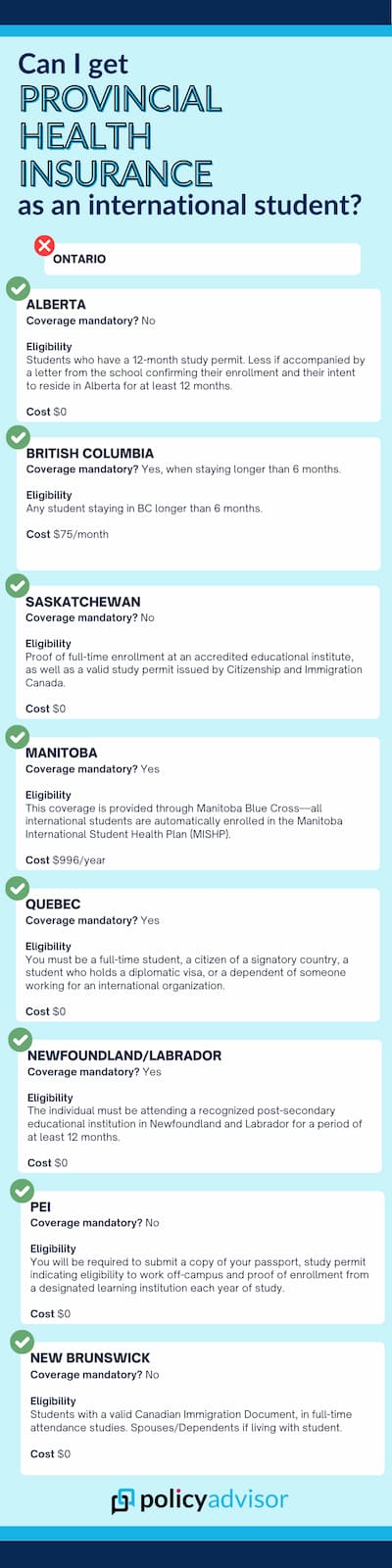

How can I get healthcare as an international student in Canada?

You can access private health insurance benefits through various sources, such as your parents’ work or group plan, their individually purchased extended health plan, your student union’s group health plan, or a private plan you’ve purchased yourself.

These student health insurance plans typically cover medical expenses like dental and vision care, mental health support, paramedical services, etc. that are not included in provincial insurance, providing additional protection up to specific coverage limits.

What to do if I’m not covered by my province’s health insurance plan?

If you are not eligible for healthcare under this plan, you need to look into private health insurance options to cover your healthcare needs. Your university may offer a student group health insurance plan and you should look into purchasing an emergency travel medical plan if you haven’t done so already.

Student group health care plan

Your university or college would typically have a contract with a health insurance provider for group health insurance. The cost of participating in this program will be outlined in your student fees. If you are an international student, this program may be mandatory.

Emergency travel medical plan

Your student health plan may cover you during the semester, but it may have coverage restrictions if you travel outside of the province where your school is located or it may only cover you while classes are in session.

To make sure you’re fully protected as an international student, you should purchase emergency travel medical insurance for students. This insurance will pay for emergency medical care as well as prescriptions while you are away from your home country.

Do students get free healthcare in Canada?

In Canada, healthcare access for students varies depending on the province and the student’s residency status. Canadian citizens and permanent residents who are students generally receive provincial health coverage at no extra cost.

However, international students often do not automatically qualify for free healthcare. Some provinces, like British Columbia and Saskatchewan, allow international students to enroll in their public healthcare plans, but they may still need to pay monthly premiums or enroll in private insurance for additional coverage.

Other provinces, like Ontario, typically require international students to purchase private health insurance or enroll in a health plan provided through their school.

Can international students get a health card in Canada?

Does student health insurance cover mental health?

Yes, most student health insurance plans in Canada cover mental health services, though the extent of coverage varies by plan. Many include access to counseling, therapy, and mental health support programs either on-campus or through partnered providers.

Coverage limits may apply, so students might need to pay a portion out-of-pocket or seek additional private insurance if they need extended care. Provincial health plans in some regions also cover basic mental health services for eligible students.

What can I do if I’m 25 and no longer covered under my parents?

Some health insurance plans allow you to stay on your parent’s plan even as an adult. Typically, you can remain covered until age 18 or 21, or up to age 25 if you’re a full-time student. However, eligibility may end if you get married. Once you’re no longer eligible for your parent’s coverage, you’ll need to set up your own health insurance.

For those with complex health needs, getting personal health insurance offers added protection. Fortunately, premiums for the student age group are generally affordable since young adults typically have fewer health expenses compared to older individuals.

Should I opt out of my student health plan?

Opting out of your student health plan depends on your existing coverage and health needs. If you’re already covered under a comprehensive private plan, such as your parents’ work or group insurance, you might consider opting out to save on fees. However, student health plans are often cost-effective and offer coverage for services like dental, vision, and paramedical care, which may not be included in other plans.

Before opting out, compare the benefits of your existing coverage with the student plan. If the student plan provides additional or complementary coverage, it might be worth keeping. Always evaluate your specific health needs and financial situation before making a decision.

You might opt out of your student health plan if:

- You are fully covered under your parent’s plan

- You are fully covered under a spouse’s plan

- You are fully covered under your own private health insurance plan

Keep in mind that some student group plans may have specified enrollment dates, usually in the fall or spring. In the case that you’re relying on your parent’s coverage and you turn 25 halfway through the school year, you might be without coverage until the following enrollment period.

When should I not opt out of your student health plan?

Am I covered if I go to school out of province?

If you are a Canadian and go to school outside of your home province, your provincial coverage will extend for the usual emergency services. However, you may have to pay upfront and submit the receipt later on to get your money back.

Additionally, each province has a standard of what they will reimburse for each emergency service. For example, one province may have a $75 fee for ambulatory services, whereas another charges $300.

If you have extended medical insurance, each company has different rules about out-of-province services. Your health insurance provider may decide:

- You are NOT covered for any out-of-province medical procedures, services, or treatment. For example, your dental insurance wouldn’t be covered.

- You are covered for but only up to the limit dictated in your home province. For example, BC has a standard dental cleaning price, whereas Alberta dentist’s prices vary. If you are from BC and get your teeth cleaned in Alberta, your dental coverage limit will be the limit set for BC, meaning you could have to pay for the difference.

It’s always best to check your extended health insurance policy documents to see exactly what it covers and where. If you are not sure how to access that information, reach out to your broker or one of our agents.

What happens if I don’t have health insurance as a student?

If you don’t have health insurance as a student in Canada, you may face high out-of-pocket costs for medical care, as basic services like doctor visits, hospital stays, and emergency care can be expensive without coverage.

Some provinces offer limited public health coverage for international students, but if you’re ineligible, private health insurance is essential. Additionally, many schools offer affordable student health plans that provide coverage for essential services, which can be especially helpful during unexpected medical needs.

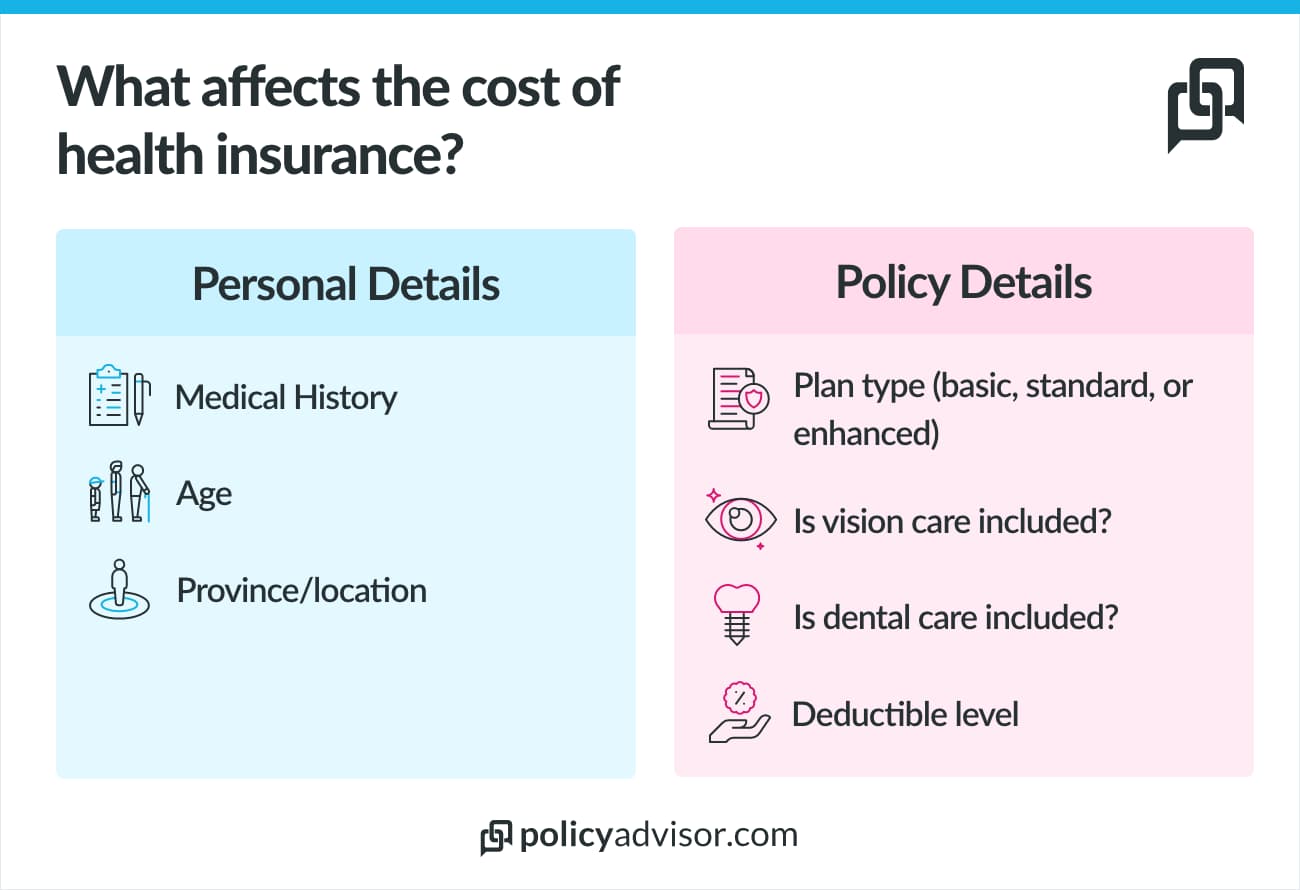

How much does health insurance cost per month in Canada?

The cost of health insurance for students starts at $61 per month if you’re a healthy individual with no pre-existing conditions. However, if you’re unfortunately suffering from or diagnosed with an illness, you’d still be eligible for health insurance at slightly higher premiums.

For a student with pre-existing conditions, the cost of private health insurance starts at $99 and can extend to $300 per month or more depending on your specific plan details and coverage.

How can I get private health insurance quotes for students in Canada?

To get private health insurance quotes for students in Canada, we recommend speaking with our experienced advisors to compare quotes from across 30+ top insurance providers.

With PolicyAdvisor, you also get free instant quotes, the lowest rates across the market, and lifetime after-sales support. Schedule a free consultation with one of our licensed advisors today!

Frequently asked questions

Am I covered if I go to school out of province?

Your province may cover some out-of-province doctor visits and emergency medical care, but they do not usually cover things like ambulance services.

You may have to front some of the cost and you may be reimbursed by your provincial health care plan at a later date. Your private, extended, or group plan may not cover you outside of your home province.

Am I covered if I go to school outside of Canada?

If you are travelling outside of the country, your provincial or private health insurance will not cover your medical expenses. You must purchase travel medical insurance. This might be included in extended health insurance automatically, but not always. If it does not come included in your existing health insurance policy, we can help you shop for the best emergency travel medical insurance on the market!

How do I file a health insurance claim?

Some health insurance plans pay the service provider (doctor, pharmacist, physiotherapist, etc.) directly, while others pay you back later. Imagine you need medicine from the pharmacy. If your insurance covers it directly, the pharmacy sends the bill to them. You pay only a part of the cost.

But if they don’t cover it directly, you pay the full price and then send the receipt to your insurance company. They give you some money back for the medicine. If you have to file a claim, contact your insurance company’s claims submission page.

Can I get health insurance with pre-existing conditions?

Yes, you can get health insurance with pre-existing conditions, but coverage may vary. Some plans cover pre-existing conditions immediately, while others impose waiting periods or exclude them entirely.

As a student, you may be covered under your parents’ extended health plan, the group benefits offered by your school’s student union/organization, or both. However, if you don’t have any of this coverage if you choose to opt out of your student plan, or if you would like to add more coverage, private health insurance options are available to you. Because students are generally young and healthy, the premiums are lower than they would be later in life.