- Health insurance claims can be processed in two ways: direct billing, where the healthcare provider submits the claim on your behalf, or reimbursement, where you pay upfront and file a claim for repayment

- To ensure a smooth claims process, always have the necessary documents ready, including your policy number, itemized receipts, and proof of payment

- Most insurers require claims to be submitted within 9 to 15 months from the date of service, so it’s important to check your policy’s deadline

- Submitting claims online is usually faster than mailing paper claims, and setting up direct deposit can speed up reimbursement

A health insurance claim is your formal request to an insurance provider for coverage or reimbursement of medical expenses. Whether it’s a routine check-up or an emergency procedure, knowing how to file a claim lets you access your policy’s benefits anytime you require it.

However, the process can be confusing, especially during stressful times. In this article, we’ll simplify the steps so you can file your health insurance claim confidently.

What does a health insurance plan cover?

Your health insurance plan should typically cover doctor visits and specialist consultations, prescription medications, diagnostic tests and lab work, hospital stays, surgeries, and paramedical services like physiotherapy, and chiropractic care.

How are health insurance claims processed?

Health insurance claims are processed in two ways: direct billing or reimbursement.

- Direct billing: Your healthcare provider submits the claim directly to your insurer. You only pay the remaining balance, if applicable. To use this option, provide your policy number, member ID (for group plans), and the policyholder’s name

- Reimbursement: You pay for medical services upfront and then submit a claim to get reimbursed. This method requires you to keep all receipts and medical documentation

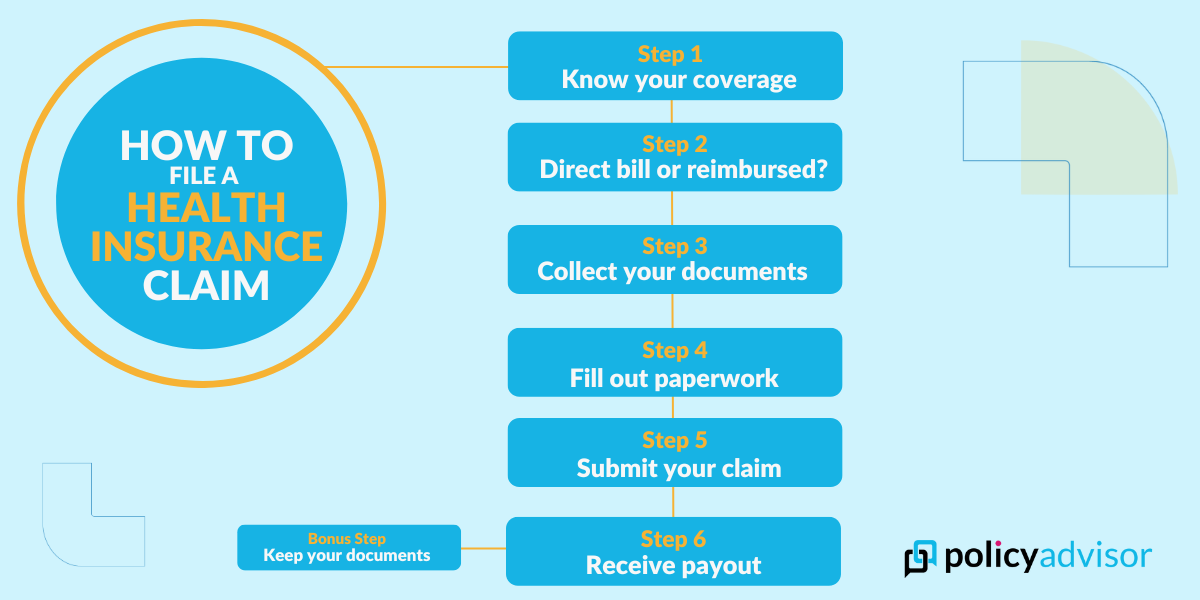

What are the steps to file a health insurance claim?

Filing a health insurance claim in Canada can feel overwhelming, especially when dealing with medical expenses. Whether you’re using direct billing or paying upfront for reimbursement, understanding your policy and the claims process is essential.

Knowing what expenses are covered, what documents you need, and how to submit your claim can help you avoid delays and maximize your benefits.

Here are the steps to file a health insurance claim in Canada:

Determining what you can claim

Before submitting a claim, confirm which medical expenses your insurance covers. Check your insurer’s website or contact their customer support to clarify your benefits.

Most health insurance plans cover:

- Prescription drugs

- Dental care (cleanings, fillings, extractions, etc.)

- Vision care (eye exams, glasses, contact lenses)

- Paramedical services (chiropractic, physiotherapy, massage therapy, mental health therapy)

- Medical equipment (crutches, CPAP machines, glucose monitors)

- Emergency travel medical insurance

Checking whether your insurer uses direct billing or requires reimbursement

The way your claim is processed depends on whether your healthcare provider offers direct billing or if you need to pay upfront and submit a claim for reimbursement.

Direct billing

With direct billing, the healthcare provider submits the claim directly to your insurance company, and you only pay the remaining balance. To use direct billing, provide the provider with:

- Policyholder’s name

- Your name

- Policy number

- Member ID (if it’s a group plan)

Direct billing simplifies the claims process by eliminating the need for you to pay upfront. Some insurers require pre-authorization for direct billing, meaning you may need to complete a one-time setup with your insurer.

Reimbursement

If your provider doesn’t offer direct billing, you must pay out of pocket and file a claim for reimbursement. In this case, you will need to submit receipts and supporting documents to your insurance company.

If you have multiple insurance policies, you may need to pay first and then claim reimbursement through a coordination of benefits process.

Gathering the required documentation

Each insurer may require different documents depending on the type of service received. However, for most claims, you will need:

- Your policy number and/or member ID

- The name of the person receiving the service (you, spouse, dependent, etc.)

- An itemized receipt from the healthcare provider

- Proof of payment (if seeking reimbursement)

Completing the claim form

Once you have your documents, you will have to fill out the claim form. Depending on your insurer, you may submit claims online or via mail.

Online claims submission: Many insurers offer an online portal or mobile app where you can:

- Upload scanned copies of receipts and documents

- Fill out a digital claim form

- Receive real-time claim updates

Some insurers also allow claim submissions via email by completing a digital PDF form and attaching supporting documents.

Paper claims submission: If online claims aren’t available, print and mail your completed claim form along with any required documents. Some insurers require original receipts, so make copies before mailing them.

Submitting your claim

Once your claim is complete, you must submit it electronically or by mail.

- Online: Claims are typically reviewed faster, and you may receive an instant decision.

- Mail: Processing can take longer, but it’s an option if online submission isn’t available.

Your insurance provider will review the claim to determine the reimbursement amount. If additional information is needed, they will contact you.

Receiving your reimbursement

Once approved, your insurer will send an Explanation of Benefits (EOB) outlining:

- The total amount claimed

- The portion covered by insurance

- Any remaining balance you are responsible for

Reimbursement is typically issued via cheque or direct deposit, depending on your setup. Set up direct deposit with your insurer to receive claim payments directly into your bank account. You will need to provide:

- Bank institution number (3 digits)

- Branch transit number (5 digits)

- Bank account number (9+ digits)

Direct deposit speeds up the reimbursement process and eliminates waiting for a mailed cheque.

Keeping your records

Even if you submit your claim online, you must always keep copies of:

- Receipts and invoices

- Prescription details

- Referral notes (if applicable)

Your insurer may request these documents later, especially in case of a claim audit or appeal process if your claim is denied.

How to coordinate benefits with multiple insurance plans?

If you have more than one health insurance plan (e.g., through your employer and a spouse’s plan), you can coordinate benefits to maximize coverage.

- File your claim with your primary insurer first. Wait for them to process the claim and issue an EOB

- Submit the EOB and the remaining balance to your secondary insurer for additional reimbursement

On your claim form, select coordinating benefits and provide details of your primary insurance coverage. This ensures both insurers process your claim correctly.

How long do you have to submit a health insurance claim in Canada?

Most insurance companies require claims to be submitted within 90 days to 15 months from the date of service. Some group health plans may have shorter deadlines, while others offer more flexibility. Hence, we recommend checking your policy details or contacting your insurer to ensure you submit your claim on time.

How long does it take for an insurance company to pay out a claim in Canada?

An insurance company typically takes a few weeks to pay out a health insurance claim in Canada, however, the exact timeline depends on the insurer and the method of submission.

- Online claims: Typically processed within a few days, with reimbursement via direct deposit or cheque

- Paper claims (by mail): Can take several weeks, depending on processing times and mail delivery

- Large or complex claims: May take longer if additional documents or verification are required

What are some reasons a health insurance claim may be denied?

A health insurance claim may be denied for several reasons, including incomplete or incorrect information, ineligible expenses, or policy limits being exceeded. Your claim could also be rejected if your coverage has lapsed, if you didn’t get pre-authorization for a required service, or if key documents like receipts or medical referrals are missing.

If this happens, you can file an appeal by submitting additional documentation, such as a doctor’s confirmation that the treatment was necessary. Most insurers provide an online appeal process or a claims department you can contact directly. If your appeal is denied and you believe the decision was unfair, you may escalate the issue to an ombudsman or, consider legal action.

Need help submitting your health insurance claim?

If you’re unsure how to file your health insurance claim, we’re here to help. We can connect you with the claims departments of our partner insurance companies based on your provider.

Our expert insurance advisors can also review your coverage, guide you through the claims process, and help you explore other top insurance options if your current plan doesn’t meet your needs. For more details or to start your claim, visit your insurer’s website or reach out to us for personalized assistance.

Frequently asked questions

What if my health insurance doesn’t cover all expenses?

If your health insurance doesn’t fully cover a medical expense, you have options. If you have dual coverage, you can submit the remaining balance to your secondary insurer for reimbursement. If you don’t have secondary coverage, you’ll need to pay the remaining amount out of pocket. If your current plan isn’t meeting your needs, our experts at PolicyAdvisor can help you explore better coverage options.

How long does it take for a health insurance claim to be processed?

Processing times vary by insurer. Online claims may be processed instantly, within 24 hours, or within a week, especially for smaller expenses. Some insurers use automated portals for faster processing. If you submit a paper claim by mail, it may take longer due to document handling and review times. Large claims or those flagged for additional review could also take more time before reimbursement is issued.

Is there a time limit to submit a health insurance claim?

Yes, insurers set deadlines for claim submissions, typically ranging from 9 to 15 months from the date of service. Even if your policy has expired, you can still submit a claim as long as the service was received while your policy was active. To avoid missing deadlines, check your insurer’s specific time limits.

What is a health insurance claim quote?

A health insurance claim quote allows you to estimate coverage before receiving a service. Your healthcare provider can request a pre-approval from your insurer, detailing how much will be covered and what you may need to pay out of pocket. This helps you make informed decisions before proceeding with treatment.

Where can I find my health insurance policy number?

Your policy number is on your health insurance member ID card, policy documents, or your insurer’s online portal. If you’ve misplaced it, contact your insurance company’s claims helpline for assistance.

Filing a health insurance claim ensures you receive coverage for medical expenses under your policy. This guide explains the step-by-step process, including determining claim eligibility, required documentation, submission methods, and reimbursement timelines. Whether using direct billing or seeking reimbursement, understanding how claims work helps you avoid delays and maximize your benefits.