- Capital Dividend Accounts (CDA) let Canadian corporations distribute dividends tax-free to eligible shareholders

- Corporations must verify the CDA balance, pass a board resolution, and file the election properly

- Staying compliant with Canada Revenue Agency (CRA) rules and maintaining proper documentation are critical to avoiding penalties

- Missteps can trigger taxes and penalties, so careful planning is essential

A Capital Dividend Account (CDA) lets Canadian private corporations distribute eligible corporate funds to shareholders as tax-free “capital dividends.” It is one of the most efficient ways to distribute corporate wealth, fund buyouts, and plan estates. Every eligible dollar reaches shareholders (or trust beneficiaries) without erosion from personal tax. The Capital Dividend Account applies to all private corporations resident in Canada, but not limited to Canadian-controlled private corporations (CCPCs).

In this guide, we explain how the Capital Dividend Account (CDA) works, how the Canada Revenue Agency (CRA) monitors it, how CDA balances are calculated, and the key planning considerations that matter most for incorporated entrepreneurs, professionals, and family-owned businesses.

What is a Capital Dividend Account (CDA) in Canada?

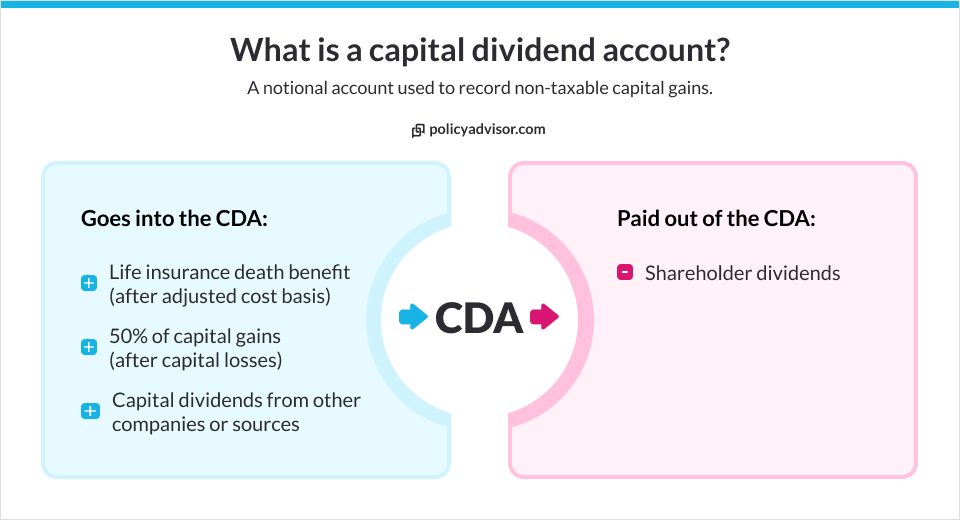

A Capital Dividend Account is a notional tax account for private corporations to track non-taxable surpluses that can be distributed tax-free to Canadian-resident shareholders. Capital dividends are generally exempt from personal income tax for Canadian‑resident shareholders when the election is filed correctly.

Why does CDA matter?

The CDA is relevant for all Canadian-resident shareholders, not just Canadian-controlled private corporations. It matters because it:

- Allows tax-free distributions: Corporations can pay certain amounts to shareholders without personal tax

- Supports succession planning: Ensures smooth transfer of wealth to heirs or partners

- Provides liquidity for buyouts: Facilitates funding for shareholder or partner buyouts

- Strengthens estate and corporate planning: Helps structure dividends efficiently for long-term corporate and personal wealth

What qualifies for the Capital Dividend Account?

The Capital Dividend Account tracks specific tax-free amounts earned inside a corporation. These entries determine how much can be paid to shareholders tax-free.

| Category | Effect on CDA | Notes |

| Non-taxable portion of capital gains | Credit | The tax-free portion of a capital gain adds to the CDA |

| Life-insurance proceeds above adjusted cost basis (ACB) | Credit | Only the excess death benefit above the policy’s ACB qualifies |

| Capital dividends received from others | Credit | Capital dividends received from other corporations add to your CDA |

| Capital dividends previously paid | Debit | Reduces your available CDA balance |

| Non-deductible portion of capital losses | Debit | Reduces the CDA; careful record-keeping is required |

Among these qualified amounts, corporate-owned life insurance plays a major role in increasing CDA balances for tax-free distributions.

Corporate-owned life insurance (COLI) and the CDA

Corporate-owned life insurance maximizes CDA credits by converting death benefits into tax-free shareholder payouts, strengthening overall estate and succession strategies. When a corporate-owned life insurance policy pays a death benefit, only the amount above the policy’s adjusted cost basis (ACB) is credited to the CDA. The full death benefit is not taxable to the corporation. The CDA portion can be paid to shareholders tax-free. The ACB portion does not go into the CDA, it only becomes taxable if the corporation pays it out later as a regular dividend. The table below illustrates how the death benefit, ACB, and CDA credit interact:

| Item | Amount | Tax Treatment |

| Death benefit from corporate-owned policy | $2,000,000 | Tax-free to corporation |

| Adjusted Cost Basis (ACB) | $200,000 | Policy cost basis |

| CDA Credit (Death benefit − ACB) | $1,800,000 | Tax-free to shareholders via CDA dividend |

| Remaining portion | $200,000 | Non-taxable to corporation; taxable to shareholders if distributed as regular dividend |

This approach allows business owners to convert corporate-owned life insurance proceeds into tax-free shareholder distributions, providing liquidity for estate planning, buy-sell agreements, and efficient wealth transfer.

How the CDA works

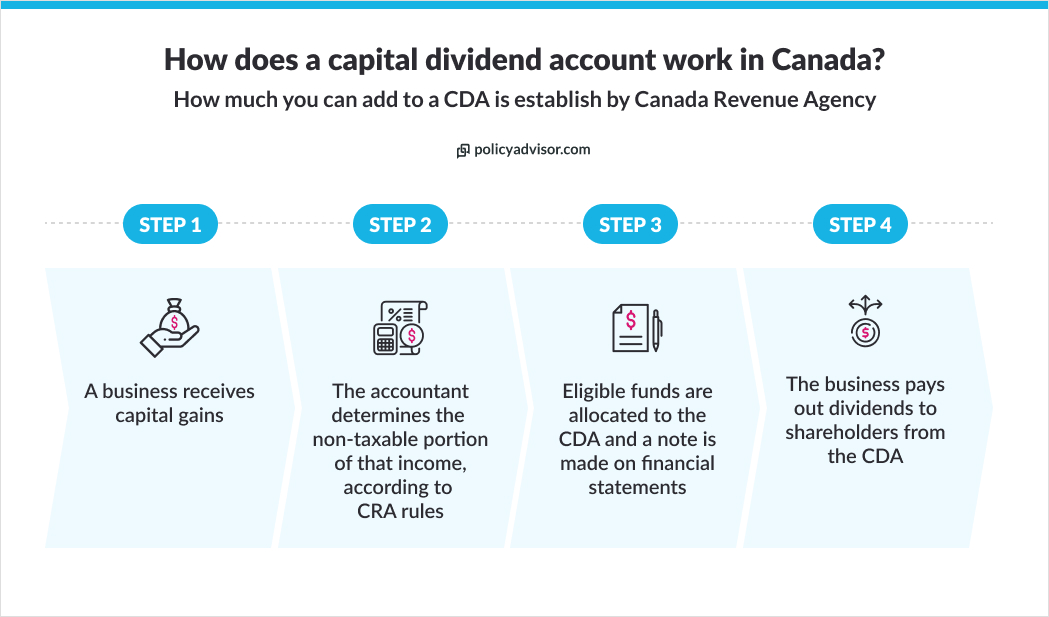

A CDA works by tracking tax-free amounts a corporation can distribute to shareholders without personal tax. When eligible funds enter the corporation, they are recorded in the CDA.

Here’s how the CDA works:

- Eligible tax-free amounts enter the corporation: The corporation receives a capital gain or other eligible tax-free amount, for example, the non-taxable portion of a capital gain or the portion of life-insurance proceeds above the policy’s adjusted cost basis (ACB)

- The tax-free portion is calculated and recorded: The accountant determines the exact non-taxable amount and records it in the Capital Dividend Account. The CDA is a notional accounting ledger (not a bank account), and it must always remain above zero

- The CDA balance accumulates over time: The CDA grows as qualifying amounts are added and decreases when capital dividends are paid. Accurate tracking, ACB calculations, and clear, dated records are important because the CRA can review the balance

- The corporation elects to pay a capital dividend: When the business is ready to distribute tax-free funds to shareholders, it files the required election (Form T2054 under subsection 83(2) of the Income Tax Act) before or at the time of payment and verifies the CDA balance

- Tax-free dividends are paid to shareholders: Dividends are paid up to the available CDA amount, and Canadian-resident shareholders receive the payment tax-free. Paying more than the CDA balance triggers penalty tax, so confirming the balance immediately before payment is essential

How to calculate the Capital Dividend Account balance?

To calculate your Capital Dividend Account balance, add all the tax-free amounts your corporation has earned and subtract any tax-free dividends you’ve already paid out. This gives you the amount you can distribute to shareholders tax-free.

CDA = (Tax-free capital gains) + (Life insurance proceeds over ACB) + (Capital dividends received) − (Capital dividends paid) − (Non-deductible capital losses).

| Non-taxable portion of capital gains | $50,000 |

| Life insurance proceeds (death benefit − ACB) | $100,000 |

| Capital dividends received | $20,000 |

| Capital dividends already paid | −$30,000 |

| Non-deductible portion of capital losses | −$10,000 |

CDA balance = $50,000 + $100,000 + $20,000 − $30,000 − $10,000 = $130,000.

The corporation can distribute $130,000 as tax-free capital dividends.

Risks, penalties, and compliance associated with CDA

Managing a Capital Dividend Account requires understanding its risks, penalties, and compliance rules. Mitigate these by verifying CDA balances with your accountant, maintaining detailed records (ACB statements, resolutions), and filing elections on time before distributions. These accounts offer valuable tax advantages, but missteps can trigger penalties, taxes, and shareholder disputes.

- Over-paying the CDA balance: Paying more than your CDA balance triggers a 60 percent penalty tax on the excess, making the distribution highly inefficient

- No negative balance allowed: The CDA cannot go below zero, and any over-payment may lead to CRA reassessment and shareholder issues

- CRA documentation expectations: The CRA requires accurate records, including ACB statements, gain/loss reports, board minutes, and election filings, or the tax-free treatment may be challenged

- Cross-border shareholder considerations: Only Canadian-resident shareholders can receive capital dividends tax-free; non-resident payments typically face withholding tax under treaty rules

- Election filing accuracy: Elections under subsection 83(2) must be filed correctly and on time to ensure the dividend remains tax-free

- Event-based checks: CDA balances should be verified before major transactions such as buyouts, estate distributions, or reorganizations

Frequently asked questions

What is a Capital Dividend Account (CDA)?

A Capital Dividend Account is a notional tax account for private corporations to track non-taxable surpluses that can be distributed tax-free to Canadian-resident shareholders. It lets you pay certain amounts to shareholders as tax-free capital dividends when you file a valid election with the CRA.

How do corporations verify their CDA Canada balance?

Corporations track the CDA Canada balance using internal records or with their accountant to ensure dividends do not exceed the available balance. Schedule 89 optionally requests CRA verification for added assurance (not mandatory).

What risks apply to CDA Canada distributions?

Corporations face risks like CRA reassessments, 60% Part III tax, and 25% GAAR penalties if distributions are abusive or poorly documented.

Can CDA distributions be used in estate planning or buyouts?

Corporations can use CDA distributions in estate planning or buyouts, but they must verify balances before key events to keep dividends tax-free.

When must the CDA election be filed?

The CDA election (Form T2054) must be filed on or before the earlier of the day the dividend becomes payable and the day it is paid to shareholders. Filing after this deadline incurs penalties and jeopardizes the tax-free status of the dividend.

A Capital Dividend Account (CDA) lets Canadian private corporations pay eligible tax‑free dividends to shareholders. To keep them tax‑free, verify your CDA balance, approve the dividend by a certified directors’ resolution, and file it on or before the dividend becomes payable. Strong documentation keeps you compliant and protects value in succession, estate, and buyout planning.