- Limited pay whole life insurance offers lifetime coverage with payments that end early, often in 5, 8, 10, 15, 20 years, or up to age 65

- Once premiums are complete, your policy stays paid-up for life, no future payments, just ongoing protection and cash value growth

- Plans differ in cost and flexibility; shorter terms mean higher annual premiums but faster ownership

- It suits high-income earners, business owners, and retirement planners who want stability and tax-efficient growth

- Compared to traditional whole life, limited pay offers long-term value and freedom from lifelong financial commitments

Limited pay whole life insurance is a type of permanent whole life coverage where you pay your premiums for a predetermined, “limited” period, such as 5, 8, 10, 15, 20 years, or up to age 65. When the scheduled limited‑pay period is completed and the policy is paid‑up completely, the coverage is designed to remain in force for life. This differs from traditional life-pay whole life insurance, where premiums are paid every year for as long as the policy is in force.

This guide explains what limited pay whole life insurance is, how it works, how it differs from traditional plans, and its key features and benefits.

How does limited pay whole life insurance work?

Limited pay whole life insurance lets you pay premiums for a limited period while keeping coverage for life. Once your payment term ends, the policy becomes “paid-up,” meaning no further premiums are required.

Here’s how the process works:

- Select the whole life insurance plan that meets your coverage and benefit needs

- Choose your payment term: Select how long you want to pay premiums (e.g., 5-pay, 10-pay, 15-pay, 20-pay, or pay-to-65), locking in guaranteed level payments for that period

- Apply and complete underwriting: Submit an application and go through underwriting so the insurer can assess your health, risk profile, and final premium rate

- Pay premiums for the selected term: Pay premiums, annually or monthly, only for the chosen limited period

- Premiums build value and coverage: Each payment funds the policy’s cash value and activates the permanent death benefit for your beneficiaries

- Cash value grows over time: As premiums are paid, the cash value increases on a tax-deferred basis if the policy is “exempt” under the Income Tax Act. Non-exempt policies are taxed annually on growth. Participating policies may also receive dividends.

- Access to cash value: Once enough value has accumulated, you can borrow or withdraw from it (subject to policy rules) for retirement income, emergencies, or other needs. Loans and withdrawals may reduce the death benefit and cash value, and may have tax implications

- Policy becomes fully paid-up: When the payment term ends, no further premiums are required for life

- Lifetime protection continues: The policy stays in force for your entire lifetime, and the death benefit is generally paid tax-free to individual beneficiaries. In some corporate or policy loan situations, it may be taxable

Key features and benefits of limited pay whole life insurance

Limited pay whole life offers guaranteed lifelong coverage, premiums that end early, and the potential to build cash value for long‑term goals without paying for life. It’s designed for Canadians who want lifetime coverage without paying premiums forever.

Here are its key features and benefits:

- Short premium payment window: Lifetime protection with a compressed, level premium payment period

- Guaranteed cash value: Builds steadily every year. Growth is generally tax-deferred for exempt policies, while non-exempt policies are taxed annually on the increase

- Dividend accumulation: Participating policies earn dividends that enhance coverage or cash value. Dividends are not guaranteed and depend on company’s performance

- Paid-up additions: Dividends can be used to buy extra insurance for compound growth

- Tax advantages: Exempt policies enjoy tax-deferred cash value growth and generally tax-free death benefits; non-exempt policies are taxed on growth, and some corporate or policy loan situations may affect death benefits

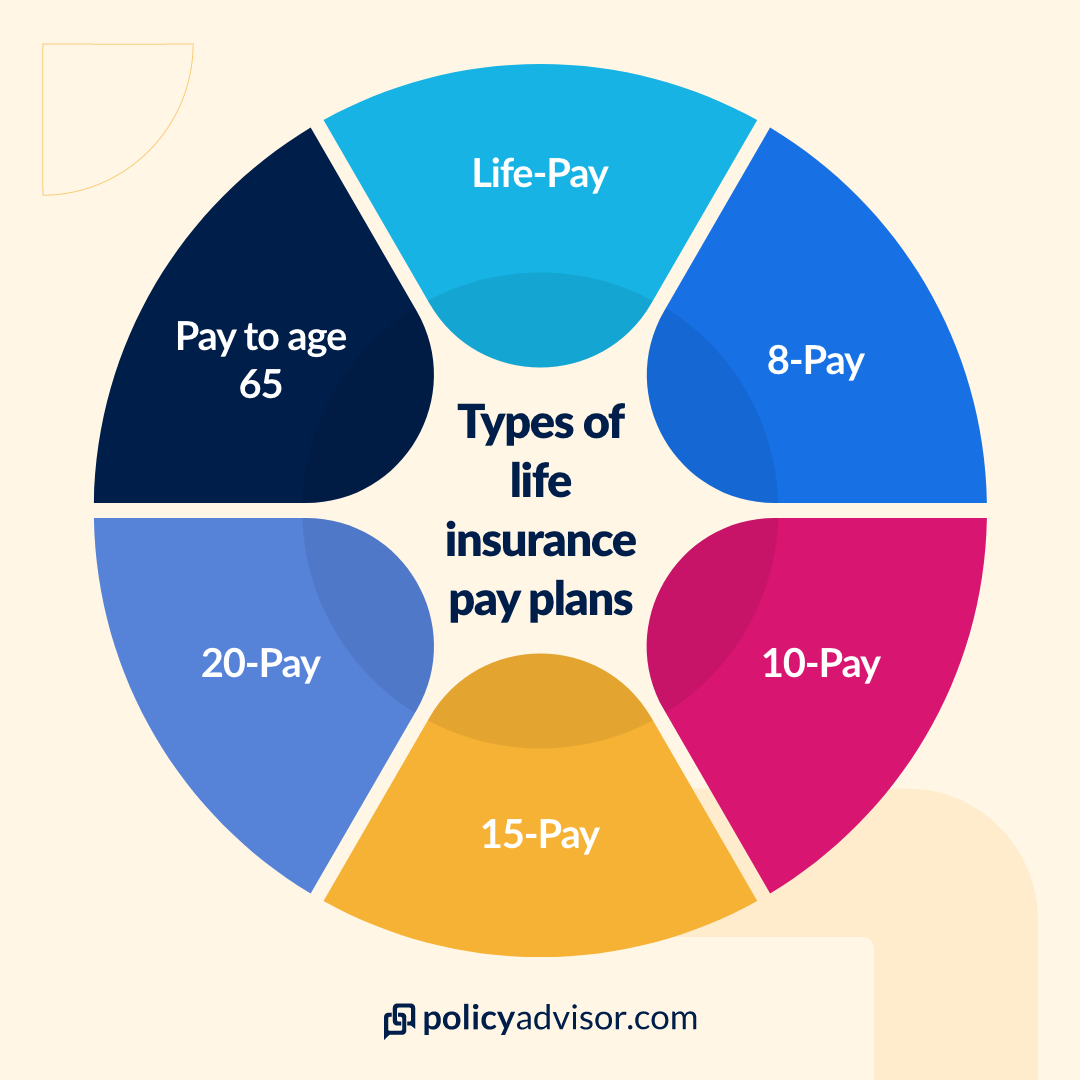

Types of limited pay whole life insurance in Canada

Limited pay whole life insurance comes in several payment structures, with 10-pay and 20-pay being the most common while 5-pay, 8-pay, and pay-to-65 are less commonly offered by insurance providers. Each defines how long you’ll pay premiums before the policy is fully funded. After that, coverage continues for life with no further payments.

5-pay whole life:

In 5-pay whole life insurance, you pay premiums for just five years. Although less common, it’s a fast, high-commitment option, best for high earners or those focused on estate and business planning who want quick ownership.

8-pay whole life:

8-pay whole life insurance is offered only by a few carriers, it’s a short-term option that offers quick ownership without the intensity of 5-pay. Best suited for business owners or professionals planning to use the policy for long-term wealth transfer.

10-pay whole life:

10-pay whole life insurance is the most commonly offered limited pay, where payments end in 10 years, giving you lifetime coverage and faster cash value growth. It is ideal for those who want a clear end date before retirement.

15-pay whole life:

15-pay whole life insurance balances affordability and early completion, but offered by a few carriers only. It is a good fit for mid-career professionals who want to manage cash flow but still finish payments before their 50s or 60s.

20-pay whole life:

This is one of the most common limited-pay options available; 20-pay whole life insurance spreads premiums over 20 years, keeping annual costs manageable. It is ideal for younger buyers starting long-term coverage early in life.

Pay-to-65 whole life:

In pay-to-65 whole life insurance, premiums continue until age 65, matching your working years. Once you retire, payments stop, but coverage remains for life. This makes it a practical choice for retirement planners.

Example of a limited pay whole life policy: Limited pay whole life insurance works well for those starting later in life. It guarantees lifetime coverage while allowing cash value growth during your life. To see how these payment terms work in practice, let’s look at a real-life example of a 20-pay policy.

- Jack, 35, buys a 20-pay whole life policy with $100,000 coverage

- He pays $1,900 per year for 20 years

- By age 55, the policy is fully paid-up

- Dividends continue and can supplement his retirement income

- Jack keeps guaranteed lifetime coverage without paying any more premiums

Limited pay vs. traditional whole life insurance

The core difference between limited pay and traditional whole life is the payment period. Limited pay plans offer lifelong coverage without having to pay premiums for your entire life. Traditional whole life typically requires premiums to age 100 or for life, though some policies allow earlier cessation of out-of-pocket payments through premium offsets. Since premiums are concentrated into a shorter payment period, limited pay plans have higher premiums than traditional whole life. Cash value growth is typically faster in the early years of a limited pay policy, but actual growth depends on the product and dividend scale.

| Feature | Limited pay whole life insurance | Traditional whole life insurance |

| Premium payment period | Pay premiums for a fixed payment term (5,10 or 20 years) | Pay premiums for life (no fixed term) |

| Premium amount | Higher annual premiums due to the shorter payment term | Lower annual premiums spread over a lifetime |

| Cash value growth | Builds faster due to front-loaded payments | Gradual |

| Ideal for | Business owners, high-income earners, parents funding policies for children, pre-retirees, and those who are focused on estate planning | Those who prefer smaller, ongoing premium payments and those seeking lower-cost lifetime coverage using whole life for final-expense needs |

The trade-off is that limited pay plans cost more in the short term but deliver payment-free coverage for life. Traditional plans cost less annually but keep you tied to premiums for decades. For Canadians who value financial independence before retirement, limited pay options often strike the right balance between cost, flexibility, and lifetime protection.

To see how this works in real life, let’s look at Jack’s 20-pay whole life policy compared to a traditional life pay plan.

| Feature | 20-pay policy | Traditional life pay |

| Age at start | 35 | 35 |

| Coverage | $100,000 | $100,000 |

| Payment term | 20 years | Lifetime |

| Annual premium | $1,900 | $900 |

| Total premiums paid | $38,000 | $40,500 |

| Paid-up age | 55 | N/A |

| Cash value & dividends | Accumulates quickly; continues after payments | Accumulates gradually |

| Death benefit | $100,000 guaranteed | $100,000 guaranteed |

Who should consider limited pay whole life insurance in Canada?

Limited pay whole life insurance is best suited for Canadians who want lifetime coverage without lifelong payments. It appeals to those with stable income and long-term financial goals.

Who benefits most:

- High-income professionals: Ideal for individuals who want to finish paying premiums early and enjoy retirement without ongoing expenses. Doctors, lawyers, and executives often use 10-pay or 15-pay plans for efficient wealth planning

- Business owners: Great for entrepreneurs looking to fund policies quickly and use them as corporate assets. Paid-up policies may also support succession or shareholder protection, though tax treatment depends on Capital Dividend Account (CDA), Adjusted Cost Base (ACB), and other factors

- Parents or grandparents: Useful for those buying policies for children or grandchildren. A 10-pay or 20-pay plan can lock in coverage early, leaving the next generation with fully paid-up lifetime protection

- Retirement planners: Perfect for anyone aiming to eliminate financial obligations before retirement. Pay-to-65 structures align naturally with working years, ensuring a stress-free transition into retirement

- Estate planners: Favoured by individuals building long-term legacy plans. Fully funded policies ensure guaranteed coverage and predictable estate value with no premium surprises later in life

Limited pay whole life insurance offers valuable long-term benefits, but it’s not right for everyone. Understanding its limitations helps you make an informed decision. It may not be ideal for the following reasons:

- Higher short-term costs: Premiums are compressed into fewer years, so annual costs are higher. This can strain cash flow if income is inconsistent

- Reduced flexibility: Once you choose a payment schedule (10-pay, 20-pay, etc.), most policies don’t allow changes. Some may offer reduced paid-up coverage or premium offsets

- Commitment required: Missing payments during the funding period can impact cash value and performance. These plans work best for buyers with predictable income

- Limited early liquidity: Cash value growth is modest in the first few years, especially for shorter pay periods

- Opportunity cost: Large early premiums may reduce your ability to save elsewhere or manage debt.

How to choose the right limited pay option

- Choosing the right limited pay option means matching your payment term to your budget, timeline, and financial goals. Consider your age, income, and whether you want to prioritize liquidity, legacy, or retirement planning.Selecting the right option is not about the lowest cost; it’s about the best fit for your financial timeline and long-term goals. A licensed PolicyAdvisor expert can compare limited pay options and select a plan best suited to your needs.

Frequently asked questions

What is limited pay whole life insurance?

Limited pay whole life insurance is a permanent policy where you pay premiums for a set number of years, such as 5, 10, 15, 20, or until age 65, instead of for your entire life. Once the payment term ends, the policy becomes fully paid-up, and your coverage continues for life. This structure suits Canadians who want to finish payments early while keeping lifelong protection and building guaranteed cash value.

How does limited pay whole life insurance differ from traditional whole life insurance?

The key difference between limited pay and a whole life insurance plan is how long you pay premiums. With limited pay whole life insurance, payments end after a fixed term, while traditional whole life requires ongoing payments for life. Both offer lifetime coverage and cash value, but limited pay policies cost more annually since you pay them off sooner.

What is paid-up life insurance?

Paid-up life insurance is a policy that no longer requires premium payments but continues to provide lifetime coverage. You can reach paid-up status by completing the limited pay term or electing reduced paid-up status. Some policyholders also use premium offset, where dividends or cash value cover future premiums, though the policy isn’t fully paid-up in that case. It’s a useful option for policyholders who want lifelong coverage without ongoing costs.

Can I convert my existing whole life policy into a limited pay plan?

No, most existing whole life insurance policies cannot be directly converted into limited pay plans. However, some insurers allow premium offset, where dividends cover future premiums, or policy exchanges under certain conditions. It’s best to review your policy terms or consult your advisor to confirm what’s possible with your provider.

What happens after I finish paying premiums on a limited pay plan?

Once you’ve completed your payment term, your policy becomes fully paid-up. You no longer need to make premium payments, but your coverage continues for life. You can also access your policy’s cash value through loans or partial withdrawals, depending on your insurer’s rules.

Who should consider a limited pay whole life policy?

Limited pay whole life insurance is ideal for professionals, business owners, and families who want permanent protection but prefer to pay premiums before retirement. It is also a good fit for those who want to use life insurance for estate planning or tax-efficient wealth transfer.

How can I make limited pay whole life insurance more affordable?

You can make your limited pay plan more affordable by choosing a longer pay term or improving your insurability. You can also use policy features like paid-up additions (PUAs), which let you use dividends to buy extra coverage, boosting your policy’s value without increasing out-of-pocket costs. Some policies also allow additional deposits (ADO), which do require extra payments.

What’s the difference between limited pay and paid-up additions?

Limited pay determines how long you make premium payments, whereas paid-up additions (PUAs) let you use dividends to purchase extra coverage. PUAs may accelerate when a policy reaches paid-up status, but they do not always make the base policy fully paid-up. Instead, they primarily increase your death benefit and cash value without lengthening the payment period.

Can businesses buy limited pay whole life insurance?

Yes, corporations in Canada can use limited pay whole life insurance through corporate-owned life insurance (COLI) to create a valuable corporate asset. The company pays premiums over a set term, and the policy can support buy-sell funding, executive compensation, or long-term financial planning.

Limited pay whole life insurance offers lifelong protection with a shorter payment period, available in 5-pay, 8-pay, 10-pay, 15-pay, 20-pay, and pay-to-65. This structure helps Canadians secure guaranteed coverage, grow cash value tax-deferred, and finish payments before retirement. Explore how it works, key types, pros and cons, and how to choose the right plan for your goals.