Compare & Buy Canada’s Best Mortgage Insurance

Trusted by Canadians

The Gold Standard

They are the Gold Standard of Client Experience. The whole process was simple, hassle-free, uber transparent and all of this at no cost. Our advisor’s knowledge and attitude reeled us in from the first call. We felt as if we were premium clients.<...

Lipika

Knowledgeable and helpful

Very knowledgeable and helpful in determining the best plans for my son and I and he took the stress out of the process. Fully explained all of the options available to me, and answered all of my questions. I know that I made an informed decision ...

Franz T

Skeptical to believer

First I was skeptical about high reviews but anyways PolicyAdvisor. I could see that they are trying to give best details they have and guide us to choose policy rather than selling it. Rarely I type in reviews. I can say that PolicyAdvisor is wor...

Meenakshi N

Excellent service

Thank you for the excellent customer service. You’ve been very supportive in all our questions. After the video call, he didn’t really push to sell. We appreciate your time, and support in giving us updates and follow-ups and phone calls until we ...

Jessa Y

Genuinely Cared

My advisor genuinely cared about making sure I was comfortable and informed throughout the process, and patiently answered my many questions. He also always followed up to make sure I was up to date on my application process.

Jessica F

Simpler than expected

Answer all our questions in a timely manner, and the process was much more simple than I was expecting. We had our life insurance sorted and approved within a few days. I really like that they did the comparisons of policies for us.

Joanne V

Life Insurance made easy

Was looking for a life insurance policy and the search was exhausting by conventional means, until I found PolicyAdvisor. My representative was excellent, and explained all my options and preferred quotes. Life Insurance made easy, thank you all a...

Pedro

Unbiased advice

If you’re looking for best rate and an advisor, I would highly recommend PolicyAdvisor. They are expert in finding the best insurance provider. They are reliable and give unbiased advise. I’m glad I came across Policy Advisor online as they helped...

Zeny D

A walk in the park

I was able to derive a personalized quote within a minute. From there on it was as smooth as taking a walk in the park. I did not have to wait in long lines, could chart my progress, and had full control of my application.

Mayank

Super easy

I’d previously reached out to one of the big insurance companies directly but found them so unresponsive and uninterested. I’m glad we found PolicyAdvisor. They made comparing options easy so we found something that worked for our need...

Lindsay

What is mortgage insurance?

In Canada, mortgage insurance is a protection product typically offered by your mortgage lender or financial institution.

In the unfortunate event of your death, with your mortgage loan still outstanding, this insurance will pay off the remainder of your mortgage debt. It should not be confused with mortgage default insurance or mortgage loan insurance (more on that below).

There are several problems with lender-provided mortgage insurance: coverage value reduces with time, premiums get more expensive with age, premiums increase when you refinance or port your loan, you have no control over the proceeds, and the coverage is not even guaranteed!

Instead, Canadians are better served by mortgage protection through term life insurance.

Types of mortgage insurance

Mortgage insurance and related products go by several different names in Canada. Here’s how to tell the difference between each type of mortgage insurance.

Mortgage insurance

- A protection product offered by your mortgage lender that covers your diminishing mortgage debt should you pass away. This insurance is coupled with your monthly payments

- Also known as: mortgage life insurance, lender-provided mortgage insurance

Mortgage protection

- This protection uses term life insurance to match your mortgage’s amortization period and provide a flexible, cost-effective protection product that offers your beneficiaries more control over how the benefit is used

- Also known as: mortgage protection through term life insurance, mortgage protection insurance, private mortgage insurance, mortgage protection life insurance

Mortgage default insurance

- A (sometimes) mandatory, one-time insurance fee paid by Canadian homeowners if their initial down payment is below 20% of their total mortgage home value

- Also known as: mortgage loan insurance, CMHC insurance

Recognized as a leader in the industry

How does mortgage protection life insurance work?

Mortgage protection life insurance provides a consistent payout that is not tied to your mortgage debt. Instead, it’s a term life insurance policy: the term simply matches your mortgage’s amortization period.

The payment is guaranteed as the policy is underwritten when purchased (meaning the insurance company takes your personal factors into account when determining the price). Because of this rigorous underwriting, the premiums are typically lower. Your beneficiaries have complete control over how they wish to use the proceeds of mortgage life insurance – even if you’ve paid off your home.

Many Canadians choose mortgage life insurance as an alternative to mortgage insurance both to save money and for its added flexibility.

Mortgage insurance versus mortgage protection life insurance

When compared head-to-head, term life insurance beats mortgage insurance for protecting your home and your loved ones.

| Mortgage insurance |

VS |

Mortgage protection life insurance |

|---|---|---|

| Only covers the decreasing, outstanding mortgage balance | Can cover everything from debts to family expenses and obligations like a conventional loan or property taxes | |

| Only covers the borrower | Can cover you and your family | |

| No flexibility to change amount or term | Can increase coverage amount and term | |

| Coverage reduces with monthly mortgage payments | Consistent coverage throughout the term | |

| Coverage not guaranteed, only evaluated at claim | Guaranteed coverage means a higher probability of paid claims and lower waiting period | |

| Your lender is the beneficiary | You choose the beneficiary | |

| Generic rates, usually higher, and stay same even with reducing coverage | Personalized premiums, with lower pricing for healthier clients | |

| Coverage may be lost when switching lenders | Ability to switch lenders throughout the mortgage term | |

| Can only be used by lender to pay outstanding balance of mortgage | Can use proceeds in any way and create a more flexible financial plan |

Do I require mortgage insurance?

Mortgage insurance is not mandatory. Instead, a homeowner can choose mortgage protection life insurance, such as a term life policy. It pulls double duty, protecting your mortgage debt and covering other life insurance needs at the same time. This means the same policy you use to protect your mortgage loan can also be used to cover the cost of living for those you leave behind in the unfortunate event of your death.

Need insurance answers now?

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them.

Is mortgage insurance worth it?

Mortgage insurance products from your bank or mortgage provider are not worth it.

Generally, the premiums are higher than alternative forms of insurance, and the benefit you receive (in this case a fully paid off home for those you leave behind) is not guaranteed. Instead, mortgage protection through term life insurance can provide a more flexible benefit that does a superior job of protecting your home and your family in the event of your passing.

Is mortgage insurance a waste of money?

Mortgage insurance is not a waste of money in specific circumstances. In cases where you do not qualify for private mortgage insurance through a term life policy or other insurance products that would cover your mortgage, mortgage insurance may be worth it.

Disqualification could be due to family medical history or an illness, which prevents your approval for coverage. In these rare cases where mortgage insurance is your only alternative, it’s worth it. Mortgage insurance coverage is better than no coverage at all.

How long do you pay mortgage insurance for?

Your payment terms for lender-provided mortgage insurance policies usually match your amortization period, and you have little choice in how long you pay your premiums or the size of the benefit. With mortgage protection life insurance you tailor the size and length of the policy to your mortgage and other needs.

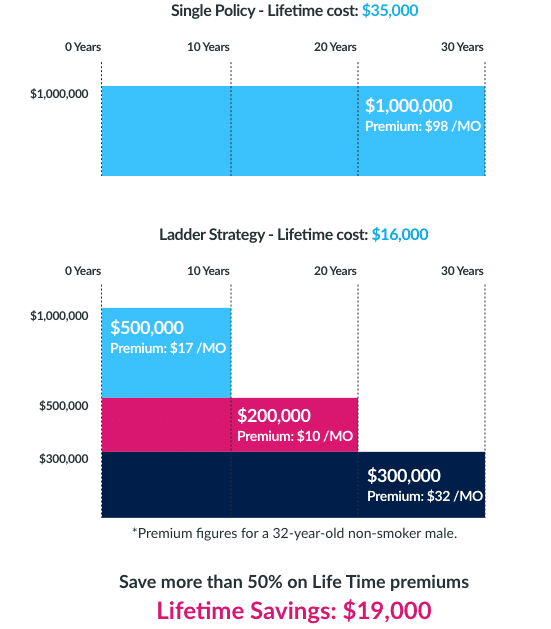

Another advantage of insuring your mortgage with term life insurance is you can implement a ladder strategy. What this means is you hold multiple term life insurance policies simultaneously of varying lengths and benefit amounts to stagger the amount of protection you have over the years. Some even add a small permanent life insurance policy to their ladder to account for final expenses.

With this method, you can take out a larger life insurance policy for a shorter term to save yourself money during the riskiest financial years of your life. In the below example, one is able to taper off coverage from $1-million dollars to $300,000 over 30 years and save tens of thousands of dollars in premium payments.

How much is mortgage insurance?

Many different factors go into the cost of mortgage life insurance. There are individual factors pertaining to your insurability, such as age, smoking status, gender, health and more. Plus there are policy-dependent factors that hinge on your mortgage amortization period, like the amount of coverage you need and the term length.

PolicyAdvisor’s tools can help you get an online mortgage life insurance quote. They will take into account your gender, smoking status, health, family medical history, occupation and many other risk factors that will inform the potential costs of your insurance premiums.

You’ll instantly receive private mortgage insurance quotes from 30 of Canada’s largest insurers that may be drastically less expensive than lender-provided mortgage insurance premiums. Learn more about what affects the cost of coverage below, or get custom insurance quotes today.

What is the average cost of mortgage insurance?

The cost of a mortgage protection insurance policy (term life insurance) depends on personal factors and the details and depth of your desired coverage. Age, smoking status, and health are some of the biggest personal determiners of the cost of a term life policy. The length and amount of coverage you need may be dictated by your outstanding mortgage balance and the years of payments you have left.

| Age | Male | Female |

| 25 | $31 | $22 |

| 35 | $33 | $26 |

| 45 | $75 | $54 |

| 55 | $223 | $155 |

| 65 | $716 | $487 |

Term life insurance premiums, $500,000 death benefit, non-smoking, 20-year term

Frequently asked questions

No, mortgage life insurance is a different type of insurance than CMHC coverage. They are totally separate policies that provide coverage for very different things.

Mortgage life insurance is a financial product meant to protect you and your loved ones, should you pass away during the amortization period of your mortgage.

CMHC insurance exists to protect your lender should you default on repaying your mortgage loan. It is also known as mortgage loan insurance.

Mortgage loan insurance is mandatory in Canada if your downpayment for your mortgage is less than 20 percent. You can avoid paying mortgage loan insurance (or CMHC Insurance) if you secure a larger downpayment

We are always building relationships with new potential partners to offer Canadians the most comprehensive choices for mortgage protection insurance policies. Compare Canadian insurance companies now with our online tool.