Trusted by Canadians

The Gold Standard

They are the Gold Standard of Client Experience. The whole process was simple, hassle-free, uber transparent and all of this at no cost. Our advisor’s knowledge and attitude reeled us in from the first call. We felt as if we were premium clients.<...

Lipika

Knowledgeable and helpful

Very knowledgeable and helpful in determining the best plans for my son and I and he took the stress out of the process. Fully explained all of the options available to me, and answered all of my questions. I know that I made an informed decision ...

Franz T

Skeptical to believer

First I was skeptical about high reviews but anyways PolicyAdvisor. I could see that they are trying to give best details they have and guide us to choose policy rather than selling it. Rarely I type in reviews. I can say that PolicyAdvisor is wor...

Meenakshi N

Excellent service

Thank you for the excellent customer service. You’ve been very supportive in all our questions. After the video call, he didn’t really push to sell. We appreciate your time, and support in giving us updates and follow-ups and phone calls until we ...

Jessa Y

Genuinely Cared

My advisor genuinely cared about making sure I was comfortable and informed throughout the process, and patiently answered my many questions. He also always followed up to make sure I was up to date on my application process.

Jessica F

Simpler than expected

Answer all our questions in a timely manner, and the process was much more simple than I was expecting. We had our life insurance sorted and approved within a few days. I really like that they did the comparisons of policies for us.

Joanne V

Life Insurance made easy

Was looking for a life insurance policy and the search was exhausting by conventional means, until I found PolicyAdvisor. My representative was excellent, and explained all my options and preferred quotes. Life Insurance made easy, thank you all a...

Pedro

Unbiased advice

If you’re looking for best rate and an advisor, I would highly recommend PolicyAdvisor. They are expert in finding the best insurance provider. They are reliable and give unbiased advise. I’m glad I came across Policy Advisor online as they helped...

Zeny D

A walk in the park

I was able to derive a personalized quote within a minute. From there on it was as smooth as taking a walk in the park. I did not have to wait in long lines, could chart my progress, and had full control of my application.

Mayank

Super easy

I’d previously reached out to one of the big insurance companies directly but found them so unresponsive and uninterested. I’m glad we found PolicyAdvisor. They made comparing options easy so we found something that worked for our need...

Lindsay

What is children’s life insurance in Canada?

Children’s life insurance is a permanent (whole life insurance) policy that is issued on the life of a child or grandchild in Canada. Children’s whole life insurance policies provide:

- Lifelong insurance coverage as long as the premiums are paid

- Cash value accumulation that the child can use later in life for major goals such as paying for education, buying a car, or making a down payment on a first home

- The benefit of getting an insurability guarantee at a young age

- Fixed or level premiums, especially if the policy is structured as a limited pay whole life plan, where premiums are paid for a set number of years, after which the policy is fully paid-up

In short, children’s life insurance combines lifelong protection with a steady savings component, giving your child or grandchild a financial head start and peace of mind.

How does children’s life insurance work?

Children’s whole life insurance is typically owned by the parent or legal guardian/caregiver of a child, who pays regular premiums. Since insurers consider children to be “low-risk” the premiums are usually lower and there is no medical exam required.

The policy is transferred to the child once he/she reaches adulthood. In case a child dies while the whole life insurance policy is active, the insurance company pays a lump-sum death benefit to the parent or beneficiary.

Children’s life insurance remains in force for life (if premiums are paid).

Participating policies may pay non‑guaranteed dividends, which can be used to buy paid‑up additions, reduce premiums, or be taken in cash. This provides your child with both lifelong insurance coverage and a head start on their financial savings and monetary goals.

Whole life insurance accrues a cash value, which the policyholder can withdraw from, like a savings account or use as collateral for a loan from a financial institution.

Who can buy life insurance for kids?

A children’s life insurance policy is typically purchased by a parent, grandparent, or legal guardian, someone with caregiving or financial responsibility for the child.

Does children’s life insurance require a medical exam?

No, most children’s whole life insurance plans in Canada don’t require a medical exam for standard coverage amounts.

What is the age limit for children’s life insurance?

Most Canadian insurance companies allow you to purchase children’s life insurance up to the age of 17 or 18, depending on the insurer and the policy type.

Children’s whole life insurance not only provides lifelong protection but also includes a valuable savings element called cash value. This cash value grows tax-deferred over time, offering additional financial benefits alongside the guaranteed death benefit.

What is cash value in children’s whole life insurance?

Cash value in children’s whole life insurance refers to the savings component that is included in these policies, in addition to the guaranteed death benefit. A portion of the premiums that are paid by you for your child’s policy goes towards building the cash value that grows on a tax-deferred basis. Unless the cash value is withdrawn, there is no tax applicable on it.

The cash value typically increases over time due to interest and investment earnings. Policyholders can choose to withdraw their cash surrender value or can take out loans using their policy’s cash value as collateral.

As long as premiums are paid for the children’s life insurance, the policy remains in force and gradually builds cash value; a savings reserve that grows over time based on the insurer’s guarantees.

In the case of a participating whole life plan, the policy could also earn dividends (based on the discretion of the insurer) that one could use to pay for additional coverage or reduce future premiums.

Why buy children’s life insurance in Canada?

Children’s life insurance is a thoughtful and practical way for parents to secure lifelong coverage and build long-term savings that grow as their child grows.

Key benefits of children’s life insurance are:

- Lifelong financial protection: The policy stays in force for the child’s life, ensuring future financial stability

- Affordable premiums: Buying early ensures a low premium that remains stable even when the child is older

- Financial flexibility: Access the cash value later for education or other goals

- A legacy that grows: Build a financial gift that increases in value over time

- Peace of mind: Know they’ll always have coverage, no matter what life brings

Why is child life insurance in Canada a popular choice among grandparents?

For grandparents, buying life insurance for a grandchild isn’t just a policy; it’s a lasting gift of love and security. Child insurance is affordable to start, grow in cash value over time, and ensure a lifelong protection for their grandchildren.

Children’s life insurance vs. Registered Education Savings Plan (RESP)

A Registered Education Savings Plan (RESP) is designed specifically to fund post-secondary studies. RESP has a lifetime contribution of $50,000 and can only be used for education at eligible institutions on the Designated Educational Institution List. If the beneficiary does not attend a qualifying program, government grants must be returned, and investment income may be withdrawn as an Accumulated Income Payment (AIP), which is subject to tax and possible penalties.

Children’s life insurance, on the other hand, provides lifelong protection along with flexibility. It builds cash value over time, which can be accessed for any goal including education, a first car, a home down payment, or even starting a business. It’s a way to combine financial protection with long-term growth potential.

| Children’s life insurance | Registered Education Savings Plan (RESP) |

|---|---|

| Funds can be used for any purpose | Educational Assistance Payments (EAPs) must be used for eligible post-secondary education, but there is no strict requirement for receipts; funds are released upon enrollment |

| Cash value can be accessed via withdrawals or policy loans (tax implications may apply) | EAPs are available once the beneficiary enrols in an eligible post-secondary program |

| Policy loans are generally not taxable when received; tax consequences may arise on disposition or if the policy lapses | Growth/grants are taxable to the students when withdrawn. |

| No fixed maximum, but limits apply under insurer rules and Maximum Tax Actuarial Reserve (MTAR) guidelines | Lifetime contribution limit is $50,000 per beneficiary |

| Returns are typically lower and more stable than RESP equity investments, but actual returns depend on policy type and market conditions | May be exposed to volatility depending on chosen investment plans |

| Doesn’t have matching government contribution | Canada Education Savings Grant (CESG) matches 20% of annual contributions up to $500/year, but unused room can be carried forward, allowing up to $1,000/year if there is carry-forward |

Child term rider vs. children’s life insurance

A children’s term insurance rider is an optional add-on available for most insurance policies that offers term insurance protection for the children of the insured at an additional cost. The child term rider offers no cash value, the coverage is not permanent, and the maximum death benefit is substantially lower than a standalone policy.

A child rider can be typically added to the parent’s insurance policy when they apply for coverage, but age limits and rules may differ by insurer.

Most insurers require child rider addition at policy issue, but some allow later addition with evidence of insurability. Child rider coverage typically ends when the child turns 25 or the parent turns 65, though exact terms may vary by insurers. Some insurers allow the child rider to be converted to a permanent insurance policy, typically between the age of 21 and 25, though conversion options may vary by providers.

In contrast, children’s life insurance is a standalone whole life policy that offers lifelong protection and cash value growth. Children’s life insurance can be purchased independently by a parent, grandparent, or legal guardian and continues for life as long as premiums are paid.

| Child term rider in Canada | Children’s life insurance in Canada |

|---|---|

| Dependent rider, added on to parent’s or legal guardian’s insurance policy | Independent, individual insurance policy |

| Has to be added at the time of purchasing policy for a parent | Can be purchased anytime before the age of 18 |

| Must be purchased by parent or legal guardian | Can be purchased by parent, grandparent, legal guardian |

| Has an expiry date based on either the age of the child (25 years) or the parent (65 years), whichever comes first | Permanent coverage with no expiry date |

| Limited coverage amount, usually up to $30,000 max | Larger possible coverage amounts are available |

| Provides a fixed, level death benefit | Coverage amount can grow through paid-up additions from participating policy dividends |

| No cash value | Accrues cash value |

How much does children’s life insurance cost?

The cost of a children’s life insurance premium depends on several factors, including age, gender (where permitted by regulations), coverage amount, insurer, policy type (participating or non-participating), and premium payment period. Gender-based pricing is permitted for life insurance in most provinces, but not in Quebec for individual life insurance as of 2024.

For example, the estimated monthly premium for a three-year-old boy’s $100,000 whole life insurance policy is likely to be between $22 and $25 per month, with premiums paid for life. Alternatively, $250,000 in coverage for a one-year-old girl could be about $95–$105 per month with a 20–pay option.

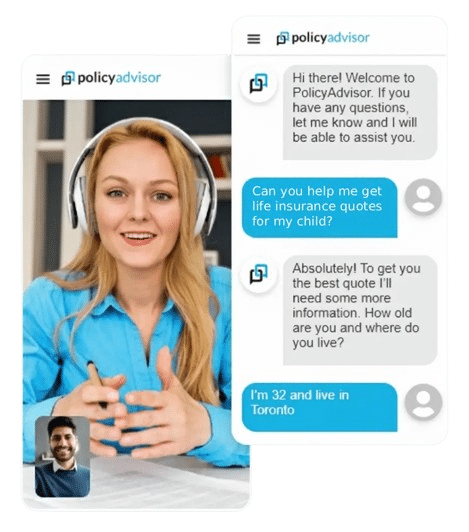

Get your free children’s life insurance quote today!

To get started with children’s life insurance, speak with one of our licensed advisors. We will guide you through a few simple questions about your child, your goals for coverage, and the level of long-term protection you want to build. From there, we compare leading Canadian insurers and present the most suitable policy options for your needs, so you can confidently secure early lifelong coverage at a competitive rate.

PolicyAdvisor is a top-rated children insurance broker in Canada, serving hundreds of businesses nationwide with trusted, CRA-compliant solutions.

PolicyAdvisor is a top-rated children insurance broker in Canada, serving hundreds of businesses nationwide with trusted, CRA-compliant solutions.

Frequently asked questions