- Employee benefits for small businesses in Canada typically range from $80 to $350 per employee per month, depending on the type of coverage offered

- Basic plans generally cost $80 to $200 per employee, while enhanced plans can go up to $250 and comprehensive coverage can reach $350 or more

- Offering health benefits can lead to improved employee satisfaction, with 79% of employees prioritizing health insurance over other compensation

- Small businesses can manage employee benefits costs effectively through strategies like leveraging virtual health care and optimizing benefit structures based on employee needs

Offering employee benefits is one of the smartest ways for small businesses in Canada to attract and retain top talent. In fact, according to the Canadian Life and Health Insurance Association CLHIA, 68% of all health insurance purchases in Canada come through group insurance plans, indicating how even very small teams can access competitive pricing with the right design.

On average, small business employee benefits can cost between $80 and $200 per employee/month for basic coverage, $100 to $250 for enhanced plans, and up to $350 for comprehensive options. Several factors may influence the cost of employee benefits in Canada, including company size, employee age, industry type, and claims history. In this blog, we will highlight how small businesses can still find cost-effective group plans tailored to their budget and employee needs. Read on to learn about small business employee benefits costs in Canada..

What are employee benefits for small businesses?

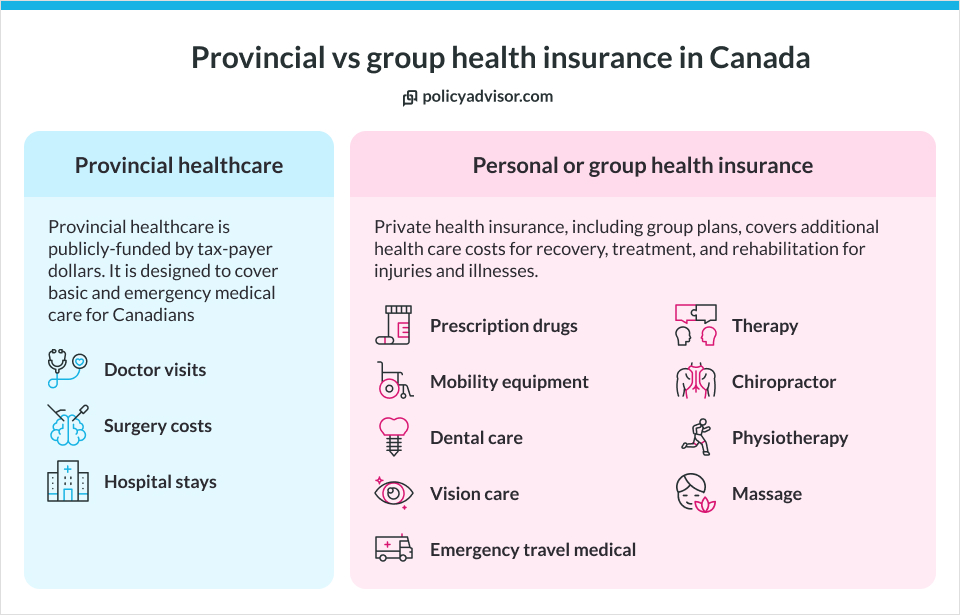

Employee benefits are non-wage benefits or compensation given to employees in addition to their regular salaries. For small businesses in Canada, these benefits typically include health insurance, dental care, life insurance, disability coverage, and other perks like mental health support and retirement plans.

Here are some common small business employee benefits packages in Canada:

- Group health insurance: Provides coverage for medical expenses, including hospital visits, surgeries, and prescription medications

- Dental and vision coverage: Covers cleanings, fillings, eye exams, and prescription eyewear

- Mental health coverage: Offers access to mental health services, including counselling and therapy, promoting overall emotional well-being

- Life and disability insurance: Offers financial protection in case of death, critical illness, or long-term disability

- Employee Assistance Programs (EAPs): Provide access to counselling, addiction support, and stress management resources

- Retirement savings plans: Include group registered retirement savings plans (RRSPs), deferred profit sharing plans (DPSPs), or pension plans with optional employer contributions

- Wellness perks: Can feature gym memberships, mental wellness apps, paid mental health days, or remote work options

- Health spending accounts: Health spending accounts (HSAs) allow employers to reimburse employees tax-free for eligible medical, dental, or wellness expenses not covered by public plans

Why should small businesses offer employee benefits?

Offering employee benefits can significantly improve employee satisfaction and retention. In a competitive job market, employees often prioritize employers who provide comprehensive health and wellness benefits over those who do not.

According to a survey by Benefits Canada, 79% of employees would prefer employee benefits over an appraisal, and the most preferred benefit is health insurance.

What does a group insurance plan for small business look like?

A group plan provides affordable coverage to the employees and their dependents. The group plans are available as Basic, Standard, and Enhanced options. Moreover, when it comes to providing employee benefits for small businesses, offering benefits such as health insurance, which provides extended coverage for medical expenses, and dental insurance, covering 80% of basic dental care, can positively impact your workforce’s health. Additionally, options like vision care, which includes an annual eye exam and $200 towards eyewear, and disability insurance, offering 60% of salary after 30 days of disability, are crucial for financial security.

Below is a breakdown of what is offered in group insurance for your employees:

| Coverage | Basic | Standard | Enhanced |

| Drug maximum | $5,000/person | $10,000/person | Unlimited/person |

| Paramedical services | $300/practitioner | $500/practitioner | $1,000/practitioner |

| Vision care |

|

$150/person for 24 months |

$300/person for 24 months |

| Dental (Basic & Major) | $700 combined | $1000 combined | $1500 combined |

| Dental Coinsurance | 50% | 50% | 80% |

| Recall exam | 1 every 9 months | 1 every 6 months | 1 every 6 months |

|

Pooled benefits (Life Insurance) |

$25,000 | $50,000 | $75,000 |

|

Health Spending Account (HSA) |

As requested | As requested | As requested |

| Travel insurance | Yes | Yes | Yes |

How much does a small business’s benefits package cost per employee in Canada?

On average, the cost of benefits per employee in Canada can range between $80-$200 per month per employee for a very basic plan, $100-$250 for a standard plan, and $150-$350 for an enhanced plan. These are indicative costs only and may change based on the coverage a small business chooses and the plan details.

Depicting the cost for basic, standard, and enhanced group health plans:

| Benefits | Basic plan | Standard plan | Enhanced plan |

| Health coverage | |||

| Employees – Single | $50/month | $70/month | $92/month |

| Employees – Couple | $98/month | $130/month | $180/month |

| Employees – Family | $110/month | $170/month | $195/month |

| Dental coverage | |||

| Employees – Single | $30/month | $60/month | $81/month |

| Employees – Couple | $100/month | $128/month | $140/month |

| Employees – Family | $170/month | $200/month | $250/month |

| Pooled benefits | |||

| Life insurance & AD&D | $12/month ($25,000) | $18/month ($50,000) | $26/month ($75,000) |

| Critical illness | Not selected | Not selected | Not selected |

| Long-term disability | Not selected | Not selected | Not selected |

| Total monthly premium | $3,000/month | $4,100/month | $5,500/month |

| Cost per employee | $150/month | $205/month | $275/month |

*This table provides an indicative cost for a small business that has 20 employees.

What is the cost of group benefits for employers as a percentage of payroll?

The average annual premium for group insurance typically varies based on the size of the business. For smaller businesses, the cost usually ranges from 10-20% of payroll, reflecting their more limited risk pools and potentially higher per-employee costs.

In contrast, larger companies may see premiums as high as 30% of payroll, due to their larger risk pools and more extensive benefit offerings. However, there are cost-effective options available for small businesses, where group insurance plans can be customized to fit tighter budgets, costing as little as 1% to 5% of payroll. This flexibility allows small employers to provide valuable benefits without overwhelming their financial resources.

Which are the cheapest group benefits plans available for small businesses?

Group health benefits plans can start as low as $79 per employee, depending on the level of coverage and the specific options selected. These lower-cost plans may include basic coverage, such as essential health and dental services, but they can be customized to include additional benefits as needed. Small businesses can explore various options to find a plan that meets their budget while still providing valuable protection for their employees.

What factors affect employee benefit costs for small businesses?

Factors like employee demographics, type of coverage, claims history, the location of the business, employee/employer share, and the industry affect the cost of employee benefits for small businesses.

- Business size and workforce demographics: The number of employees and their ages, health conditions, and family size influence benefit costs, as larger or older workforces typically result in higher premiums

- Type and extent of coverage: Offering more comprehensive benefits, such as dental, vision, disability, or prescription drug coverage, increases costs compared to basic health plans

- Location and industry: Regional health care costs and the industry in which the business operates can impact benefit expenses. Some regions or industries may face higher premiums due to risk factors or local health care costs

- Claims history: A company’s history of claims affects its premiums, as frequent or high-value claims may lead to increased costs in subsequent years

- Plan design and contributions: The way a plan is structured, including deductible amounts, copayments, and employer-employee contribution splits, plays a key role in determining the overall cost of benefits

How can small businesses lower the costs of employee health benefits?

Managing employee health benefits can be challenging for small businesses in Canada; however, by reducing prescription drug costs and incorporating government programs, small businesses can offer competitive benefits while keeping expenses under control.

Here are a few things small businesses can do to manage the costs of employee benefits:

- Cap prescription drug costs: Implementing caps on drug coverage or exploring hybrid spending accounts to manage rising prescription drug costs

- Incorporate virtual healthcare: Virtual consultations are cost-effective, improving access to care and reducing overall health care expenses

- Leverage government programs and tax credits: Take advantage of tax credits and government initiatives that support small businesses in offering employee health benefits

- Invest in preventive care: Wellness programs reduce long-term health care costs by promoting healthier lifestyles and preventing chronic diseases

- Pooled benefits: Small businesses can pool their employee benefit plans with other businesses, allowing them to share risks and lower premium costs. This collective approach allows small businesses to offer comprehensive health benefits while sharing the cost burden with other companies

Are employee benefits tax-deductible in Canada?

Yes, group benefits provided by an employer are generally tax-deductible in Canada. Employers can deduct the cost of providing group benefits, such as health and dental insurance, from their business income when calculating their taxable income.

It’s important for employers to consult with a tax professional or review the Canada Revenue Agency (CRA) guidelines to ensure they are complying with the specific rules and requirements for deducting group benefits.

How to get the cheapest group benefits insurance quotes in Canada?

Finding affordable group benefits insurance for your small business doesn’t have to be complicated. With PolicyAdvisor, you can secure comprehensive employee coverage at competitive rates, starting as low as $80 per employee per month.

At PolicyAdvisor, we make the process quick and hassle-free. You can rely on us to:

- Compare quotes from 30+ leading Canadian insurers in one place

- Get personalized group benefits quotes in under 60 seconds

- Tailor your plan to meet the specific needs of your employees and budget

- Speak with licensed advisors for expert guidance on the best coverage

- Rely on after-sales support, including claims assistance and plan updates

Whether you are a startup or an established small business, PolicyAdvisor helps you find the best group insurance plan at the lowest possible rate. Schedule a call with us today to get the best employee insurance quotes.

Frequently Asked Questions

Which employee benefit do employees value the most?

Health and dental insurance are often considered the most valued benefits among employees. Group health insurance provides more extensive coverage than provincial health plans.

What are the best small business employee benefits insurance companies?

Top providers include Manulife, Sun Life Financial, and Canada Life, recognized for their comprehensive offerings and competitive pricing.

How do employee demographics impact the cost of group benefits?

Employee demographics significantly affect group benefit costs; younger employees generally incur lower health care costs compared to older employees, which influences premiums.

What is the average cost per employee for benefits in Canada?

On average, employee benefits can cost between 15% and 30% of payroll, including both mandatory and supplemental benefits.

How can small businesses balance benefit costs with employee satisfaction?

Small businesses can balance benefit costs with employee satisfaction by offering flexible options that allow employees to choose benefits that suit their needs, promoting wellness programs to reduce long-term healthcare costs, and encouraging cost-sharing through copayments or deductibles. Focusing on key benefits like health and dental, and regularly communicating the value of the benefits package, can enhance employee appreciation and satisfaction.

What are the typical costs for a basic health and dental plan for small businesses?

Basic health and dental plans generally range from $80 to $200 per employee per month, depending on the coverage options selected.

The cost of for small business employee benefits in Canada typically ranges from $80 to $350 per employee per month, depending on the plan design. Factors influencing these costs include the number of employees, their demographics, industry type, and claims history. The most common benefits included in these packages are health insurance, dental care, vision care, life insurance, and disability coverage.

Canadian Life and Health Insurance Association. Fact Book 2023. Toronto: CLHIA, 2023