- Insurance brokers help small businesses customize their group insurance plans by first assessing the needs of the company. They start by evaluating employees' age, family status, and health concerns, alongside the business's budget

- Insurance brokers give small businesses access to a wide variety of group insurance options. They offer a detailed comparison of premiums, coverage, and any additional benefits. This ensures small businesses choose the best insurance plan to meet their budget and employees' needs

- They also guide small businesses through the entire purchase process and plan implementation. They offer ongoing management services, including handling policy renewals, assisting with claims, and offering continuous support

- Insurance brokers also help businesses enhance their group insurance plans by offering add-ons and wellness programs

- Brokers ensure that all group insurance plans comply with Canada’s insurance laws. They stay updated on any regulatory changes and help small businesses avoid legal complications by making sure their plans remain compliant

- A good insurance broker is experienced in insurance, offers clear communication, and has relationships with many insurers. They can help simplify the complex process of claims, policy management, and offer affordable insurance solutions that suit your business’s needs

Insurance brokers play a major role in helping small businesses get customized group insurance plans tailored to their specific team. This will include understanding the employee demographic, choosing the right amount of benefits, and even understanding the employer’s team size and budget requirements.

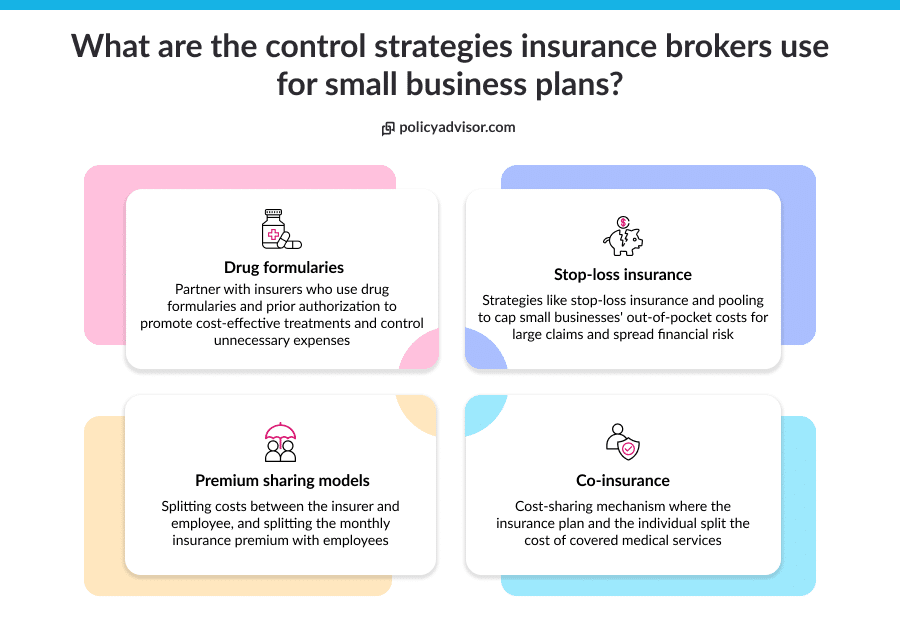

However, when it comes to investing in custom group health solutions, employers often look for ways to offer comprehensive coverage to their employees while keeping the cost under control.

The best group insurance brokers in Canada help small businesses cater to the diverse needs of their employees by providing customized insurance solutions. Let us understand this in detail further in the article.

How do brokers help in tailoring group benefits for small businesses?

Insurance brokers play a key role in helping small businesses get the right group health insurance plan for their employees. They assess the business’s specific needs and budget, offer customization options, such as adding riders for extra coverage, assist with managing the policy, handling paperwork, renewals, and any claims that arise.

Assessing your business needs

The first step in customizing group insurance for small businesses requires a thorough assessment of your business’s needs. Your insurance broker will mostly:

- Examine your employee demographics, such as age, family status, etc

- Identify the health concerns of your employees and check whether their medications are covered

- Consider your budget restrictions

- Assess how custom group benefits align with your business objectives

This assessment allows small business group insurance brokers to create a strategic approach that fits your business’s unique requirements.

Offering tailored plans

Small business insurance brokers compare policy offerings from multiple insurers and recommend the best plans that businesses can choose based on their preferences. These plans may include group health insurance, life insurance, disability insurance, dental plans, vision care, and other specialized benefits.

The right custom group benefits insurance broker will not simply recommend the cheapest group health insurance plan. Instead, they will help you compare premium costs, coverage levels, and other additional benefits to choose the plan that best suits your needs.

Know the types of group health insurance plans in Canada (2025)

Plan purchase and management

Insurance brokers also help in the purchase of group health insurance for small businesses, along with its ongoing management. Once a plan is selected, brokers help in the purchase process as well as the plan’s setup.

They also offer continuous plan management services, which include managing renewals, assisting with claims, and offering ongoing support.

Add-on services and wellness programs

Another important way to tailor group health insurance for small businesses is by adding extra benefits that improve the standard coverage. Reputable insurance brokers like PolicyAdvisor help small businesses choose multiple riders, such as critical illness insurance or accidental death and dismemberment (AD&D) riders, which are often not included in base plans but are important for the overall well-being of their employees.

Moreover, small business group insurance brokers also help businesses set up wellness programs that focus on keeping employees healthy. These programs not only support employees’ health and satisfaction but can also lead to higher employee retention in the long run.

Learn about the importance of mental health coverage for employees

Managing compliance

With an extensive knowledge of current insurance laws and regulations, brokers also help in managing any compliance-related concerns.

They ensure that the selected insurance plan complies with Canada’s insurance laws and regulations. Moreover, they also keep the small business owner updated with any changes in the regulations over time. This practice helps in reducing legal complications and penalties arising from non-compliance.

Know the benefits of small business group health plan customization

Which are the best group insurance companies for small businesses?

Many insurance companies offer a broad range of group insurance for small businesses. Here is a list of some group insurance companies that you can choose from.

| Insurance company | PolicyAdvisor ratings | What sets them apart |

| Sun Life | 4.5/5 |

|

| Canada Life | 4.5/5 |

|

| Manulife | 4.5/5 |

|

| Desjardins | 4.5/5 |

|

| Green Shield Canada | 4.5/5 |

|

| Blue Cross | 5/5 |

|

| Equitable Life of Canada | 4.5/5 |

|

| Benefits by Design (BBD) | 4.5/5 |

|

| Empire Life | 4.5/5 |

|

Deciding on the best insurance company depends on your business needs and financial goals. With the help of insurance brokers like PolicyAdvisor, you can compare the coverage and pricing of each company and choose the one that best suits your business.

What are the advantages of working with an insurance broker?

As a trusted advisor, an insurance broker works on your behalf to find the best custom insurance solutions for your business. They not only offer insurance expertise, claim assistance, but also help you save a lot of time and money.

Here are some benefits of working with an insurance broker for your small business employee benefits:

- With a deep knowledge of insurance products, industry trends, and insurance regulatory requirements, insurance brokers help you make an informed decision

- For small businesses, researching, comparing, and buying group health insurance can also be time-consuming. Insurance brokers like PolicyAdvisor.com make this task easier by comparing employee benefits from 30+ top insurance companies in Canada

- An insurance broker can also help you save costs, as you don’t end up buying a heavy premium plan. They understand your financial needs while still aiming to offer comprehensive group benefits coverage

- Moreover, their familiarity with multiple insurance products and pricing lets insurance brokers quickly identify affordable group insurance for small business, thus helping you save money in the long run

- Not only with the purchase process, but an insurance broker also helps businesses through the entire claim process, making it less complicated

How to choose the right insurance broker for your small business?

When choosing the right insurance broker, businesses should look for the following aspects:

- Extensive experience in insurance, preferably employee benefits

- Verified credentials and licensing

- Offers clear, responsive communication

- Has a wide network of insurer tie-ups in the market

- Helps you in claims support and plan management

- Has a good reputation, reviews, and testimonials

Our licensed insurance advisors at PolicyAdvisor work closely with businesses to understand their specific needs and offer custom group insurance solutions that simplify policy purchase and management.

Frequently asked questions

What is the role of an insurance broker in the group health insurance claim process?

An insurance broker not just assists with customizing a plan, but they also guide you through the entire claims process, making it simpler and less stressful. From helping fill out claim forms and gathering necessary documents to communicating directly with the insurance company on your behalf, an insurance broker manages it all.

Why should small businesses use insurance brokers for group insurance?

Small businesses should use insurance brokers for group insurance, as brokers make the purchase process easier and faster. They help customize group health insurance plans and take care of the ongoing management, claims, and compliance support.

What is the difference between insurance brokers and insurance agents?

Insurance brokers work for you. They are not connected with any one insurance company. They compare insurance plans from multiple insurers to find the best coverage for your needs. Thus, they are unbiased and offer honest opinions.

On the other hand, Insurance agents work for one or more insurance companies. They sell policies offered by the companies they represent, which means the options they offer you are limited. Their goal is to match you with one of their company’s plans, not necessarily the best plan for your business.

Do small business group insurance brokers offer ongoing service after buying the group plan?

Yes. From helping you choose the best group insurance plan to renewal, to claims support, to ongoing plan management, an insurance broker will handle all of it for you.

Apart from this, if you have any plan-related questions over time, insurance brokers are available to answer them for you.

How to choose a small business insurance broker in Canada?

To choose an insurance broker in Canada, make sure they are licensed and have a good reputation. Pick someone who works with multiple insurance companies, compares plans as per your business needs, and helps with claims too. Look for good service, fair fees, and experience of the broker as well. Our experienced and licensed advisors at PolicyAdvisor compare plans with 30+ insurers to help you get the best group health insurance plan at affordable rates.

As a small business owner, dealing with insurance can be both time and cost-consuming. Group insurance plans are a great way to support the physical well-being of your employees, but choosing the right plan can be tricky. Insurance brokers can help you find an affordable employee benefit plan with their expert guidance that supports your business goals and your team as well.