- Manulife’s plan offers extensive benefits, including health, dental, and professional services, ensuring employees receive necessary support for their health needs

- Businesses can customize coverage amounts from a minimum of $10,000 for basic life insurance up to $1.5 million, providing flexibility based on group size and needs

- Plans start at approximately $4,525 per month for 19 employees, with costs varying based on chosen benefits and employee demographics

- Features like Workplace Advisor and the Resilience Program provide mental health support, enhancing overall employee well-being

- What are the key features of Manulife’s Employee Benefits for Small Businesses plan?

- What does Manulife’s Employee Benefits for Small Businesses plan cover?

- What are the participation requirements for Manulife's group benefits plans?

- What is the cost of employee benefits for small businesses from Manulife?

- What we like about Manulife’s Employee Benefits for Small Businesses plan

- Frequently asked questions

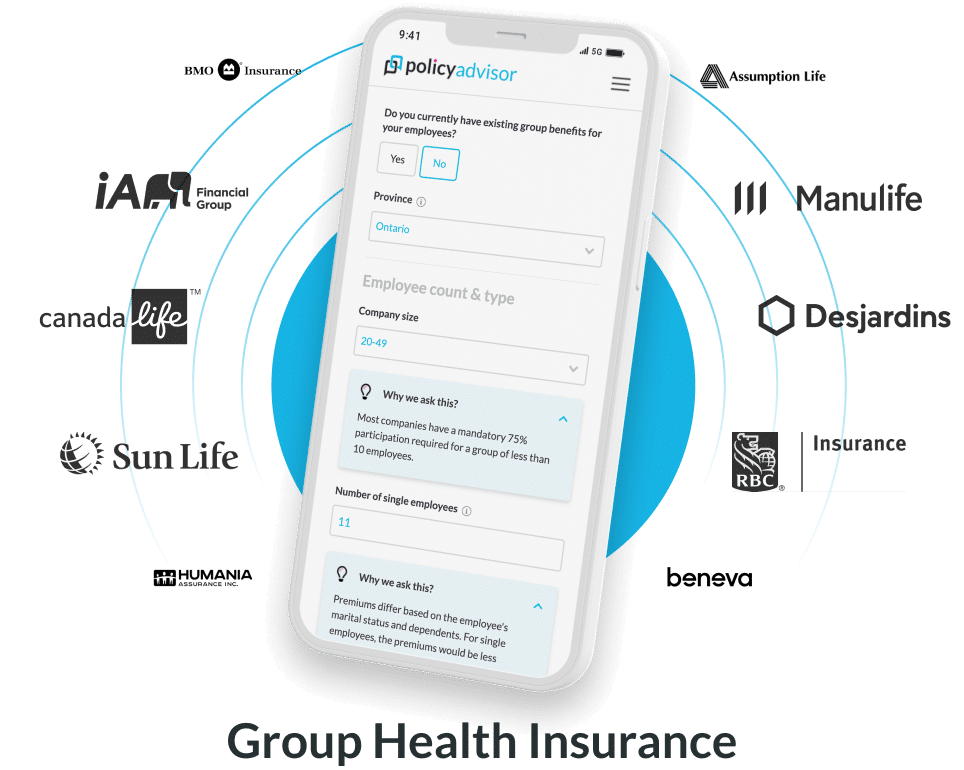

Manulife’s group benefits plan for small businesses is designed specifically for small businesses with 2 to 50 employees. This plan covers extended health care, vision and dental care, additional features like Health Spending Accounts, and more.

In this article, we’ll explore the key features of Manulife’s group benefits plan, available benefits, the costs associated with offering these benefits, and other details.

What are the key features of Manulife’s Group Benefits for Small Businesses plan?

Manulife’s Group Benefits plan is available to small businesses with 2 to 50 employees with coverage options starting at a minimum of $10,000 for basic life insurance and can extend up to $1 million for smaller groups and $1.5 million for larger ones. The plan includes a coverage reduction of 50% at age 65 and remains active up to age 75 for life insurance, with AD&D coverage lasting until age 71, ensuring ongoing protection for employees over the long term.

Key features of Manulife’s small business group health plan

| Category | Details |

| Minimum group size | 2-50 employees |

| Minimum coverage amount | $10,000 for basic life insurance |

| Maximum coverage amount | $1,000,000 for groups with 2 to 24 plan members and $1,500,000 for groups with 25 to 50 plan members |

| Reduction | Coverage reduces by 50% at age 65 |

| Termination age | 75 years for life insurance and 71 years for Accidental Death and Dismemberment (AD&D) |

What does Manulife’s Employee Benefits for Small Businesses plan cover?

Manulife’s group benefits plan for small businesses offers extended healthcare coverage, day-to-day care with flexible drug reimbursement options, professional services from chiropractors to dieticians, dental, and vision care.

Manulife’s employee benefits plan details

| Benefits/Coverage | Details |

| Day-to-day coverage | Drugs: Reimbursement options include pay-direct (drug card), brand/generic, or provincial formulary; deductible ranges from $0–$200

Professional services: Chiropractor, physiotherapist, psychologist, osteopath, podiatrist, naturopath, speech therapist, massage therapist, acupuncturist, athletic therapist, social worker, chiropodist, dietician, and audiologist (maximums range from $250 – $1,000 per year) |

| Extended healthcare | Hearing aids: $500 per 5 years

Private duty nursing: Up to $10,000 per year Orthopedic shoes & Orthotics: $150 (shoes) and $400 (orthotics) Out-of-Canada treatment: Lifetime max $5,000,000 |

| Income replacement | Short-term disability (STD): 55%–75% weekly earnings; benefit duration 13–52 weeks, depending on group size

Long-term disability (LTD): 60%–75% monthly earnings, benefit duration up to age 65 |

| Dental care | Basic services: 50%–100% coverage

Major services: 50%–80% coverage Orthodontics: 50%–60% coverage, with maximums ranging between $1,000–$3,000 depending on group size Recall exams: Options for up to 2 visits/year |

| Additional benefits | Vision care: Maximum $50–$300 every two years

Surgical stockings: $400 per year Ambulance services: Covered for emergency situations Trip cancellation and emergency travel assistance for up to 60 days |

How does Manulife’s employee and family assistance program work?

Manulife’s Employee Assistance Program consists of two key offerings: Workplace Advisor and Resilience. Workplace Advisor is for small businesses with 2 to 50 plan members, providing unlimited access to short-term counselling for employees and their eligible dependents.

This program focuses on addressing personal and workplace issues, allowing employees to seek help as needed. Additionally, it offers toll-free manager coaching, equipping business leaders with the tools to effectively handle employee concerns. With an online Human Resource library and courses for both leaders and employees, Workplace Advisor aids a supportive work environment.

Resilience is designed for larger organizations, requiring a minimum of 25 plan members. This program expands upon the services provided by Workplace Advisor, offering comprehensive, confidential counselling (mental health support) and health management services to managers, employees, and their families. Resilience ensures that support is accessible no matter where employees live, work, or travel across Canada, emphasizing convenience and accessibility.

Who is eligible for Manulife’s group benefits plans?

Manulife’s group benefits plans are designed for businesses with 2 to 50 employees. To qualify, employees must be actively working for the policyholder or any associated company on a full-time basis at their usual place of work in Canada. Full-time status is defined as a normal work schedule of at least 20 hours per week for a full 52 weeks each year, which also includes paid vacation time.

The eligibility criteria also include various waiting periods up to 12 months, allowing businesses the flexibility to select the option that best suits their needs. Additionally, there are five employee classes available within the plans, all of which are subject to Manulife’s underwriting guidelines, ensuring that the coverage is tailored to meet the diverse requirements of small businesses.

What are the participation requirements for Manulife’s group benefits plans?

Manulife has specific participation requirements for its group benefits plans that vary according to the size of the group. For small groups with 2 to 9 employees, either the employer or both the employer and employees must contribute 100% of the costs for coverage.

In larger groups, specifically those with 10 to 50 employees, the employer must still contribute 100% of the cost for the plan, while employee contributions can be reduced to a minimum of 75%. These requirements ensure that a significant portion of the workforce is engaged in the benefits program, promoting a healthier and more productive work environment.

Manulife’s group plan participation requirements

| Group size | Cost paid by | Minimum participation requirement (%) |

| 2 – 9 employees | Employer | 100% |

| Employer and Employee | 100% | |

| 10 – 50 employees | Employer | 100% |

| Employer and Employee | 75% |

What is the cost of Manulife’s group benefits plans?

The cost of employee benefits for small businesses from Manulife is approximately $4,525 per month for a small business with 19 employees. However, the actual cost may vary depending on the specific benefits chosen and employee demographics.

Sample plan for a small business with 19 employees

| Benefit | Volume | No. of lives | Rate | Premium |

| Life | ||||

| Basic Life | $462,500 | 19 | $0.119 | $55.04 |

| Non-evidence Limit | $25,000 | |||

| Accidental Death & Dismemberment (AD&D) | $462,500 | 19 | $0.060 | $27.75 |

| Extended Healthcare | ||||

| Single | 5 | $63.79 | $318.95 | |

| Couple | 8 | $151.88 | $1,215.04 | |

| Family | 6 | $155.79 | $934.74 | |

| Total Extended Healthcare | 19 | $2,468.73 | ||

| Dental care | ||||

| Single | 5 | $58.23 | $291.15 | |

| Couple | 8 | $113.15 | $905.20 | |

| Family | 6 | $129.51 | $777.06 | |

| Total Dental | 19 | $1,973.41 | ||

| Total | 19 | $4,524.93 | ||

*Indicative costs. Actual costs may vary based on industry specifics, employee demographics, and final plan design chosen.

Is dental care available to all Manulife group health plan members?

Yes, dental care is available to all plan members, offering options for both basic and major services coverage. However, to access orthodontic services specifically, the group must have at least 3 members enrolled with family coverage. This requirement ensures comprehensive support while providing flexibility based on the group’s size and coverage needs.

What we like about Manulife’s group benefits for small businesses plans

Manulife’s group insurance for small businesses plans focus on enhancing employee wellness and support. Benefits such as Workplace Advisor, Health eLinks, Health Service Navigator, and the Resilience Program are what make Manulife one of the most reliable group health insurers in Canada.

Some of the benefits our advisors recommend are:

Workplace Advisor is an employee assistance program for small businesses with 2 to 50 members and provides unlimited access to various forms of short-term counselling for employees and eligible dependents. Additional features include:

- Toll-free access to manager coaching

- Online Human Resource Library

- Online courses for leaders and plan members

- Eldercare and childcare search resources

- Trauma response service

Health eLinks® is an online knowledge center promoting health and wellness and includes an online health risk assessment (HRA) for plan members. It helps participants track health results provides access to valuable resources and action plans, and encourages proactive health management, benefiting the overall workforce

Health Service Navigator® serves as a one-stop access point for integrated health tips and medical condition information. It provides resources to navigate the Canadian healthcare system, and offers access to world-class doctors for second opinions on serious illnesses, ensuring reliable support during health challenges

Resilience® Program is available for groups with a minimum of 25 members. This offers confidential counselling and health management services. This program also enhances wellness offerings, fostering a supportive environment for employee health and well-being

How to get the best employee benefits rates from Manulife?

To get the best employee benefits rates from Manulife, we recommended speaking with one of our experienced advisors. Our licensed advisors can help you compare different coverage options from Manulife, get instant quotes, and find the most suitable employee benefits package for your small business.

Frequently Asked Questions

How can I check the status of my Manulife claim?

To check the status of your claim with Manulife, you can log into your Manulife account on their official website, where you can view the real-time status of your claims. Alternatively, you can use the Manulife mobile app, which allows you to access your claim information, submit new claims, track their progress, and receive notifications about updates. If you prefer direct communication, you can also contact Manulife’s customer service for assistance.

Does Manulife cover vaccines under their health plans?

Yes, Manulife typically covers vaccines as part of their extended health care plans. This coverage generally includes routine vaccinations, such as flu shots and travel vaccinations, that are recommended by healthcare professionals. However, it’s important to note that the specifics of vaccine coverage can vary depending on your individual plan type and the province in which you reside.

Are there any specific documents required to file a Manulife claim?

To successfully submit a claim to Manulife, you will need to complete a specific claim form based on the type of service (e.g., health or dental), which can be found on Manulife’s website or mobile app. Additionally, include your plan contract number and member certificate number, available on your benefits card or claims statement.

You must also submit original receipts for all expenses incurred, detailing the services provided, including dates, costs, and the provider’s information. Depending on the nature of the claim, you may need to provide additional supporting documentation, such as medical provider forms, statements from other health plans, or proof of payments made, to ensure a smooth and efficient claims process.

Manulife’s Group Benefits plan for small businesses with 2 to 50 employees offers a range of essential coverage options including extended healthcare, vision and dental care, and features like Health Spending Accounts. The plan provides flexibility in coverage amounts, with life insurance coverage options starting at a minimum of $10,000 and extending up to $1.5 million. Key benefits include comprehensive day-to-day care, professional services, and out-of-Canada treatment, alongside income replacement through short- and long-term disability.

1-888-601-9980

1-888-601-9980