- Co-operators has an AM financial rating of A and is backed by $64 billion in assets

- Co-operators has two participating whole life insurance policies - Protector™ and Ascend™

- The Versatile Term™ is available in varied term lengths, including 10, 15, 20, 25, or 30 years

Our Co-operators life insurance plan review

Co-operators is a full-service insurance co-operative, owned by 46 members, including co-ops, credit unions, and representative farm organizations. They offer home, auto, travel, life insurance, investment products, as well as group health and dental benefits.

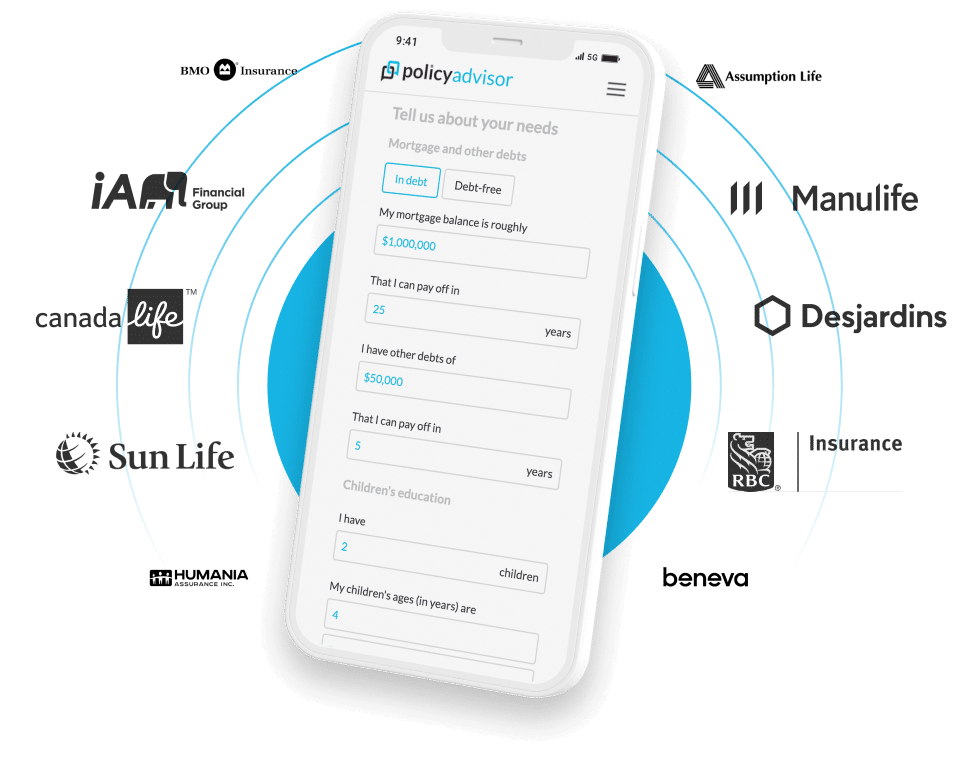

This insurance company has a strong AM Best rating and is financially stable with over $64 billion in assets. While they are a major player in the insurance industry, their term life insurance products are not competitively priced compared to offerings from our insurance partners at PolicyAdvisor. Use PolicyAdvisor’s quoting tool to find the right coverage through several competitive quotes from Canada’s best life insurance companies.

Co-operators life insurance pros and cons

Pros

- Option for a one-year term life policy for short-term coverage

- Offers a full suite of insurance products

- Financially stable organization

Cons

- One-year term life insurance only offers low coverage amounts

- High premiums for other term insurance products

- No online application process on the website

About Co-operators Insurance

The Co-operative Life Insurance Company was founded in 1945 by a group of farmers in Saskatchewan who lost most of their belongings, savings, and life insurance during the Great Depression. They found that traditional insurers did not meet their unique needs as farmers, so in 1945 with the financial support of the Saskatchewan Wheat Pool, they founded their own insurance co-operative.

A similar story was unfolding for farmers in Ontario, and by 1959, the Co-operators Life Insurance Association was incorporated for business. In 1978, the Saskatchewan and Ontario branches amalgamated to operate under the name The Co-operators. Since then, The Co-operators has expanded its operations Canada-wide.

Co-operators: Quick facts

- Founded: 1945

- Headquarters: Guelph, ON

- AM Best Rating: A (excellent)

- Better Business Bureau Accreditation and Rating: A+

- Assets: $20.6 billion

- Annual Premiums: $5.05 billion

What type of life insurance does Co-operators offer?

Co-operators offers a full suite of term, whole, universal, and no-medical life insurance products.

Co-Operators term life insurance

The Co-Operators provide a one-year, renewable policy as well as longer term life insurance options with terms of 10, 15, 20, 25, or 30 years. Its one-year term coverage has a maximum coverage amount of $475,000, while other terms offer up to $5 million.

Co-Operators whole life insurance

The Co-Operators have two participating whole life insurance products—Protector™ and Ascend™. The two products both offer guaranteed cash value after three years, dividends, and coverage for children. However, Ascend offers more choices for limited payment plans and the option to purchase paid-up additions with your dividends. Available coverage amounts for their whole life policies are not listed online.

Co-Operators universal life

Co-Operator’s universal life insurance policies have similar benefits to their participating whole life series, with the added bonus of flexibility in choosing your coverage options and investment accounts.

Co-Operators infinity term insurance

This policy is the Co-operators’ answer to a term to 100 life insurance policy. It is a permanent policy without the cash value savings component. It’s for those who like the stability of coverage for a lifetime, but want to pay less in monthly premium than they would for a regular whole or universal life policy.

What term life insurance amounts and coverage does the Co-operators offer?

The Co-operators has both a yearly renewable term insurance product and a separate product for longer terms.

Term Life 1

- Available Term Lengths: 1 year

- Maximum Amount of Coverage: $475,000

- Renewability: Yes

- Convertibility: Yes, before your 70th birthday.

Versatile Term™

- Available Term Lengths: 10, 15, 20, 25, or 30 years

- Maximum Amount of Coverage: $5 million

- Renewability: Yes

- Convertibility: Yes, before your 70th birthday.

Cost of term life insurance with Co-operators

As mentioned, the Co-operators is a single insurance provider that does not have the most competitive prices for their term insurance products. PolicyAdvisor allows you to instantly shop for insurance with over 30 insurance providers to ensure you get the best coverage for the best price.

Here’s how Co-operators stacks up to one of our insurance partners, Desjardins, for a 30-year-old, non-smoking female looking for $1 million in coverage for a 20-year term.

What other insurance products do the Co-Operators offer?

While Co-Operators got their start in life insurance back in 1945, they have since expanded to offer a full line of insurance products.

Critical Illness

Critical Illness insurance offers a lump-sum payment in the event you are diagnosed with a critical illness or injury such as heart attack, cancer, or stroke. Co-Operators offers four critical illness products—term 10, term 20, up to age 75, and up to age 75 with a 20 pay plan—that cover up to 25 conditions.

Mortgage Insurance

If you’ve recently purchased a home, mortgage insurance will pay off your mortgage in the event you pass away. Usually, this coverage is offered by the mortgage lender itself and will only cover the mortgage, and no other outstanding debts. However, Co-Operators offers a separate, portable mortgage protection plan that mirrors the benefits of term life insurance.

Home Insurance

As a property and casualty company, Co-Operator’s home insurance products are a big part of their business. Home insurance covers your property in the event your property is damaged or destroyed in an event such as a fire, flood, or windstorm.

Farm Insurance

Going back to their roots, Co-Operators offers farm-specific property insurance that is tailored to the unique needs of farmers, from hobby farms to large production. Their insurance products include coverage for livestock, machinery, poultry, farm structures, and pollution.

Business Life

Similar to their farm insurance product, Co-Operators has standard business property insurance that covers business stock, liability, equipment breakdown, and loss of income coverage.

Auto Insurance

Co-Operators offers competitive auto insurance for your car, motorcycle, and other recreational vehicles in provinces that do not already have public auto insurance programs.

Travel Insurance

Co-Operators offers different options for travelling Canadians, visitors to Canada, international students, and expatriates, administered by Allianz Global Assistance. You can choose from single and multi-trip coverage, trip cancellation and interruption, and also emergency medical top-up.

How can I find the best term life insurance?

As Canada’s best online life insurance advisor, we will assist you in comparing and choosing products across all our partner companies. Speak to our licensed advisors and we will be able to assist you in finding you the best coverage for your needs.

Frequently asked questions

Is Co-operators life insurance convertible?

Yes, both Term Life 1 and Versatile Term™ are convertible to permanent options, including whole life and universal life. This does not require medical evidence before age 70 and is ideal for young buyers planning for long-term needs.

What are the different types of life insurance options available with Co-operators?

Co-operators has life insurance options, including Co-operators term life insurance, Co-operators whole life insurance, Co-operators universal life, and Co-operators infinity term insurance.

Can I get other insurance products from Co-operators apart from life insurance?

Yes, you can get different insurance products from Co-operators, including critical illness insurance, mortgage insurance, home insurance, auto insurance, and business insurance.

The Co-Operators is a full-service insurance co-operative that offers home, auto, travel, and life insurance. Founded in 1945, it differentiates itself from corporate insurance companies by focusing efforts on member feedback and needs. Co-Operators offers a unique one-year renewable term insurance product with lower coverage amounts as well as traditional term life insurance. However, its products can be pricy.