- Whole life insurance accumulates a cash value as the policy matures

- Some whole life policies allow you to use your policy dividends which you can take as cash, reinvest, or save

- Enhanced life insurance uses policy dividends to purchase a 1-year term policy and paid-up additions to fund an ever-increasing death benefit

- Enhanced life insurance is a cost effective way to meet your death benefit goals and watch your death benefit increase without extra premium

Enhanced life insurance lets you put whole life policy dividends towards additional guaranteed life insurance coverage. This is possible through a combination of paid-up additions and one-year term life insurance policies. This option is ideal for anyone purchasing a whole life insurance policy and seeking the best premium-to-payout ratio and offers great bang for your buck.

However, enhanced life insurance consumes your whole life policy’s dividends, which you could otherwise withdraw as cash, use to reduce your premiums, or leverage for other purposes.

As with all policies, how to best use it depends on your own financial goals. PolicyAdvisor is here to explain how an enhanced life policy may benefit your circumstances. This article discusses enhanced life insurance and how you can leverage it.

How to use your life insurance policy dividends

A whole life policy may provide dividends based on the performance of your insurer or their investment portfolio. You can receive these dividends in a variety of ways to capitalize on the policy’s living benefits.

- Cash: The insurance company cuts you a cheque for the dividends earned.

- Premium reductions: The insurance company applies the dividends gained to your premium costs, meaning you pay less.

- Dividends on deposit: Dividends are put into a savings account managed by your insurer — the account generates interest, and withdrawals are allowed anytime.

- Paid-up additions: An additional coverage paid for by your policy dividends.

- Enhanced insurance: Increases your current coverage through a combination of paid-up additions and an additional term insurance policy.

Learn more about life insurance policy dividends.

What is enhanced life insurance?

Enhanced life insurance uses your policy dividends to “enhance” your life insurance coverage without additional costs.

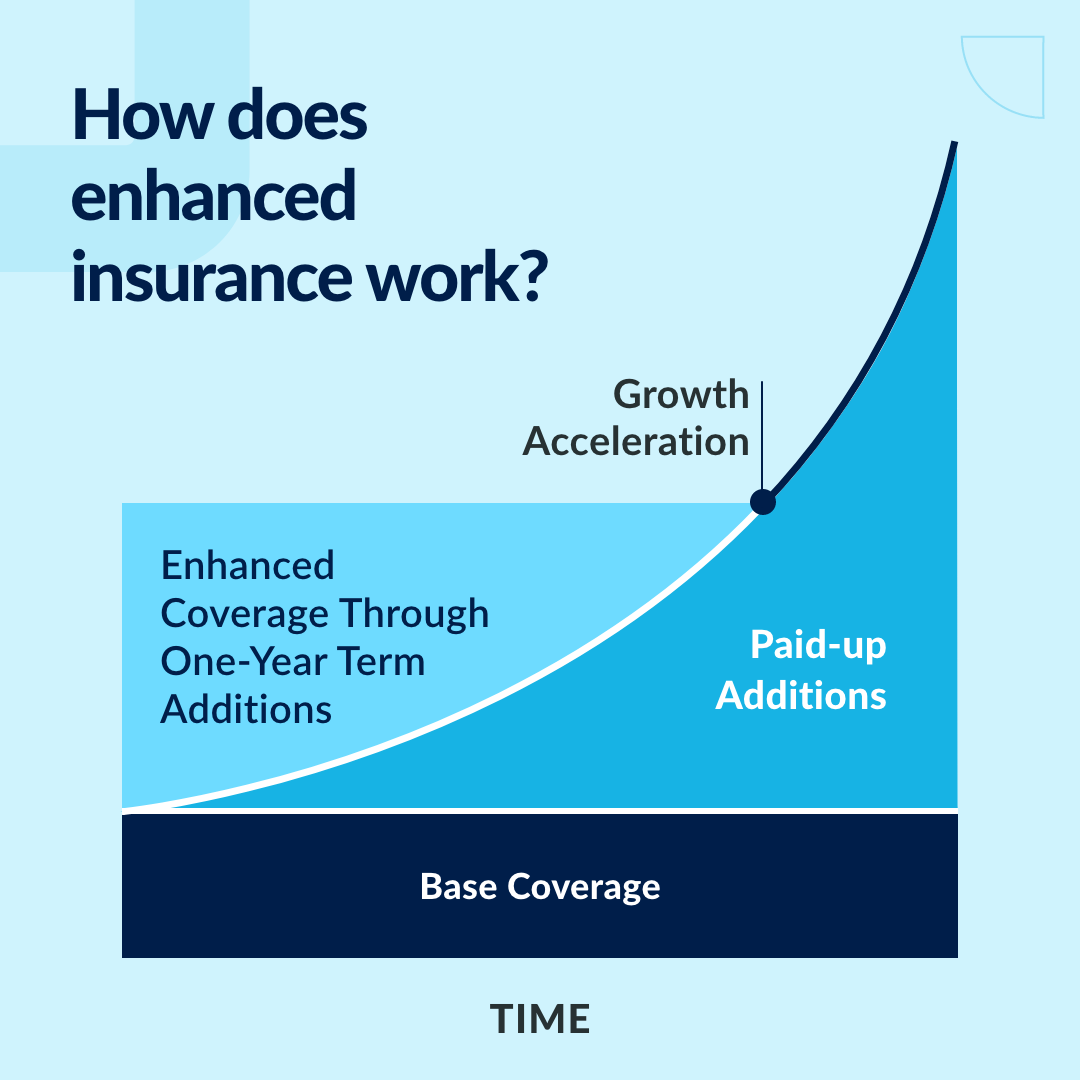

Enhanced life insurance puts your whole life policy’s dividends towards a combination of one-year term insurance policies and paid-up additions. The two combined guarantee a minimum death benefit while allowing cash value to build in the enhanced portion of the whole life policy.

In contrast, only putting dividends towards paid-up additions cannot guarantee a minimum death benefit because the payout depends on the cash value built up by paid-up additions. The one-year term insurance policies effectively maintain a minimum payout until the paid-up additions’ cash value is large enough to meet the desired payout on its own.

How does enhanced life insurance work?

Your whole life insurance policy has a base coverage amount. When you choose to use your policy dividends from this policy for enhanced insurance, a one-year term and paid-up additions are added to that baseline to increase your overall coverage to the new desired amount. As the cash value of your enhanced policy increases through the paid-up additions, the death benefit from the separate term life insurance coverage is no longer needed; the cash value of the paid-up additions have grown enough to reach your desired coverage amount.

Any dividends from the enhanced life coverage are reinvested into more paid-up additions, which accelerate the cash value growth of your policy.

The first year of your enhanced life insurance is likely composed entirely of the one-year term policy. The paid-up additions haven’t had time to build up a cash value.

In year two, another term policy comes into force with a slightly smaller death benefit. The death benefit should equal the difference between the cash value of your paid-up additions and your desired enhanced life insurance payout.

The term policy payout gets smaller as time progresses, and the paid-up additions’ cash value gets larger.

At a certain point, the paid-up additions build enough cash value to cover the entire payout of the enhanced life insurance. The coverage then no longer requires one-year term policies; this is called the “enhanced crossover point.”

Insurers can’t guarantee an enhanced crossover point because the point depends on your policy dividends. Your dividend may be higher in one year if your insurer or their investments do well or vice versa.

After the enhanced crossover point, policy dividends no longer go towards one-year term life policies. Additionally, the paid-up additions continue to build cash value through dividends from its own cash value and the original whole life policy. As a result, your payout may exceed your initial desired death benefit, at no cost to you.

Example of enhanced term life insurance

Suppose you have a whole life policy that’s worth $100,000, and you want to increase your death benefit by $30,000 through enhanced life coverage. In the first year, 90% of your whole policy’s dividends might go to a term policy for $30,000. The remaining 10% of the dividends would go towards paid-up additions. The paid-up additions may have a nominal cash value in its first year.

The cash value of your paid-up additions increase as the years go by — let’s say to $1,000 by year two. As a result, your enhanced life insurance purchases a smaller term life policy to make up for the fact that your original policy’s cash value has increased. More dividends can then be reinvested into the paid-up additions as they are not tied up in the 1-year term life insurance policy.

At year ten, the enhanced policy hits its enhanced crossover point. The paid-up additions’ cash value has reached $30,000, and 0% of the whole life dividends now go towards a one-year term policy.

In years after the enhanced crossover year, the paid-up cash value continues to grow.

| Term Life Policy | Paid-Up Additions | |||

|---|---|---|---|---|

| Dividend Investment | Death Benefit | Dividend Investment | Cash Value | |

| Year 1 | 90% | +$30,000 | 10% | +$300 |

| Year 2 | 85% | +$29,000 | 15% | +$1,000 |

| Year 3 | 80% | +$27,500 | 20% | +$2,500 |

| … | … | … | … | |

| Year 9 | 8% | +$5000 | 90% | +$29,000 |

| Year 10 | 0% | $0 | 100% | +$30,000 |

| Year 11 | 0% | $0 | 100% | +$33,000 |

| Year 12 | 0% | $0 | 100% | +$35,000 |

In this example, your policy’s death benefit has increased to $35,000 with no additional cost to you, because it was grown using your policy dividends.

Frequently Asked Questions

How is enhanced life insurance different from reduced paid-up insurance?

Reduced paid-up insurance lets you forfeit your whole life policy and take the cash value as the death benefit instead of the prior agreed-upon coverage amounts, premium payments, and other policy terms and conditions.

A reduced paid-up policy is “paid up” such that it doesn’t require further premium payments. The death benefit is also generally “reduced” compared to your original whole life policy payout.

With enhanced life insurance, you don’t forfeit your whole life policy — you’re just putting the dividends towards additional coverage. Enhanced life insurance still provides the coverage and the premium obligations of your original whole life policy.

Reduced paid-up insurance is generally for someone who wants to retain a death benefit without paying any premiums. In contrast, an enhanced life policy is for those who want the highest death benefit for the lowest premium payment.

Enhanced life insurance is also a policy dividend option that you select at the outset of your whole life purchase. Reduced paid-up options are a non-forfeiture option, which lets you receive partial benefits or refunds if you stop paying your insurance premiums.

How do I purchase enhanced term insurance?

You usually set up enhanced life insurance when you purchase a whole life policy. However, before diving right into the enhanced option, you and an advisor should determine the amount of life insurance you need and your monthly or annual life insurance budget.

Your desired payout and budget allow an advisor to structure your whole life policy into a base and the enhanced amount that fits your goals. It’s important to note that only participating whole life insurance policies allow you to capitalize on these dividends—non-participating life insurance does not allow access to policy dividends.

Enhanced life insurance is one of many options to leverage your whole life policy dividends. Whether it’s right for you depends on your preferences and circumstances.

Speak to one of PolicyAdvisor’s licensed insurance advisors today to determine whether enhanced life insurance could better you and your family’s financial position.

Permanent life insurance policies accumulate a cash value. Some whole life policies allow you to use the dividends generated from the cash value to fund an additional enhanced life insurance policy. This uses your policy dividends to purchase a combination of paid-up additions and a 1-year term life insurance policy to reach your intended coverage amount but at a lower cost.

1-888-601-9980

1-888-601-9980