- IFAs offer quick access to cash by using a permanent life insurance policy’s cash value as collateral

- Choosing the right lender helps secure appropriate borrowing limits, interest rates, and repayment terms

- Equitable Bank, Manulife Bank, and DUCA Credit Union are common lender options in Canada

- Regular reviews with a professional advisor are important to manage risks such as rising interest rates or fluctuating dividend scales

An Immediate Financing Arrangement or IFA, in Canada, lets business owners and high-earning individuals use the cash value of a permanent life insurance policy as collateral to secure a loan. Several Canadian banks and credit unions offer IFA programs in Canada. Some of the popular Canadian lenders offering IFA include Equitable Bank, Manulife Bank, DUCA Credit Union, and a few more. In the section below, we will take you through these lenders and what they offer.

How to choose the right IFA lender in Canada?

Choosing the right Canadian lender depends on several factors. Here are a few factors to help you select a suitable lender for your IFA plan:

- Borrowing limit: Confirm the percentage of cash surrender value (CSV) the lender will advance today and over time, and whether a “replacement of premium” option is available

- Interest rates: Compare interest rates across lenders and their historical stability to help protect your expected returns

- Ease of underwriting: Look at how complex the lender’s approval process is, what collateral they need, and how fast they can issue the credit

- Collateral requirements: Confirm whether the policy assignment alone is sufficient, or if additional security or guarantees are required, especially for premium replacement structures

- Availability of the advisor: Choose lenders whose dedicated advisor or relationship manager is accessible and experienced with IFAs, so any issue can be resolved quickly

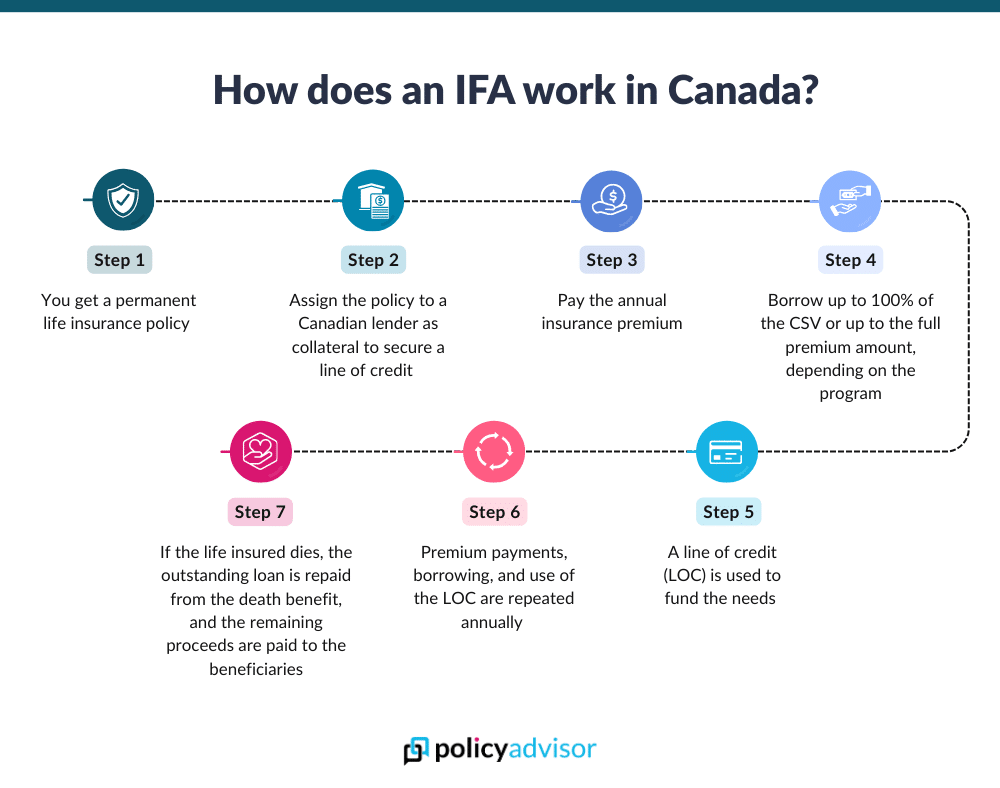

How does an IFA work in Canada?

Getting an immediate financing arrangement in Canada can become easy when you follow these steps:

Canadian lenders offering an immediate financing arrangement

Here is a list of popular Canadian lenders offering an Immediate Financing Arrangement in Canada:

- Equitable Bank

- Manulife Bank

- DUCA Credit Union

Equitable Bank IFA

Equitable Bank has a history dating back to 1970, when it was founded as the Equitable Trust Company. In 2013, it became a Schedule I Bank and now ranks as the 7th largest bank in Canada in terms of assets. Over the years, Equitable Bank has expanded its offerings with immediate financing arrangements or IFA to help you access up to 100% of the premium paid towards a permanent life insurance policy.

Here are some of the benefits of choosing Equitable Bank IFA:

- There is no additional collateral required except for the insurance policy

- Competitive interest rates so that you get better returns

- Use of technology for the complete documentation process and easy access to the loan

- An IFA is available to a wide range of borrowers, whether or not they are high net worth; the only requirement is an annual policy premium of $100,000

- You can choose from program 1 and program 2, depending on your net worth and FICO score

Eligibility:

You will be eligible to get an IFA from Equitable if you:

- Are a resident of Canada

- Have a whole life insurance policy or are in the process of obtaining a whole life policy with an annual premium of $100,000

- Meet the financial requirements to ensure that the loan can be paid back

Overview of Equitable Bank IFA

| Typical client profile |

|

| Collateral | CSV of a whole life policy from an approved carrier |

| Approved insurance carrier |

|

| Loan amount | $100,000 minimum annual premium |

| Premium frequency | Annual only |

| Loan repayment | Any time, without penalty |

| Application fee | $1000 or 0.25% of the annual premium amount, whichever is greater |

Manulife Bank IFA

Manulife Bank dates back to 1993 and is one of the Canadian banks founded by an insurance company. It operates as a wholly-owned subsidiary of Manulife Financial, one of Canada’s largest and most respected financial institutions. With an asset size of more than $29 billion, Manulife Bank has grown significantly over the past three decades. It has offered IFA programs since 1995.

Here are some of the reasons why you should choose Manulife Bank IFA:

- There is no maximum IFA size when you choose Manulife

- You can borrow up to 100% of the cash value of a whole life insurance policy or 90% against a Universal Life (UL) policy invested in Guaranteed Investment Accounts (GIAs)

- There is flexibility to choose from two structures: 100% CSV lending, or 100% replacement of premium, which requires paying the full premium and providing additional collateral

- There is no penalty for repaying the loan amount

- Experienced salespeople, loan adjudicators, and risk management people who know about IFA help you structure your IFA

Eligibility:

You will be eligible to get an IFA from Manulife if:

- You have a minimum IFA size of $300,000 over ten years, or $30,000 per year

Overview of Manulife Bank IFA

| Typical client profile |

|

| Collateral |

|

| Approved insurance carrier |

|

| Loan amount |

Minimum of $300,000 over ten years or $30,000 per year |

| Premium frequency | Annual |

| Loan repayment | Anytime, without penalty |

DUCA Credit Union IFA

DUCA Credit Union (DUCA Financial Services Credit Union Limited) was founded in 1954. Over the years, it has evolved into one of the largest member-owned financial institutions in Ontario. It has an asset size of $6 billion and offers a range of financial services, including immediate financing arrangements. DUCA’s Immediate Financing Arrangement is a strategy that combines permanent life insurance with a loan, giving clients both insurance protection and access to capital for other investments.

Here are some of the benefits of choosing DUCA IFA:

- DUCA makes the approval of a loan easier as it works with the major Canadian life insurance carriers

- A 100% lending ratio is available for whole life policies

- There are 3 primary structures to choose from: borrow the equivalent of 100% of the CSV each year, or the equivalent of 100% of the CSV and the entire premium each year, or 100% of the CSV plus the entire premium and a portion of net interest payments

- A competitive interest rate applies

Eligibility:

You will be eligible to get an IFA from DUCA when:

- The minimum loan amount is $50,000 and the maximum is $10,000,000

- It is used for a personal or corporate line of credit (LOC)

Overview of DUCA IFA

| Typical client profile |

|

| Collateral |

|

| Approved insurance carrier |

|

| Loan amount | $50,000 minimum |

| Premium frequency | Annual |

| Loan repayment | Any time |

| Application fee |

|

Equitable Bank vs. Manulife Bank vs. DUCA Credit Union: Which IFA lender fits your needs?

Here is a table that illustrates the key differences between Equitable, Manulife, and DUCA, the popular lenders in Canada.

Equitable vs Manulife vs DUCA

| Feature | Equitable bank | Manulife bank | DUCA |

| Minimum loan amount | $100,000 annual premium | $300,000 over ten years or $30,000 per year | $50,000 |

| Collateral requirements | CSV of whole life policy | CSV of whole life policy and additional collaterals, only if you opt for 100% replacement of the premium structure |

|

| Available structures to choose from | Program 1 and Program 2 | 100% CSV lending and 100% replacement of premium |

3 primary structures:

|

| Approved insurance carriers |

|

|

|

Is IFA really helpful in Canada?

An immediate financing arrangement is helpful for high‑income Canadians and business owners who need permanent life insurance but also want to keep their capital available for investments. It becomes helpful by providing liquidity to fund your immediate business and investment needs.

However, it is also a strategy that involves risks like rising interest rates, fluctuating dividends affecting CSV and policy performance, making it work best when carefully designed and monitored with a qualified advisor. Consult our licensed insurance experts who can help you decide if IFA is the right choice for you. We will help you choose the right strategy no matter what. Schedule a consultation with our advisors now!

Frequently asked questions

What is IFA in Canada?

An Immediate Financing Arrangement (IFA) uses the cash surrender value of a permanent life insurance policy as collateral for a line of credit. You maintain coverage while potentially accessing capital for business or investment purposes, subject to credit approval and lender advance rates.

Which lenders offer IFA in Canada?

Many Canadian financial institutions offer IFAs. Examples include: Equitable Bank, Manulife Bank, and DUCA Credit Union.

Is it worth paying an IFA?

An IFA strategy is worthy if you are a high-income earner or business owner who has strong, stable cash flow and can invest the borrowed funds at attractive returns. If your income is uncertain, your risk appetite is lower, or you cannot comfortably handle rising interest costs, the IFA strategy may not be beneficial for you.

How to apply for IFA?

To apply for an IFA in Canada, first, secure a permanent life insurance policy. Assign the policy to the lender as collateral, then, depending on the program, borrow up to 100% of the policy’s CSV or up to the full premium amount. Use the funds for qualified business or investment purposes as appropriate.

Is IFA interest tax-deductible?

Interest may be deductible when borrowed funds are used to earn income from a business or property, and other conditions are met. Tax outcomes depend on your facts. Get tax advice from a financial advisor before implementing an IFA strategy.

An Immediate Financing Arrangement (IFA) lets you use the cash surrender value of a permanent life policy as collateral for a line of credit. In Canada, lenders such as Equitable Bank, Manulife Bank, and DUCA Credit Union offer IFA programs. Compare interest rates, collateral, and the underwriting process to choose the right lender for your situation.