- You can borrow against some permanent life insurance policies in Canada by assigning the policy to a lender as collateral for a secured loan. This works with permanent life insurance policies that build cash value, such as whole life or universal life

- Using life insurance as collateral gives you tax-free access to funds, protects your personal assets, and may offer competitive interest rates

- Borrowing against your life insurance can reduce death benefits, risk policy cancellation, and may require additional collateral if loan conditions change

Permanent life insurance policies in Canada, including whole life and universal life, can be used as a financing tool. By borrowing against the policy’s cash value, you can access funds without selling investments or using personal assets. This approach is commonly used by business owners, incorporated professionals, and high-net-worth individuals to fund business growth, real estate purchases, or urgent cash needs while keeping their coverage in place.

In this guide, we will discuss how to use whole life insurance as collateral in Canada, along with the key risks and benefits to consider before using your policy to secure a loan.

What types of life insurance can be used as collateral?

You can use whole life or universal life insurance as loan collateral because they build cash value that lenders can secure against. These permanent policies grow cash value over time, giving banks a guaranteed asset to lend against.

Most banks will not accept term life insurance as collateral because it has no cash value and may expire before the loan is repaid. If the term expires before the loan is repaid, it creates repayment risk for the lender, making permanent policies the preferred option for collateral borrowing.

How to borrow against whole life insurance in Canada

You can borrow against your whole life or universal life policy in two main ways: through a policy loan from your insurer or a collateral loan from a bank. Both options let you access your policy’s cash value without cancelling coverage.

Policy loans (from the insurer)

- Borrow directly against your cash value

- No lender approval required

- Simple process

- Policy remains in force if the loan is managed properly

Collateral loans (from a bank or financial institution)

- Use your cash value as security for a bank loan

- Banks may allow borrowing up to 100% of the cash value

- Loan proceeds are typically tax-free

- Unpaid balances reduce the death benefit

Both options provide liquidity and flexible repayment while keeping your life insurance coverage intact.

How does using cash value as collateral work?

The cash value component of a whole life insurance policy can be used as security for a loan, giving a financial institution, such as a bank, a guarantee that the money borrowed will be repaid. Here’s how it works:

- Set up a cash value life insurance policy: First, purchase a whole life insurance policy. Whole life policies, both participating and non-participating, generate cash value. If you need help choosing the right policy, speak to our licensed advisors at PolicyAdvisor for personalized recommendations

- Wait for the policy to accumulate value: It typically takes a few years for your policy to accumulate meaningful cash value. The exact timeline depends on your policy type, age at purchase, and premium funding. Some insurers may also have rules on how early you can access cash value, so review your policy guidelines

- Apply for the loan: Once you have sufficient cash value, apply for a loan with a lender, usually a major Canadian bank or another financial institution. Complete the required loan application process

- Use the policy as collateral: During the loan application, list your cash value life insurance policy as an asset to use as collateral. The bank will review the cash value and determine how much they are willing to lend

- Complete a collateral assignment with your insurer: To finalize the collateral assignment, you legally assign the policy to the lender. This does not make the lender a beneficiary. The assignment gives the lender rights to the policy proceeds up to the loan amount; any remainder goes to your named beneficiary

Eligibility and required documents for loan approval

To qualify for a loan secured by your whole life or universal life insurance policy, lenders typically require the following eligibility criteria and documents:

- An active, in-force permanent policy (whole life or universal life) with a positive cash surrender value (CSV)

- No irrevocable beneficiary designated on the policy, or written consent obtained from the irrevocable beneficiary

- All premiums must be current with no pending lapses or overdue payments

- A recent in-force illustration and cash surrender value statement provided by your insurance company to confirm how much cash value is available for collateral

- Completed collateral assignment form submitted to the insurer, along with an official acknowledgement letter confirming the assignment

- Credit application form detailing the purpose of the loan, as required by the lending institution

- Proof of identity and income may also be required by the lender to assess creditworthiness

- Having these documents ready and meeting eligibility requirements helps ensure a smooth and timely loan approval process. Note that in Quebec, special attention is required to obtain written consent from any irrevocable beneficiaries to proceed with collateral assignment

Borrowing against life insurance can affect your death benefit. Here’s an example illustrating how a collateral loan impacts the death benefit and the accumulated interest over time.

| Feature | Amount | Details |

| Cash Surrender Value (CSV) | $120,000 | Accumulated value available as collateral |

| Loan Amount (75% of CSV) | $90,000 | Bank lends 75% of CSV |

| Interest Rate | Prime + 1.5% (8.2%) | Annual interest for five years |

| Annual Interest Payment | $7,380 | Interest-only payment per year |

| Total Interest Over 5 Years | $36,900 | Accrued if unpaid |

| Total Owed if Loan Unpaid | $126,900 | Principal + accrued interest |

| Original Death Benefit | $200,000 | Before loan deduction |

| Death Benefit After Unpaid Loan | $73,100 | Remaining for beneficiaries

|

This approach provides liquidity, protects personal assets, and gives tax-free access to funds without selling investments.

What are the benefits of using life insurance as collateral for a loan?

Using life insurance as collateral offers several financial advantages, including tax-free access to funds, protection of personal assets, and competitive interest rates.

Benefits of collateral loans on life insurance:

- Access liquidity without selling your investments: You can borrow tax-free while your policy stays in force, giving you quick funds without sacrificing other assets

- Protect your personal assets: Your home, car, and other property typically remain safe if you struggle to repay the loan. Larger loan amounts may require additional collateral or guarantees

- Enjoy lower interest rates than unsecured loans: Since the loan is secured by your policy’s cash surrender value, you often pay less interest compared to unsecured borrowing. Always compare current rates for your situation

- Keep your coverage active: Your life insurance remains in force, ensuring your beneficiaries stay protected throughout the loan term

- Benefit from faster approvals and flexible repayment: Collateral loans usually process quicker and offer repayment options that suit your needs better than unsecured loans

- Potentially deduct interest paid: If you use the loan to earn income from a business or rental property, you may be able to deduct the interest, consult a tax expert to confirm

What are the risks of borrowing against life insurance in Canada?

Borrowing against your life insurance comes with financial risks, including reduced death benefits, possible policy cancellation, and the potential need to provide additional collateral if loan conditions change.

Key risks to consider before using life insurance as collateral:

- Reduced death benefit if unpaid: Any outstanding loan balance is deducted from your policy’s death benefit first. To manage this risk, set up a clear repayment plan and schedule annual reviews to stay on track

- Policy cancellation risk: If you default on the loan, the lender could surrender your policy’s cash surrender value (CSV), causing coverage loss. Keep premiums current and maintain a healthy cash buffer within the policy to reduce this risk

- Interest rate and cash value growth changes: Rising loan interest rates or slower cash value growth may require you to provide additional funds or collateral. Choose conservative growth assumptions when taking the loan and monitor your loan-to-value (LTV) ratio regularly

- Possible additional collateral requests: Lenders may ask for more collateral over time, especially for long-term loans. Negotiate loan covenants upfront and maintain consistent policy coverage to minimize this possibility

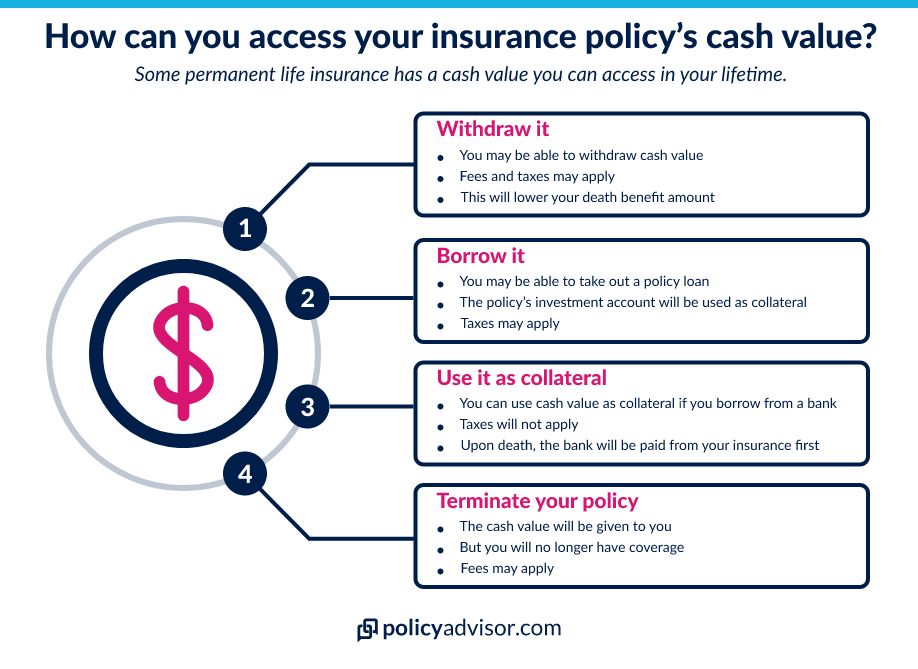

What are some ways to leverage your life insurance policy’s cash value?

Besides using your policy as collateral for a bank loan, you can access your life insurance cash value in other ways to meet financial needs. Here are the most common options:

- Withdraw it: You may be able to withdraw some or all of your policy’s cash value directly. Keep in mind, fees and taxes may apply, and any withdrawals will lower your death benefit amount

- Borrow it: You can take out a policy loan from your insurer, using your policy’s investment account as collateral. Interest rates vary, and taxes may apply depending on your provider and how you use the funds

- Use it as collateral: You can secure a bank loan by using your policy’s cash value as collateral. Loan proceeds are generally tax-free, and upon death, the bank is repaid from the insurance before your beneficiaries receive the remainder

- Terminate your policy: If you no longer want coverage, you can end (surrender) your policy and receive the accumulated cash value. This option comes with fees and means you give up your life insurance protection

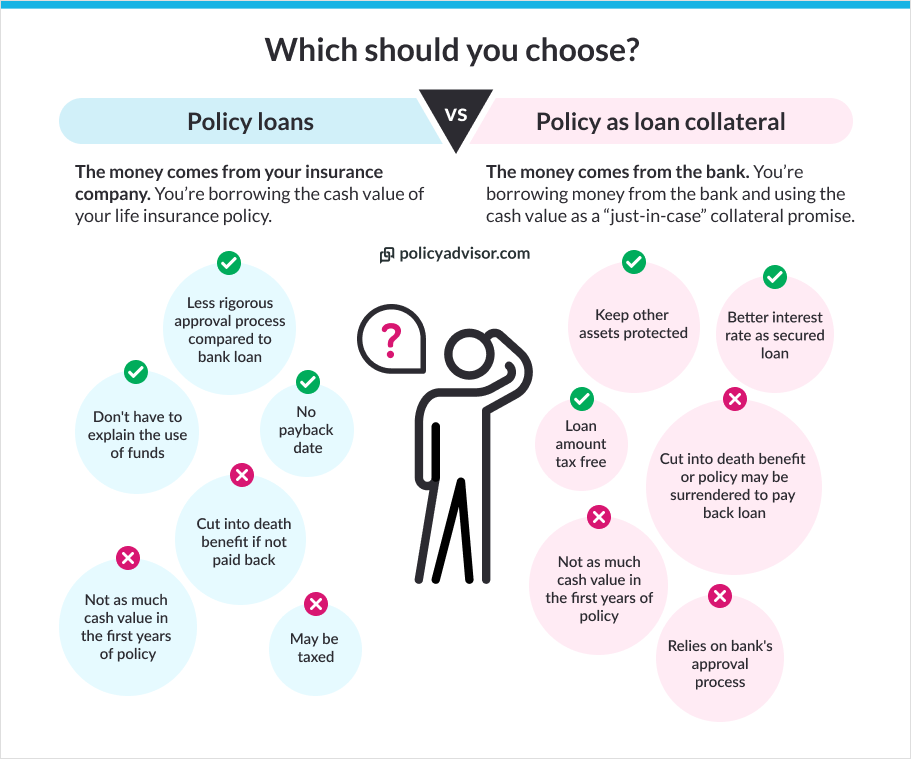

Life insurance policy loans vs. collateral loans

The main difference between a life insurance policy loan and using your life insurance as loan collateral is the lender (who you’re getting the loan from).

In life insurance policy loans, the money comes from your insurance company. You’re borrowing the cash value of your life insurance policy.

In collateral loans, the money comes from the bank. You’re borrowing money from the bank and using the cash value as security. In both cases, the lender has a first claim on the death benefit up to the outstanding balance.

| Feature | Policy Loan | Collateral Loan |

| Where the money comes from | Insurance company | Bank or lender |

| Credit check required? | No | Yes, typically |

| Loan is secured by | Cash value of your policy | Cash value used as collateral |

| Impact if unpaid | Any outstanding balance plus interest is deducted from your policy’s death benefit. If the accrued interest exceeds your policy’s cash value, your coverage may lapse | The lender has first claim on the death benefit if you pass away, or may surrender your cash value if you default. Any remaining funds go to your beneficiaries |

| Interest rates | Typically higher | Often lower due to collateral |

| Repayment flexibility | Very flexible, no fixed schedule | Structured repayment required |

| Best for | Low credit score / fast access | Larger borrowing amounts & lower interest costs |

Overall, using whole life insurance as collateral gives you predictable access to credit while keeping your coverage intact.

Policy loan or collateral loan: which one to choose?

Choosing the best option depends on your financial situation:

- Choose a policy loan if you need fast, easy cash without a credit check

- Choose a collateral loan if you qualify for bank financing and want lower interest rates

Both rely on your death benefit as protection to ensure the lender is repaid.

When you borrow against a life insurance policy, is the loan taxed?

No, loans secured by your life insurance policy, whether from a bank or your insurer, are generally not taxable as long as your policy stays in force. Withdrawals may be taxable if they exceed your policy’s adjusted cost base (ACB). Tax treatment depends on your individual policy details and how you use the funds.

How ACB affects taxation

Understanding your policy’s Adjusted Cost Base (ACB) helps determine how much you can safely withdraw or borrow without triggering taxes. The ACB reflects the total premiums paid for a permanent life insurance policy, reduced by the prescribed Net Cost of Pure Insurance (NCPI) and any previous withdrawals. It does not include maintenance fees or other charges unrelated to the policy’s cost of pure insurance.

| Item | Amount | Notes |

| Total premiums paid | $5,000 | Amount paid into the policy |

| Net Cost of Pure Insurance (NCPI) | $1,450 | Prescribed amount to cover pure insurance cost |

| Previous withdrawals | $0 | Any prior withdrawals that reduce ACB |

| Adjusted Cost Base (ACB) | $5,000 − $1,450 − $0 = $3,550 | Remaining tax-free value available for withdrawal

|

If you withdraw more than $3,500, the excess may be taxable.

Difference between policy withdrawals, policy loans, and policy collateral

The key difference between policy withdrawals, policy loans, and using a policy as collateral is how each option treats taxation and repayment.

| Type | Tax Treatment |

| Policy withdrawals | The amount withdrawn above the policy’s ACB is taxable |

| Policy loans | Loan proceeds are tax-free if the policy remains in force |

| Policy as collateral | Loan proceeds are tax-free since the funds come from a lender, not policy withdrawals. The policy remains in force. |

How can I use life insurance cash value to pay off debts?

If you have a permanent life insurance policy like whole life or universal life, you can leverage its cash value to manage and pay off debts in several ways:

- Take a policy loan: You can borrow against your policy’s cash value to pay off high-interest debts. Since this is a loan from your insurer, you don’t need a credit check, and the loan is tax-free

- Make a partial withdrawal: Many policies allow you to withdraw a portion of your cash value to cover outstanding debts. Unlike a loan, you don’t have to repay this amount, but it permanently reduces your policy’s cash value and may impact future benefits

- Surrender your policy (last resort): You will receive the cash surrender value, which can help pay off debts, but you will lose your coverage and may trigger taxes. If you still need life insurance protection, consider arranging new coverage before surrendering your policy.

How to set up your life insurance as loan collateral?

If you’re looking to draw a loan using your life insurance policy as collateral, seeking the help of a professional can make your work easier. PolicyAdvisor’s licensed insurance experts will make this journey easy for you. c

Our advisors will help you choose the life insurance products that are most suitable as collateral for loans, and how to maximize the benefits of using life insurance in this capacity.

Schedule a call with us below to explore how you can structure your life insurance to serve as effective collateral for your borrowing needs.

Frequently asked questions

Can you borrow against your life insurance in Canada?

Yes. In Canada, you can use a permanent life insurance policy, such as whole life or universal life, as collateral for a secured bank loan. Term life insurance typically isn’t accepted because it has no cash value and may expire before the loan is repaid.

How much can you borrow against life insurance in Canada?

Banks typically let you borrow 100% of your policy’s cash value when you use it as collateral. Lenders determine the exact amount based primarily on the policy’s cash value and type, and sometimes consider your credit score, policyholder age, and loan size. You may only be able to get a lower percentage if you have poor credit, as a lender may be wary of lending your full cash value amount. Similarly, if your cash value grows too slowly and cannot keep up with the bank’s loan interest rates, the lender may be more hesitant to approve you for the full amount.

What if you cannot pay your bank loan back?

If you’re unable to repay your bank loan secured by life insurance, your lender has specific options to recover the balance based on your loan agreement and policy assignment. If you default, the lender may surrender your cash value to repay the balance, or, if you pass away while the assignment is in force, they may be paid first from your policy’s death benefit. Check your collateral agreement to understand what your lender will do in each scenario.

Which lenders accept life insurance as collateral?

Most major Canadian banks and credit unions accept assignments of whole life or Universal Life policies with CSV. That includes banks like RBC, Scotia Bank, TD and many others.

Lenders usually require an acknowledgement letter from your insurer and may set minimum CSV thresholds. Availability and terms differ by institution, so speak with a PolicyAdvisor expert to compare your options and find the best fit for your needs.

Can I take money out of my life insurance as a loan?

Yes, you can take money out of your life insurance as a policy loan, but only if you have a permanent life insurance policy with a cash value component, such as whole life or universal life insurance.

You can borrow against the cash value through an insurer policy loan without external lender approval. The loan stays tax-free as long as the policy is in force, but a lapse or assignment may trigger tax. However, unpaid loans reduce the death benefit, and interest accrues on the borrowed amount.

You can use whole life or universal life insurance as collateral for a secured loan in Canada by assigning the policy to a lender. This borrowing strategy offers liquidity without selling investments and can provide competitive rates. Loan proceeds are generally tax-free if the policy remains in force. However, it comes with risks like reduced death benefits and possible policy cancellation if the loan isn’t repaid.