- RBC Insurance offers two participating whole life plans: Growth Insurance and Growth Insurance Plus

- Growth Insurance offers lifetime coverage starting at $25,000 that begins to accumulate cash value after five years. It also includes a juvenile guaranteed insurability benefit for policyholders under 18 at no additional cost

- Growth Insurance Plus offers lifetime coverage starting at $250,000, and begins accumulating cash value after the first year

- RBC whole life insurance has 5 dividend strategies: cash payments, reduced premiums, interest-earning deposits, paid-up additions (PUAs), or enhanced insurance

- RBC whole life policy has 3 coverage options: single-life, joint-first-to-die, and joint-last-to-die

RBC Insurance, backed by one of Canada’s largest banks, offers participating whole life policies that build cash value and provide guaranteed lifelong protection. RBC provides two whole life plans: Growth Insurance and Growth Insurance Plus, each with distinct features. While the former has coverage starting from $25,000, the coverage for Growth Insurance Plus begins at $250,000. In this review, we will explore their whole life insurance offerings, focusing on their key features, benefits, types, and pros and cons to help you decide if they are the right fit for your needs.

PolicyAdvisor’s RBC whole life insurance rating (4/5)

RBC whole life insurance earns a 4 out of 5 rating from PolicyAdvisor. The ratings are based on different factors, including cash-value growth, fees, riders availability, policy performance, and bonus stability.

With an asset size of $28.6B and a LICAT ratio of 135%, RBC demonstrates strong financial strength. It’s estimated par fund size is $9.60 million and has maintained a stable dividend rate over the past few years.

RBC dividend scale interest rate (DSIR) for the past few years has been as follows:

| Year | DSIR |

| 2021 | 6.00% |

| 2022 | 6.00% |

| 2023 | 6.00% |

| 2024 | 6.25% |

| 2025 | 6.30% |

Pros and cons of RBC’s whole life insurance

RBC’s whole life insurance plans offer several advantages, including lifetime coverage, cash value accumulation, multiple payment and dividend options, flexible use of cash value, and automatic premium loans. However, there are also some downsides, like higher premium costs, delayed access to cash value, and variable dividends.

Here’s a complete breakdown of the pros and cons of RBC whole life insurance:

Pros and cons of RBC’s whole life insurance

| Pros | Cons |

| Offers 5 dividend options, the highest among Canadian insurers | The deposit option is available only if the premium payment period is 20 Pay or Life Pay |

| Allows deposit option payments to purchase additional insurance | Cash value is only accessible after 5 years for Growth Insurance policyholders |

| Provide a $25,000,000 coverage limit | |

| Includes a juvenile guaranteed insurability benefit at no additional cost for insureds under 18 |

What are the different types of RBC whole life insurance?

RBC offers two participating whole life plans with lifetime coverage and cash value accumulation: RBC Growth Insurance and RBC Growth Insurance Plus. The plans also pay annual dividends, based on the performance of the “par” account, which is funded by premiums from participating policyholders.

Here’s a closer look at the two plans:

- RBC Growth Insurance: Provides lifelong coverage starting at $25,000, with cash value accessible after five years. Annual dividends can be issued as:

-

- Cash payments: You can receive your dividends as cash, though they may be taxable

- Premium reductions: Dividends are applied to your premiums for the following year. Any excess dividends are paid to you directly

- Interest-earning deposits: Dividends are deposited into an interest-bearing account, which you can access anytime. Any interest earned is taxable

- Paid-up additions: This option uses dividends to buy additional insurance coverage. The added coverage can earn dividends and build its own cash value over time

- Enhanced insurance: Your dividends can also be used to buy a mix of paid-up additions and one-year term insurance. The insurance purchased using paid-up additions can earn dividends and build cash value in the future

For policyholders under 18, the plan includes a juvenile guaranteed insurability benefit at no additional cost.

- RBC Growth Insurance Plus: Offers lifelong coverage starting at $250,000, with cash value accessible after the first year. It includes the same dividend options as the Growth Insurance plan.

Key features of RBC’s Grow Insurance and Grow Insurance Plus

| Category | RBC Growth Insurance | RBC Growth Insurance Plus |

| Cash value accumulation | Accessible after 5 years | Accessible after the first year |

| Premium type | Fixed with flexible payment options:

Life Pay, 10 Pay, 20 Pay |

Fixed with flexible payment options:

Life Pay, 10 Pay, 20 Pay |

| Maximum issue age | Up to 80 years | Up to 80 years |

| Coverage amount range | $25,000 to $25,000,000 | $250,000 to $25,000,000 |

| Dividend options |

|

|

| Policy loan availability | Yes, you can borrow against your policy’s cash value if it’s not in the grace period | Yes, you can borrow against your policy’s cash value if it’s not in the grace period |

| Payment flexibility | Monthly or annually | Monthly or annually |

| Living benefits |

|

|

| Additional riders | Guaranteed Insurability Benefit Rider, Renewable and Convertible Term Rider, Total Disability Waiver of Premium Benefit Rider, Accidental Death Benefit Rider, Children’s Term Insurance Rider, Payor Death and Disability Waiver of Premium Benefit Rider | Guaranteed Insurability Benefit Rider, Renewable and Convertible Term Rider, Total Disability Waiver of Premium Benefit Rider, Accidental Death Benefit Rider, Children’s Term Insurance Rider, Payor Death and Disability Waiver of Premium Benefit Rider |

Source: RBC Insurance

Source: RBC Growth Insurance and RBC Growth Insurance Plus Guide

RBC whole life limited-pay options

Both RBC growth insurance and RBC growth insurance plus are available with limited-pay options. These plans let you choose from the available premium paying options, including 10-pay, 20-pay, and lifetime pay. Choose a suitable premium pay option and enjoy coverage for life with RBC whole life plans.

How much dividend does RBC pay?

RBC’s dividend payments depend on its dividend scale, which changes annually. While the dividends in a par account are not guaranteed, historically, RBC has maintained a dividend scale interest rate of 6.00%. This was recently increased to 6.30%, effective April 2025. Policyholders can expect their dividends to be paid according to this new rate until March 31, 2026.

Dividend Scale - Participating Whole Life Insurance

Compare dividend rates from top Canadian insurers

| 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|

| Equitable | 6.05% | 6.25% | 6.40% | 6.40% |

| Manulife | 6.10% | 6.35% | 6.35% | 6.35% |

| iA Financial Group | 5.75% | 6.00% | 6.25% | 6.35% |

| Desjardins Insurance | 5.75% | 6.20% | 6.30% | 6.30% |

| RBC Insurance | 6.00% | 6.00% | 6.25% | 6.30% |

| Sun Life | 6.00% | 6.00% | 6.25% | 6.25% |

| Empire Life | 6.00% | 6.00% | 6.00% | 6.25% |

| Foresters Financial | 5.50% | 5.50% | 5.50% | 6.25% |

| Co-operators | 5.90% | 5.90% | 6.00% | 6.00% |

| Assumption Life | 5.75% | 5.75% | 5.75% | 5.75% |

| Canada Life | 5.25% | 5.50% | 5.50% | 5.75% |

Factors affecting the dividends of RBC whole life policy

Each year, dividends are determined based on the performance of the participating account backing RBC Growth Insurance and Growth Insurance Plus. The factors that affect the performance include investments, policy cancellations, and administrative costs, which will be detailed in the section below:

- Investment returns: Premiums from all participating policyholders are combined into a shared fund called the participating account. Managed by RBC portfolio managers, this fund is then diversified across assets like bonds, equities, and real estate to achieve long-term, stable growth. The returns earned directly influence the level of dividends distributed

- Policy cancellations: Dividends also reflect experience with policy cancellations and death claims. These assumptions support stability and sustainability for policyholders

- Administrative costs: RBC’s ability to control administrative and operational costs also impacts the dividends. Efficient management means fewer expenses and more funds that can potentially be allocated to dividends

Riders available with RBC whole life insurance policy

Listed below are some of the riders that you can include in your RBC whole life insurance policy to enhance its coverage:

- Guaranteed insurability benefit: This lets you get additional life insurance coverage without updating any health or lifestyle information

- Payor death and disability: It is only applicable to the payor of the life insurance policy and is helpful in waiving off the premium if the payor dies or suffers disability

- Children’s term rider: It provides term insurance coverage to all the children of the life insured

- Waiver of premium rider: This rider will waive the premium in the event of permanent disability of the life insured

- Accidental death benefit rider: This provides additional death benefit if the life insured dies due to an accident

How can I access my RBC whole life cash value?

You can access the cash value of your RBC whole life policy in several ways:

- Policy loans: You can borrow up to 90% of your policy’s cash value, provided it’s not in the grace period

- Use policy as collateral: You can request to use your policy as collateral for a loan

- Cash withdrawal: You can withdraw a portion of your guaranteed cash value by reducing your base life insurance coverage. This will decrease the death benefit your beneficiary could receive

- Premium offset: If your policy has sufficient cash value, you can use it to pay premiums. This option is not guaranteed and is available only once your policy reaches the earliest offset date, with no outstanding loans

How do you apply for RBC’s whole life insurance?

Choosing the right whole life insurance involves several important decisions, such as selecting the right plan, coverage level, and premium structure, that can quickly become overwhelming. Here is how you can buy RBC whole life insurance policy with PolicyAdvisor:

- Speak with a licensed PolicyAdvisor expert

- Review RBC whole life insurance plans along with the other options available

- Receive a personalized illustration and finalize your application online

PolicyAdvisor offers free quotes at the best market rates and lifetime after-sales support to address any questions or adjustments you may need in the future. Schedule your free consultation with our licensed advisors today!

Frequently asked questions

Is RBC’s whole life insurance worth it?

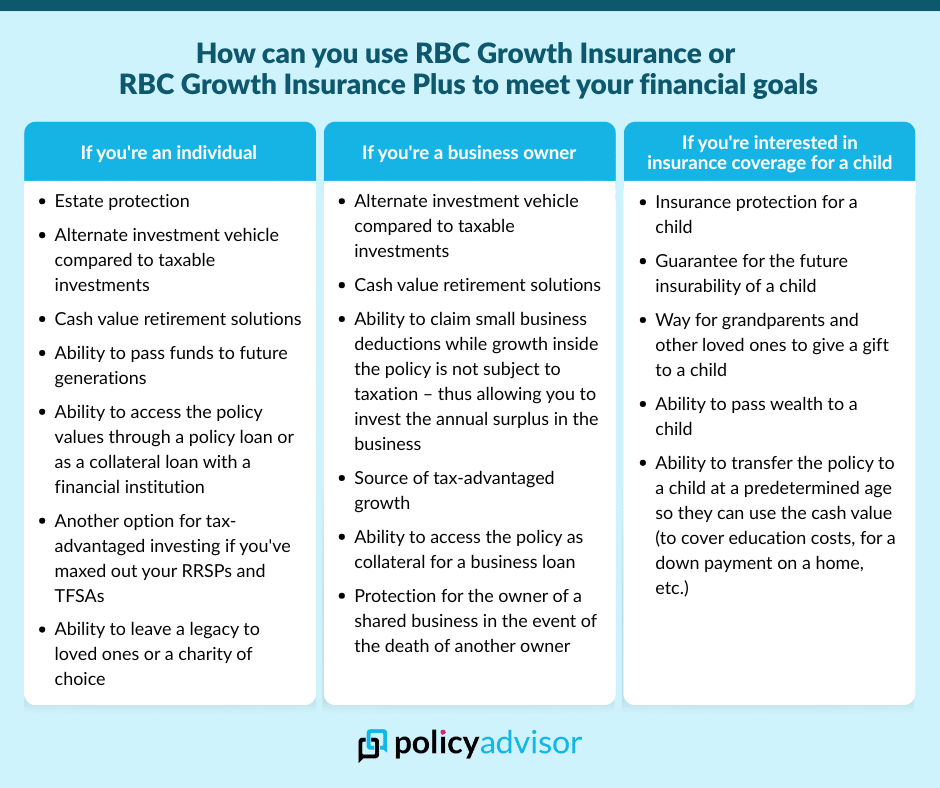

Whether RBC’s whole life insurance is worth it depends on your individual financial goals and budget. If you are looking for a tax-deferred growth opportunity with guarantees like lifelong protection and tax-free death benefit, then RBC’s whole life insurance is worth considering. However, due to higher premium costs, it is important to assess their affordability and payment options before making a decision.

Does RBC offer participating policies with dividends?

Yes. Both Growth Insurance and Growth Insurance Plus are participating policies that pay annual dividends based on the participating account’s surplus.

What is the difference between RBC Growth Insurance and Growth Insurance Plus?

RBC Growth Insurance and RBC Growth Insurance Plus differ mainly in terms of their starting coverage amount and cash value accessibility. Growth Insurance offers affordable lifetime coverage starting at $25,000, with cash value access after 5 years. Growth Insurance Plus requires a higher minimum coverage of $250,000 but offers cash value access after just one year.

Can I convert my RBC term life insurance to whole life insurance?

Yes, RBC offers conversion options in its YourTerm policies that allow you to upgrade your term life insurance to any of RBC’s permanent life offerings, including whole life insurance, until the age of 71.

Does RBC have whole life insurance?

Yes. RBC offers participating whole life insurance. These policies provide lifelong coverage, cash value growth, and five dividend options. You can choose between RBC Growth Insurance and RBC Growth Insurance Plus; both are participating whole life insurance policies.

What happens if I miss a premium payment for my RBC whole life policy?

If your policy has accumulated enough cash value, RBC may use it to cover premiums through an automatic premium loan. However, if the loan amount exceeds the cash value, you will need to make a payment, or the policy will lapse.

Does RBC offer deposit option payments?

Yes, RBC offers a deposit option that lets you make payments in addition to the required premiums. These extra payments help increase the non-guaranteed cash value of your policy in the long term. The deposit option is available only if your chosen dividend option is paid-up additions and the premium payment period is 20 Pay or Life Pay.

RBC Insurance offers two participating whole life policies with five dividend options: Growth Insurance and Growth Insurance Plus. You can choose from three coverage options: single life, joint-first-to-die, and joint-last-to-die. Additionally, you can select between paying premiums for life or a limited period of 10 or 20 years.