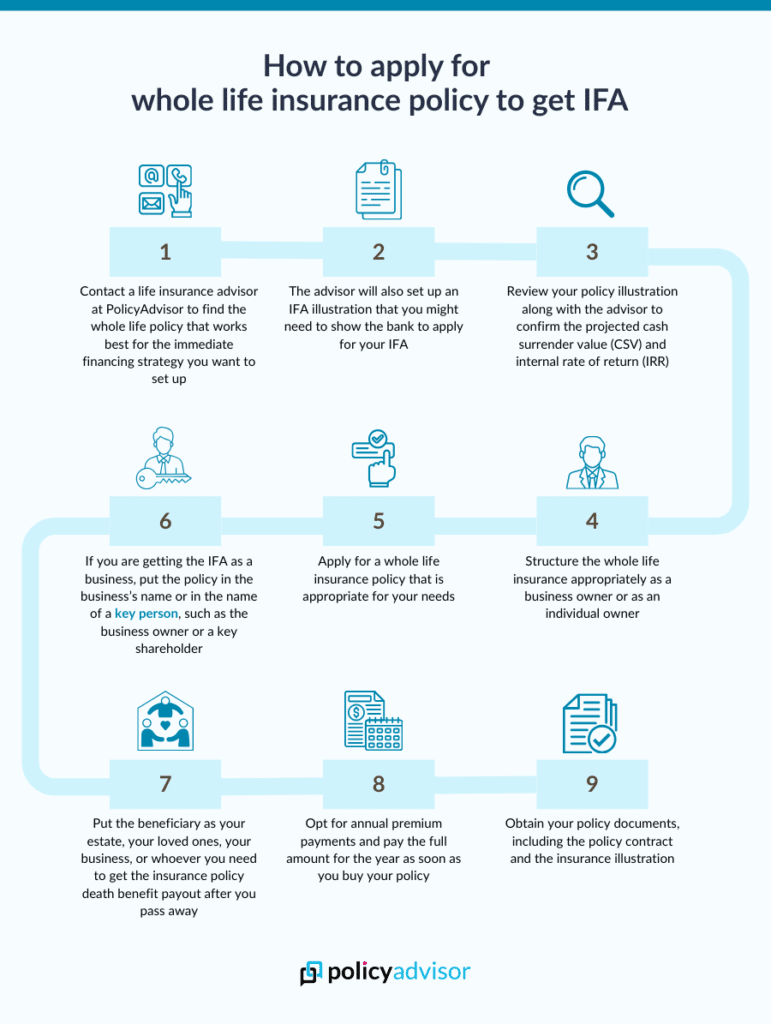

- The process to get an IFA starts by assessing your needs and buying a permanent life insurance policy

- It is important to build your IFA strategy with a licensed insurance advisor and tax professional to align coverage, collateral, and other requirements

- Financing can be available quickly after approval; timelines vary by lender and underwriting

An immediate financing arrangement can help you pursue specific financial goals. The process can feel daunting if you are unsure where to start.

If you have done some preliminary research and want to explore whether an IFA is right for you, then this article will help you learn how to get started, what you’ll need, and what to expect.

Steps to set up an immediate financing arrangement in Canada

To start an immediate financing arrangement, follow these steps:

Step 1: Assess your financial needs

Before you proceed with an IFA, outline your goals and build a financial plan with a licensed insurance advisor.

An experienced licensed insurance advisor can work alongside your accountant and provide invaluable guidance in navigating the financial implications of an IFA effectively. To begin, assess key factors such as: the amount of life insurance you need; premium amounts; premium and interest payment frequency; the financing amount required; and potential lenders.

Step 2: Apply for a permanent insurance policy

For an IFA, you will need a whole life insurance policy (or a universal life insurance policy) with a suitable death benefit and cash value. We can help you find the whole life policy that works best for the immediate financing strategy you want to set up. For IFA, you would typically need a policy that can grow cash value in the early years. Our advisors will run various structures for you to set up a policy structure that meets your cash value and projected death benefit needs.

Step 3: Contact your bank, lender, or financial institution

Once you have bought the insurance policy, you should choose a Canadian bank, lender, or financial institution you want to borrow from. Based on your request, the lender may ask for a minimum loan amount, an insurance policy from only an approved life insurance company, and proof of strong cash flow. Apply for up to 100% of the cost of life insurance premiums you paid in Step 2, or up to 100% of the projected cash surrender value in your insurance illustration.

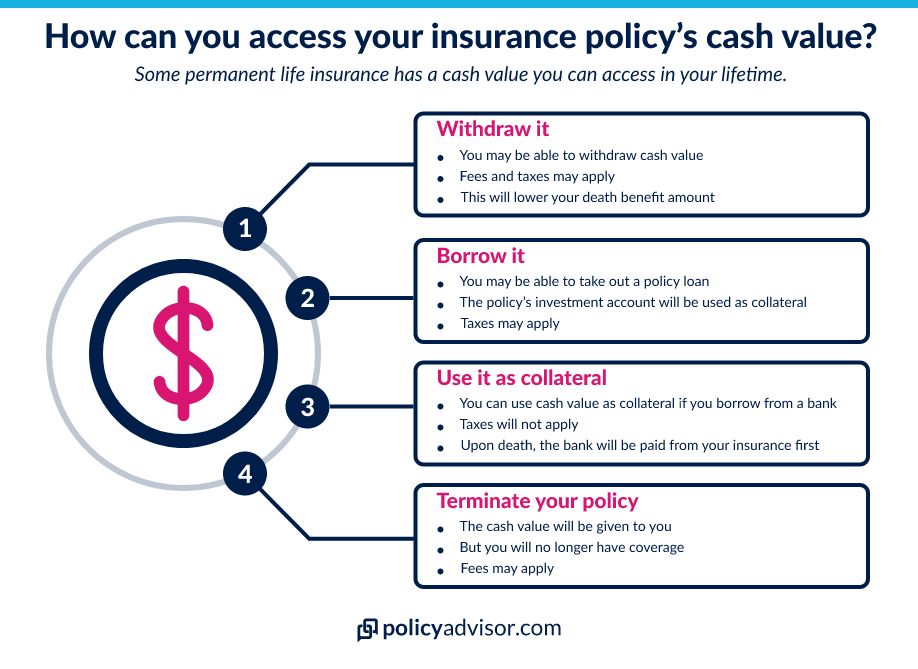

Step 4: Assign collateral

When you apply for the line of credit, tell your lender that you want to use your whole life insurance policy as collateral. You and your lender execute a collateral assignment of the life insurance policy. This means that you agree that your life insurance policy will be used by the lender if you are unable to pay back the loan proceeds. You do not change the beneficiary; the beneficiary named in Step 2 remains the same.

Step 5: Get financing

The next step is to wait for the lender to process your application. The lender will let you know when they approve your application. This can be immediate or take a few days, depending on the lender. The lender can ask for additional collateral if they need extra security, depending on how much you are borrowing. They will contact you to ask what other assets you can use as collateral, such as real estate or investments. You and your lender agree on terms such as the interest rate, interest payment frequency and amount, repayment terms, and the draw schedule. After your application is completed and the terms have been mutually agreed to, you can get instant access to the financing.

Step 6: Reinvest

Use the loan for investment or business growth according to your plan. Borrowed funds are generally not taxable; however, investment returns may be taxable. Interest may be tax-deductible in Canada if the borrowed money is used to earn business or property income, and other conditions are met.

Step 7: Uphold loan terms

Now that the agreement has been made and you have the loan proceeds, you have to live up to your part of the arrangement. This varies depending on the agreement you have with your bank or lender. You must pay the interest monthly, make loan drawdowns according to the schedule you agreed to, and pay off the loan according to the schedule you agreed to.

Remember that the lender holds your life insurance policy and possibly other assets as collateral. If you breach the terms, the lender may realize on the collateral, including recovering from the policy’s cash value or reducing the overall death benefit.

Step 8: Annual review

If you have a line of credit that has to be revisited every year, your lender might want to check on the policy performance, loan repayment status, additional collateral security requirements, as well as your financial health. They may also revisit annual renewal fees to determine if they will stay the same or not.

Do I need to do anything else to set up an IFA?

Yes, while the 8 steps covered above are standard, you may have additional steps to take. But these steps are optional and can vary, depending on the agreement you have with your lender. It may be different for everyone, so not everyone who gets an IFA may have to take the steps below.

In many cases, an IFA strategy is established with the understanding that it will be paid off after the borrower dies. However, this is not always the case.

- Repaying the loan during your lifetime: If you choose to pay the loan off early, you can make regular loan payments the same way as you would with any loan or financing arrangement. You would pay regular interest payments, plus pay back the amount you borrowed as annual deposits or as a lump sum at any point in time. If you go with this option, your beneficiaries get the full policy proceeds from your life insurance after you pass away.

- Repaying the loan after your death: If you don’t want to worry about paying back the IFA right away, you can also let it be paid back as a deduction from your death benefit. You still have to make interest payments during your lifetime. Once you pass away, any outstanding loan balance would be deducted from your insurance policy’s tax-free death benefit. Keep in mind that this will mean less money for your beneficiaries, though.

Things to keep in mind when you set up IFA in Canada

When setting up IFA in Canada, listed below are a few things that you need to keep in mind:

- Choose the right permanent life insurance policy that will be helpful in meeting your borrowing needs

- Check the loan limits and other terms and conditions, as they will vary from lender to lender

- Be prepared with the necessary documents, including policy document, income proof, lender-required forms, etc

- Keep the policy performance in check, as the dividend scale fluctuations can affect the borrowing power and loan sustainability

- Understand the loan repayment options with your lender

- Keep an alternate plan ready for potential rising rates, lender terms, or any unforeseen financial difficulties

How long does an IFA take to process?

The processing time for an IFA application depends on the lender. Usually IFA applications are approved within 1 to 3 weeks.

Once you’re approved, financing comes through right away. There’s no waiting period — that’s why it’s called immediate financing, after all.

Contact a professional

If you’re interested in starting an IFA, you should speak to an expert to make sure you have your ducks lined up in a row. An IFA strategy can have many benefits for business owners and other high-income earners in Canada. But you don’t have to decide alone.

Schedule some time with one of our insurance professionals and we’ll be happy to help you figure out if an IFA could be right for you.

FAQs about how to set up an immediate financing arrangement

Do I pay bank fees for an IFA?

Yes, banks and lenders typically charge a flat fee for an immediate financing arrangement. This is separate from interest payments. The flat fee is typically about $500 to set up the IFA. Always confirm set-up fees, legal costs, renewal fees, and interest rate terms before you proceed.

Depending on the loan amount, the initial fee may be waived by the lender. Ask what the charges will be before you decide who to go with.

What kinds of insurance policies can be used to set up an IFA?

Your insurance options for an IFA are:

- A participating permanent life insurance policy

- Cash value universal life insurance, but that comes with more risks and complications

What is an immediate financing arrangement?

An Immediate Financing Arrangement (IFA) pairs a permanent life insurance policy with a bank loan secured by the policy. You fund the premium, assign the policy as collateral, and borrow against its value to redeploy capital, commonly used by high-income individuals and business owners seeking liquidity, potential interest deductibility, and long-term estate value.

Getting an immediate financing arrangement (IFA) starts by looking at your financial goals and buying a whole life insurance policy. From there, you go to the bank or lender of your choice and apply for a line of credit using your policy as collateral. You will need to ensure you have the necessary documentation and that you know what to expect.