- Canada has public healthcare that covers basic health emergencies, but not all services are included.

- Private insurance covers part of the cost of medication, dental care, vision care, travel medical emergencies, medical equipment, and more.

- Personal health insurance usually costs about $60-$200 per month, depending on your age, health, and coverage type.

- You can have more than one health insurance plan and coordinate the benefits for 100% coverage.

- What is private health insurance?

- What does personal health insurance cover?

- Does health insurance cover dental care?

- Does health insurance cover vision care?

- How much does private health care cost in Canada?

- What are the different tiers of private medical insurance plans?

- Types of private medical insurance available in Canada

- What's the difference between public and private health insurance in Canada?

- Is personal health insurance worth it in Canada?

- How to choose the right health insurance plan

- Apply for private health insurance

- Medical Insurance FAQ

You’ve probably heard that Canada has a free national health insurance program. We do have many healthcare costs that are publicly funded by taxpayers. However, this “free” health care doesn’t cover everything you might require to fully recover from an injury or illness.

To cover those expenses, many Canadians use private health insurance. In this article, we go over the different types of health insurance available in Canada, how to apply for it, and how to choose the best provider for you.

What is private health insurance?

Private health insurance, also called personal health insurance, is an insurance plan that covers medical expenses that aren’t covered by provincial health plans, such as OHIP in Ontario. It helps to pay a portion of those additional costs so that you don’t have to.

You may also see private health insurance called:

- Personal health insurance

- Private medical insurance

- Extended health insurance

Most Canadians get private health insurance either through their employer benefits, through a family member’s plan, or by buying it on their own.

Different health insurance providers have several tiers of coverage that you can use to supplement other plans and make your coverage as comprehensive as you need it to be.

What does personal health insurance cover?

Private health insurance covers the medical expenses that government healthcare does not.

Extended health insurance can cover:

- Prescription drugs

- Dental care

- Vision care

- Paramedical expenses (chiropractic services, physiotherapy, massage, therapy, mental health services, etc.)

- Medical equipment (blood sugar meters, crutches, CPAP machines, etc.)

- Emergency travel medical insurance

What you’re covered for and how much costs the insurance company will pay (coverage amount) depend on your provider and what tier of coverage you select.

Additionally, insurance companies have a price list of what they think is a “reasonable amount” for any service, equipment, or medication within your particular province. So, keep in mind that they may only cover costs based on that.

For example, under your prescription drug coverage, your plan may feel that name-brand medication like Ozempic is overpriced, and will only approve coverage for a generic alternative with the same ingredients.

Does personal health insurance cover dental care?

Yes, personal health insurance often covers a varying range of dental services. Most providers include preventative coverage for all of their dental plans — usually covering 60%-80% of costs for things like oral exams, cleanings, etc.

Enhanced or top-tier plans may also cover major dental work like root canals, crowns, or other orthodontic procedures.

Some providers may not automatically include dental care with their base plans, but instead may offer a dental care add-on for an additional fee.

Personal health insurance can cover dental services such as:

- Teeth cleaning and scaling

- Dentist’s diagnostics

- X-rays

- Whitening

- Orthodontic services (braces, Invisalign, etc.)

Does private medical insurance cover vision care?

Yes, personal health insurance usually covers vision care. Most plans cover one visit to an optometrist every 24 months and some money for corrective lenses, frames, or contacts.

More comprehensive plans may include coverage for corrective eye surgery. And, like dental coverage, some providers may not automatically include vision care with their base plans, but may offer a vision coverage add-on for an additional fee.

Personal health insurance can cover eye care costs such as:

- Eye exams

- Prescription eyeglasses

- Prescription sunglasses

- Contacts

- Laser eye surgery

Does health insurance cover mental health services?

Yes, private health insurance usually includes some form of mental health services, although the extent of coverage can vary widely depending on the plan you choose.

You may be able to receive some mental health support by seeing a family doctor (which would be covered by provincial health care), but private health insurance can help you further on your mental health journey by providing additional support.

Personal health insurance can cover mental health resources such as:

- Clinical counsellors

- Therapists

- Psychologists

- Psychotherapists

- Social Workers

- Family therapy

- Virtual mental health resources

- Coverage for prescription medication and other mental health treatments

Can you purchase private health insurance in Canada?

Yes, you can purchase private health insurance in Canada. While the government provides universal healthcare covering essential medical services, private insurance covers services not included, such as dental care, vision, prescription medications, and specialized treatments.

It is especially useful for those seeking additional benefits, faster access to certain services, or coverage during waiting periods for public healthcare. You can get private health insurance through individual plans or as a benefit provided by your employer.

How much does private health insurance cost in Canada?

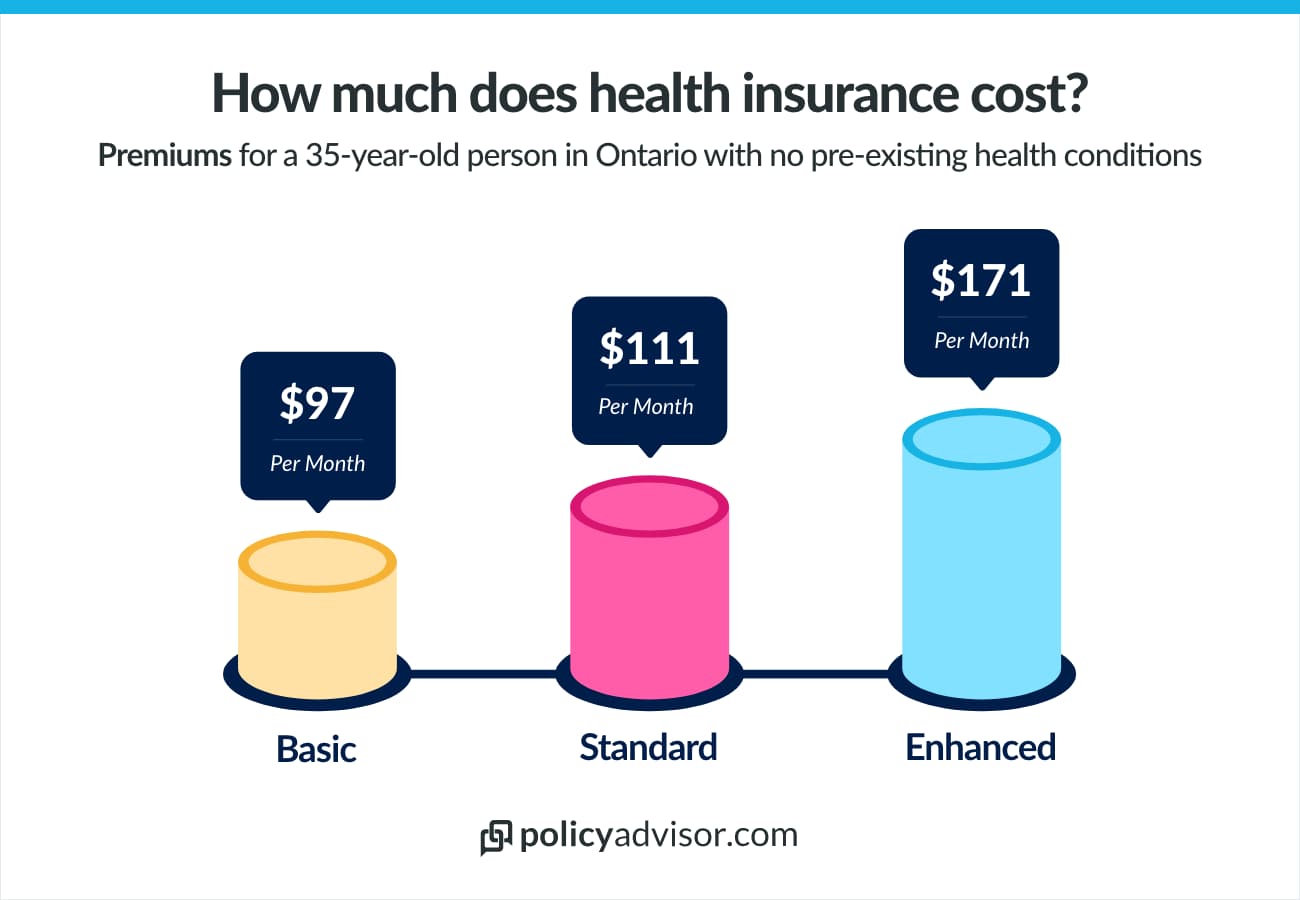

In general, you can expect to pay anywhere from $60 to $200 a month for private health insurance in Canada. The monthly cost of medical coverage depends on your health as well as the plan you select.

Your health insurance premiums are determined by details such as:

- If you have any existing health conditions

- Your age

- Where you live

- What tier of coverage you have

- The waiting period (how long you have to wait before getting medical services)

- Your deductible amount (how much you pay before insurance coverage kicks in)

If you are in poor health, it may be difficult to get standard health insurance coverage, but there are other options for you.

Some private health plan providers, like Manulife, GreenShield, Canada Life, and Blue Cross, offer something called a guaranteed acceptance healthcare coverage plan. This lets you get a plan without answering too many medical questions.

However, these plans are likely to be much more expensive and offer less coverage than standard plans. It’s best to speak with one of our licensed insurance agents and let us help you find the right coverage for your needs.

What are the different private medical insurance plan tiers?

Supplemental health care is usually put into a tiered system, with each tier increasing its coverage at higher costs. The plans are usually separated into basic, standard, and enhanced tiers. Coverage tiers and costs for each of these tiers may look like the following:

Private medical insurance tiers

| Plan Type | Coverage | Price |

| Basic health plan |

Prescription drugs – 60%, up to $750 Dental – 60%, up to $500 Vision – No coverage Paramedical – $25 per visit, up to $250 ($35 for psychologist/social workers) Travel – No coverage |

$61/month |

| Standard health plan |

Prescription drugs – 70%, up to $7,000 Dental – 70%, up to $750 (preventative only) Vision – $250 every 2 years, $50 per eye exam Paramedical – 100%, up to $300 per practitioner (up to $1,000 for psychologists/social workers) Travel – $5 million in emergency health coverage for the first 60 days |

$106/month |

| Enhanced health plan |

Prescription drugs – 80%, up to $5,000 Dental – 80% for preventative care, up to $750; 50% for restorative care, up to $500; 60% for orthodontic, up to $1,500 Vision – $300 every 2 years, $50 per eye exam Paramedical – 100%, up to $400 per practitioner (up to $1,500 for psychologists/social workers) Travel – $5 million in emergency health coverage for the first 60 days |

$166/month |

*Quote for a 35-year-old person in Ontario with no pre-existing health conditions.

Every tier of plan will also have:

- Different deductible amounts

- A set waiting period before you can claim coverage

- Its own process for claims

What are the types of private medical insurance available in Canada?

In general, there are three types of personal health insurance plan offered in Canada, including medically underwritten health insurance, guaranteed acceptance health insurance and replacement health insurance. Based on your unique circumstance and specific requirements, you can choose any of these plan for your healthcare emergencies.

1. Medically underwritten health insurance

Standard health insurance is medically underwritten. This means that during the application process, the insurance company will ask you about your health and lifestyle and use your answers to determine your eligibility and price for your insurance.

For this type of health insurance, insurers may exclude any pre-existing conditions. But you still have options for health insurance if you have a health issue.

2. Guaranteed acceptance health insurance

Guaranteed acceptance health insurance is usually a no-questions-asked kind of policy. There are no or very few medical questions or medical underwriting, and pre-existing conditions are generally covered.

Most companies will have the 3-tiered options — basic, standard, and enhanced — for medically underwritten policies, but just basic or standard options for guaranteed acceptance policies.

Key differences between standard vs guaranteed acceptance health plans

| Medically-underwritten health insurance | Guaranteed acceptance health insurance |

| Has medical questions on the application | No or few medical questions on the application |

| Price depends on your current health history | Price is higher because there is no medical underwriting |

| Has 3 tiers of coverage: basic, standard, or enhanced | Only has basic or standard coverage |

| Generally will not cover pre-existing conditions | Generally will cover pre-existing conditions |

3. Replacement health insurance plans

The third most common type of personal health insurance in Canada is a replacement plan that’s meant for people who already had coverage through a group plan, such as through their work.

If you’re leaving your job or retiring, you can get health insurance without having to pass the usual medical requirements. But you must make the switch within 60-90 days of your work benefits ending.

Replacement plans can be especially useful for people who may have medical issues and may not get the best rates from a regular medically underwritten health policy, such as senior individuals.

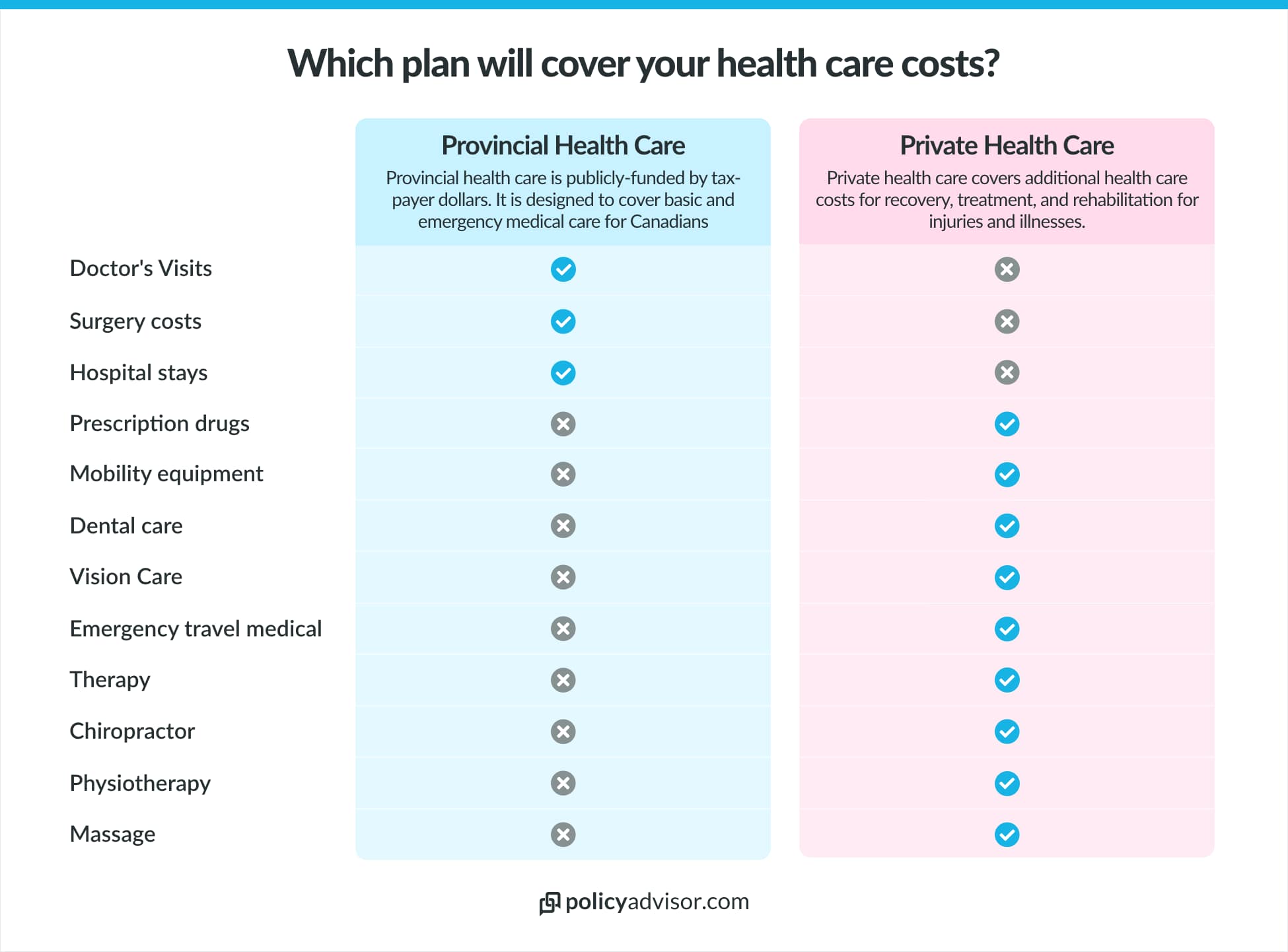

What is the difference between public and private health insurance in Canada?

The main difference between public and private health insurance in Canada is what they cover — public health insurance generally handles the immediate, urgent care needs while private health insurance covers a portion of the costs related to recovery.

Public health insurance covers basic and emergency medical services such as hospitalization, surgeries, and doctor’s visits.

Private health insurance covers health care services and other medical expenses such as prescription medication, paramedical services (chiropractic services, physiotherapy, massage), and other medical equipment (CPAP machines, crutches, nebulizers, etc.).

For example, if you had a car crash:

- Public health insurance will cover the ambulance services to get to the hospital and the cast for your broken leg.

- Private health insurance will provide physiotherapy coverage so you can walk and run normally again.

Canadians may coordinate this coverage so that all of their medical expenses are paid for under either their universal health plan, provincial health plan, private health insurance, or travel medical coverage.

What do public healthcare plans in Canada include?

Universal health insurance

The “Medicare” system in Canada is a universal health system that is publicly funded through taxpayer dollars. It allows all Canadians to access essential medical care such as hospital visits and emergency surgery.

The federal government also provides some national-level health care such as the Universal Dental Benefit, which provides children from low-income families access to regular dental treatments.

Provincial health insurance

Our universal healthcare system here in Canada is provincially administered. Each provincial or territorial health insurance will have different rules to qualify for “free” universal healthcare.

In order to access public coverage with the provincial plan, some provinces require you to be a permanent resident for at least three months, while others will require longer.

What do private healthcare plans in Canada include?

Private health care insurance

Many Canadians buy additional health insurance coverage through their employers or purchase private health insurance policies to cover gaps in the public healthcare system.

Private plans can vary in coverage and cost, depending on the provider, the specific policy, and your own health history.

Travel health insurance

Emergency travel medical insurance covers unexpected medical events and treatment when you’re traveling. You can buy it when you’re traveling outside of Canada or if you’re a visitor to Canada.

This is a form of private insurance, and those who buy it have many options for travel insurance providers.

Is it worth getting health insurance in Canada?

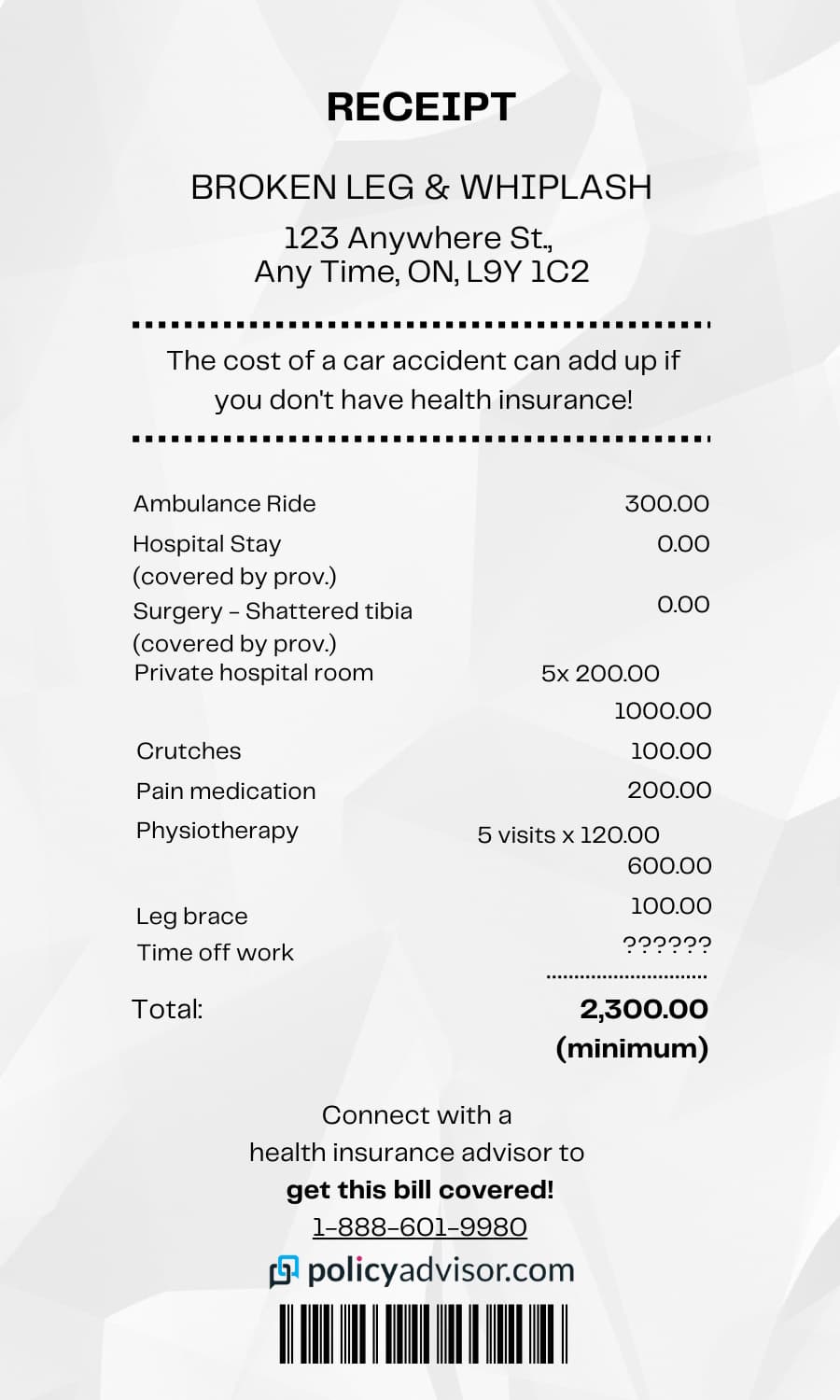

Yes, private health insurance is worth it in Canada. It can help you get the medical care you need without paying extremely high costs.

Even if you have access to provincial health care, it will not cover all the medical costs required for you to recover from an injury or illness. It doesn’t always pay for preventative healthcare. An extended healthcare policy supplements your public coverage so you get the treatment you need to stay healthy in the long term.

Just imagine trying to pay this medical bill below after a car accident, without private health insurance to cover you.

How to choose a health insurance plan?

To choose the health insurance plan that works best for you, start by thinking about your insurance needs. Ask yourself:

- Do I have health insurance coverage through my employer?

- Do I have health insurance coverage through my spouse’s employer?

- Do I have dependents who need more coverage?

- How much can I afford to spend on health insurance each month?

The answers to these questions will help you determine which plan is the best for you and your family.

Which health insurance tier should I choose?

Still having trouble figuring out which personal health insurance plan is best for you? Here is a list of plan types and the scenarios in which they might be right for your insurance needs.

Take a look at these health insurance tiers to choose from:

Basic Health Plan

- If you are on a tight budget

- If you are using it to supplement other plans (employer or group plans)

Mid-Tier Health Plan

- If you are looking for a primary plan with decent coverage

- If you want it for combined coverage with other plans (employer or group plans)

Enhanced Health Plan

- If you have no other health insurance through your work, through your spouse’s work, or other group benefits and you intend to use this as your primary plan

- If you want it for combined benefits with other plans (employer or group plans)

- If you are looking for your expenses to be 100% covered through the coordination of benefits

- If you want to coordinate benefits with other plans because your family has high medical costs (i.e. lots of kids with braces, glasses, medications)

Guaranteed Acceptance Health Plan

- If you have any pre-existing conditions or health issues

- If you don’t want to go through medical questionnaires

Replacement Health Plan

- If you are retiring and may have health issues that would prevent you from getting standard health insurance

- If you’re leaving a job with regular benefits

Who are the leading Canadian private health insurance providers?

There is no single “best” health insurance provider because everyone’s coverage needs are different. Each provider has something different to offer.

At PolicyAdvisor, we work with exceptional health insurance providers that all have great coverage options, depending on what kind of coverage you’re looking for.

We offer health insurance from the following providers:

- Blue Cross

- Canada Life

- Desjardins

- GMS

- GreenShield

- Manulife

- Sun Life

- And more!

Additionally, we offer guaranteed acceptance plans through Edge Benefits.

Apply for private health insurance

If you’re looking for a great price on , PolicyAdvisor can help! We have a team of licensed insurance experts to help you go through health plans from Canada’s best insurance providers.

Book a quick call with one of our advisors today and let us help determine your health insurance needs.

Frequently Asked Questions

What if you’re leaving your job with benefits?

If you have a job with benefits and you’re leaving that job, your private health coverage will likely come to an end.

But you can get replacement or guaranteed acceptance health plans with most insurance providers when you leave. This means that when you transition to your new plan, you don’t have to go through any medical questionnaires — your new individual policy is guaranteed to be accepted.

However, you must apply for the new coverage within the first 60-90 days of your employer benefits ending.

Isn’t health insurance in Canada free?

Some parts of healthcare are free in Canada. With universal healthcare, you don’t have to pay for basic medical expenses like seeing a doctor, surgery, non-private hospitalizations, etc.

But it does not cover costs associated with recovery, such as prescription medication, paramedical expenses, vision care, dental care, or medical equipment that may be needed to recover from injury or illness. Private insurance can cover these expenses and more.

Is private health insurance tax deductible in Canada?

In some cases, private health insurance can be tax deductible. For example, if you are self-employed or a business owner, it may be written off as a business expense.

Individuals may be able to include premiums as part of their medical expenses when calculating tax credits as well.

What if I’m covered under my spouse’s plan?

If you have private medical coverage through your spouse, that’s great! We’re glad that you have some sort of health insurance coverage to keep your financial wellness in check while you rest and recover. However, employer benefits may not have the most comprehensive plan.

You may consider buying your own individual plan to supplement your spouse’s employer’s plan to fit all your family’s needs. You can use both plans to get close to 100% coverage for your medical costs by coordinating your benefits.

Personal health insurance covers expenses that provincial government health care does not, such as prescription medications, dental care, vision care, and paramedical services. There are different types of private health insurance plans available, and they vary in coverage and cost. The cost of premiums depends on factors like age, health status, coverage extent, and insurance provider, but you can expect to pay $60-$200 a month.

1-888-601-9980

1-888-601-9980