- Self-employed individuals need personal health insurance because most do not have group benefits through an employer

- Private health insurance helps to pay for health care costs not covered by provincial health plans

- Self-employed workers may be able to deduct their health insurance premiums on their taxes

Being self-employed has a lot of upsides. You get to be your own boss, set your own hours, and plan your professional life on your own terms. The downside? No group health insurance. Whether it’s prescription medication, vision care, dental visits, or other preventative care, the costs can be substantial.

Health insurance plans for self-employed individuals help cover the costs of medical expenses that provincial coverage does not cover.

Read on to find out how to choose the best health insurance plans for self-employed people and more expert tips.

What does health insurance for self-employed individuals mean?

Health insurance for self-employed individuals in Canada refers to health coverage plans that are specifically tailored for those who run their own businesses or work as freelancers. Such individuals do not have employer-provided benefits and need a health insurance plan that covers medical expenses such as doctor visits, hospital stays, medications, and more.

Self-employed individuals often purchase these plans through private insurers, government exchanges, or association health plans. They have the flexibility to choose from a variety of coverage options, though premiums, deductibles, and out-of-pocket costs can vary depending on the plan chosen. Additionally, self-employed individuals may be eligible for tax deductions on their health insurance premiums, making it more affordable.

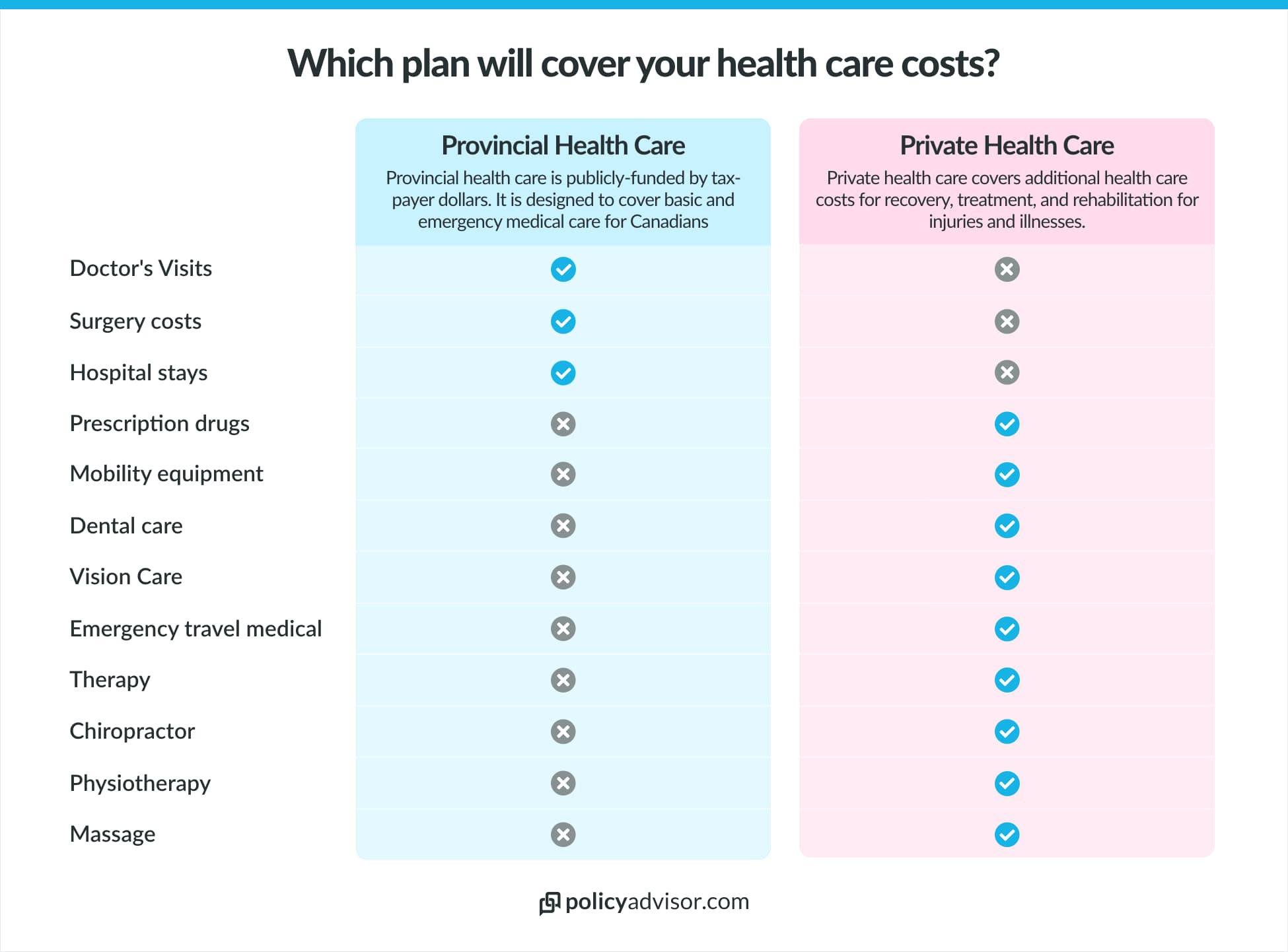

Private vs. government healthcare

Government healthcare in Canada has limited coverage. It generally only covers emergency care that requires urgent intervention such as doctor’s visits, emergency surgeries, hospitalization due to a severe illness, etc.

Private health insurance covers health care services and other medical expenses such as prescription medication, paramedical services (chiropractic services, physiotherapy, massage), and other medical equipment (CPAP machines, crutches, nebulizers, etc.).

As someone who is self-employed, you are entitled to provincial health insurance. But it may not be enough. Think of it this way: public health insurance handles immediate care of injury and illness, while private health insurance covers the costs needed to fully recover.

Provincial/territorial healthcare coverage

Provincial and territorial healthcare systems in Canada, known as universal healthcare, provide coverage for essential medical services deemed medically necessary.

This includes emergency services, doctor visits, specialist referrals, hospital stays in standard rooms, primary mental health care, palliative and end-of-life care, maternity care, and some prescription drugs.

Self-employed individuals should get private health insurance to supplement their provincial coverage.

What are the advantages of personal health plans for self employed individuals in Canada?

The main advantages of private health insurance for self employed Canadians are the flexibility it brings with customizable options, tax benefits, portability, and more. Let’s look at these in detail:

- Flexibility: A self-employed person gets to choose their individual plan, rather than being stuck with a group plan that may not fit their unique needs

- Customizable options: Similarly, they can tailor their health insurance coverage to make sure their plan works best for them

- Independence: Having your own individual plan plan for health coverage means you’re not reliant on anyone for financial protection

- Portability: Health coverage through an employer will end if you leave the job or retire, but private insurance moves with you

- Tax benefits: You can get a tax deduction for health insurance premiums you pay for a private health plan. We’ll talk more about this below

Why do self-employed individuals need private health insurance?

Self-employed people need private health insurance to fill the gaps in provincial or government coverage. Private health insurance offers financial protection and tax benefits, both of which are important for self-employed individuals.

Let’s take a detailed look at why self-employed individuals need private health insurance:

- Provincial health plans cover emergency medical care. Other essential services such as dental care, vision care, mental health related therapies, massages and chiropractors, are all covered under private health insurance. Without private health insurance, the costs for these services can be substantial

- Unexpected medical bills on top of running a business is not a good combo. Private health insurance helps ease the financial burden that a sudden illness can cause

- The premiums for private health insurance can often be deducted from a self-employed individual’s taxable income. This makes private health insurance affordable and financially advantageous

Having private health insurance coverage can help you stay healthy and focused on your work. It means you won’t have to worry about unexpected medical bills that could hurt your personal and business finances.

What does private healthcare insurance cover?

Private healthcare insurance in Canada supplements provincial healthcare by offering coverage for services not fully covered by the public system.

This typically includes:

- Dental care

- Vision care (including eyeglasses and contact lenses)

- Prescription drugs (often with more comprehensive options)

- Semi-private or private hospital rooms

- Certain medical services not covered by provincial plans (such as chiropractic care, physiotherapy, and massage therapy)

- Enhanced coverage for ambulance services, medical equipment, and treatments abroad

| Healthcare Service | Provincial Healthcare | Private Healthcare |

| Emergency Services | Fully covered | Covered; can offer additional services |

| Hospital Stays | Fully covered (standard room) | May or may not be covered |

| Prescription Medications | Limited coverage (varies by province) | Covered; typically more comprehensive coverage |

| Surgical Procedures | Covered | May or may not be covered for some kinds of surgeries |

| Maternity Care | Fully covered | Covered; may offer additional prenatal and postnatal care |

| Mental Health Services | Limited coverage; varies by province | Covered; includes a broader range of services |

| Diagnostic Tests (e.g., MRI, X-ray) | Covered; wait times may apply | Covered; usually faster access |

| Dental Care | Not typically covered | Covered under specific plans; varies by plan |

| Vision Care | Not typically covered | Covered under specific plans; includes eye exams and corrective lenses |

| Physiotherapy | Limited coverage | Covered; more extensive options available |

| Chiropractic Services | Limited coverage | Covered under specific plans |

| Alternative Medicine (e.g., acupuncture) | Not typically covered | Covered under specific plans |

| Home Care and Nursing Services | Limited coverage | Covered; often more extensive |

| Long-term Care | Partially covered; subsidies available | Covered under specific plans; usually better facilities |

| Ambulance Services | Partially covered; co-payment required | Covered; may provide additional coverage for costs |

| Medical Equipment | Partially covered | Covered; often more comprehensive |

| International Travel Coverage | Not covered | Covered; includes emergency medical services abroad |

| Cosmetic Surgery | Not covered | Covered under specific plans |

| Health and Wellness Programs | Not typically covered | Covered under specific plans; includes gym memberships, wellness programs |

What kind of health benefits can I get if I’m self employed?

Self-employed Canadians can get health insurance that only covers costs related to health, like prescription drugs, paramedical services, or nontraditional therapies. Or, they can also get a plan with supplemental coverage, which can help cover costs for things like dental and vision care.

Let’s look at the different types of coverage the self-employed can access in Canada below.

Traditional health insurance

Personal health insurance plans come in tiers, depending on the coverage level that you’re looking for. In general, these health insurance packages come in basic, standard, or enhanced. The more the plan covers, the more it will cost.

Cost and coverage tier for traditional health insurance

| Plan Type | Coverage | Price |

| Basic health plan | Prescription drugs – 70% of the first $750 (up to $525 every year)

Dental – 70% of the first $575 (up to $400 every year) Vision – $150 every 2 years Travel – $5 million in emergency health coverage for the first 9 days of each trip |

$97/month |

| Standard health plan | Prescription drugs – 70% of the first $750 and 90% of the next $4,972 (up to $5,000 every year)

Dental – 80% of the first $400 and 50% of the next $860 (up to $750 every year) Vision – $250 every 2 years Travel – $5 million in emergency health coverage for the first 9 days of each trip |

$111/month |

| Enhanced health plan | Prescription drugs – 90% of the first $2,222 and 100% of the next $8,000 (up to $10,000 every year)

Dental – 100% of the first $500 and 60% of the next $700 (up to $920 every year) Vision – $250 every 2 years Travel – $5 million in emergency health coverage for the first 9 days of each trip |

$171/month |

*Quote for a 35-year-old person in Ontario with no pre-existing health conditions.

Supplemental health insurance

Aside from the health insurance coverage we noted above, self-employed people can also get supplemental health insurance to cover vision and dental care needs.

Dental insurance for self employed

To get dental costs covered, self-employed people can get private health benefits. Most private health insurance plans have dental built right into the plan cost, but some may only have it for standard or enhanced tiers of coverage.

Vision care insurance for self-employed

Many individual health coverage plans also have vision care built into their packages. Usually, basic packages will cover you for an eye exam at least once every two years. Some also cover some costs for glasses, but plans can include other services too.

Critical illness insurance for self-employed

Critical illness insurance can be especially valuable for self-employed individuals, providing a tax-free lump sum if you’re diagnosed with a serious illness. Without employer benefits to fall back on, this coverage helps protect your income and keep your business running during recovery.

How much does health insurance cost per month for a self-employed person?

The average costs of private health insurance costs around $80 to hundreds in monthly premiums for self-employed Canadians. The cost of health insurance depends on your age, where you live, what kind of plan you buy, and more. The chart below shows some sample quotes for private health coverage for self employed individuals.

Health insurance cost per month for a self employed individual

| Plan Type | Sun Life | Manulife | Desjardins |

| Basic | $61.32/month | $114.40/month | $101.19/month |

| Standard | $126.62/month | N/A | $101.19/month |

| Enhanced | $199.46/month | $176.40/month | $132.29/month |

*Quotes based on single-person coverage (for yourself only) for a 35-year-old resident of Ontario in normal health.

Are there deductible options for self-employed health cover in Canada?

Yes, private health insurance has several options for deductibles. This is how much you have to pay out of pocket before insurance starts helping with the costs. The deductible makes a difference in your premium rates. Higher deductibles mean lower monthly premiums, but you also have to pay more upfront if you have a claim.

Is health insurance tax deductible for self-employed in Canada?

Yes, self-employed Canadians can deduct their health insurance on their yearly income tax return under the Medical Expense Tax Credit. You can qualify as long as:

- You are the sole proprietor of your business

- Your business income is your primary source of income

You may be able to claim medical expenses on behalf of your dependents too. Just be sure to consult a tax professional to make sure you’re filing properly.

What insurance is best for the self-employed?

The best health insurance for self-employed individuals depends on their unique requirements and circumstances. If you are young, generally healthy, and with no dependents, a standard private health insurance plan might work for you. If you have a family and are a smoker, an enhanced plan might work better for you. For those with a pre-existing health condition, a guaranteed acceptance plan will work best.

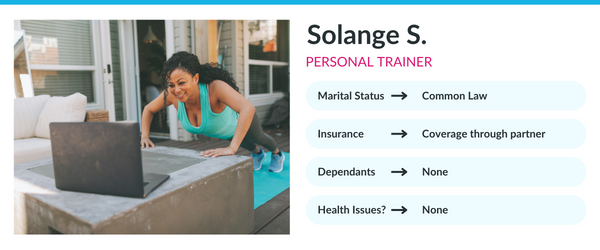

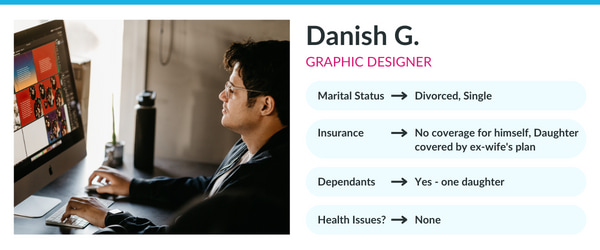

To get you started in thinking about which plan would work best for you, check out some of our self-employed friends below and see what plan worked best for them.

We suggest…

A standard plan.

Why?

Her spouse’s plan has fairly decent coverage for prescription drugs and dental insurance. That would cover most of Solange’s needs, and her own basic plan will make up the rest. If things change in the future and they have kids, we would suggest a more comprehensive supplementary plan. But for now, basic coverage is perfectly fine.

We suggest…

An standard plan.

Why?

While she has great coverage through her husband’s federal employee benefits plan, Cindy’s income in inconsistent and she doesn’t always have extra income to cover the remaining 20-30% of the medical service bills. Plus, her three boys all need braces. Her husband’s plan will cover about 70% of that, and her standard plan could make up the rest.

We suggest…

An enhanced plan.

Why?

His daughter has coverage through his ex-wife’s work plan, but Danish doesn’t have any coverage at all. As a self-employed business owner and single dad who is pre-diabetic, he needs to take his health seriously — and every penny counts. An enhanced plan can help him budget his healthcare costs so he can provide for his daughter and protect himself.

What are the best health and dental insurance companies for the self-employed?

These are the companies our experts recommend for the best self-employed health insurance plans:

- Blue Cross (Ontario) — unmatched prescription and dental coverage without limits

- Canada Life — comprehensive coverage options and flexible plans

- Manulife CoverMe — great options for flexibility and add-ons like dental-only, vision-only, or prescription drugs-only

- Sun Life — offers health coverage as one of its flagship products

- GreenShield (Sure Health) — offers guaranteed acceptance coverage for those with pre-existing conditions or who cannot qualify for other plans

- Desjardins — offers a SOLO healthcare product specifically for health and dental

- GMS — also has guaranteed acceptance plans plus no waiting periods and a LifeWorks digital wellness program to promote physical and mental well-being

How to get the best health insurance for self-employed individuals?

If you’re looking for advice on how to apply for the best self-employed health insurance options, just follow these 5 tips below:

Figure out what you need

The key to getting the best coverage is knowing and understanding what essential health benefits you need to cover and how the cost compares to the advantages.

Shop around

Comparing health insurance quotes can be easily done online through PolicyAdvisor. Look at different options to find the package that gives the most bang for your buck.

Apply online

Time is money and you can save both when you submit your application online with one of our friendly, licensed advisors. Getting medical insurance for self employed people is fast and easy with us

Compare companies closely

The health insurance provider you choose makes a difference. Compare quotes for health insurance from top companies to find who can give you the best deal. Or speak with our licensed advisors and let us do it for you!

Check with associations you’re part of

If you’re a part of any organization, check and see if they offer insurance coverage or discounts. Many of them offer exclusive insurance plans or deals.

What to avoid when looking for the best medical insurance for self employed in Canada?

When looking to get the best self-employed health insurance coverage, you should also avoid these faux-pas:

- Not comparing quotes — There’s no shame in window-shopping. Shop around before you buy, or contact us and let our agents help you find the best health plans for self-employed Canadians

- Skipping reviews — See what real customers have to say before you choose to buy from an insurance company

- Waiting too late — The sooner you buy, the lower your premiums will be and the better your plan options will be

- Cutting corners — You don’t have to get the most expensive plan, but don’t leave yourself without enough coverage either. Insurance isn’t something to skimp on

- Short-term thinking — Think about yourself and your business long-term to get a plan that will cover you now and in the future

- Not reading your policy — Understanding your coverage details is important to make the most out of your coverage, and your policy will tell all. Be sure to read it carefully!

Get affordable health insurance for self-employed individuals in Canada

If you’re a self-employed individual looking to find the right health insurance coverage that fits your diverse needs, you may need a little help! While you may be aware of your needs, it can be difficult to go through all the plans on your own!

This is where health insurance advisors like our experts at PolicyAdvisor come in! Not only can we help you pick the right plan, but we can also help you get the best possible riders and customization to ensure all your needs are taken care of. With the help of PolicyAdvisor, you can focus on your business while we keep you financially protected in case of a medical emergency.

Frequently asked questions

Can a self-employed person get group benefits?

No. If you are an independent worker, self-employed, or a gig worker, you are likely not able to access group benefit plans unless you:

- Are covered on a spouse’s plan

- Have coverage through a club or other group association

- Are a small business owner who bought a group plan for your employees

Unless you fit one of these categories, you should buy your own health plan for self employed Canadians.

Can I get health insurance for my business?

Yes. If you are a small business owner, you can buy an affordable health insurance plan as a group benefits package for yourself and your employees.

What if I’m newly self-employed, but had health insurance with my previous employer?

If you recently left a job that had a company group plan, many insurance companies will let you get guaranteed issue health insurance that doesn’t ask medical questions.

- As long as you apply within 60-90 days of your employee benefits ending, you may be able to keep your same health care plan.

- But, there may be better health coverage choices available to you.

There are many affordable health insurance plans for self-employed individuals. Speak with one of our licensed insurance advisors to plan out your best move for coverage.

What other insurance should I have if I’m self-employed?

As a self-employed person, you should consider buying:

- Disability insurance

- Critical illness insurance

- Life insurance

- Liability insurance

- And more

Being self-employed comes with benefits like independence, but it also means no group health insurance. Extended health care insurance can help cover out-of-pocket expenses for medical, dental, and vision care. Self-employed individuals can also deduct health insurance premiums on their taxes.