- Corporate-owned life insurance (COLI) protects Canadian businesses from key-person loss and supports succession planning

- The corporation receives the life insurance death benefit tax-free and can pay it out tax-free to Canadian shareholders through the Capital Dividend Account (CDA), as long as the proper election and adjustments are made

- Permanent life insurance offers tax-deferred cash value growth within the corporation

- COLI is particularly valuable for professional corporations, family-owned businesses, and firms seeking intergenerational wealth planning

Corporate owned life insurance (COLI) is one of the most effective financial planning tools available to Canadian business owners. Beyond providing a tax-efficient way to protect business continuity, COLI also supports long-term wealth accumulation within the corporation.

Given that 98.1% of all employer businesses in Canada are small businesses, many depend heavily on one or two key individuals whose loss could significantly disrupt operations. For such companies, corporate-owned life insurance serves as a strategic safeguard, and ensures stability, liquidity, and financial resilience under current Canada Revenue Agency (CRA) guidelines.

What is corporate-owned life insurance in Canada?

Corporate-owned life insurance (COLI) is a life insurance policy purchased and owned by a Canadian corporation. In this arrangement, the business pays the premiums and receives the death benefit proceeds. Unlike personally-owned policies, the corporation is both the policy owner and the beneficiary, creating unique tax planning opportunities under the Income Tax Act.

In a typical COLI structure:

- The corporation owns the policy: The business, not the individual, holds all ownership rights and can access policy benefits

- The insured is a key person: Coverage applies to shareholders, partners, executives, or essential employees whose loss would have a significant financial impact on the company

- Premiums are paid with corporate after-tax dollars: Premiums are paid with corporate after-tax dollars: Premiums are typically paid from retained earnings and are not tax-deductible, except in limited cases where the policy is assigned as collateral for a business loan. In such cases, only the portion of the interest expense on that loan, not the premium itself, may be deductible, and only to the extent that the CRA deems it reasonably related to the loan security

- Death benefits flow to the corporation: Proceeds are paid directly to the business, not personal beneficiaries

- Permanent insurance is most common: Canadian corporations typically use whole life or universal life policies, which build cash value and provide lifetime coverage

The strategic value of corporate-owned life insurance (COLI) goes far beyond simple death benefit protection. Under Canadian tax law, insurance proceeds received by a corporation may qualify for preferential treatment through the Capital Dividend Account (CDA), allowing certain amounts to be distributed tax-free to shareholders.

Policies must also meet the Income Tax Act’s exempt test to ensure that cash value accumulation remains tax-exempt within the policy, preserving its long-term tax advantages for the corporation.

How corporate-owned life insurance differs from personal life insurance

Corporate-owned life insurance differs from personal policies in ownership, premiums, and tax treatment. The corporation owns the policy, pays with retained earnings, and receives the death benefit, offering advantages for tax planning and business succession.

Here’s how a corporate life insurance policy differs from personal life insurance:

| Factor | Corporate-owned life insurance (COLI) | Personal life insurance |

| Ownership structure | Corporation owns the policy, controls all rights, and is typically the beneficiary | Individual owns the policy and names beneficiaries who receive proceeds directly |

| Premium payment source | Premiums paid from corporate retained earnings; may offer tax efficiency depending on corporate vs. personal tax rates | Premiums paid with after-tax personal income |

| Death benefit | Paid tax-free to the corporation; distribution to shareholders requires planning through tools like the capital dividend account | Paid tax-free directly to named individual beneficiaries |

| Estate impact | Policy is a corporate asset and follows business succession rules; not part of the individual’s estate | Generally bypasses the estate when a beneficiary is named; may enter the estate (probate exposure) if no beneficiary is designated |

| Primary use cases | Tax planning, key-person protection, succession funding, buy-sell agreements | Family protection, debt repayment, income replacement, personal estate planning |

Why do Canadian businesses purchase corporate life insurance?

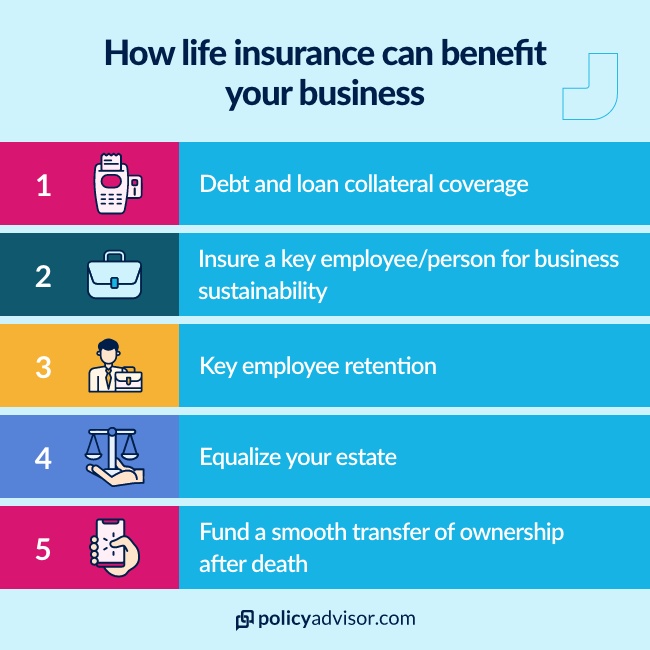

Canadian business owners purchase corporate-owned life insurance to achieve multiple strategic objectives, from protecting business continuity to building tax-efficient wealth.

Why whole life works best for COLI

When a Canadian business invests in corporate owned life insurance, the conversation isn’t about the cheapest policy. It’s about strategic corporate value, liquidity, and flexibility. Whole life insurance transforms a COLI policy from a simple risk-transfer tool into a tangible corporate asset.

Here’s why whole life insurance truly works best for a Canadian business:

- Permanent coverage aligns with long-term strategy: Term insurance expires; the risk returns. Whole life guarantees coverage for the insured’s lifetime. For businesses planning multi-decade succession, funding buyouts, or maintaining continuity after the loss of an owner or executive, permanent coverage eliminates uncertainty.

- Cash value is corporate-owned liquidity: Every dollar in cash value belongs to the corporation. That cash is accessible for strategic purposes: funding buy-sell agreements, providing executive retirement bonuses, supporting capital projects, or stabilizing the company during transitional periods. From a corporate finance standpoint, COLI cash value is a low-risk, tax-efficient asset on the balance sheet.

- Tax efficiency and CDA optimization: Death benefits flow tax-free into the corporation and can be credited to the capital dividend account (CDA). Sophisticated structuring ensures maximum shareholder value extraction while minimizing corporate tax exposure. When paired with a well-managed adjusted cost basis (ACB), withdrawals or policy loans can fund executive compensation or corporate initiatives without triggering unnecessary tax liabilities.

- Predictable growth for financial planning: Participating whole life policies provide dividends that increase both cash value and death benefit. Unlike term, which is a sunk cost, whole life allows CFOs to plan with predictable figures: premium schedules, anticipated cash value, and expected CDA contributions. This transforms insurance from an expense into a strategic instrument for corporate planning.

- Executive retention and incentivization: COLI structures can support executive benefit or retention programs when properly designed, though employer-paid benefits linked to individual coverage may be taxable to the recipient.

Also read: Whole life insurance for doctors

How the capital dividend account works with corporate owned life insurance

The Capital Dividend Account (CDA) is one of the most powerful tax planning tools for Canadian private corporations. When combined with corporate-owned life insurance (COLI), it can enable more efficient after-tax distributions under current CRA rules for shareholders. Understanding how CDA credits work is crucial for optimizing a COLI strategy.

Understanding the capital dividend account

- The CDA records certain tax-free amounts received by private Canadian corporations so they can be distributed tax-free to shareholders

- Corporations do not need to formally maintain the CDA, but accurate tracking is important

Key advantages:

- Tax-free dividend distribution: CDA amounts can be paid to Canadian-resident shareholders as capital dividends free of personal income tax; non-resident shareholders may have withholding tax applied

- No double taxation: The CDA ensures the same income is not taxed at both the corporate and personal level

- Strategic dividend planning: Corporations can time capital dividend payments to maximize tax efficiency for shareholders

Life insurance death benefits and CDA credits: When a corporation receives a life insurance death benefit, the CDA credit is calculated as:

CDA addition = Death benefit – Adjusted Cost Basis (ACB)

The adjusted cost basis (ACB) of a life insurance policy is the policyholder’s cumulative after-tax investment in the contract. It is calculated as the total premiums paid minus the net cost of pure insurance (NCPI) and any policy withdrawals or loans, plus or minus other permitted adjustments as defined under the Income Tax Regulations.

Over time, as the NCPI increases, the ACB gradually declines. For most permanent life insurance policies that are held until death and have not been accessed through withdrawals or loans, the ACB typically remains close to the total premiums paid, but may be somewhat lower in later years.

Capital Dividend Account (CDA) example: how tax-free benefits are calculated

For example, a corporation buys a $2,000,000 whole life insurance policy on its 45-year-old founder and pays $450,000 in total premiums over 30 years. Upon the founder’s death at age 75:

- Death benefit received: $2,000,000

- Adjusted cost basis (premiums paid): $450,000

- CDA credit: $2,000,000 – $450,000 = $1,550,000

This means the corporation can distribute $1,550,000 to shareholders as a tax-free capital dividend. If this were a regular dividend taxed at 50 percent, shareholders would have paid $775,000 in personal taxes, showing the significant tax efficiency of combining COLI with the CDA.

In practice, the CDA credit is based on the net death benefit minus the adjusted cost basis (ACB), taking into account any policy withdrawals. Shared ownership arrangements may also affect CDA eligibility, but policy loans do not reduce the CDA credit.

How to maximize capital dividend account benefits with corporate life insurance

Strategic policy design is essential for Canadian corporations seeking to maximize the capital dividend account (CDA) benefits of corporate-owned life insurance. By carefully structuring coverage, premium levels, and policy features, businesses can increase CDA credits, enhance tax efficiency, and support long-term corporate wealth. Key considerations for optimizing CDA advantages include:

- Higher face amounts, lower premiums: Policies with higher death benefits relative to premiums generate larger CDA credits. Permanent policies typically provide better ratios than term insurance that is converted later

- Limiting policy loans and withdrawals: Any amounts withdrawn from the policy reduce the adjusted cost basis (ACB), which in turn decreases the eventual CDA credit

- Multiple policies on multiple lives: Covering several key individuals diversifies risk and creates CDA credits as each insured passes away, offering ongoing tax planning opportunities over decades

- Participating whole life advantages: Policies that pay dividends can increase CDA benefits when dividends are used to purchase paid-up additional insurance, boosting both cash values and death benefits. However, it is important to note, dividends are not guaranteed but declared annually by the insurer based on participating fund performance.

What are the tax benefits of corporate life insurance in Canada?

Corporate-owned life insurance (COLI) offers multiple layers of tax advantages, making it especially valuable for Canadian business owners in higher tax brackets. Understanding these benefits helps corporations structure policies to maximize after-tax wealth.

Tax-free death benefit treatment

- When structured as an exempt life insurance policy under the Income Tax Act, death benefits are typically received by the corporation tax-free.

- Unlike other corporate investments where growth is taxed, the full insurance benefit remains available for business use.

- There is no cap on the death benefit amount eligible for tax-free treatment, making COLI particularly valuable for high-net-worth business owners.

Tax-deferred cash value accumulation

Permanent life insurance policies build cash value that grows without annual taxation:

- Investment income sheltering: Returns generated inside the policy, interest, dividends, or capital gains, accumulate tax-free until withdrawn, creating a significant advantage over non-registered corporate investments. Over 20–30 years, tax-deferred compounding in COLI can generate substantial additional corporate wealth compared with taxable corporate investments.

- Exempt policy rules: To receive preferential tax treatment, policies must meet Income Tax Act exemption tests that limit deposits relative to insurance coverage. Properly structured policies maximize investment room while maintaining exempt status.

How much does corporate-owned life insurance cost in Canada?

The cost of corporate-owned life insurance (COLI) varies based on several factors, including the age and health of the insured, policy type, coverage amount, and additional features. Unlike personal insurance, corporate policies are often designed to combine death benefit protection with long-term cash value accumulation and tax advantages.

| Policy type | Coverage | Annual premium | Year 10 cash value | Strategic use |

| Term 20 | $1 Million | $3,000 | $0 | Pure protection, no corporate asset |

| Whole life (non-par) | $1 Million | $12,000 | ~$100,000 | Permanent coverage, corporate liquidity |

| Whole life (par, participating) | $1 Million | $15,000 | ~$150,000 + dividends | Permanent coverage, CDA optimization, executive benefits |

*These sample premiums reflect a 40-year-old male non-smoker at standard rates for comparison purposes; actual premiums vary.

Additionally, understanding typical cost drivers helps Canadian businesses budget effectively and evaluate the return on investment.

| Factor | Impact on Corporate Life Insurance Premiums | Typical Effect / Range |

| Age and health of the insured | Younger and healthier individuals pay less | A 35-year-old non-smoker may pay 60–70% less than a 55-year-old for equivalent coverage |

| Coverage amount | Larger death benefits increase total premiums but reduce cost per $1,000 of coverage | Economies of scale reduce unit cost for higher face amounts |

| Policy type | Permanent policies cost more upfront but build cash value | Whole life or universal life premiums can be 3–5× higher than term initially |

| Underwriting class | Better health ratings lower premiums | Preferred/elite ratings reduce premiums 25–40%; substandard ratings increase them proportionally |

| Gender | Life expectancy differences affect cost | Females often pay less than males at equivalent ages |

| Riders and additional benefits | Extra features increase base premiums | Critical illness, guaranteed insurability, or enhanced coverage can add 10–50% to premiums |

Disclaimer: This guide is for informational purposes and should not replace professional tax or legal advice.

Frequently asked questions

Can my business deduct COLI premiums on taxes?

Generally, premiums for corporate-owned life insurance are not tax-deductible when the policy benefits the business rather than employees. However, certain structures, such as executive benefit plans or key-person insurance combined with whole life cash value strategies, may allow partial tax advantages. It’s essential to consult a tax advisor to align the policy design with Canada Revenue Agency rules and ensure that any potential deductions are properly applied.

Who should be insured under a corporate-owned life insurance policy?

Typically, businesses insure owners, executives, or key employees whose death would materially affect operations, cash flow, or valuation. This can include founders, top management, or specialized personnel critical to revenue generation or intellectual property management. The selection of insured individuals should align with succession planning, buy-sell agreements, and business continuity objectives.

How does COLI support buy-sell agreements and business succession?

COLI provides immediate liquidity to fund ownership transfers when an owner dies. Without insurance, surviving shareholders might have to sell assets, incur debt, or dilute ownership to complete the purchase. With COLI, the company receives the death benefit, which can then be used to pay out the deceased owner’s shares at fair market value, ensuring a smooth and financially secure transition.

What role does the capital dividend account (CDA) play in COLI?

Through the CDA, corporations can pay shareholders tax-free capital dividends equal to the death benefit minus the policy’s ACB. When a death benefit is credited to the CDA, shareholders can receive it as a tax-free dividend, providing a significant strategic advantage in succession planning and estate equalization. Proper calculation and management of the adjusted cost basis (ACB) are critical to maximize tax efficiency while maintaining corporate flexibility.

Unexpected loss of a key executive or owner can jeopardize a business. Corporate-owned life insurance (COLI) provides Canadian business owners with a strategic tool that combines financial protection, tax efficiency, and long-term asset growth. Unlike personal life insurance, COLI is owned by the corporation, allowing businesses to fund buy-sell agreements, secure loans, protect key personnel, and enhance employee benefits, all while maintaining control over the policy’s value.

Statistics Canada, Key Small Business Statistics – December 2023, Government of Canada