- Equitable whole life insurance ensures lifelong protection with guaranteed death benefits and cash value growth

- The company offers customizable policies with multiple payment plans and riders like critical illness and disability waivers

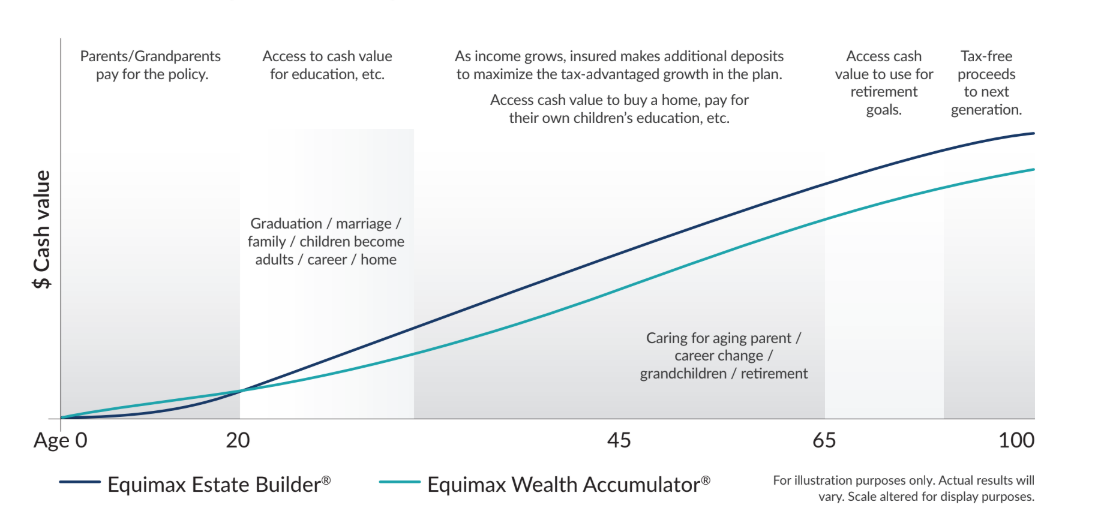

- The Equimax Estate Builder plan focuses on legacy, while Equimax Wealth Accumulator prioritizes cash value growth

- With Equimax, individuals can enjoy tax-deferred growth and tax-free death benefits for added financial security

Equitable Life is one of Canada’s strongest mutual insurers, recognized for disciplined investment management, consistent dividend performance, and a clear focus on policyholder value.

The company’s 10-year average DSIR is approximately 6.24%, underscoring its reliability and competitive long-term cash value performance. In 2025, the company maintained a 6.40% dividend scale interest rate for its participating policies. This dividend scale rate remains unchanged from the previous year and is one of the highest among Canadian participating insurers, which may support steady cash value growth for policyholders.

In this review, we’ll explain how Equitable’s whole life insurance plans work, their key benefits, features, dividend performance, and why the company remains a top choice for Canadians looking to balance protection with long-term financial growth.

Equimax Wealth Accumulator

20-pay

pay-to-100

PolicyAdvisor rating

Equitable whole life insurance earns a 5 out of 5 rating from PolicyAdvisor for its mutual ownership structure, competitive dividend scale, and long-term focus on policyholder value. As a Canadian mutual life insurer, Equitable distributes profits back to participating policyholders rather than external shareholders, reinforcing long-term stability and strong participating performance.

Equitable’s participating whole life policies share in the company’s profits through annual dividends. The Dividend Scale Interest Rate reflects the participating account’s investment performance and is used to help determine dividend payments, which are not guaranteed and are declared at the sole discretion of Equitable’s Board of Directors each year.

Equitable’s participating account highlights (2025–2026):

- Estimated par block assets: $2.7 billion (largest Canadian mutual)

- Dividend scale interest rate (DSIR): 6.40%

- Par policyholders: 312,000+

- Expected dividends paid to policyholders: ~ $175 million

- Par business history: 102 years with uninterrupted participating business

- Dividend on deposit interest rate: 3.50%

- Policy loan interest rate: ~ 6.50% for most Equimax policies with qualifying policy numbers

- Dividends are not guaranteed and vary based on investment performance, mortality experience, expenses, and other participating account factors

Equitable offers two participating whole life plan options under the Equimax product line:

- Equimax Estate Builder®: Designed for long-term value and legacy goals

- Equimax Wealth Accumulator®: Designed for earlier cash value accumulation and financial flexibility

Equitable participating policies offer multiple premium payment options, including lifelong premiums, 20-pay, and 10-pay structures, giving policyholders flexibility to match their financial planning needs.

Rating methodology

PolicyAdvisor rates Equitable whole life insurance 5/5 based on factors similar to those used for other participating products including mutual company advantages, dividend scale stability, long-term cash-value performance, premium payment flexibility, participating account strength, and available riders.

Dividend Scale - Participating Whole Life Insurance

Compare dividend rates from top Canadian insurers

| 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|

| Equitable | 6.05% | 6.25% | 6.40% | 6.40% |

| Manulife | 6.10% | 6.35% | 6.35% | 6.35% |

| iA Financial Group | 5.75% | 6.00% | 6.25% | 6.35% |

| Desjardins Insurance | 5.75% | 6.20% | 6.30% | 6.30% |

| RBC Insurance | 6.00% | 6.00% | 6.25% | 6.30% |

| Sun Life | 6.00% | 6.00% | 6.25% | 6.25% |

| Empire Life | 6.00% | 6.00% | 6.00% | 6.25% |

| Foresters Financial | 5.50% | 5.50% | 5.50% | 6.25% |

| Co-operators | 5.90% | 5.90% | 6.00% | 6.00% |

| Assumption Life | 5.75% | 5.75% | 5.75% | 5.75% |

| Canada Life | 5.25% | 5.50% | 5.50% | 5.75% |

What are the key features of Equitable’s whole life insurance?

Equitable offers participating whole life insurance for individuals looking to safeguard their financial future. These insurance options can be availed by individuals within 80 years of age and have a minimum coverage range of $10,000 (for single policies). Policy loans and dividends are available in Equitable’s whole life insurance, with varying degrees of tax advantage. Find out more below:

| Category | Details |

| Policy type | Whole life insurance |

| Cash value accumulation | Available. Can be accessed after the first year of purchasing the policy |

| Maximum issue age | 80 years |

| Coverage amount range | $10,000 to no maximum |

| Dividend options | Paid-up additions, enhanced protection, or paid in cash/held on deposit |

| Policy loan availability | Available |

| Tax benefits | Tax-advantaged growth of cash value |

| Payment options | Life pay, 10 years, and 20 years payment options available |

| Additional riders | Disability waiver of premium, critical illness, Excelerator Deposit Option (EDO) |

Additional policyholder support (KIND program)

New Equimax participating whole life policies include Equitable’s built-in KIND program. It provides compassionate and snap advances, access to policy cash value in cases of severe disability, and bereavement counselling benefits.

What is Equimax by Equitable?

Equimax is Equitable Life’s flagship participating whole life insurance product, designed to provide lifelong protection while steadily building cash value. It combines guaranteed coverage and level premiums with the potential for long-term financial growth through annual participating dividends.

Equimax is available in two plan options tailored to different financial goals: Equimax Estate Builder®, ideal for long-term wealth transfer and legacy planning, and Equimax Wealth Accumulator®, suited for individuals or business owners seeking higher early cash values and financial flexibility.

How does Equimax’s participating whole life insurance work?

Equitable Life’s Equimax participating whole life insurance combines guaranteed lifelong protection with long-term growth through dividends. It’s designed for clients who want both security and a financial asset that builds value over time.

Here’s how the plan works:

- Permanent life insurance coverage: This type of policy provides lifetime protection with guaranteed premiums and death benefits, ensuring stability for estate and wealth transfer goals

- Guaranteed cash value: Equitable whole life builds cash value over time within the policy. Wealth Accumulator begins accumulating cash value early, while Estate Builder focuses on stronger long-term growth

- Participating policy and dividends: As a participating plan, Equimax is eligible to receive annual dividends based on the performance of Equitable Life’s participating account, which reflects factors like investment returns, expenses, and mortality experience

- Dividend options: Policyholders can choose how to use their dividends, receive them in cash, keep them on deposit to earn interest, buy paid-up additions (PUAs) for more coverage, or apply them to reduce premiums. The Enhanced Protection Option, available only at issue, combines PUAs with a one-year term addition for extra coverage flexibility

- Premium payment choices: Equitable offers flexible payment schedules-10 Pay, 20 Pay, or Pay to Age 100. Once the payment period ends, coverage remains in force for life

- Access to cash value: Policyholders can access built-up cash values through loans or withdrawals. Cash value can also serve as collateral for financing needs, though such actions may affect future dividends or death benefits

- Mutual company advantage: As a mutual insurer, Equitable Life operates without shareholders, meaning participating policyholders share in the company’s long-term success through dividends and stable account management

What are the different Equitable whole life insurance plans to choose from?

Equitable Life offers two participating whole life insurance plans under its Equimax product line, Equimax Estate Builder and Equimax Wealth Accumulator. Both plans offer lifetime coverage and the opportunity to build guaranteed cash values, but they cater to different financial goals.

- Equimax Estate Builder is designed for clients focused on long-term value, estate planning, and wealth transfer. It provides higher death benefits and steady cash value growth, making it ideal for individuals who want to leave a lasting financial legacy or support charitable giving

- Equimax Wealth Accumulator offers stronger early cash value growth and greater liquidity in the initial years. It’s suited for clients or business owners who may need access to cash value earlier for opportunities like funding education, buying property, or investing in a business

| Category | Equimax Estate Builder® | Equimax Wealth Accumulator® |

| Primary focus | Designed for long-term estate planning, wealth transfer, and legacy growth | Focused on higher early cash values and short-to-medium-term liquidity |

| Ideal for | Individuals and families aiming to grow and transfer wealth tax-efficiently | Business owners or professionals who value early access to cash within 20 years |

| Cash value growth | Moderate in early years, strong long-term accumulation | Higher early cash values, with slightly lower long-term accumulation |

| Death benefit growth | Higher long-term death benefit to offset estate or capital gains taxes | Moderate death benefit growth, emphasizing cash accessibility |

| Dividend options | Dividends can be received in cash, on deposit, or used to purchase paid-up additions (PUAs) | Dividends can be received in cash, on deposit, or used to purchase paid-up additions (PUAs) |

| Premium payment options | Available as 10 Pay, 20 Pay, or Pay to Age 100 | Available as 10 Pay, 20 Pay, or Pay to Age 100 |

| Liquidity and collateral use | Strong long-term value, typically used for estate purposes or future borrowing | High early cash values make it well-suited for collateral loans or funding business opportunities |

| Child or grandchild coverage | Ideal for lifelong coverage with gradual value growth for education or inheritance | Offers earlier access to cash values for education or financial milestones |

| Charitable giving | Well-suited for estate donations or legacy philanthropy | Allows more flexibility for lifetime charitable contributions |

| Business protection | Works well for long-term shareholder or key-person protection with stable growth | Better for businesses that prioritize early liquidity and short-term funding options |

| Coverage availability | Available as Single Life, Joint First-to-Die, or Joint Last-to-Die | Available as Single Life, Joint First-to-Die, or Joint Last-to-Die |

| Minimum sum insured | $10,000 (child) or $50,000 (adult) | $10,000 (child) or $50,000 (adult) |

| Maximum sum insured | Up to $25,000,000 total Equimax coverage | Up to $25,000,000 total Equimax coverage |

What are the pros and cons of Equitable’s whole life insurance policy?

Equitable has several advantages, such as lucrative riders, availability for a collateral loan, multiple dividend payout options, and tax-free death benefits. However, there are some disadvantages, such as the non-availability of a non-participating whole life insurance option, higher premium costs, and slow cash value growth during the initial days of the Equitable Estate Builder plan.

| Pros | Cons |

| EquiLiving Critical Illness Rider provides a lump-sum payout for covered illnesses to cover medical costs or support recovery | This policy has higher premiums compared to term insurance, making it less accessible for tight budgets |

| Excelerator Deposit Option allows additional tax-deferred contributions to enhance the policy’s cash value growth | Equitable does not have a non-participating whole life insurance option to choose from |

| Variable dividend options provide flexibility to increase the death benefit, reduce premiums, earn interest, or receive cash | It is not ideal for short-term goals or individuals seeking immediate returns |

| Tax-advantaged growth offers long-term savings potential and typically tax-free death benefits for beneficiaries |

Highlights of Equitable’s whole life insurance policy document

An Equitable Life whole life insurance policy document includes:

- Policyholder and insured details: Names, ages and coverage start dates for the owner and insured

- Coverage amount: The death benefit and any additional term or rider coverage selected

- Payment and premium schedule: The chosen pay structure (10-pay, 20-pay or life pay), premium amount, billing frequency and premium guarantees

- Dividend options: How dividends can be used, including paid-up additions, cash payout, enhanced protection, premium reduction or left on deposit

- Guaranteed values: Tables showing guaranteed cash value and death benefit, along with illustrated non-guaranteed values based on the current dividend scale

- Policy loans and withdrawals: Rules for borrowing or withdrawing from cash value, including limits and interest rates

- Riders and living benefits: Available add-ons such as critical illness, term riders, accelerator deposit option and waiver of premium

- Beneficiary designation: How to assign or update primary and contingent beneficiaries

- Surrender and cancellation provisions: Steps to terminate the policy and access any guaranteed surrender value

- Participating account disclosure: How dividends are generated and how the participating account operates

- Legal and definitions: Key legal terms, exclusions, reinstatement rights and claim procedures

What are the different limited-pay options offered by Equitable?

Equitable Life offers three limited pay structures for its participating whole life insurance plans (Equimax Estate Builder and Equimax Wealth Accumulator):

- 10-pay: Premiums are paid for 10 years. Once the payment period ends, the policy is fully paid up and lifelong coverage continues with no further premiums

- 20-pay: Premiums are paid for 20 years, after which the policy is fully paid up for life

- Life pay: Premiums are paid for life or until age 100, depending on the contract. This option usually offers lower annual premiums than 10-pay or 20-pay plans

Why should you purchase Equitable Life whole life insurance for children?

By purchasing Equitable’s whole life insurance policies for your child or grandchild, you’re giving them more than just lifelong coverage;, you’re setting the foundation for their financial future. Equitable Life whole life insurance for children offers permanent coverage at children’s rates, with paid-up options in 10 or 20 years.

It provides tax-advantaged cash value growth, offering financial flexibility through loans or withdrawals for future needs. Also, ownership can transfer tax-free to the child upon adulthood, securing their financial foundation.

For example, if you buy a 20-pay whole life insurance for a 5-year-old child at an annual premium of $1,200, the policy’s value will continue to grow without any further premium payments after the first 20 years.

By simply paying $100 a month, parents can now secure the financial future of their children, ensuring they have enough coverage to fund important life events as well as emergencies and can also leave a fortune behind for their future generations.

How can you pay for Equitable whole life insurance?

Equitable Life provides three main payment options for its Equimax whole life insurance policies: Life Pay, 10 Pay, and 20 Pay. Each of these payment options can be beneficial to different individuals based on their unique situations.

- Life Pay: This option requires premiums to be paid throughout the policyholder’s lifetime or until death. It’s designed for those who prefer lower annual payments spread over a longer period

- 10 Pay: In this scenario, the premiums are paid for only 10 years, after which the policy is fully paid up. This option is ideal for individuals who want to secure lifelong coverage quickly and have the financial resources to afford higher annual payments

- 20 Pay: This option allows policyholders to complete premium payments over 20 years. It balances affordability and early completion, making it suitable for those who want to avoid lifetime payments but prefer a payment period longer than 10 years

Does Equimax help with tax payouts during death?

Yes, Equimax Estate Builder whole life plan can help with tax payouts upon death. This specific plan is designed to provide a larger death benefit, which can be used to offset estate taxes and other final expenses.

The death benefit is typically paid out tax-free to beneficiaries, providing them with the funds needed to settle the estate without the burden of additional tax liabilities.

The Equimax Estate Builder whole life plan provides a death benefit that can be used to:

- Cover estate taxes: The death benefit can help beneficiaries pay for estate taxes, ensuring the full value of the estate is passed on without forcing them to liquidate assets

- Leave a legacy behind: The policy ensures that the financial legacy you leave behind remains intact, allowing your beneficiaries to inherit more

How are whole life insurance dividends determined by Equitable?

Equitable Life’s whole life insurance dividends are determined by the performance of its participating (PAR) account. The financial performance of PAR accounts can depend on factors like investment returns, mortality payouts, premium lapses, and tax obligations.

Strong investment performance, fewer claims, and lower premiums lapsing can lead to higher dividends, while the opposite may result in lower payouts.

Dividends are paid at the sole discretion of Equitable Life’s board of directors. As such, dividends can vary from year to year depending on the insurer’s performance. The decision to distribute dividends is made with the aim of ensuring steady, predictable returns while minimizing volatility.

| Year | DSIR |

| 2025 | 6.40% |

| 2024 | 6.40% |

| 2023 | 6.25% |

| 2022 | 6.05% |

| 2021 | 6.05% |

| 2020 | 6.20% |

Now, let’s take a look at the average dividend scale returns by Equitable’s participating accounts and interest rates over the last 30 years:

| Timeframe | Equitable PAR account return | Equitable dividend scale interest rate |

| 5 years | 6.52% | 6.15% |

| 10 years | 6.26% | 6.37% |

| 20 years | 6.79% | 6.95% |

| 30 years | 7.35% | 7.72% |

| Standard deviation over 30 years | 1.79% | 1.31% |

Source: Equitable dividend scale interest rate, 2024

Which Equitable whole life plan type is right for you?

Equitable’s Estate Builder and Wealth Accumulator plans are built to suit the diverse needs of policyholders. From long-term goals to immediate cash value accumulation, individuals can choose the right Equimax plan for them based on their individual needs.

| What to look for | Equimax Estate Builder | Equimax Wealth Accumulator |

| If you are looking for higher long term benefits for planning your estate | ✓ | ✘ |

| If you’re looking for a higher death benefit that can reduce tax burden for your next of kin during transfer of property | ✓ | ✘ |

| If you’re looking for affordable insurance coverage to secure the financial future of your children or grandchildren | ✓ | ✓ |

| If you’re looking to build immediate cash value to start a business | ✓ | ✓ |

| If you’re looking to make philanthropic donations but also reduce your tax implications now and in the future | ✓ | ✓ |

| If you’re looking to create a steady retirement fund | ✓ | ✓ |

| If you’re looking for quick access to higher cash value through a policy loan or collateral loan | ✘ | ✓ |

What are the various dividend options on an Equimax whole life insurance plan?

Equitable’s participating whole life insurance has several dividend options to choose from, including cash payout, premium reduction, paid-up additions, on-deposit, and enhanced protection.

- Paid in cash: Dividends are paid directly to the policyholder each year

Best for: Clients who want annual income or flexibility rather than reinvestment - Premium reduction: Dividends reduce future premiums, lowering out-of-pocket costs while keeping coverage intact

Best for: Clients seeking immediate savings and simplicity - On deposit: Dividends are held in an interest-bearing account with Equitable Life and can be withdrawn anytime

Best for: Clients who prefer liquidity and guaranteed interest growth - Paid-Up Additions (PUA): Dividends buy additional permanent coverage that grows cash value and death benefit tax-deferred

Best for: Clients focused on long-term accumulation and estate enhancement - Enhanced protection: Combines base permanent coverage with a one-year renewable term (OYT) layer. Dividends first pay OYT costs; any remainder buys PUAs that gradually replace the term layer

Best for: Clients who want higher early coverage, faster growth, and stronger estate value

What is the living benefit offered by Equimax whole life insurance?

The living benefit offered by Equimax whole life insurance allows policyholders to access a portion of their policy’s cash value if the life insured becomes severely disabled due to a physical or mental impairment.

This benefit can be applied once per policy year and is subject to Equitable Life’s administrative guidelines. Any payment made under the Living Benefit will reduce the policy’s death benefit.

Individuals suffering from life-threatening conditions such as cancer, AIDS, coronary artery disease, myocardial infarction, chronic kidney or liver failure, Alzheimer’s disease, etc, can be eligible to receive Living Benefits under their whole life insurance policy. Also, the insured individual must have been impaired for a period of 90 days significantly affecting their day-to-day life, and their ability to continue employment.

What are the additional riders available with Equitable’s Equimax whole life insurance?

Whole life insurance by Equitable has customization options along with various riders such as critical illness, additional term life insurance, disability waiver, and more. Insured individuals can choose from these options to further enhance their chances for a higher payout in case of severe illness or disability.

- Disability waiver of premium rider: Waives premiums if the policyholder becomes disabled, ensuring continued coverage without financial strain

- Term life insurance rider: Available only with single policies, this allows you to add term life insurance coverage to your whole life policy, providing additional protection within a single plan

- EquiLiving critical illness rider: Offers financial protection in the event of a severe illness, allowing you to access benefits for medical or living expenses

- Excelerator Deposit Option (EDO): Enables you to make lump-sum contributions to your policy, boosting its cash value and increasing your death benefit

How to get the best whole life insurance quotes in Canada?

When it comes to finding the best whole life insurance quotes in Canada, you have a few options. You could spend hours browsing different websites and comparing policies on your own, but that can quickly become overwhelming and time-consuming. This is where PolicyAdvisor comes in!

What sets PolicyAdvisor apart is not just the competitive pricing and multiple options to choose from, but also the lifetime after-sales support. After you’ve secured your policy, you’re not left on your own. Our team of expert advisors is always available to help with any questions or adjustments you need, ensuring you have ongoing support every step of the way. It’s a stress-free way to get the best coverage while knowing you’re always taken care of, now and in the future.

Frequently asked questions

Can I transfer ownership of my Equitable whole life insurance policy to my children or grandchildren?

Yes, Equitable allows you to transfer ownership of your whole life insurance policy to your children or grandchildren when they reach the age of majority.

This is a great way to start building generational wealth, as they can access the policy’s cash value for future expenses such as education or a down payment on a house.

Can I add extra coverage to my Equitable whole life insurance policy in the future?

Yes, Equitable offers various options to increase your coverage over time. With features like paid-up additions, you can use dividends to purchase additional life insurance, increasing your death benefit and cash value. This flexibility allows you to tailor your policy as your life circumstances evolve, ensuring that you always have the coverage you need.

What happens to my Equitable whole life policy if I stop making premium payments?

If you stop making premium payments on your Equitable whole life policy, it won’t necessarily lapse immediately. The policy’s cash value can be used to cover the premiums for a period of time, depending on how much cash value you’ve accumulated. However, once the cash value is exhausted, your coverage may likely end. It’s important to keep track of your policy’s status from time to time.

Can a person with pre-existing conditions be eligible for the Living Benefit of a whole life insurance policy?

No, a person with pre-existing conditions may not be eligible for the Living Benefit under Equitable’s whole life insurance policy if the condition existed at the time the policy was first issued or at the date of the last reinstatement.

Equitable Life’s whole life insurance offers lifelong coverage, guaranteed cash value, and tax-advantaged growth, making it an appealing option for long-term financial planning. With flexible plans like Equimax Estate Builder and Wealth Accumulator, policyholders can customize coverage for estate planning or wealth accumulation.