- You have several options when your term life insurance policy expires

- Most term life policies allow for automatic renewal of the policy at expiry, thereby extending your coverage for a set period of time, without asking you to requalify

- Automatically renewing your policy is easy, but the renewal premiums are typically much more expensive

- You can save money by reapplying for term life insurance with full underwriting

- Opting for automatic renewal may be the best option if you have developed a health concern or can no longer apply for new coverage

- If your insurance needs have changed, you can cancel the policy and apply for another for different amount or term

Term life insurance has the word term in it for a reason – it covers you for a limited period of time. Typically, short-term life insurance lasts for 10, 15, 20, 25, 30 years, or until a certain age, depending on what you initially selected when you purchased the policy.

But what happens when that term ends? Can you renew your life insurance policy? Should you renew your life insurance policy or start a new one if you have that option? Or can you convert your policy to coverage for life?

What happens when my term life insurance policy expires?

Your life insurance coverage ends when your policy matures – or in other words, expires or reaches the end of its term. It is important that you know what to do with your existing policy ahead of its expiry.

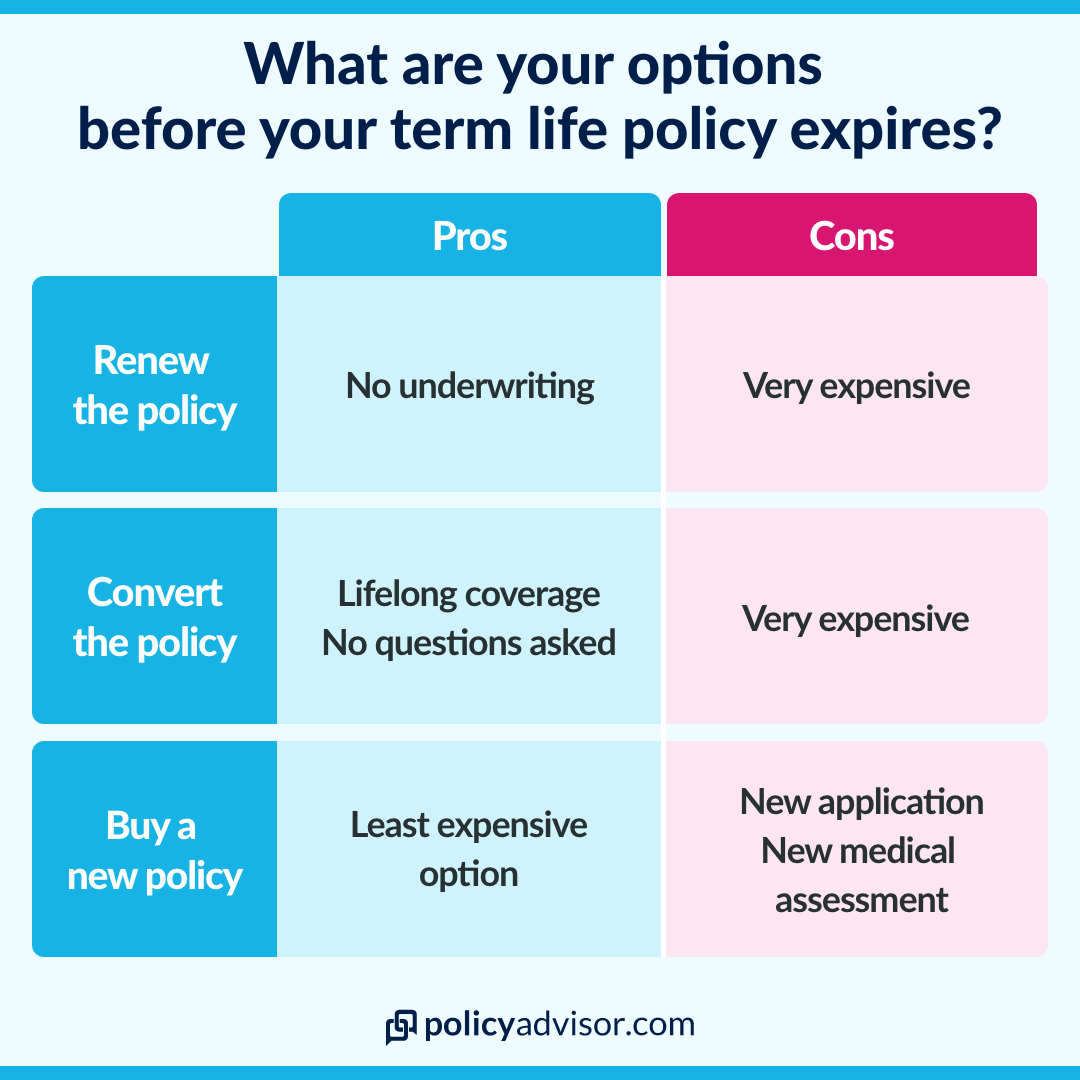

At this time, you have three options:

- Let the policy expire if you no longer require coverage

- Renew the policy (either automatically or with the help of your provider)

- Apply for an entirely new policy

Additionally, some term life insurance policies also have a conversion option. Within a certain time frame, a convertible term life insurance policy can be converted into a permanent life insurance policy that offers coverage for your entire life. This option is best suited for those whose insurance needs have evolved and are now seeking lifelong coverage.

What is a term life insurance renewal?

A renewable term life insurance policy lets you continue your coverage after the expiry of the initial term without having to medically requalify. While the renewal of your existing policy seems like an easy and convenient option, it has its downsides. This convenience comes with a starkly higher insurance premium compared to what you would pay if you took out a new policy.

The choice of whether to renew your existing policy, take out new coverage, or forego any coverage at all will depend on your given situation and financial obligations. It is important to reexamine why you purchased term life insurance in the first place, and whether or not your coverage needs have changed.

As well, learning about important aspects of the cost of renewing your policy and your own insurability can help you make the right decision.

Can my term life insurance be renewed?

Almost all insurance companies offer renewal options on their term life insurance policies. For example, if your initial policy is for a 10-year term, the coverage automatically renews at the end of the term for another 10 years unless you specifically cancel your coverage. However, the renewal is subject to a higher premium – more on that later.

Most companies will allow for renewal of the policy up to a certain age, such as 70 or 75 years old. Once you reach that age, the policy can no longer be renewed and the coverage will expire. The latest date by which you can renew your coverage is usually stated in your policy document.

What are the different types of renewable term life insurance policies?

The most common renewable policies are those that renew at the end of the initial term – at 10, 15, or 20 years.

This is another category of renewable term policies that have a yearly renewable term. Such policies – as the phrase suggests – are renewed every year. At each renewal, the premium becomes more expensive. The initial cost of premiums in such policies are low compared to typical term policies, but those premiums increase every year and become more costly in the longer run.

Are all term life policies renewable?

Most term life policies are renewable, but not all. For instance, some term life policies have a specified age of expiry. Such policies are not renewable upon the end of their original term. This includes some term-to-65 policies.

Do I have to take a medical exam if I decide to renew my term life policy?

In case of renewal of a policy, proof of insurability (which means undergoing a medical exam or answering a medical questionnaire) is not required. Regardless of any changes to your medical history or new health issues, your coverage will continue. But you will pay a higher premium for the continued coverage.

Do I pay a higher premium if I renew my term life insurance?

When you renew your existing term life insurance, your new premium is significantly higher than what you originally paid. The renewal premiums can be 5 to 10 times more than your initial premiums for term insurance.

Why are renewal premiums high?

With term life insurance renewal, you do not have to provide proof of good health. This is why an insurance company charges you a higher premium at renewal. Since the insurance company has no way of knowing your current health condition, it assumes that with the increase in your age you may have developed certain health conditions, your health may have deteriorated, or you may have even developed a terminal illness. This will increase the chance of a claim, posing a higher risk for the insurance company that they may pay out a death benefit.

If you are renewing coverage without medical underwriting or proof of insurability, your good health or fitness regimen makes no difference in the eyes of an insurance provider.

Should I ever renew a term life policy?

If you have developed serious health conditions since you were last approved for your policy, the insurance company may charge you a higher premium than a renewal for your term coverage. Also, they may deny coverage altogether. If you are unable to get new coverage and still have coverage needs, then sticking with the renewal process for your existing coverage is your best option.

Do I have to take new coverage from my existing provider?

No, it is not necessary to take new coverage from the original insurance company which provides your current policy. You have the choice to take out a new policy from any other insurance company. Doing so may be more cost-effective or better meet your overall insurance needs.

Picking a life insurance provider is always your choice. Still, before making any decision or switching providers, research who the best life insurance companies are in Canada. Weigh the pros and cons of each provider to see which best suits your own coverage requirements.

What if I do not want to renew my life insurance policy or take out new coverage?

You are not bound to renew your policy or take new coverage. It is entirely your choice. If your financial situation has evolved to the point where you have no liabilities then why continue paying term life insurance premiums for another decade or two?

Situations where this makes sense can include:

- You have paid off your outstanding mortgage,

- Your children have completed their education and are self-sufficient

- You have set aside significant assets or coverage for your dependents

You have the option to put the money you would have spent on a renewed policy to some other use. Additionally, you can find alternative whole life or permanent life policy if you are still worried about some final expenses.

Be sure to let your insurance provider know your plans and that you will no longer be continuing with the policy. Neglecting to call or email your provider will lead to the automatic renewal of your policy.

What should I do? Renew my existing coverage or get new coverage?

The answer here is not one-size-fits-all. When considering your current situation, expert advice from a licensed insurance advisor or financial advisor can help you assess your options. If you have developed health concerns (such as heart disease, a kidney disorder, or cancer) it may make it difficult for you to get new coverage. In such a case, renewal might be your best option.

But, if you have no major health concerns or your insurance requirements have changed then your existing policy may not adequately meet your coverage needs. At this point, seeking a new term insurance policy for a higher amount is a good option.

Lastly, if you opt for new coverage at the same amount or a reduced amount, your premium payment will be lower compared to the one offered at renewal.

Assessing your life insurance needs

You should regularly assess your life insurance requirements. As discussed above, your needs can change with time. Both personal and career changes can impact your insurance profile. An assessment before the expiry of your term policy is recommended. It can ensure that you get just the coverage you need and enjoy peace of mind for the rest of your life.

That said, if you are unsure of your insurance needs, there’s no need to worry. Our licensed insurance agents can help you determine how much coverage you need and for how long, and if renewal is the right option for you at this time.

When a term life insurance policy expires, policyholders have a few options. They can let the policy lapse, they can apply for a whole new policy, or they can renew their existing policy. There are many benefits to renewing a term life insurance policy. They include not having to undergo additional medical tests, though premiums can be substantially higher.

1-888-601-9980

1-888-601-9980