- What is infinite banking?

- Can you use your life insurance for infinite banking?

- How does infinite banking use life insurance cash value?

- How do I borrow money from my whole life insurance?

- How long do I need to have life insurance before I can borrow from it?

- Can I withdraw money from my life insurance?

- Is infinite banking legit?

- Can I really become my own bank?

- How to use life insurance for infinite banking?

- Why infinite banking is not for everyone

- What are the risks of infinite banking?

- Pros and cons of infinite banking

- Who should use infinite banking?

- Frequently asked questions

Infinite banking is a real financial concept, but it is often oversimplified on social media as “be your own bank.”

On FinTok, “be your own bank” is often promoted as a “secret” way to grow money quickly. In reality, you borrow against a permanent life insurance policy that must be funded for years, pay interest on loans, and manage policy risk carefully.

In this article, we explain how infinite banking works in Canada, where it can backfire, who it may suit, and simple alternatives that usually deliver better results with less risk.

What is infinite banking?

Infinite banking is a strategy that leverages the cash value in a participating whole life insurance policy to borrow for personal or business needs. Popularized by R. Nelson Nash, an American economist, it is practised in Canada through policy loans or bank loans secured by cash value, not by literally “becoming your own bank.”

Infinite banking works when:

- You fund a participating whole life policy (often with paid-up additions to accelerate cash value)

- You access cash via a policy loan or a bank loan secured by cash value

- In many Canadian non-direct recognition policies, dividends are credited on the full cash value even when there is a loan; with direct recognition, the credited rate on the loaned portion may be reduced

- You repay on your own schedule, but interest accrues and unpaid loans reduce the death benefit

In theory, the borrowed funds can be used for other investments before being repaid. The interest that would have been paid to a bank may also be reinvested.

The strategy aims to grow cash value while using the same borrowed funds for additional investment opportunities.

Can you use your life insurance for infinite banking?

Yes, you can use your life insurance for infinite banking, but only specific types of permanent life insurance are suitable, and only when certain conditions are met.

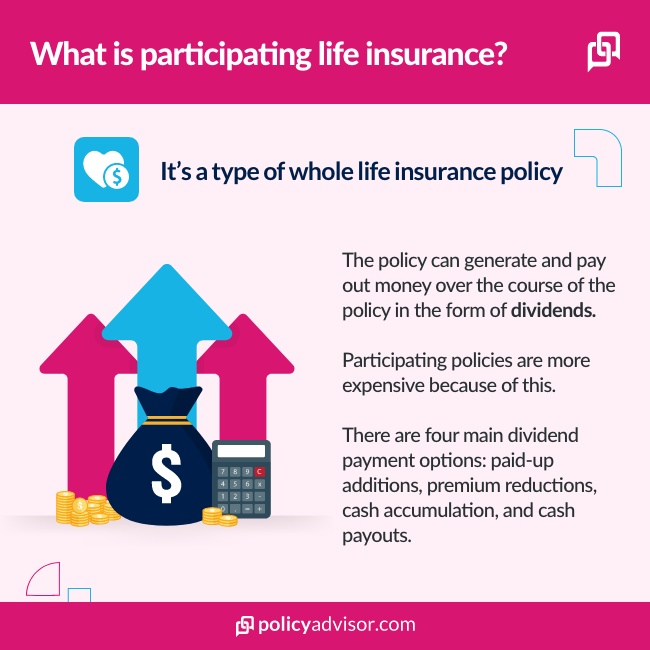

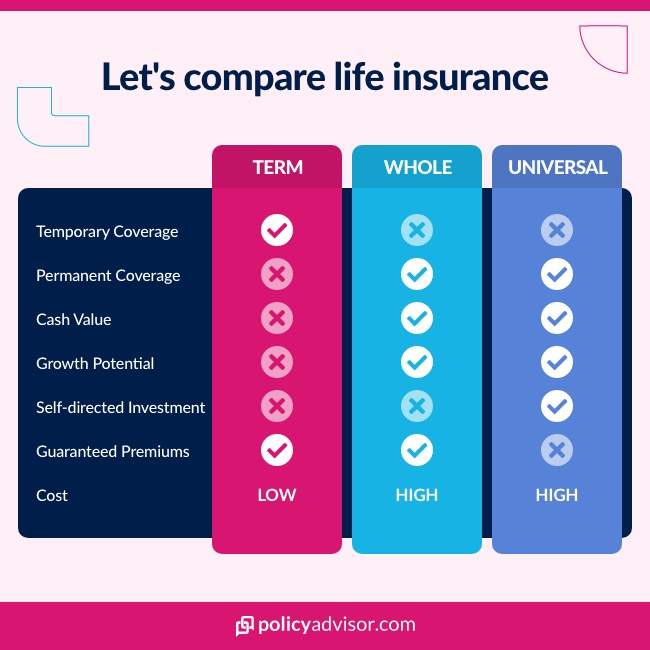

Infinite banking in Canada typically uses participating whole life insurance or, in limited cases, universal life insurance that builds cash value. Term life insurance does not qualify because it has no cash value.

The strategy requires more than just the right policy. It also requires:

- Strong and consistent cash flow to fund premiums

- A long time horizon, as cash value takes years to accumulate

- Willingness to manage interest costs and policy complexity

Borrowing is done through policy loans or bank loans secured by cash value. Interest is charged in both cases. You are not borrowing from yourself, and loan balances reduce the death benefit if left unpaid.

In many Canadian participating whole life policies with non-direct recognition, dividends may continue to be credited on the full cash value even when a loan is outstanding. Direct recognition policies may credit a lower rate on the loaned portion.

Infinite banking is a long-term, leveraged strategy. It is not a substitute for savings or a short-term investment approach.

For a detailed explanation of policy mechanics, see our guide to what is whole life insurance?

How does infinite banking use life insurance cash value?

Infinite banking focuses on the flexible access to life insurance cash value while it can continue growing in many policies.

Cash value can typically be accessed through policy loans or, in some cases, withdrawals. Loans do not require a fixed repayment schedule, but interest accrues, and any unpaid balance reduces the death benefit.

Some policies allow cash value to grow faster through additional funding options, particularly within participating whole life insurance or certain universal life insurance structures.

Participating whole life insurance may declare dividends annually, but dividends are not guaranteed and can change. Policyholders can direct dividends to:

- Reduce premiums

- Purchase paid-up additions to increase cash value and death benefit

- Take them as cash

While borrowing allows continued participation in policy growth under many Canadian structures, outstanding loans still accrue interest and reduce the amount paid to beneficiaries if not repaid.

How do I borrow money from my whole life insurance?

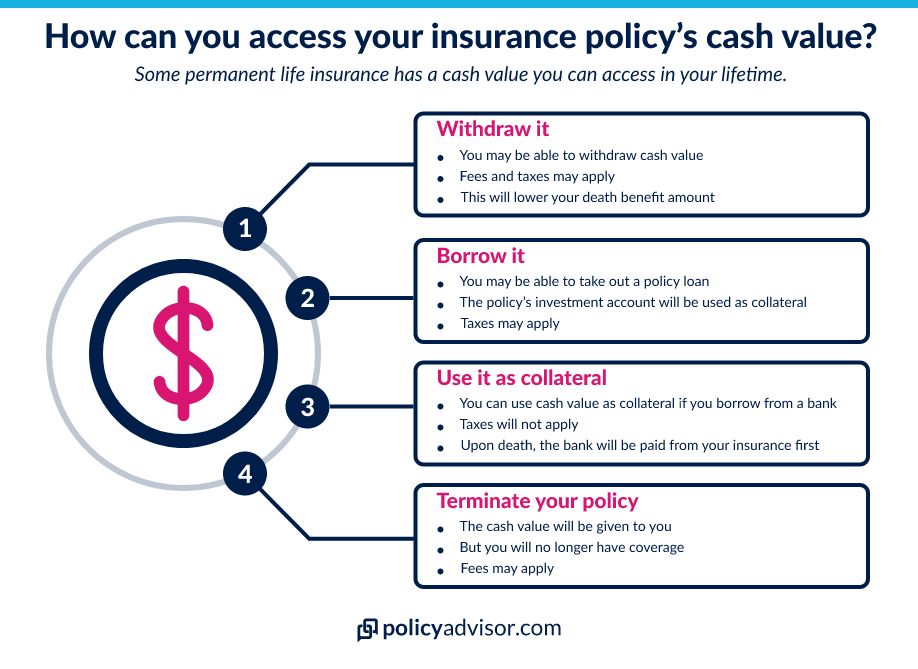

You can borrow from your life insurance cash value in two ways:

- Borrow directly from your life insurance provider: You can borrow from your life insurance cash value through your insurer. This is called a policy loan. Interest rates are usually lower than what a bank would charge. Most policies allow borrowing up to 90–95% of the cash surrender value, though this may not always exceed bank loans secured with collateral. You are not obligated to pay it back, although it would be in your best interest to do so. Life insurance policy loans can function somewhat like getting an advance on your death benefit. If you pay it back, your death benefit does not change. If you don’t pay it back, the amount plus interest will be deducted from your lump sum death benefit. This would leave your loved ones with less money to support themselves when you are no longer around, which is the primary function of life insurance

- Use it as collateral for a bank loan: You can also use your life insurance policy’s cash value as collateral to borrow from a bank, lender, or other financial institution. Again, this only works for whole or universal life policies that have a cash value. With this type of loan, the bank or lender could seek repayment from your cash value if you do not pay it back. In this case, that amount would again be deducted from your death benefit, leaving your beneficiary with a lower amount. Banks also have their own rules and interest rates, which are usually higher

Tax note: Policy loans are generally not taxable. Tax can arise if you withdraw or surrender the policy, or if the policy lapses with a loan outstanding and there’s a gain (proceeds minus adjusted cost basis). For example, if your policy’s ACB is $75,000. You have a cash surrender value of $50,000 and an outstanding loan of $40,000. If you surrender the policy, the total proceeds are $50,000 + $40,000 = $90,000. Taxable gain = $90,000 – $75,000 = $15,000.

How long do I need to have life insurance before I can borrow from it?

You can usually borrow from life insurance as soon as your cash value is sufficient. There is no minimum time requirement in most cases.The limiting factor is how long it takes to build cash value. This can take several years.

Even with options that accelerate growth, such as universal policies, limited pay plans, enhanced life insurance, or accelerated deposit options, it generally takes years before substantial cash value is available.

Permanent life insurance is designed to provide lifelong coverage, not as a standalone investment. It is not a get-rich-quick strategy.

Can I withdraw money from my life insurance?

Yes, most life insurance policies allow withdrawals against its cash value. For infinite banking, withdrawals are generally discouraged for two reasons:

Withdrawals are taxable on the gain (proceeds minus allocated Adjusted Cost Basis). Withholding tax may apply, but insurers report amounts to the CRA and may not always deduct it. Withdrawn cash no longer earns growth and reduces the death benefit. Insurers have different rules for withdrawals. Some limit how much or when you can withdraw. Others may not allow withdrawals at all.

It is important to consult a licensed life insurance advisor before borrowing from or withdrawing cash value.

Is infinite banking legit?

Yes, infinite banking is a legitimate strategy. It is practised by some individuals.

Infinite banking is a complex financial concept. Official certification comes from the Nelson Nash Institute, which authorizes Infinite Banking Concept (IBC) practitioners globally, including in Canada. Canadian advisors adapt the strategy to comply with local tax rules.

Social media often oversimplifies the strategy, suggesting unlimited money is possible. This can mislead viewers and result in buying products they do not fully understand.

Some people call it a “scam,” but the strategy itself is legitimate.

It is important to speak with a licensed expert before implementing infinite banking.

Can I really become my own bank?

No, you cannot use a life insurance policy to become your own bank.Some sellers claim you can “be your own bank,” but this does not work in most cases.

You can buy a whole life insurance policy and borrow against its cash value.

However, borrowing is not interest-free, and you are not literally paying yourself.

How to use life insurance for infinite banking?

Infinite banking works by borrowing against your policy’s cash value or death benefit. A policy loan functions as an advance on your cash value or death benefit. Interest is charged on the loan. Some advisors suggest reinvesting gains to offset interest, but this depends on the performance of other investments. If the policy lapses, you lose access to the cash value. Any loan amount above the policy’s adjusted cost basis (ACB) may be taxable.

Unpaid loans also reduce the death benefit for your beneficiaries.In theory, borrowing and reinvesting can grow cash value. This requires maintaining payments and managing interest carefully.Life insurance is not a risk-free investment. Poor planning can affect your policy and your family’s financial security.

Why infinite banking is not for everyone

Infinite banking is not suitable for everyone.It is not a one-size-fits-all strategy. It may work for highly skilled investors with a high risk tolerance.

Most people may benefit more from simpler, stable investment plans.

1. Infinite banking is costly

Building an infinite banking strategy requires funding a permanent life insurance policy. Whole life insurance is significantly more expensive than term life insurance.

For example, a 30-year-old female non-smoker with $250,000 coverage would pay about $15 per month for a 20-year term policy. The same coverage with a basic whole life policy would cost over $100 per month.

Dividend-paying whole life policies, which Infinite Banking Concept (IBC) practitioners often recommend, cost even more.

The question is whether the potential benefits justify the higher cost.

2. Not everyone can get a whole life insurance policy

Some individuals may not qualify for whole life insurance.

Underwriting for whole life insurance is stricter than for other types of life insurance. Pre-existing medical conditions, health concerns, or lifestyle factors may result in denial.

If you cannot get coverage, the infinite banking strategy is not an option.

3. IBC is complicated and risky

Infinite banking is complex and carries risk.

You are managing multiple moving parts over decades. This includes insurance premiums, dividends (which are not guaranteed), loan interest, and changing tax rules.

For most Canadians, simpler strategies deliver similar or better outcomes with far less effort and risk. Maximizing registered accounts like a Tax-Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP), combined with low-cost investing, is often more efficient.

Personal finance plans should be tailored to your needs. A complicated strategy is not always necessary to build wealth or protect your family. In many cases, simpler approaches work better.

What are the risks of infinite banking?

Infinite banking can reduce or put your death benefit at risk if it is poorly managed.

- Loan risk: Policy loans accrue interest over time. If loans are not repaid, the outstanding balance plus interest reduces the death benefit your beneficiaries receive

- Policy performance risk: Dividends on participating whole life policies are not guaranteed and can change. In direct-recognition policies, the insurer may credit a lower dividend rate on the portion of cash value used as collateral for a loan. This can reduce expected growth

- Funding and lapse risk: Infinite banking requires consistent, long-term premium funding. Income disruptions or underfunding can reduce cash value or force policy changes. If premiums stop entirely, the policy may lapse. While nonforfeiture options, such as reduced paid-up insurance, may preserve some value, they typically lower coverage

- Tax risk: Policy loans are generally not taxable. However, if the policy lapses or is surrendered while a loan is outstanding, taxable gains may be triggered if the proceeds exceed the policy’s Adjusted Cost Basis (ACB)

- The stakes are higher than with traditional investments: Infinite banking directly affects your life insurance protection, not just your returns. Regular reviews and repayment planning with a licensed life insurance advisor or financial planner are essential before and during implementation

Pros and cons of infinite banking

Infinite banking offers flexibility and potential tax advantages, but it comes with high costs and long-term risk.

| Pros | Cons |

| Flexible access to liquidity through policy loans or bank loans secured by cash value | High premiums and a long funding runway |

| Potential for stable, tax-deferred cash value growth within exempt limits | Complex to manage over decades |

| Dividends may be declared on participating whole life policies and can be used to buy paid-up additions to accelerate cash value growth | Returns depend on dividend scales and policy design, with less control than self-directed investing |

| Policy loan interest rates are often lower than unsecured bank loans | Loans accrue interest, and unpaid balances reduce the death benefit |

| Easier access to loans compared with traditional lenders | Risk of policy lapse or reduced coverage if premiums cannot be maintained |

| Quick access to liquid assets when cash flow is needed | Withdrawals or policy changes can trigger tax consequences |

| Insurer-managed investments reduce direct market exposure | Cash value is not diversified across asset classes |

Who should use infinite banking?

Infinite banking is best suited to high-income Canadians with long-term planning needs and stable cash flow.

The strategy tends to work best for individuals in higher tax brackets who can commit capital for 10 years or more. The potential tax deferral and cash value growth are more meaningful at higher income levels.

Some business owners may also benefit. In Canada, corporate-owned life insurance (COLI) is commonly used to offset taxes, build cash value, and allow the corporation to pay premiums. When paired with an Infinite Banking Concept (IBC) strategy, it can support corporate planning or predictable borrowing needs.

Experienced financial professionals may also find value if they:

- Have strong financial security

- Understand policy mechanics

- Are patient enough to wait for long-term results

Frequently asked questions

Is infinite banking legal in Canada?

Yes. Infinite banking is legal in Canada. It uses approved permanent life insurance policies and established loan rules. Borrowing against life insurance cash value is allowed. The main risks come from cost, complexity, and poor planning, not legality.

Is infinite banking the same as “be your own bank”?

No. Infinite banking does not make you your own bank. You borrow from an insurer or a lender, not from yourself. Interest applies to all loans. Any unpaid balance reduces your death benefit.

Does infinite banking really make money?

Sometimes it makes money, but it does not guarantee profits. Outcomes depend on policy design, dividend performance, loan interest, and long-term funding. Poor performance or rising costs can reduce or eliminate gains. It is not a quick path to wealth.

Is infinite banking better than a TFSA or RRSP?

No. For most Canadians, registered accounts work better. Maximizing a tax-free savings account (TFSA) and registered retirement savings plan (RRSP) usually delivers similar or better outcomes with less cost and risk. Infinite banking is typically considered only after registered options are fully used.

What happens if I stop paying premiums with an infinite banking policy?

Your policy may be reduced or lapse. Cash value may temporarily cover costs. Coverage can drop through reduced paid-up insurance. If the policy lapses with an outstanding loan, taxes may apply, and the death benefit can be lost.

Infinite banking is a strategy that leverages the cash value of a whole life insurance policy for borrowing. While legitimate, it is complex, costly, and carries risks. This guide explains how it works, its pros and cons, and who may benefit from it.