- Private health insurance in Canada works alongside the publicly funded healthcare system to provide additional coverage for services not covered by the government

- Seniors with pre-existing conditions still qualify for coverage through guaranteed acceptance health insurance plans

- Those approaching retirement can convert or replace their group plan into an individual plan

If you’ve made it to the sunset years, you’re one of the lucky ones! Congrats!

When you approach that golden retirement age of 65, you have a lot to look forward to! No more work, more free time, vacations, and discount pancakes at Denny’s on Wednesdays to name a few. But as you age, there are a few things you should square away before your final clock out.

A common question you might have is, do I have enough money to retire? But you should also consider your health insurance. Does your health insurance follow you after you retire? Will you be able to get health insurance as you age or if you have a pre-existing condition? Read on to find out how to choose the best health insurance plans for seniors.

What is personal health insurance for seniors?

Private health insurance is used to cover medical expenses that government health care does not. Coverage for seniors health insurance may include:

- Prescription medications

- Dental services

- Vision care

- Paramedical services (massage, chiropractic care, physiotherapy, mental health services, etc.)

- Medical equipment

- Travel insurance (emergency medical)

In addition to these preventative and restorative health care services, your private health insurance plan can cover other commonly required medical expenses for seniors.

- In-home nursing and home care for registered nurses, practical nurses, and care aids

- Hearing aids

- Orthopedic shoes

- Cancer treatments

- Wheelchairs, walkers, and traction kits

- Diabetic supplies

- Medic alert systems

- Oxygen tanks

- Semi-private or private hospital rooms

- Ambulance trips

- Other medical supplies

Your exact coverage and coverage limits will depend on the type of plan you have.

What are the best health insurance plans for seniors & retirees?

The best health plan will depend on your unique situation. In general, there are three types of health insurance available for seniors:

- Personal health insurance

- Replacement health insurance

- Guaranteed acceptance health insurance

Compare health insurance policies for retirees and seniors

The perfect health policy for you will depend on your health and employment situation as a senior. The chart below outlines how the top-tier plans compare for personal health insurance, replacement health insurance, and guaranteed health insurance in terms of coverage and price.

Types of health insurance for seniors and retirees

| Coverage | Personal health insurance | Replacement health insurance | Guaranteed acceptance health insurance |

| Prescription drugs | 100% up to $10,000 per year | 80% up to $2,600 per year | 80% up to $2,500 per year |

| Dental care | 100% preventative care up to $920 | 80% preventative up to $800 per year | 80% preventative up to $562 |

| Vision care | $250 every 2 years | $200 every 2 years | $150 every 2 years |

| Pramedical expenses | $25 per visit, up to $500 per year per service | Up to $650 per year combined | 80% up to $500 per year |

| Travel medical | $5 million in emergency health coverage for the first 10 days | $5 million in emergency health coverage for the first 10 days | $5 million in emergency health coverage for the first 10 days |

| Price | $212/month | $224/month | $258/month |

*Quote for a 65-year-old single person in Ontario with no pre-existing health conditions or dependents.

Keep in mind, these are example plans with the top-tier coverages for all plans. Depending on your personal health history and company you’re applying for, not all coverages may be available. Additionally, not every plan will have a deductible amount, eligibility qualifications, waiting periods before you can claim coverage, and its own process for claims.

What are the different types of health plans?

Every person will have different health needs and require a different plan to meet their current and expected medical expenses.

You might choose the following options:

- If you are in good health

- If you are 69 years old or under

- If you want to coordinate benefits with other plans (employer, group, or spouse’s plan)

- If you are looking for your expenses to be 100% covered through the coordination of benefits

- If you want to coordinate benefits with other plans because you or your family has high medical costs (i.e. lots of kids with braces, glasses, medications)

- If you are retiring and may have health issues that would bar you from standard health insurance

- If you’re leaving a job with regular benefits

- If you need coverage within 30-90 days of your group benefits ending

- If you have any pre-existing conditions or health issues

- If you don’t want to go through medical questionnaires

Can I keep my employer’s health insurance when I retire?

Sometimes. Some employers will allow you to keep your group health insurance plan when you retire. Some will have age restrictions, depending on the contract they have with their group health insurance provider.

If you cannot keep your employer group health benefits when you retire, you can purchase your own personal health insurance, replacement plan, or guaranteed plan.

Your best bet is to shop around before you decide on any replacement or guaranteed plans. Guaranteed or instant approval plans can be expensive and group plans have restricted coverage, so they may not be best for you as you entire retirement age.

Individual plans allow you the flexibility to choose your own coverage options. They are underwritten based on your own personal lifestyle and health history, not an average of those in your group.

Options for your health plan when you retire:

- Keep your employer’s group plan

- Transfer your group policy to an replacement policy

- Shop around for your own affordable health insurance plan

At PolicyAdvisor, we can help you look at your current plan details and see if it’s working for your needs either now or as you approach that golden 65th birthday retirement age. If not, we work with Canada’s best health and dental insurance providers and can find the perfect plan for you.

How much does personal health insurance for seniors cost?

You can expect to pay $150-300 per month for health insurance as a senior. The cost will depend on your age, health, and any pre-existing conditions. Personal health insurance plans are the most affordable health insurance for seniors.

Replacement health insurance has a mid-range cost but with lower benefit amounts. Guaranteed health insurance is the most expensive plan for seniors because there is little underwriting.

Is health insurance worth it for retirees in Canada?

Yes. Health insurance is worht it for seniors and retirees. Just like the price of housing, food, and everything else, medical costs are going up by the day. While Canada’s publicly funded healthcare system provides essential medical services, it may not cover all the healthcare needs of seniors like mobility equipment and drug costs. Private health insurance helps alleviate the financial burden, making healthcare more accessible and affordable for seniors.

The reality is, that the older we get, the more likely it is that our health will deteriorate. Having an extended health insurance plan in place makes sure that you don’t have to stress about how you’re going to pay for your next medical treatment or medication.

Having health insurance means more than financial protection—it provides peace of mind. Your quality of life is directly linked to your health care. Having health insurance allows you to focus on your well-being without worrying about potential expenses. And that is priceless!

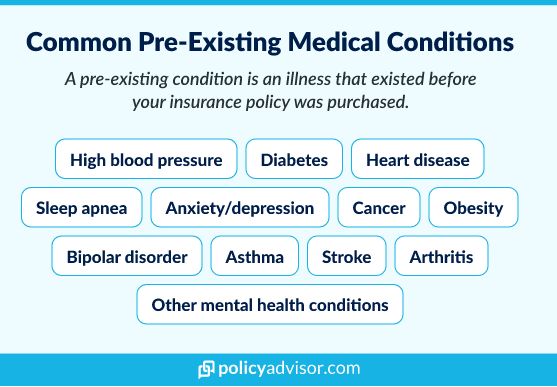

Can I get health insurance if I have a pre-existing condition?

Yes. It’s possible to get health insurance if you have a pre-existing condition. However, the extent of your coverage and the price will depend on your health history. Even if you’ve survived a serious health event like a heart attack, stroke, or cancer, or if you have a chronic health condition, you can still get health insurance. However, policies may have a particular waiting period after these events until they can provide coverage.

Guaranteed-issue plans are usually the go-to option if you have any kind of pre-existing medical condition that bars you from traditional health insurance plans. These plans are fast, easy, and convenient to apply for because they don’t ask many health questions. Some may limit your coverage for prescription drugs related to your pre-existing condition. Some may not have dental benefits or vision coverage. Additionally, they are more expensive than other plans.

What is the best health insurance company for seniors?

The “best” senior health insurance company really depends on your needs and budget. If you have existing health conditions or other complex health issues, you might consider guaranteed issue medical plans, which are only offered by some companies. However, if you’re in good health for your age, there are many coverage options.

Here are our health insurance partners that have affordable health insurance plans for seniors in Canada:

- Blue Cross: Offers personal and replacement plans.

- Canada Life: Offers personal and guaranteed plans.

- Desjardins: Offers personal and replacement plans.

- GMS: Offers personal and guaranteed plans.

- GreenShield: Offers personal, replacement, and guaranteed plans.

- Manulife: Offers personal, replacement, and guaranteed coverage plans.

- Sun Life: Offers personal and replacement plans.

What to consider when buying health insurance for seniors in Canada?

When buying health insurance for seniors in Canada, you need to consider several factors, such as:

- Health status: Your policy must address both ongoing and potential health concerns, such as heart disease, osteoporosis, and diabetes, which are more prevalent among seniors

- Types of services: Your insurance plan should cover services not included in provincial healthcare, such as prescription drugs, dental and vision care, and paramedical and travel expenses, to help reduce your overall healthcare costs

- Premiums: Health insurance premiums for seniors typically range from $150-300 monthly, depending on the applicant’s age, health status, and desired coverage. The ideal plan should balance affordability with coverage

- Additional benefits: Review optional add-ons offered by a provider. Many providers let you customize your coverage for specific needs, such as physiotherapy and chiropractic care

Get the best quote for seniors health insurance

We understand the unique healthcare needs of seniors and are committed to helping you find the perfect medical coverage that suits your requirements. Our easy-to-use platform provides access to a wide range of top-tier insurance providers, ensuring you have ample options to choose from.

With PolicyAdvisor.com, you can compare plans, benefits, and costs effortlessly, empowering you to make informed decisions that prioritize your health and financial well-being.

If you’re looking to talk to a real human advisor, we have those too!

Book a call with one of our friendly expert insurance advisors today to chat about protecting your personal and financial health today!

Frequently asked questions (FAQs)

Is healthcare free for seniors in Canada?

In some provinces, there are programs for senior health care for those who need financial assistance. These programs may assist with the partial cost of prescription drugs and other healthcare services not covered by the standard government plan.

The eligibility requirements for these social assistance programs vary—some just require that you be over 65 while others have income thresholds. For more information about services for seniors, visit your provincial government’s website.

Do seniors get a discount on health insurance?

Some provincial healthcare programs help with out-of-pocket medical expenses, but private health insurance companies don’t offer discounts. This is because the rate of illness and injury among seniors can be high. That being said, health insurance is a competitive market and there are plans at various coverage and premium levels available to you depending on your budget.

What is the average cost of medical expenses in retirement?

Experts estimate at age 65, the annual spend on health care is $5,400 per person. This research is from a 2014 report and as inflation increases, retirees can expect to pay more. This estimate is also for a healthy individual. If you develop or are diagnosed with any type of serious illness, you can expect to pay more.

For example, 1 in 2 Canadians will be diagnosed with cancer once in their lifetime—with a greater chance of this as you age. Cancer medicine with 28-day treatment costs over $7,500 now accounts for more than half of all oncology sales in Canada.

What is long-term care insurance?

Long-term care insurance is a type of insurance policy designed to cover the costs associated with long-term care services for individuals who need assistance with daily living activities due to illness, disability, or aging.

These services typically include help with activities such as bathing, dressing, eating, and mobility, which may be required either in a nursing home, long-term care facility, assisted living facility, or even in the individual’s own home.

This is not the same as health insurance and is a separate insurance product. However, some health insurance plans have coverage for in-home care.

What is the best type of insurance for seniors?

The best type of health insurance for seniors involves a combination of provincial healthcare and private health insurance, tailored to specific needs. Provincial healthcare covers essential services, while private insurance takes care of prescription drugs, dental and vision care, and paramedical and travel expenses.

Some private insurance options are:

- Personal health plan: For those who are in good health and who want to combine the benefits of personal health insurance with other plans, such as employer, group, or spousal insurance

- Replacement health plan: For those who are retiring from their job and need to replace their group benefits within 30-90 days of their ending

- Guaranteed acceptance health plan: For individuals with pre-existing health conditions or those looking to avoid medical underwriting

There are different types of health insurance plans available for seniors, and they vary in terms of coverage and benefits. Those who are retiring may choose to go with a personal health plan if they are in good health or a replacement health plan if their group benefits have run out. Guaranteed issue health insurance plans can cover seniors with pre-existing health conditions, usually at a higher cost.