- Life insurance is a great way to ensure your growing family is financially protected

- You can get life insurance when you are pregnant as long as you aren't subject to any other health risks

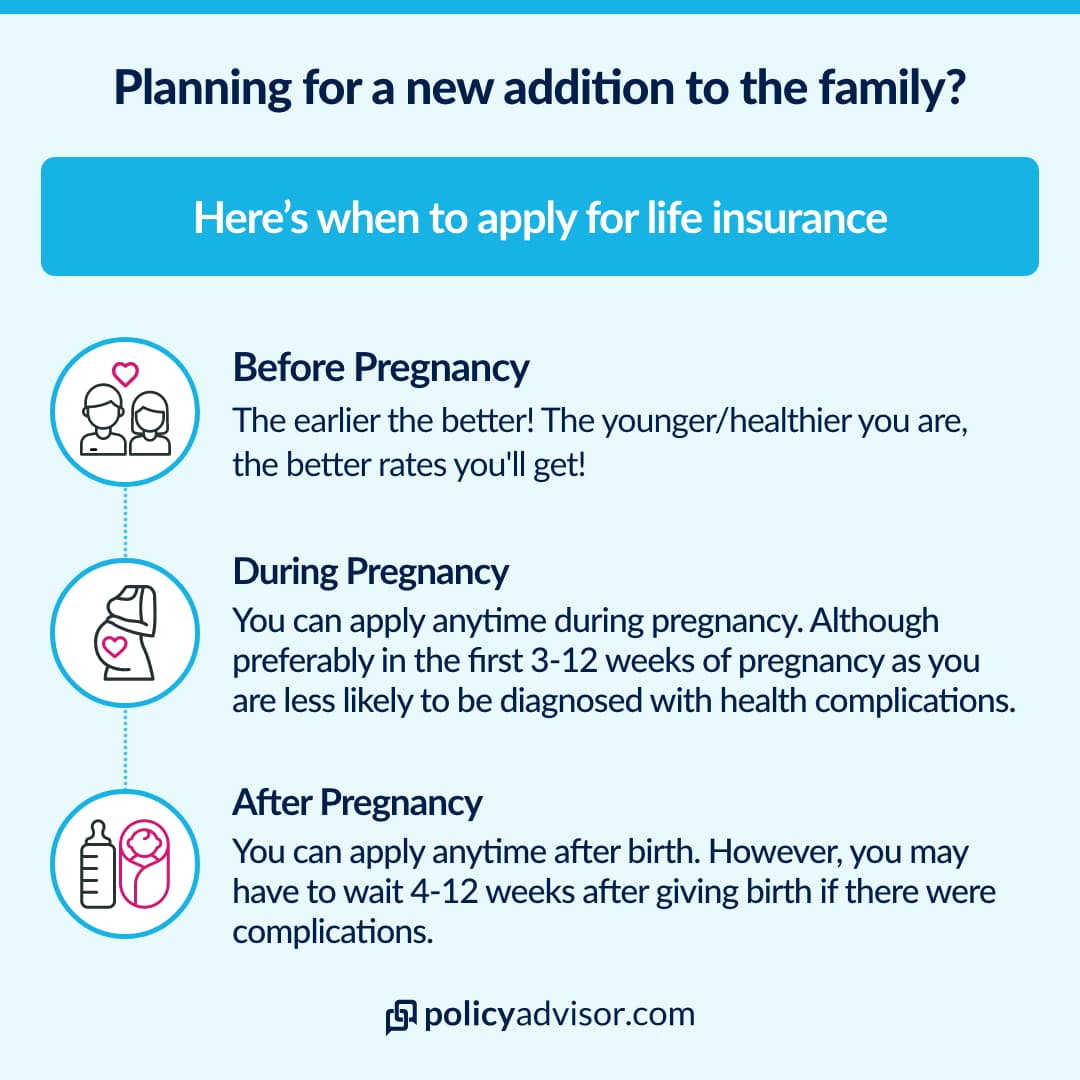

- Apply for life insurance as soon as you can (before you are pregnant if possible)

- Can I get a life insurance policy if I’m pregnant?

- Do you have to declare pregnancy on a life insurance application?

- Does weight gain matter for a life insurance application

- Which trimester should you apply for life insurance?

- Should you name your baby as a life insurance beneficiary in Canada?

- How do I get the lowest life insurance rates if I'm pregnant?

Pregnancy can be an exciting time. The anticipation of welcoming someone new into your family is thrilling for many expectant parents. But, pregnancy can also come with a lot of new financial, physical, and psychological stress. From making space in your home to mentally preparing for a child to choosing a name, there are a lot of things that can cause worry. And while many like to focus on picking out nursery colours and the top-of-the-line stroller, one major cause of stress that they encounter during pregnancy is the financial implications of a child and a growing family.

Raising a child comes with a lot of new expenses, and one of the last things you want to worry about when you’re expecting is who would shoulder those expenses if something were to happen to you early on in your child’s life. One way to alleviate some of that stress is by purchasing a life insurance policy. Life insurance can offer peace of mind, leaving you with the comfort of knowing your future child will have some financial support.

Can I get a life insurance policy if I’m pregnant?

Yes, you can get a life insurance policy when pregnant. While pregnancy, even smooth ones, can cause a lot of strain on the body, it is possible to get life insurance at any time during your pregnancy! That being said, if you have a pregnancy-related complication such as gestational diabetes, the underwriting process can get a bit more complicated. Additionally, if you apply really close to your due date, underwriters may postpone your application until after you give birth.

Any pregnancy has associated health risks before, during, and after birth and can lead to a variety of medical conditions and complications. Thus, the insurance company takes a higher financial risk when approving your application while you are pregnant compared to when you are not. This may be reflected in higher costs and less extensive coverage depending on if the pregnancy has complications. Otherwise, pregnancy is not usually a huge concern for insurance companies. However, it is always best to apply for coverage ASAP—the later you apply for insurance during pregnancy, the more likely there may be health complications that could impede the approval process.

Do you have to declare pregnancy on a life insurance application?

Yes, you must declare a known pregnancy on a life insurance application. In the eyes of an insurance provider, it’s a state of health. Not disclosing a known pregnancy when applying for life insurance would be similar to not disclosing a heart condition, cancer diagnosis, or other health issues.

If a claim is made on your policy and it’s determined that you did not disclose a pregnancy, your beneficiaries (your loved ones) could be denied the life insurance payout. Misrepresenting your health conditions during the underwriting process is considered life insurance fraud. This can result in denied claims or a reduced death benefit to pay for the premiums you should’ve been paying due to your specific health conditions, in this case, pregnancy.

During the application process, you may be asked about your history of pregnancy. Some complications that the insurance company may be concerned about are:

- Miscarriage

- Preeclampsia

- Taxoemia

- Gestational diabetes

- Caesarean section

- Postpartum depression

- Other more rare complications of pregnancy or childbirth

During the medical exam portion of the application, you may be subject to a blood or urine test, but usually not a pregnancy test. Further, you should still disclose to the examiner that you are pregnant as they may not be aware.

In the rare circumstance that you do not pass medical requirements for life insurance applications due to complications such as gestational diabetes, you still have options! Some insurers have life insurance policies that do not require a medical exam, called no-medical life insurance. No-medical insurance is great for those who are denied coverage from traditional carriers due to medical concerns or those with high-risk lifestyles or occupations. However, the premiums for no-medical policies tend to be higher than traditional life insurance plans.

Learn more about life insurance and diabetes.

How much does weight gain matter for a life insurance application?

Weight gain is expected during pregnancy and insurance providers do take that into consideration when offering coverage. However, similar to when applying for life insurance you’re not pregnant, your weight is a factor when determining rates or coverage restrictions.

Insurance providers consider your Body Mass Index (BMI) and any increased risk factors for conditions that could arise due to a fluctuation in your current weight, regardless of if you’re pregnant or not. But, since weight gain is an expected part of pregnancy, any weight gain that is classified as normal will not negatively impact your coverage or life insurance premium.

If you are considered a high-risk pregnancy due to your weight before conception, the insurance company may consider you high risk as well. Most companies will use your pre-pregnancy weight when determining coverage.

Which trimester should you apply for life insurance?

The earlier the better! The best option is to apply for life insurance before you get pregnant. If you’re already pregnant, you should apply for life insurance in the first trimester of pregnancy.

The further along in your pregnancy you are the more likely it is that you will develop complications. These complications, such as gestational diabetes, are seen by insurance providers as a liability, similar to a pre-existing condition. In addition, if you are considered a high-risk pregnancy, your insurance application may require further underwriting. A high-risk pregnancy may include someone who has been diagnosed with gestational diabetes or pre-eclampsia. Pregnancies at age 45 or older as well as multiple birth pregnancies such as triplets are also considered high risk.

If rates are too expensive later on in your pregnancy, or you are experiencing a high-risk pregnancy with many complications, it’s recommended that you wait at least four to eight weeks after giving birth to apply. By then, it’s likely that you will have lost some weight and the health complications you may have experienced during pregnancy such as high blood pressure will be resolved.

Does your existing life insurance policy change when you have a baby?

Your existing life insurance policy does not change if you become pregnant, so you still have coverage through your existing plan. Insurance providers are well aware that many people who purchase a life insurance policy can and will become pregnant.

If you purchased life insurance coverage prior to becoming pregnant, you don’t have to let your life insurance company know, however, there are some changes you may consider making to your existing policy, such as increased coverage and naming your child as the beneficiary.

Should you name your baby as a life insurance beneficiary in Canada?

Yes, if you choose to do so, you can name your baby as your life insurance beneficiary. Chances are if you’re pregnant and considering life insurance, you want to make sure that your future child has some financial security if something happens to you.

However, the reality is that in Canada you must be the age of majority to receive an insurance payout. If your insurance beneficiary is not yet 18, the money will be held in a trust by a trustee until they become of age. This means they will not directly receive the benefit until they are 18. Additionally, you should wait until the child is actually born before naming them as a beneficiary to avoid future administrative and emotional grief should the child miscarry.

You can choose to either set up a trust for your child knowing they won’t have access until they are 18, or you can name a partner, family member, or friend as the beneficiary. It is most beneficial to your child to name the person who would be caring for your child as the beneficiary as the money can be used to pay for their care. But this is a personal choice, and it’s best to chat with an advisor to determine who you think would be the best beneficiary of your life insurance policy.

Learn more about life insurance beneficiaries.

How do I get the lowest life insurance rates if I’m pregnant?

To get the lowest life insurance rates during pregnancy, apply as soon as possible. While it’s best to get life insurance before becoming pregnant, that’s not always possible or easy for many Canadians. So, apply early in your pregnancy to ensure lower rates. Every insurance provider will have different stipulations and coverage when it comes to providing life insurance to someone who is pregnant, so it’s best to talk with an advisor to find a policy that fits your needs. The team at PolicyAdvisor is happy to help you find the best insurance option for your growing family.

Life insurance riders to consider if you’re pregnant

Life insurance riders are additional benefits and coverage that you can add to a life insurance policy. Since we all have unique needs and expectations, a rider can help to personalize your life insurance policy to fit you and your growing family. Riders are also a more affordable way to add additional types of coverage without purchasing a separate policy to include things such as disability insurance and critical illness insurance.

If you’re getting life insurance while you’re pregnant, you may want to consider adding some of the following riders to your life insurance policy:

- A child term rider is term life insurance for a child’s life. This can help cover the costs of a funeral or burial if something were to happen to your child.

- A spousal rider is additional coverage that will cover the life of your spouse. This is a good option if your spouse is unable to secure their own life insurance policy due to ineligibility or affordability.

- A hospitalization income rider will provide a daily cash payout if you end up hospitalized for a long period of time in order to help cover some of the costs.

- A children’s critical illness insurance rider will provide a lump sum payment if your child is diagnosed with a critical illness such as cancer.

To learn more about life insurance riders reach out to one of our policy advisors to customize a life insurance policy that’s perfect for your family.

Final Thoughts

Pregnancy and preparing for a new child is an exciting and somewhat stressful time. Let our team at PolicyAdvisor help reduce some of that stress by setting your family up with an affordable life insurance policy from one of the 20+ providers we work with. Book a call with one of our advisors today!

Life insurance makes sure your new family’s financial future is taken care of. You should have no problem getting life insurance when you’re pregnant, so long as your pregnancy doesn’t involve any complications. It’s always best to apply for coverage sooner in your pregnancy, rather than later as birth may cause medical complications.

1-888-601-9980

1-888-601-9980