- Whether you're in active breast cancer treatment, early remission, or long-term survival, there are life insurance options available

- Guaranteed issue policies provide immediate coverage during treatment, while standard policies offer the best rates for long-term survivors

- Early-stage cancers (Stage 0-1) and localized treatments like surgery result in more favorable underwriting than advanced stages or systemic treatments like chemotherapy

- Our advisors recommend waiting for 3-5 years after completing treatment to qualify for standard life insurance rates. Applying too early may result in higher premiums or policy restrictions that follow you for the life of the policy

A breast cancer diagnosis brings overwhelming emotions and practical concerns including whether you can still get life insurance after cancer. However, having breast cancer doesn’t automatically disqualify you from coverage, but the application process requires careful timing and strategy.

According to the Canadian Cancer Society, 25% of all new cancer cases in women are breast cancer. For those undergoing treatment or in remission, one of the most frequent concerns is about life insurance and breast cancer, specifically, whether they can still qualify for coverage and what options are available.

In this comprehensive guide, we’ve covered everything breast cancer patients and survivors need to know about securing life insurance in Canada, including coverage options, premium costs, and the best life insurance companies for cancer survivors.

Can I get life insurance with breast cancer?

.If you’re wondering whether you can get life insurance with breast cancer in Canada, the answer is yes, but eligibility depends on several important factors.

Life insurance and breast cancer are closely linked through the way insurers assess risk, particularly when dealing with pre-existing conditions.

In Canada, life insurance typically pays a tax-free lump sum to your beneficiaries, regardless of how you pass away. However, breast cancer, as a pre-existing condition, may impact whether you qualify, how much you pay in premiums, and what policy options are available.

Immediate eligibility during active treatment

If you are currently undergoing treatment for breast cancer, your options for life insurance are more limited. Most traditional life insurance companies will postpone or decline applications during active breast cancer treatment, especially if chemotherapy, radiation therapy, mastectomy, or lumpectomy procedures are ongoing

However, there are still pathways to coverage:

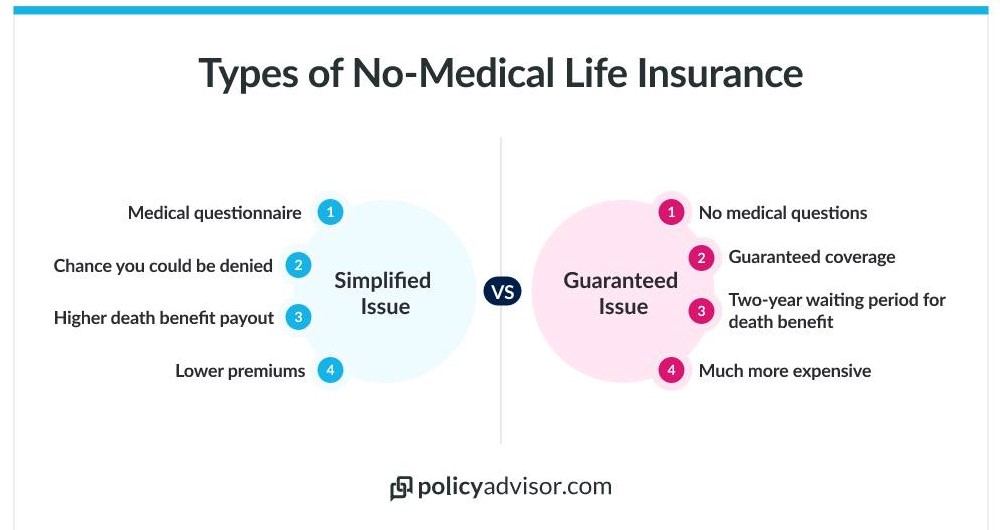

- No medical life insurance or guaranteed issue policies may be available. These typically don’t require medical exams but may offer lower coverage limits and higher premiums

- Group life insurance through an employer may also be accessible, often without health questions or exclusions

When should breast cancer survivors apply for life insurance in Canada?

Most insurers require a waiting period of 3 to 5 years in remission before approving standard life insurance after cancer diagnosis.

During the application process, insurers will assess:

- Stage of cancer at diagnosis: Early-stage cancers like Stage 0 or 1 may be viewed more favourably

- Type of treatment received: Localized treatments or successful surgical removal with no recurrence can improve your risk profile

- Current health status: Stable health post-treatment increases your eligibility and lowers premium costs

If you’re still within the remission window, simplified issue or no-medical policies may be good interim options for getting life insurance with stable pre-existing conditions until you’re eligible for fully underwritten coverage. Consult an advisor to navigate underwriting for stage-specific breast cancer cases.

What are the life insurance policies available for breast cancer patients and survivors?

In Canada, there are several life insurance options for breast cancer patients and survivors, depending on your current health status, treatment history, and how much time has passed since your diagnosis or remission.

Whether you are undergoing active treatment, newly in remission, or a long-term survivor, insurers offer various policy types such as guaranteed issue life insurance, simplified issue life insurance, and traditional life insurance.

Best life insurance policies for breast cancer patients and survivors in Canada

| Policy type | Medical exam required | Health questions | Premiums | Coverage amount | Best for |

| Guaranteed Issue Life Insurance | No | No | High | Low (up to $25,000) | Active cancer or recent diagnosis |

| Simplified Issue Life Insurance | No | Yes | Moderate | Moderate (up to $500,000) | Early remission or minor health issues |

| Traditional Life Insurance | Yes | Yes | Lower | High (up to $1,000,000+) | Long-term remission (3–5+ years post-treatment) |

| No Medical Evidence Life Insurance | No | Varies (None or Minimal) | High | Low to Moderate (up to $500,000) | Applicants avoiding medical exams or with complex health histories |

How much does life insurance cost with or after a breast cancer diagnosis?

Life insurance premiums for breast cancer patients and survivors in Canada typically range from $40–$200 per month for $100,000 coverage, with guaranteed issue policies at the higher end ($100-$200) and standard policies for long-term survivors at the lower end ($40-$80).

These rates vary significantly on various factors such as the type and stage of cancer, time since diagnosis and treatment completion, current health status, age, smoking history, lifestyle, type of policy and coverage amount.

For example, guaranteed issue policies tend to have higher premiums and lower coverage amounts due to the lack of medical underwriting, while standard policies with full underwriting may offer better rates for long-term survivors in remission.

Cost of life insurance for breast cancer patients/survivors

| Scenario | Coverage amount | Average monthly premiums | Points to consider |

| Guaranteed Issue (40-year-old female) | $20,000 | $43 | No medical exam, 2-3 year waiting period |

| Guaranteed Issue (45-year-old male) | $40,000 | $131 | Higher risk, limited coverage |

| Guaranteed Issue (60-year-old male) | $50,000 | $307 | Age and gender impact cost significantly |

| Standard (Mild Case, 4 years post-treatment) | $100,000 | $42–$50 | Requires cancer-free period, lower risk |

| Standard (Moderate Case, several years post) | $100,000 | $63–$167 | May include ratings, higher premiums |

| Survivor (2-3 years post, with rating) | $100,000 | $150–$200 | 50%–100% rating on standard rates |

Which are the best life insurance companies for breast cancer patients and survivors in Canada?

Life insurance after a breast cancer diagnosis is possible in Canada, if you’ve fully recovered and a few years have passed, companies like Canada Life, Manulife, Industrial Alliance, and RBC may offer standard coverage.

If you’re recently diagnosed or still in treatment, simplified or guaranteed issue plans from Canada Protection Plan, UV Insurance, Humania, and Assumption Life can offer coverage with fewer medical questions.

However, the best life insurance provider for breast cancer survivors largely depends on your specific circumstances, such as time since treatment, overall health, and budget.

The following insurers are recognized for their accommodating policies and flexible underwriting for cancer survivors:

| Provider | Medical Underwriting | Remission Requirement | Policy Types Offered | Coverage Options | Critical Illness Option | Best For |

| Canada Life | Detailed, traditional | 2–5 years | Term, Whole, Universal | Flexible, riders available | Yes | Survivors in stable remission seeking full-featured policies |

| Manulife | Flexible for long-term remission | 5+ years | Term, Whole, Critical Illness | Broad, includes CI add-ons | Yes | Survivors in long-term remission wanting critical illness coverage |

| Industrial Alliance | Comprehensive, tailored | 2–5 years | Term, Permanent | Competitive rates, pathology considered | Limited | Survivors in stable remission wanting detailed, fair underwriting |

| RBC Insurance | Formal, structured | Case-by-case (2–5 yrs typical) | Term, Whole, Universal | Broad; banking integration optional | Possibly as rider | Survivors who are RBC clients or prefer full service & detailed assessment |

| Canada Protection Plan | No medical or simplified | Active treatment to early remission | Simplified, Guaranteed Issue | Up to $25,000 (GI), more with simplified | No | Survivors in treatment or very early remission needing fast, accessible coverage |

| UV Insurance | Case-by-case, individualized | Post-treatment with stability | Term, Universal | Flexible structures | Not typically | Survivors with complex medical histories needing custom evaluation |

| Humania Assurance | No medical, simplified/guaranteed | Recent or ongoing health concerns | Simplified Issue, Guaranteed, CI | Limited face amounts, fast issue | Yes (simplified CI plans) | Survivors recently treated or uninsurable under traditional options |

| Assumption Life | Flexible, simplified | 1–3 years | Term, Whole, Simplified | Up to $500,000 (simplified) | No | Early remission survivors seeking moderate coverage without a medical exam |

Canada Life

Canada Life, one of Canada’s largest and oldest life insurance providers, offers comprehensive coverage for breast cancer survivors through detailed medical underwriting. Like most major insurers, Canada Life follows industry-standard practices, assessing cancer stage, treatment history, and remission duration when determining eligibility and premiums.

- Specialty: Offers term, whole, and universal life insurance with in-depth underwriting that accounts for cancer stage, treatment completion, and remission status

- Key features: Detailed risk evaluation, competitive rates for survivors in stable remission (typically 2–5 years post-treatment), broad product selection including riders and optional critical illness coverage

- Best for: Breast cancer survivors in remission seeking robust coverage from a well-established Canadian insurer with flexible and customizable policy options

Manulife

Manulife offers traditional life insurance and comprehensive critical illness coverage, making it a strong option for long-term breast cancer survivors. It provides flexible underwriting and competitive pricing for applicants in stable health.

- Specialty: Offers a wide range of policies, including standard life insurance and critical illness insurance, suitable for cancer survivors

- Key features: Flexible underwriting for survivors in long-term remission, with comprehensive critical illness plans that cover breast cancer diagnoses

- Best for: Survivors in remission for 5+ years looking for competitive premiums and additional critical illness coverage

Industrial Alliance (iA Financial Group)

Industrial Alliance is one of the largest life and health insurance companies in Canada, known for detailed medical underwriting. The company typically requires 2–5 years of remission before offering standard life insurance rates, depending on the stage of breast cancer and the applicant’s treatment history.

- Specialty: Offers term and permanent life insurance with detailed underwriting based on cancer stage, treatment completion, and remission length

- Key features: Competitive rates for those 2+ years post-treatment, thorough medical questionnaires, and consideration of favorable pathology reports

- Best for: Breast cancer survivors in stable remission seeking competitive rates through tailored underwriting

RBC Insurance

RBC Insurance offers a full suite of life insurance products with formal underwriting, including possible phone interviews and medical exams. The level of scrutiny varies by applicant. Breast cancer survivors may be approved at standard or rated premiums depending on remission status and treatment outcomes.

- Specialty: Offers term, whole, and universal life insurance with structured underwriting and optional integration with RBC banking

- Key features: Thorough medical underwriting, preferential consideration for RBC clients, broad coverage range

- Best for: Survivors who are RBC clients or comfortable with in-depth underwriting and want comprehensive coverage through a single provider

Canada Protection Plan

Canada Protection Plan is one of the most accessible life insurance providers for individuals affected by breast cancer. Known for its no-medical and simplified issue policies, it offers coverage options even for those currently undergoing treatment or recently diagnosed.

- Specialty: Offers guaranteed issue and simplified issue policies with no medical exam, ideal for those with active cancer or recent diagnoses

- Key features: Coverage up to $25,000 for guaranteed issue policies and higher for simplified issue. Fast application process with minimal health questions

- Best for: Individuals in active treatment or early remission who need quick coverage

UV Insurance

UV Insurance applies individualized underwriting for breast cancer survivors, assessing each case based on treatment outcomes and stability of follow-up care. While the company doesn’t publicize cancer-specific guidelines, it generally adheres to industry standards, requiring completion of treatment and follow-up stability.

- Specialty: Offers term and universal life insurance with personalized underwriting for complex medical histories

- Key features: Case-by-case medical review, assessment of cancer stage and treatment response, flexible coverage structures

- Best for: Survivors with nuanced medical histories needing flexible, personalized underwriting

Humania Assurance

Humania offers simplified issue and guaranteed acceptance products that don’t require medical exams, making them accessible for individuals with cancer histories. Some of their simplified issue plans include limited critical illness coverage, including cancer.

- Specialty: Provides simplified issue life insurance and critical illness coverage with minimal or no medical underwriting

- Key features: No-medical underwriting options, cancer-included critical illness plans, fast application and approval

- Best for: Breast cancer survivors recently treated or with ongoing health concerns who may not qualify for traditional medically underwritten policies

Assumption Life

Assumption Life is a leading choice for breast cancer survivors who want coverage without going through a medical exam. With flexible underwriting and a streamlined application process, it’s especially suitable for those in early remission.

- Specialty: Provides no medical and simplified issue policies with flexible coverage options for those with stable pre-existing conditions

- Key features: Offers up to $500,000 in coverage for simplified issue policies, with quick approvals for applicants in early remission

- Best for: Survivors in early remission (1–3 years) seeking moderate coverage without a medical exam

What factors affect life insurance eligibility for breast cancer survivors?

When reviewing life insurance applications from breast cancer survivors, insurers assess a range of medical and personal factors to determine eligibility, premium rates, and policy types. Understanding these key elements can help you better prepare for the application process:

Type and stage of cancer: Early-stage cancers like Stage 0 or Stage 1 (e.g., ductal carcinoma in situ or DCIS) are viewed as lower risk and may qualify for standard policies after about 3 years of remission. In contrast, individuals with Stage 3 or 4 cancer often face longer waiting periods or may only qualify for simplified or guaranteed issue policies. Insurers may request pathology reports to verify cancer type and staging

Treatment history: Localized treatments such as lumpectomy or mastectomy are generally viewed more favorably than systemic treatments like chemotherapy or immunotherapy, which may indicate a more aggressive form of the disease. Completing treatment without complications improves eligibility

Time since treatment: Most insurers require a minimum of 3–5 years of remission for standard life insurance. Some advanced cases may need up to 7 years. The longer you’ve been cancer-free, the lower your risk profile and the better your chances of qualifying for standard rates

Current health: Conditions like diabetes, hypertension, or obesity can affect your eligibility and rates. Clear follow-up medical records, such as recent mammograms or bloodwork showing no recurrence, can support your application

Age and lifestyle: Younger applicants, especially those under 50, often qualify for better rates if their overall health is stable. Lifestyle factors such as being a non-smoker, maintaining a healthy weight, and regular exercise can also reduce premiums. For example, a non-smoker in remission for five years may pay 10–20% less than a smoker with the same history

Family history: A family history of breast cancer, particularly with known genetic mutations like BRCA1 or BRCA2, may prompt more cautious underwriting and potentially higher premiums. However, under Canadian law, insurers cannot require or use genetic test results to deny coverage (as protected by the Genetic Non-Discrimination Act)

What riders should a breast cancer survivor choose with their life insurance plan?

Breast cancer survivors should consider adding the Accelerated Death Benefit Rider, Waiver of Premium Rider, and Critical Illness Rider to their life insurance policy. These riders can provide additional financial protection and flexibility in the event of illness recurrence or treatment-related challenges:

- Accelerated Death Benefit Rider: Allows access to a portion of the policy’s death benefit if diagnosed with a terminal illness, such as advanced-stage cancer. This benefit can help cover medical costs or support living expenses during a critical time

- Waiver of Premium Rider: Waives future premium payments if you become totally disabled due to cancer treatment or related health issues, ensuring your policy stays in force even if you can’t work

- Critical Illness Rider: Pays a tax-free lump sum if you’re diagnosed with a recurrence of breast cancer or another covered serious condition. This money can be used for medical treatments, recovery costs, or other financial needs

Choosing the right life insurance policy: What to expect by breast cancer stage

Understanding how your breast cancer stage affects life insurance eligibility is crucial for making informed decisions about your coverage. Each stage presents different challenges and opportunities when applying for life insurance in Canada.

Stage 0 (DCIS – Ductal Carcinoma In Situ)

Stage 0 breast cancer, also known as DCIS, represents non-invasive cancer cells contained within the milk ducts. This is the most treatable form and receives the most favorable treatment from insurance underwriters.

- Waiting period: 3-6 months after surgical treatment completion

- Rate expectation: Standard or near-standard rates possible

- Timeline to standard rates: As early as 6 months post-surgery

- Coverage availability: Most insurers will consider applications favorably

Best strategy: Apply for traditional underwritten policies after 6-month waiting period

- Primary options: Term life insurance with major insurers (Manulife, Sun Life, Canada Life)

- Secondary options: Simplified issue if traditional underwriting is challenging

- Avoid: Guaranteed acceptance policies (unnecessary given favorable prognosis)

Stage 1 (Early-Stage Invasive Cancer)

Stage 1 breast cancer involves small tumors (typically under 2cm) that haven’t spread to lymph nodes. While requiring more caution from insurers, prospects remain generally positive.

- Waiting period: 2-5 years after treatment completion

- Rate expectation: Standard to slightly rated premiums

- Timeline to standard rates: Typically 3-5 years post-treatment

- Coverage availability: Most insurers will consider after waiting period

Best strategy: Traditional underwriting after 2-3 year waiting period

- Primary options: Major insurers with competitive underwriting (Industrial Alliance, Canada Life)

- Secondary options: Specialized high-risk insurers if declined initially

- Bridge coverage: Simplified issue or group coverage during waiting period

Stage 2 (Moderate Risk Profile)

Stage 2 breast cancer involves larger tumors (2-5cm) or spread to 1-3 nearby lymph nodes. This stage requires more extensive waiting periods and careful underwriting evaluation.

- Waiting period: 5-10 years after treatment completion

- Rate expectation: Rated premiums (25-100% above standard)

- Timeline to standard rates: 5-10 years, depending on specific factors

- Coverage availability: Limited during first 5 years, improving thereafter

Best strategy: Secure interim coverage immediately, apply for traditional coverage after 5+ years

- Immediate options: Guaranteed acceptance or simplified issue policies

- Long-term strategy: Reapply with traditional insurers after 5-7 years

- Bridge solutions: Group coverage through employer, mortgage insurance

Stage 3 (Advanced Local Disease)

Stage 3 involves larger tumors or extensive lymph node involvement but hasn’t spread to distant organs. This stage faces the most restrictive traditional underwriting.

- Waiting period: 10-15 years for traditional coverage

- Rate expectation: Heavily rated or declined for traditional policies

- Timeline to standard rates: Rarely achieved, rated premiums likely permanent

- Coverage availability: Very limited traditional options

Best strategy: Focus on guaranteed acceptance and group coverage

- Primary options: Guaranteed acceptance policies (Humania, Sun Life Financial)

- Secondary options: Group coverage maximization, mortgage insurance

- Long-term consideration: Reassess traditional options after 10+ years

Stage 4 (Metastatic Disease)

Stage 4 involves cancer spread to distant organs or body parts. Traditional life insurance is typically not available, making guaranteed products essential.

- Waiting period: Traditional coverage generally not available

- Rate expectation: Standard rates only through guaranteed acceptance

- Coverage availability: Limited to guaranteed acceptance and some group policies

- Traditional coverage: Extremely rare, typically 15+ years post-treatment if achieved

Best strategy: Immediate focus on guaranteed acceptance policies

- Primary options: Guaranteed acceptance life insurance with graded benefits

- Essential coverage: Maximize employer group coverage

- Alternative solutions: Funeral insurance, mortgage insurance where available

Get affordable life insurance from top Canadian providers!

We understand that navigating life insurance after a breast cancer diagnosis can feel overwhelming. You’re already managing so much, and the last thing you need is additional stress about protecting your family’s future.

That’s exactly why we’re here. Our experienced advisors have helped hundreds of Canadian families in similar situations find the right coverage, whether you’re currently in treatment, recently in remission, or years into your cancer-free journey.

We know the questions to ask, the insurers who truly understand your situation, and most importantly, we know that behind every application is a person who deserves compassionate, expert guidance. You don’t have to figure this out alone.

So, let us help you secure the peace of mind you and your loved ones deserve. Schedule a call with an experienced advisor today and discover how we can help protect what matters most to you.

Frequently Asked Questions

Does life insurance cover breast cancer treatment costs?

No, life insurance does not cover treatment costs. Life insurance pays a lump sum to your beneficiaries after death, while critical illness insurance or health insurance covers treatment expenses. However, some life insurance policies include accelerated death benefits that allow you to access a portion of your death benefit if diagnosed with terminal cancer.

Can I increase my life insurance coverage after breast cancer remission?

Yes, you can typically increase coverage after 3-5 years of remission, but you’ll need to go through medical underwriting again. Some insurers offer guaranteed insurability riders that allow coverage increases without medical exams, but these must be purchased before diagnosis. Consider adding this rider to existing policies for future flexibility.

Will my life insurance premiums decrease as I stay cancer-free longer?

Unfortunately, life insurance premiums are typically locked in when you purchase the policy and don’t decrease based on improved health. However, you may qualify for better rates by applying for a new policy after 5+ years of remission. Consider reviewing your options every few years to potentially secure lower rates.

What happens if my breast cancer returns after getting life insurance?

If your policy is already in force and you’ve passed the contestability period (usually 2 years), your coverage remains valid regardless of cancer recurrence. The insurer cannot cancel your policy or increase premiums due to a recurrence. However, you may have difficulty obtaining additional coverage.

Are there special life insurance programs for cancer survivors in Canada?

Yes, some insurers offer specialized programs for cancer survivors, including group coverage through cancer support organizations. The Canadian Cancer Society partners with certain insurers to offer group life insurance to members. Additionally, some employers have enhanced group life insurance benefits specifically for employees with stable pre-existing conditions.

How do BRCA gene mutations affect life insurance eligibility for breast cancer survivors in Canada?

Under Canada’s Genetic Non-Discrimination Act, life insurance companies cannot require genetic testing or use existing genetic test results to deny coverage or set premiums. However, family history of breast cancer may still be considered during underwriting. If you have a BRCA1 or BRCA2 mutation, focus on insurers with simplified issue policies that ask fewer health questions.

Breast cancer can impact life insurance eligibility in Canada, with options varying based on the stage of diagnosis and treatment history. There are three primary types of life insurance available. Guaranteed issue offers up to $25,000 in coverage with no medical exam required. Simplified issue policies provide up to $500,000 with limited health questions. Standard life insurance offers over $1 million in coverage but involves full medical underwriting. Eligibility depends on several factors, including the stage of cancer, type of treatment received, time since remission, and overall health. Age, lifestyle, and family medical history also influence premium rates. Several Canadian insurers such as Assumption Life, CPP, Manulife and Canada Life, are recognized for their flexible policies for cancer survivors.

Canadian Cancer Society. Cancer Statistics at a Glance. Canadian Cancer Society, last modified May 13, 2024. Accessed July 10, 2025.