- Companies like Manulife, TuGo, Allianz, GMS, MSH International, and Destination Canada provide diverse coverage options tailored for different types of travelers, including seniors, students, families, and frequent flyers

- Standard policies typically include emergency medical treatment, trip cancellations, delays, lost baggage, evacuation, and even COVID-19-related expenses, with optional coverage for adventure sports and accidental death

- There are customized plans for Super Visa applicants, seniors with pre-existing conditions, students studying abroad, and groups or families, offering flexibility and higher protection limits

- Travelers should assess their destination, health needs, trip activities, and budget. Consulting with experts can also help them find a plan with the right coverage at the best value

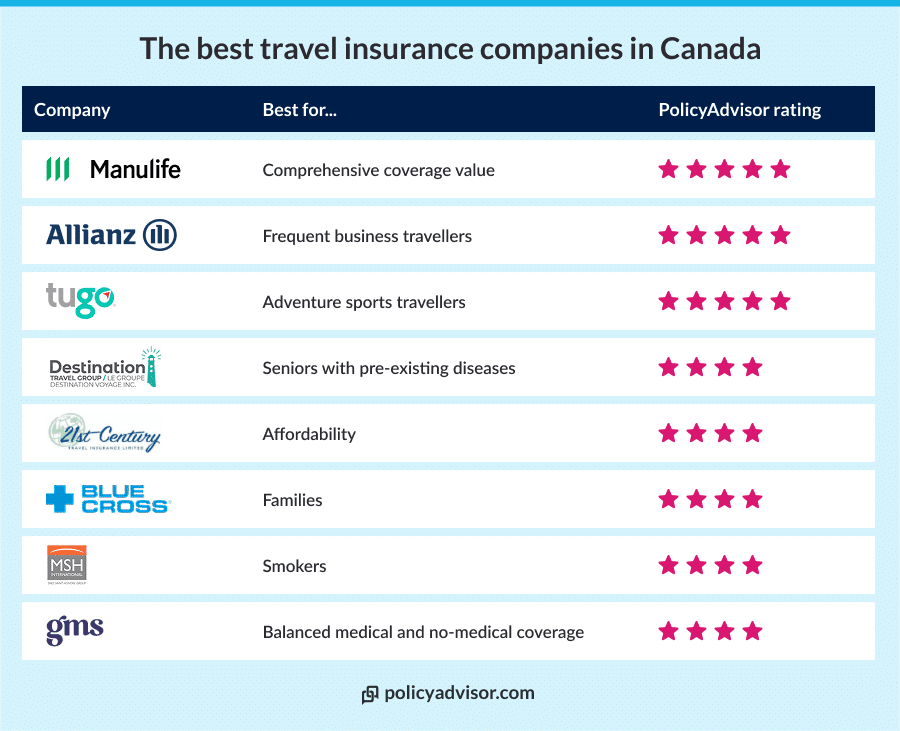

Traveling can come with a lot of risks, along with adventures. Whether you are planning a weekend getaway within Canada or an international journey abroad, securing the right travel insurance is crucial. According to a study by Blue Cross Canada, 51% of people are more likely to buy travel insurance in 2025 than in the previous years. Fortunately, Canadian travellers have a wide range of reputable options when it comes to travel insurance. Here’s a list of the best travel insurance companies in Canada and who they’re best for:

- Best for comprehensive coverage value – Manulife

- Best for families – Blue Cross

- Best for seniors with pre-existing diseases – Destination Canada

- Best for affordability – 21st Century

- Best for frequent business travellers – Allianz

- Best for adventure sports enthusiasts – TuGo

- Best for smokers – MSH International

- Best for balanced medical and non-medical coverage – GMS

What does travel insurance cover in Canada?

Travel insurance policies in Canada usually cover a range of emergency medical services such as emergency hospitalisation, surgery, emergency evacuation, and repatriation. It can also provide coverage in case of trip cancellation and delays, lost or stolen luggage, COVID-19-related emergencies, etc. You may also opt for additional benefits such as accidental death and dismemberment (AD&D), adventure sports coverage, and more.

Travel insurance benefits can be categorized as medical, non-medical, and comprehensive coverage. The most popular ones are highlighted below:

- Emergency medical expenses: Covers the cost of hospitalization, surgery, doctor consultations, and prescription medications during your trip

- Emergency evacuation and repatriation: Pays for transportation to the nearest medical facility or return to Canada in case of severe illness or injury

- Trip cancellation: Reimburses prepaid travel expenses if you need to cancel your trip due to unexpected events like illness or family emergencies

- Trip interruption: Covers additional costs if your trip is cut short because of unforeseen circumstances

- Trip delays: Provides reimbursement for meals, accommodation, and transportation if your travel plans are delayed beyond a specified time

- Lost, stolen, or delayed baggage: Compensates for lost, stolen, or delayed luggage and essential personal items during travel

- Accidental death and dismemberment: Offers financial protection to you or your beneficiaries in case of serious injury or accidental death during the trip

- Adventure sports coverage (Optional): Extends protection for high-risk activities like skiing, scuba diving, or mountain biking, often available as an add-on

- COVID-19 related medical expenses: Covers COVID-19 testing, treatment, quarantine costs, and emergency medical care if contracted during travel

What are the best travel insurance companies in Canada?

Whether you’re travelling solo, with family, or managing health conditions, the right insurer can save you thousands in unexpected costs. Companies like Manulife, Destination Canada, MSH, GMS, Blue Cross, Allianz, TuGo, and 21st Century may be the best choices for you.

Detailed reviews of the best travel insurance companies in Canada

1. Manulife — Best travel insurance for comprehensive coverage value

PolicyAdvisor rating: ★★★★★ (5/5)

Manulife is one of Canada’s largest and most established insurance providers, offering a wide range of travel insurance plans with exceptional medical coverage limits. Whether you’re going on a single trip or travelling frequently, Manulife travel insurance ensures you’re protected with generous benefits and a trusted claims process. Their travel medical insurance plans are particularly ideal for travellers seeking both medical and non-medical coverage, including trip cancellation, interruption, baggage loss, and more.

Key features of Manulife

- Up to $10 million in emergency medical coverage

- All-inclusive packages with trip cancellation, trip interruption, and baggage protection

- Companion discount available for couples

- Multi-trip and single-trip plans are available

- 24/7 worldwide emergency travel assistance

Why PolicyAdvisor recommends Manulife

- Extremely high coverage limit for medical emergencies — ideal for international travel

- Well-rounded protection, combining both medical and non-medical benefits

- Companion discount makes it affordable for couples

- Reliable brand with strong global claim support

2. Blue Cross — Best travel insurance for families

PolicyAdvisor rating: ★★★★ (4/5)

Blue Cross travel insurance is a top choice for Canadian families due to its affordable pricing structure, generous trip duration, and customizable coverage. With one of the lowest price points for family plans, as low as $77 for a family of four, and coverage of up to 180 days per trip on multi-trip policies, Blue Cross offers excellent value for frequent family travellers.

Key features of Blue Cross

- Coverage for a family of four starting at just $77

- Up to 180 days per trip with multi-trip annual plans

- Access to a large healthcare provider network

- Coverage for pre-existing conditions (depending on stability)

- Plans available for individuals, couples, and families

Why PolicyAdvisor recommends Blue Cross

- Unmatched affordability for families travelling together

- Ideal for frequent travel or extended family vacations

- Highly trusted insurer with deep healthcare expertise

- Offers both provincial and cross-border health insurance integration

3. Destination Canada — Best travel insurance for seniors with pre-existing conditions

PolicyAdvisor rating: ★★★★ (4/5)

Destination Canada specializes in travel insurance plans that are tailored to the unique needs of senior travellers, especially those with pre-existing medical conditions. Their policies are ideal for short-term trips, offering flexible underwriting, stable condition coverage, and competitive pricing for those aged 60 and above.

Key features of Destination Canada

- Coverage designed for seniors with medical issues

- Best suited for short-duration travel

- Flexible stability periods for pre-existing condition coverage

- Emergency medical coverage with optional deductibles

- Straightforward claims process for older clients

Why PolicyAdvisor recommends Destination Canada

- Especially suitable for snowbirds, grandparents, and older travellers

- Covers pre-existing conditions with flexible options

- Affordable and less complicated than many senior-focused plans

- Excellent for short trips to the U.S. or within Canada

4. 21st Century — Best travel insurance for affordability

PolicyAdvisor rating: ★★★★ (4/5)

For travellers looking for the most affordable travel insurance without sacrificing essential protection, 21st Century travel insurance offers simple, flexible plans. With options like $50,000 coverage for a $0 deductible or $200,000 with a $500 deductible, it caters to budget-conscious travellers, international students, and working holiday visitors.

Key features of 21st Century

- Emergency medical coverage starting at $50,000

- Higher limits (up to $200,000) available with affordable deductibles

- Optional coverage add-ons for trip interruption, baggage, etc.

- Flexible policy durations and deductible choices

- Easy online quotes and application process

Why PolicyAdvisor recommends 21st Century

- One of the most affordable travel insurance options on the market

- Good choice for travellers who want essential medical protection

- Excellent for students, backpackers, or budget travellers

- Easy-to-understand pricing and straightforward policy options

5. Allianz — Best travel insurance for frequent business travellers

PolicyAdvisor rating: ★★★★★ (5/5)

Allianz is a global leader in travel insurance, well-known for providing tailored coverage to frequent business travellers. With premium multi-trip plans and one of the best business trip travel insurance cancellation/interruption packages, it’s ideal for professionals who can’t afford delays or disruptions in their travel schedule.

Key features of Allianz

- Multi-trip annual plans are suited for frequent flyers

- Comprehensive trip cancellation and interruption coverage

- Optional add-ons for rental cars, baggage, and more

- Access to a global network of medical providers

- Dedicated business travel coverage and concierge services

Why PolicyAdvisor recommends Allianz

- Excellent choice for corporate and business travellers

- Comprehensive protection for expensive or time-sensitive travel

- Global footprint ensures faster claims processing abroad

- Ideal for executives and frequent international flyers

6. TuGo — Best travel insurance for adventure sports enthusiasts and older travellers

PolicyAdvisor rating: ★★★★★ (5/5)

TuGo is renowned for its flexible underwriting and inclusive coverage, especially for adventure travellers and seniors up to age 89. It’s one of the few providers that covers unstable pre-existing conditions, and it includes coverage for activities like skiing, scuba diving, and ziplining.

Key features of TuGo

- Covers most adventure and extreme sports

- Accepts applicants aged 85 and older

- Covers unstable pre-existing conditions (based on questionnaire)

- Comprehensive plans with customizable add-ons

- Emergency evacuation and worldwide assistance included

Why PolicyAdvisor recommends TuGo

- One of the few travel insurance plans in Canada that accepts travellers over 85

- Great for thrill-seekers and people looking to engage in adventure sports

- Covers pre-existing conditions that other plans may exclude

- Offers excellent flexibility for higher-risk travellers

7. MSH International — Best travel insurance for smokers

PolicyAdvisor rating: ★★★★ (4/5)

MSH International stands out by not asking about smoking habits, which can be a huge advantage for smokers who might otherwise face higher premiums or stricter exclusions.

Key features of MSH International

- Does not ask questions about tobacco or nicotine use

- Emergency medical and travel benefits

- Flexible coverage for international travellers and expats

Why PolicyAdvisor recommends MSH International

- Great option for smokers as there are no rate penalties

- Simplified underwriting with fewer personal health questions

- Ideal for both short- and long-term international trips

8. GMS (Group Medical Services) — Best travel insurance for balanced medical and non-medical coverage

PolicyAdvisor rating: ★★★★ (4/5)

GMS provides well-balanced travel insurance with strong medical and non-medical coverage, including options for trip interruption, baggage loss, and flight delay. Their plans are a good middle ground for those who want well-rounded protection without going overboard on premiums.

Key features of GMS

- Comprehensive emergency medical insurance

- Add-ons for trip cancellation, baggage loss, and more

- Plans available for singles, couples, and families

- Customizable deductibles and policy durations

Why PolicyAdvisor recommends GMS

- Great all-in-one solution for general travel needs

- Balanced and comprehensive medical and non-medical protection

- Flexible policy customization

- Strong customer service and claims reliability

What is the cost of travel insurance in Canada?

The cost of travel insurance in Canada depends on several key factors, including the traveler’s age, medical history, duration of travel, and whether coverage for pre-existing conditions is needed. For a 30-day trip with $100,000 in emergency medical coverage, premiums generally range from $70 to $280. Younger travelers in good health tend to pay closer to $70–$100, while older individuals or those requiring pre-existing condition coverage may pay between $180–$280.

Cost of travel insurance in Canada

| Age | Without pre-existing condition coverage | With pre-existing condition coverage |

| 25 | $70 | $100 |

| 35 | $80 | $135 |

| 45 | $95 | $160 |

| 55 | $130 | $180 |

| 65 | $170 | $280 |

*Illustrative rates for a traveller seeking $100,000 in coverage for a 30-day trip

What is the best travel insurance for Canadian seniors?

Seniors often need travel insurance plans that address specific health requirements, such as coverage for pre-existing conditions and emergency care. Destination Canada, Blue Cross, Manulife, and TuGo have comprehensive plans that can be the best suited for seniors.

- Destination Canada: Known for its senior-focused plans, Destination Canada offers flexible stability period requirements for pre-existing conditions and competitive pricing. It’s particularly suitable for travellers aged 60 and above planning short-term trips within Canada or to the U.S

- TuGo: TuGo stands out for covering seniors up to age 89 and for offering protection even for some unstable pre-existing conditions, based on a medical questionnaire. It also includes adventure sports coverage, making it ideal for active seniors who don’t want to compromise on experiences

- Blue Cross: With affordable multi-trip plans and coverage durations of up to 180 days, Blue Cross is a great choice for senior couples or retirees planning extended stays abroad. It also offers coverage for pre-existing conditions and access to a broad healthcare network

- Manulife: For seniors looking for high medical coverage limits and trusted global claims support, Manulife offers plans with up to $10 million in emergency medical coverage. Their comprehensive policies are ideal for international travel and longer vacations

Which are the best travel insurance companies for students?

Students need specialized travel insurance to protect against unexpected medical expenses, trip interruptions, and other emergencies. For a 30-day trip with $100,000 in emergency medical coverage, international students can expect to pay between $40 to $85, depending on the provider and specific plan features. Manulife, TuGo, Allianz, and GMS can be the best travel insurance fit for students.

- Manulife CoverMe is a popular travel insurance choice among students, offering coverage for both emergency and non-emergency medical services, mental health support, and prescription drugs

- TuGo also provides tailored student plans, covering emergency medical care, trip cancellations, and baggage loss, with easy customization options

- Allianz also offers international student plans that cover emergency medical expenses, pre-existing conditions (if eligible), and multilingual support around the clock

- GMS (Group Medical Services) delivers up to $5 million in emergency coverage, along with virtual healthcare access for minor issues

Which are the best travel insurance companies for families or groups?

The best travel insurance companies for families or groups in Canada offer affordable bundled plans, flexible policy options, and broad coverage that can accommodate multiple travellers under one contract. For a family of four planning a 15-day trip to Canada with $500,000 in emergency medical coverage, the total travel insurance cost typically ranges between $300 to $600, assuming all the travellers are in good health.

Companies like Blue Cross, Manulife, and GMS are specifically recommended for their ability to meet the unique needs of families and group travellers.

- Blue Cross: Blue Cross is a top choice for families due to its low pricing and family-friendly coverage options. A family of four can get coverage starting at just $77, with generous trip durations of up to 180 days on multi-trip plans. It also offers customizable coverage, including options for pre-existing conditions, making it ideal for family vacations, school holidays, and reunions

- Manulife: Manulife offers companion discounts that make it cost-effective for couples or small families travelling together. Their all-inclusive plans combine emergency medical coverage with trip cancellation, interruption, and baggage protection, which is essential for families managing multiple travel logistics

- GMS (Group Medical Services): GMS provides a strong balance of medical and non-medical benefits with flexible coverage for groups. Their customizable plans can be tailored based on group size, travel duration, and budget, making them a reliable option for friends, tour groups, or extended families travelling together

Which are the best travel insurance companies for pre-existing conditions?

Travellers with pre-existing medical conditions require insurance that offers flexible and reliable protection. TuGo is one of Canada’s top choices for such travellers, providing comprehensive pre-existing condition coverage.

Some of the key features of TuGo travel insurance plan include:

- Coverage for stable pre-existing conditions: TuGo covers pre-existing conditions that have remained stable for a specified period before the policy’s effective date. The required stability period varies by age and trip length:

- Travellers 59 years and under: 7-day stability period for trips up to 35 days, 90-day stability period for trips over 35 days

- Travellers aged 60-74: 180-day stability period for all trip lengths

- Travellers 75 years and over: 365-day stability period for all trip lengths

- Optional coverage for unstable conditions: For travellers 79 years and under, TuGo offers optional coverage for unstable pre-existing conditions, provided the condition has been stable within the 7 days before the policy’s effective date

- High coverage limits: TuGo provides up to $10 million in emergency medical coverage per person, ensuring substantial protection during travel

- Customizable plans: TuGo’s policies are customizable, allowing travellers to select coverage options that align with their health history and travel requirements

Which is the best travel insurance company for Super Visa applicants?

Super Visa applicants must show proof of private medical insurance from a Canadian provider, and Destination Canada and Manulife are two of the best travel insurance options. Both companies offer policies that meet Super Visa requirements, including a minimum of $100,000 in emergency medical coverage and validity for at least one year.

The cost of Super Visa insurance for a 30-day trip with $500,000 in emergency medical coverage typically ranges from $120 to $600, depending on the applicant’s age, health status, and pre-existing condition coverage.

Destination Canada is known for flexible payment options and competitive pricing, while Manulife offers strong coverage limits (up to $1 million or more) and broad medical support, including for stable pre-existing conditions. Both insurers provide easy extensions and refunds if the visa is denied, making them highly reliable choices for visiting parents and grandparents.

Which is the best travel insurance company for frequent travellers?

Allianz is one of the best choices for frequent travellers, including business professionals and avid tourists. Their annual multi-trip plans cover multiple trips within a year under a single policy, saving travellers both time and money.

Coverage includes emergency medical services, trip cancellation, baggage loss, and travel delays. Allianz plans are flexible, with options to adjust trip duration limits (such as 10, 30, or 60 days per trip) based on individual travel habits.

Their strong global network ensures fast assistance anywhere in the world, making Allianz an excellent choice for Canadians who travel several times a year.

Why is travel insurance important in Canada?

Travel insurance is important for Canadian residents due to a number of factors, including the rising cost of emergency medical care and hospitalizations, frequent travel disruptions, easy refund options, and 24/7 emergency helpline services. Some people may also opt for it because it is mandatory for some visas, such as the Canadian Super Visa.

- Rising medical costs: Healthcare outside Canada can be very expensive. Without insurance, even a short hospital visit could cost thousands of dollars

- Frequent travel disruptions: Flight delays, cancellations, and medical emergencies can happen anytime. Travel insurance protects you from losing money when plans change unexpectedly

- Mandatory by some visas and programs: Certain visas, like Canada’s Super Visa, need proof of private health insurance. Many universities also require students to have travel insurance before they start studying

- Refund options: If you need to cancel or cut your trip short due to illness or emergencies, trip cancellation and interruption insurance can refund your non-refundable costs

- 24/7 emergency help: Most travel insurance plans give you access to 24/7 emergency services. They can help you find medical care, arrange transportation, or manage travel changes when needed

What are the most common travel insurance claims in Canada?

Medical emergencies during a trip can lead to expensive bills, especially if you’re travelling without insurance. The cost depends on the type of emergency and which province you are visiting in Canada. Here’s a general idea of the most common claims made while travelling and their approximate costs:

- Neurological emergencies like seizures and severe migraines: around $37,000

- Heart conditions like heart attacks and irregular heartbeat: around $46,000

- Gallbladder problems like gallstones and infections: around $51,000

- Stroke: around $51,000

- Diabetes-related emergencies: up to $80,000

Who is eligible for travel insurance in Canada?

Travel insurance in Canada is typically for Canadian citizens or residents who are planning to take a trip either within the country or internationally. Permanent residents, international students and workers on a visa, other temporary residents, seniors, and snowbirds can apply for travel insurance in Canada.

- Canadian citizens and permanent residents: Canadian citizens and permanent residents are generally eligible for travel insurance. They can get coverage for trips within Canada or abroad

- International students in Canada: Students studying in Canada can get travel insurance that covers medical expenses, trip interruptions, and other risks during their stay

- Temporary residents and workers: Temporary workers and residents in Canada can also apply for travel insurance

- Seniors and snowbirds: Seniors, especially those traveling long-term or “snowbirding” to warmer climates, are eligible for travel insurance. Many providers offer specialized plans tailored to seniors’ health needs

How to choose the best travel insurance plan in Canada?

Choosing the best travel insurance in Canada can be overwhelming, but understanding your travel needs and the coverage options available is key. Here are some tips to help guide your decision:

- Assess your travel needs: Consider factors like the destination, trip duration, and the activities you’ll engage in. If you’re visiting a country with high medical costs, opt for higher medical coverage

- Consider your health history: If you have pre-existing conditions, look for insurance policies that cover them, such as those offered by TuGo or Manulife

- Compare coverage options: Check the coverage limits for emergency medical, trip cancellation, and baggage loss. Some plans might offer additional perks like trip interruption coverage or adventure sports protection

- Read the fine print: Make sure you understand any exclusions or limitations in the policy, especially concerning high-risk activities or pre-existing conditions

- Consult with a travel insurance advisor: It can be beneficial to consult with an insurance advisor, like those at PolicyAdvisor, who can help you compare plans and find the best coverage suited to your specific needs

Frequently Asked Questions

Can I get travel insurance for a last-minute trip?

Yes, you can get travel insurance for last-minute trips, but it’s always better to purchase it as soon as you book your travel. Many insurance providers, including Manulife and TuGo, offer coverage for spontaneous trips. However, keep in mind that certain benefits, like trip cancellation coverage, may have limitations based on when the insurance is purchased relative to your trip departure.

Can I cancel or modify my travel insurance policy if my plans change?

Most Canadian travel insurance providers allow you to cancel or modify your policy before your trip starts. If you change your travel dates or destination, you can adjust your policy to reflect the new details.

Some providers may offer a refund if you cancel within a specific timeframe, while others may charge a cancellation fee. It’s important to review your policy’s terms and conditions to understand the rules around modifications or cancellations and to avoid losing money.

How can I find cheaper travel insurance in Canada?

To find cheaper travel insurance in Canada, it’s best to shop around and compare quotes from various insurers. Adjusting your coverage levels can also help reduce costs; for example, opting for a higher deductible can lower your premium.

Additionally, consider policies with fewer add-ons or coverage options you may not need. Some providers also offer discounts for booking early, traveling with a companion, or buying multi-trip coverage. Using comparison websites like PolicyAdvisor can help you find the most affordable options tailored to your needs.

Does travel insurance cover flight cancellations due to weather?

Travel insurance typically does not cover weather-related cancellations unless you have specific trip interruption coverage. Some companies, like Allianz, may include coverage for trip delays and interruptions caused by weather, but this depends on the plan.

If you’re concerned about weather-related issues, look for policies that explicitly include coverage for such delays or interruptions.

Travel insurance is important for Canadians to protect against medical emergencies, trip cancellations, and unexpected disruptions while traveling domestically or internationally. In 2025, the best travel insurance companies in Canada include Manulife, TuGo, GMS, Allianz, MSH International, and Destination Canada. Each company offers specialized plans for seniors, students, families, and frequent travelers. Coverage typically includes emergency medical care, evacuation, trip interruption, baggage loss, and optional add-ons like adventure sports coverage. Super Visa applicants can rely on Destination Canada and Manulife for compliant insurance. Choosing the right policy involves assessing your travel needs, comparing options, and considering expert guidance.

Blue Cross. 2025 Blue Cross Travel Study Report. February 2025

https://www.bluecross.ca/wp-content/uploads/2025/02/2025-Blue-Cross-Travel-Study-Report.pdf.