- Visitors to Canada insurance is essential for visitors on a visit visa, parents visiting on Super Visa, international students, work permit holders, new immigrants on PR, and returning Canadians

- Canadian visitors insurance plans typically cover a range of medical expenses, including hospital stays, emergency medical transportation, and outpatient care

- The average cost of visitor health insurance for travellers to Canada typically ranges from $50 to $400 per month, depending on factors such as age, duration of stay, and the level of coverage chosen

- The Canadian government recommends at least a $100,000 coverage amount for visitors to Canada insurance plans

Canada continues to welcome a growing number of international visitors every year. According to Statistics Canada, over 2.4 million international visitors travelled to Canada in the third quarter of 2024 alone, marking a 3.5% increase from the same period in 2023. While Canada’s provincial healthcare system is world-class, it does not cover visitors travelling from other countries. This is where visitor to Canada insurance comes in!

Without visitor health insurance, even a visit to the doctor or a walk-in clinic could be anywhere from $100 to $600, while an emergency room or hospitalization could be as high as $6,000 per day! In this blog, we’ll explain why visitor medical insurance matters, what it covers, how much it costs, and how to choose the right plan for your stay.

What is visitor to Canada insurance?

Visitor health insurance provides financial protection for anyone travelling to Canada who doesn’t qualify for the country’s public healthcare system. Tourists, international students, foreign workers, family members on extended visits, and Super Visa applicants all face the risk of high medical expenses without insurance. Canadian healthcare does not cover visitors, so even a minor illness or injury can lead to costly medical bills.

Visitor health insurance typically includes emergency medical care, doctor consultations, diagnostic tests, prescription medications, ambulance services, repatriation benefits, accidental death & dismemberment (AD&D) coverage, and more.

When you buy travel health insurance, you secure access to essential medical care during your stay and avoid unexpected out-of-pocket expenses. Insurers design these plans to cover a wide range of emergency medical services, giving you peace of mind while you’re in Canada.

What are the types of visitor insurance in Canada?

Visitor insurance in Canada plans typically have three major coverages: medical insurance for visitors to Canada, trip cancellation and interruption insurance, and Super Visa insurance.

Medical insurance for visitors to Canada covers eligible emergency health emergencies that a non-resident might develop during their trip to Canada.

Trip cancellation and interruption insurance offers financial protection and refunds in case of trip cancellation or modification due to any unforeseen circumstances.

Super Visa insurance is a specialized product that covers parents and grandparents of Canadian citizens and permanent residents who are visiting Canada for a minimum of 12 months and a coverage of at least $100,000.

What does visitor medical insurance in Canada cover?

Visitor insurance in Canada protects travelers from unexpected medical expenses during their stay, such as doctor visits, diagnostic tests, paramedical services, ambulance services, and more.

Here’s what most visitor emergency insurance plans cover:

- Consult doctors and physicians: Insurers pay for medical consultations and, in some cases, follow-up visits if a doctor deems them necessary

- Prescription coverage after emergencies: Insurance covers the cost of prescription medications when a licensed physician prescribes them for an emergency

- Diagnostic tests: Plans cover lab tests, blood work, X-rays, CT scans, and MRIs required to treat a medical emergency

- Paramedical services: Policies reimburse the cost of treatment from licensed professionals such as physiotherapists, chiropractors, podiatrists, or massage therapists

- Care for pre-existing conditions: Some plans include limited coverage for stable pre-existing conditions, allowing visitors with ongoing health issues to receive treatment when needed

- Emergency dental treatment: Insurers cover dental care costs if a sudden accident or injury causes the need for emergency dental work or oral surgery

- Ambulance services: Visitor insurance plans pay for ground or air ambulance transportation to the nearest hospital in case of a medical emergency

- Repatriation: Insurance covers the cost to return the visitor to their home country due to a serious illness, injury, or death

- Extended stay expenses: If a doctor advises the visitor to remain in Canada longer than planned, insurance reimburses costs for hotels, meals, and local transportation

- Temporary childcare: Plans pay for temporary childcare if a hospitalized visitor cannot care for a dependent child

- Trip breaks or side trips: Some policies let visitors take short trips to another country or their home country without cancelling or interrupting their medical coverage

What are some common exclusions to visitor insurance in Canada?

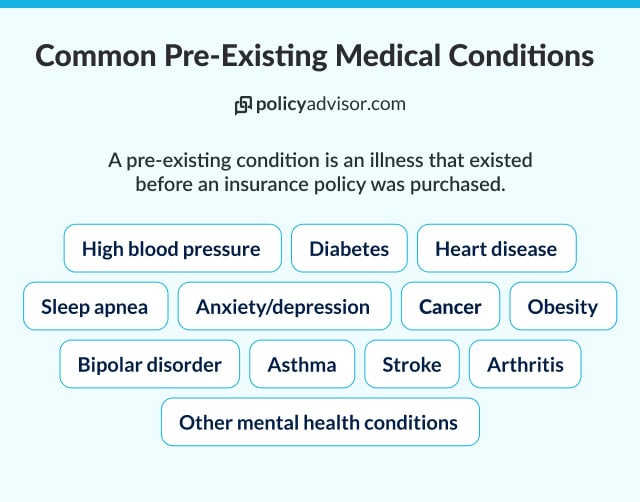

Most medical insurance plans for visitors to Canada have some common exclusions. They do not cover pre-existing conditions, pregnancy, mental health conditions, high-risk adventure activities, and anything that falls outside the Usual, Customary, and Reasonable (UC&R).

Common exclusions to a visitor insurance plan

| Exclusion | Details |

| Pre-existing conditions | Any unstable pre-existing condition |

| Non-emergency procedures | Planned surgeries, elective treatments, routine check-ups, alternative medication, and preventive care |

| Diagnostic tests | Diagnostic tests such as magnetic resonance imaging (MRI), computerized axial tomography (CAT) scans, ultrasounds, biopsies, etc. are only covered in extreme emergencies and must be pre-authorized |

| Pregnancy and maternity care | Pregnancy and maternity care are not included in visitor to Canada insurance plans. Some insurers may offer pregnancy care only under an extreme emergency |

| Mental health conditions | Mental health services, including counselling, therapy, and psychiatric care, and any ongoing treatment for mental health conditions are often excluded from visitor insurance policies |

| Drugs and alcohol related illness or injury | Incidents or illnesses resulting from chronic usage of drugs, alcohol, or other narcotics are generally excluded from visitor insurance coverage |

| High-risk activities | High-risk activities such as extreme sports (skydiving, scuba diving, bungee jumping), motor racing, and mountaineering are often excluded from visitors’ insurance coverage. Tugo is the only insurance provider that offers a Sports and Activities Coverage add-on that can provide substantial coverage if you participate in some risky activities |

| Self-inflicted injuries | Self-inflicted injuries, including those resulting from attempted suicide or any form of self-harm, are typically excluded from visitor insurance policies |

| Anything outside the usual, customary, and reasonable | Insurance companies maintain a database of UC&R for various provinces and review the claims based on it. If the claim is excessively higher than the standard cost of the treatment, they will not provide coverage for it |

| War and terrorism | Injuries or illnesses resulting from acts of war or terrorism are not covered |

| Aviation-related injuries | Any death or injury sustained while piloting an aircraft, learning to pilot an aircraft, or acting as a member of an aircraft crew is excluded |

| Injury or illness due to non-compliance with prescribed treatment | Not following recommended or prescribed therapy or treatment can void coverage |

| Side-trip against travel advisories | If an insured non-resident takes a side trip to a country that the Canadian government has issued a travel advisory for, any illness or injury as a result of that trip will not be covered under a visitor to Canada insurance plan |

Note: Insurance providers have their lists of exclusions to a visitor in Canada insurance plan. It is important to read your policy document carefully to ensure compliance.

Who needs visitor health insurance in Canada?

Any non-resident in Canada, including those visiting relatives, tourists, foreign workers, international students, and returning Canadians, need visitor health insurance. Such a policy will ensure they are protected against significant costs associated with any medical emergency during their trip.

Visitor insurance for international students in Canada

Insurance providers such as Secure Travel (RIMI), Tugo, and Travelance offer customized visitor insurance plans for international students on student visas in Canada. The cost of visitor insurance for international students in Canada ranges between $50 and $120. These prices are for a 30-day trip with $100,000 in coverage, depending on age and health. To get a student’s visitor insurance policy, applicants must be:

- Residing in Canada on a temporary basis

- Ineligible for benefits under a government health plan

- A student with proof of full-time admission in a recognized Canadian institution of learning; or

- A student completing postdoctoral research in a recognized Canadian institution of learning; or

- The spouse or dependent child of the insured student and residing with them on a full-time basis; or

- The parent, legal guardian, teacher, or chaperone of the insured student

Visitor insurance to Canada plans for students cover everything that a medical insurance visitor plan covers. Some insurers, such as Secure Travel (RIMI), also include coverage for emergency psychiatric care, trauma counselling, sexual health consultation, and tutorial services in case of illness as part of their student visitor to Canada plans.

Visitor health insurance for foreign workers in Canada

Foreign workers on a work permit who are not covered under any government health plan or an employer-sponsored plan can benefit greatly from a health insurance for visitors to Canada policy. The cost of visitor health insurance for foreign workers in Canada typically ranges between $70 and $150 per month. These prices are for a 60-day trip with $100,000 in coverage.

Visitor insurance in Canada is especially important for:

- Workers who have just arrived in Canada and are yet to receive provincial healthcare benefits

- Those whose work permits may have expired but they haven’t left Canada yet

- Workers who are in the process of getting their work permit renewed

Visitor insurance for returning Canadians

Canadians who have been living outside Canada for more than six months usually end up losing their provincial healthcare benefits. When they return to Canada, their government health coverage takes up to 2-3 months to be reinstated. This usually happens in provinces like Ontario, British Columbia, and Quebec. For a 60-day stay with $100,000 in emergency medical coverage, the cost of visitor insurance for returning Canadians ranges between $60 and $130 per month.

During the waiting period, returning Canadians can benefit greatly from a visitor’s insurance plan to cover unexpected medical costs.

Canadians who move from one province to another also lose access to their government health benefits temporarily. Visitor to Canada plans can help them manage emergency medical conditions.

Insurance for parents and grandparents of Canadian citizens

Super visa insurance is a special type of visitor health insurance that’s only available to the parents and grandparents of Canadian citizens or residents who are staying in the country for a long period of time. This health insurance covers any medical emergencies that happen during the visitor’s stay in Canada. For a 30-day trip with $100,000 in emergency medical coverage, Super Visa insurance costs typically range between $110 and $250.

The minimum requirements a super visa insurance policy has to meet are:

- Must be valid for at least one year from the date the visa holder arrives in Canada

- Must have at least $100,000 in coverage

- Must cover emergency medical care, possible hospitalization, and repatriation

- Must be active and available for review by an immigration official each time the visa holder enters Canada

- Must have been bought from a Canadian insurance company

Can I buy visitor insurance after arriving in Canada?

Yes, you can buy visitor insurance after you arrive in Canada, but most insurers apply a waiting period for illness coverage, usually between 48 hours and 8 days. During this time, the policy won’t cover any medical treatment related to illnesses. However, insurers start coverage for accidental injuries immediately once you purchase the policy.

Insurers also set a purchase window, typically requiring you to buy the policy within 30 to 45 days of your arrival. If you wait too long, you may not qualify for coverage or may face longer waiting periods and limited benefits. To avoid coverage gaps and delays, it’s best to buy your insurance as early as possible, ideally before you land in Canada.

How much does visitor health insurance cost in Canada?

The average cost of visitor health insurance for travellers to Canada typically ranges from $50 to $400 per month, depending on factors such as age, duration of stay, and the level of coverage chosen. For instance, younger travellers (under 40 years) may pay between $50 and $100 monthly, while those aged 70 years and older may see costs rise between $200 and $400 per month.

Factors that can influence the cost of medical insurance for visitors to Canada include:

- Age: Younger travellers (under 40) can expect to pay lower premiums as they are considered lower risk for health issues

- Pre-existing conditions: If you have pre-existing medical conditions, you will have to get a plan with coverage for pre-existing conditions. These plans are more expensive than plans without pre-existing conditions. Some insurers may charge a higher premium for pre-existing conditions plans, while others might exclude these conditions altogether

- Length of stay: The longer you stay in Canada, the higher the cost of insurance

- Coverage amount: Policies with lower coverage (e.g., $50,000) are more affordable but may not cover all potential medical expenses. Higher coverage limits (e.g., $100,000 or more) offer more extensive protection but come with a higher premium

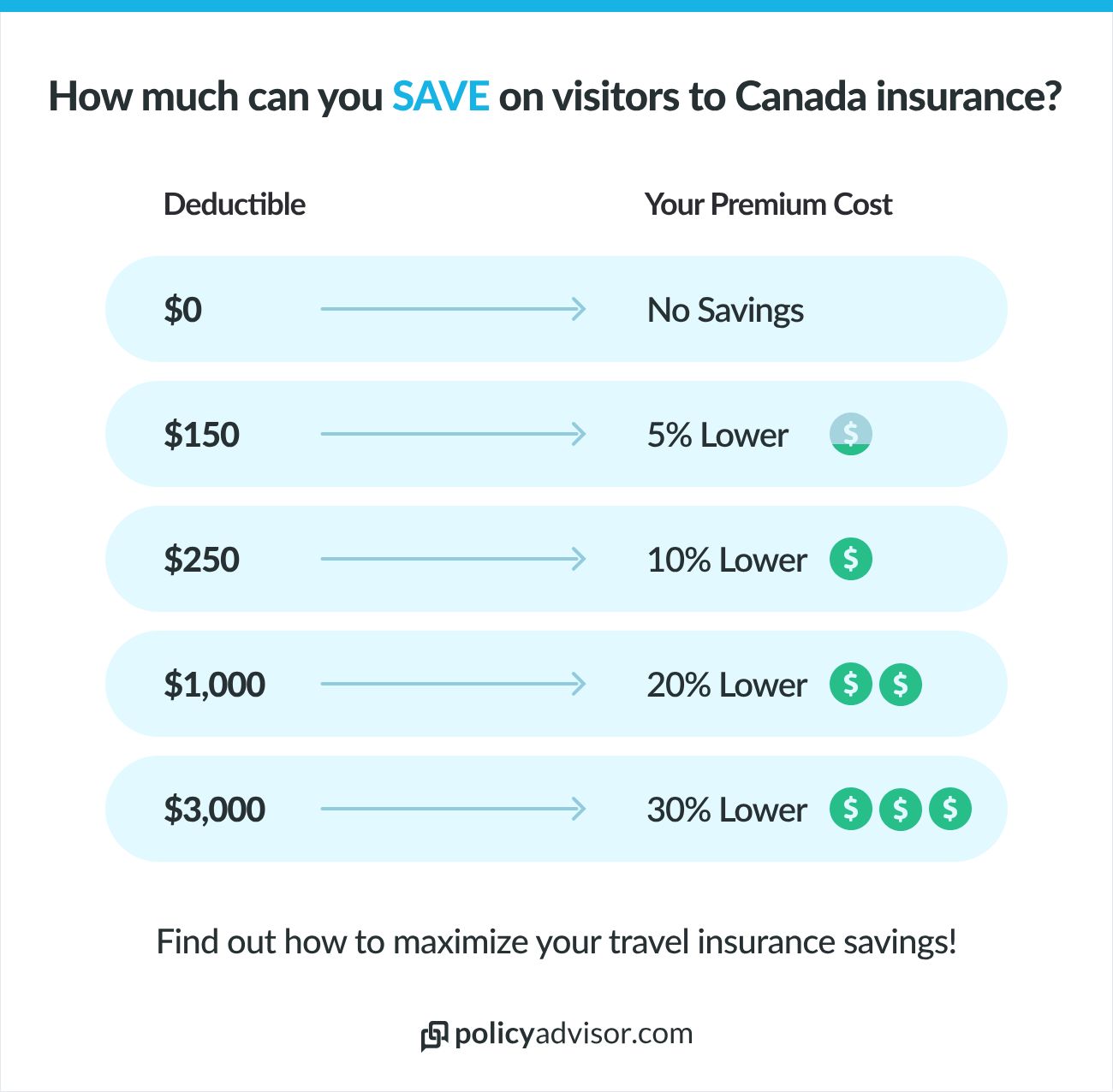

- Deductibles: High deductibles will have lower premiums and lower deductibles will lead to high premiums

How much coverage should I get for visitors to Canada insurance?

The Canadian government recommends at least a $100,000 coverage amount for visitors to Canada insurance plans. Healthcare in Canada is expensive—a visit to the doctor or a walk-in clinic could be anywhere from $100 to $600, while an emergency room or hospitalization could be as high as $6,000.

Getting adequate medical insurance for visitors to Canada coverage will help non-residents avoid paying out-of-pocket costs for emergency medical treatment.

What is a deductible for visitors’ insurance?

A deductible is the amount you need to pay out-of-pocket for your medical expenses before your insurance starts covering the costs. For example, if your deductible is $500, you’ll need to pay the first $500 of your medical bills yourself. After you’ve paid this amount, your insurance will begin to cover the remaining eligible costs according to the terms of your policy.

How can I get a cheaper visitor to Canada insurance?

Opting for plans with a higher deductible or lower coverage amount can lower premiums for a visitor in Canada policy. However, the downside is that you will have to pay the deductible amount for every emergency treatment and a lower coverage will not cover in case of a high cost medical emergency .

You can also opt for a monthly payment plan that offers more flexibility since you have to pay the premium every month instead of a lump sum amount. This can help tourists in Canada who are on a tight budget for their trip.

Which are the best visitor health insurance companies in Canada?

Several reputable companies offer emergency medical insurance for visitors to Canada. They also offer a wide range of plans to suit tourists, Super Visa applicants, international students, and family members. Companies such as Manulife, Travelance, GMS, 21st Century, and Tugo etc are among the top visitor insurance providers.

Here are some of the best visitor insurance companies in Canada:

- Manulife: Manulife offers comprehensive visitor health insurance with high coverage limits and optional add-ons, including pre-existing condition coverage

- Travelance: Travelance provides affordable, flexible plans for both short-term visitors and Super Visa applicants, including options with no medical questionnaire for certain age groups

- GMS (Group Medical Services): GMS specializes in simple, easy-to-understand coverage for emergency medical care and also offers plans for dependents

- DestinationCanada: Destination Canada’s Visitor to Canada plans offer generous coverage for emergency services and include travel assistance benefits

- 21st Century: Known for competitive pricing and strong Super Visa options, 21st Century also offers plans with stable pre-existing condition coverage

- Secure Travel (RIMI): Secure Travel, underwritten by Reliable Life Insurance (RIMI), delivers customizable plans tailored for longer stays and family visits

- Allianz: Allianz offers strong international support and flexible visitor plans, especially for those with complex itineraries

- TuGo: TuGo provides easy-to-purchase visitor insurance with multilingual support and plans tailored to students, tourists, and Super Visa holders

How can I pay for Canadian visitors’ insurance?

You can pay the premium amount for visitors to Canada insurance policy in two ways: full upfront payment and monthly payment plan.

Upfront payment is straightforward, as you make a single payment at the start, which covers you for your entire trip to Canada. Many people prefer this method for its simplicity and convenience, as it eliminates the need for recurring payments and ensures uninterrupted coverage.

Monthly payment plans spread the cost of the insurance over several months. This option can be more manageable for those on a budget or with a limited cash flow, as it breaks down the total premium into smaller, more affordable installments. Insurers usually require a credit card on file for monthly payments.

Do visitors get free healthcare in Canada?

No, visitors do not get free healthcare in Canada. Although Canada has a public healthcare system, it does not extend to foreigners and non-residents visiting the country. Visitors are required to pay out-of-pocket for any medical services they may need during their stay unless they have purchased visitor medical insurance.

Without insurance, healthcare costs in Canada can be substantial — a visit to the doctor or a walk-in clinic could be anywhere from $100 to $600, while an emergency room or hospitalization could be as high as $6,000 per day!

How long do you have to live in Canada to get free healthcare?

You can receive provincial coverage after living in Canada for about three months. To qualify for free healthcare in Canada, you typically need to be a permanent resident or a citizen. After obtaining permanent residency, you can access public healthcare services as soon as you register with your provincial or territorial health insurance plan. This registration process may vary by province. During this waiting period, it is advisable to have private health insurance to cover any unexpected medical costs.

Is visitors’ insurance in Canada refundable?

Yes, in most cases, you can cancel your visitor health insurance policy and receive a refund. However, the specifics will depend on your insurance provider’s policies.

If you need to cancel your policy before coverage begins, you’re usually entitled to a full refund of the premium you paid. All policies from Canadian insurers come with a 10-day free-look period, during which you can cancel and get a full refund for any reason.

If you cancel after those 10 days, refunds are typically only given in certain cases: if your entire trip is cancelled before you arrive in Canada, if your visa is denied, if you become ineligible under the policy, or if you pass away.

Can I extend a visitor in Canada insurance plan?

Yes, you can extend a visitor in Canada insurance plan in case you are increasing your trip duration. Extending your coverage may cost extra, with premiums varying based on the extension’s duration, your age, the coverage amount, and the deductible terms.

To extend a visitors in Canada policy you must meet the following criteria:

- No claims have been submitted or intend to be submitted

- Request for extension is made before the expiration of the current policy

- Insured remains eligible for insurance, meaning they are in good health/no change in health status and are not experiencing any symptoms or planning to seek treatment during the new coverage period

- Age at the start date of extension would not make the traveller ineligible for insurance with the respective company

- Limits on the total period of coverage from the effective date of the original policy—including extensions—may also be placed by insurers, such as 1 year for GMS or 2 years for Tugo

- The required premium for the additional period of coverage is paid

Can I get health insurance as a visitor in Canada?

Any non-resident who is visiting Canada can get a health insurance for visitors to Canada insurance plan. International students, returning Canadians, and foreign workers who are yet to receive provincial healthcare benefits are also eligible for medical insurance for visitors in Canada.

Can a visitor in Canada see a doctor?

Yes, visitors in Canada can see a doctor, either in a hospital or a clinic. However, doctor visits are expensive, sometimes going upwards of $300. Medical insurance for visitors in Canada covers the cost of a visit to a doctor.

How can I see a doctor in Canada without insurance?

If you do not have insurance and want to see a doctor in Canada, you can simply visit the emergency room of your nearest hospital or a walk-in clinic. Hospitals in Canada are legally required to provide medical care regardless of a patient’s insurance or immigration status.

You can also choose to visit a pharmacy to purchase over-the-counter medicines and if you can afford it, you can go to a private practitioner who may accept cash. However, keep in mind that costs can greatly vary and healthcare in Canada is generally expensive, especially without visitor insurance.

Can I get insurance for visitors to Canada with a pre-existing condition?

Yes, you can get travel insurance for visitors to Canada with pre-existing health conditions. Although all insurance companies in Canada provide the pre-existing policy option, coverage may be limited.

Most companies offer two variants of policy options – one that includes pre-existing illness coverage and one that doesn’t. This ensures that young and healthy individuals can opt for visitor health insurance without pre-existing condition coverage, which has lower premiums compared to the policies covering pre-existing conditions.

However, some companies such as Allianz, GMS, Tugo, Blue Cross, and MSH International only offer visitor medical insurance with an in-built pre-existing condition coverage.

Can I pause a visitor’s insurance plan to travel back home?

Yes, you can pause a visitors to Canada insurance plan and temporarily return to your home country. This is known as a “trip break” and nearly all insurers, except GMS, allow you to pause your plan. In such cases, the policy will not terminate, but rather coverage will be suspended with no claims payable for any incidents in the insured’s home country.

It is important to note here that suspension does not mean that the clock on the policy will be paused—only coverage will be paused while the policy period will continue. In the case of a monthly payment plan, payments will continue to be made while the policy continues, even though coverage is suspended.

Can I take side trips or travel to another country on my visitor insurance?

Yes, you can take side trips and travel to another country, excluding your country of origin, while on a visitors insurance, provided your plan covers side trips. Most insurers need your side trip to originate and terminate in Canada.

Insurers such as Manulife cover side trips that do not exceed 30 days per policy or 49% of the total number of coverage days. If you take a side trip that is longer than what is permitted, your policy will be suspended while you are out of Canada. Once you return, your coverage will resume.

Do travel advisories or country restrictions affect my visitor insurance?

Yes, official travel advisories affect the side trip component of a visitors to Canada plan. Side trips are when non-residents travel outside Canada, apart from their country of origin. If you travel to a country outside Canada for which the Canadian government has issued a travel warning or advisory, you will not be covered for any illness or injury that may have occurred in that region. In some cases, your policy might be terminated if you travel to a country for which the government has issued an advisory.

How to get the best visitor insurance quotes in Canada?

To find the best visitor insurance quotes in Canada, you need to compare multiple plans based on your age, trip duration, medical needs, and visa requirements. Instead of navigating dozens of options on your own, let a licensed advisor guide you.

At PolicyAdvisor, we work with 30+ top Canadian insurers to help you compare rates, understand coverage details, and find the right plan for your situation, whether you’re visiting for a few weeks, applying for a Super Visa, or hosting family members. Speak with one of our expert insurance advisors today to get customized visitor insurance quotes and safeguard your travel to Canada.

Frequently Asked Questions

Do visitors’ insurance plans require a medical examination?

No, visitors’ insurance plans typically do not require a medical examination. Insurers may require a health questionnaire or declaration about pre-existing conditions, which helps them assess risk and determine coverage options.

Can I visit Canada without health insurance?

Yes, you can visit Canada without health insurance for visitors. But it is highly recommended that you get a visitors insurance plan to avoid paying exorbitant amounts for emergency medical treatment while you are in Canada.

Can non-Canadian residents get free healthcare?

No. Non-residents in Canada do not have access to provincial healthcare. Only citizens and permanent residents are covered under Canada’s provincial healthcare.

Which is the best visitor insurance company in Canada?

Manulife, Tugo, GMS, Destination, Allianz, 21st Century, Secure Travel and Travelance are some of the top insurance companies in Canada that offer visitors to Canada insurance plans.

Visitor insurance is designed to offer emergency medical coverage for individuals visiting Canada, including tourists, international students, and temporary workers. Plans typically cover a range of medical expenses, including hospital stays, emergency medical transportation, and outpatient care. Some policies may also include additional benefits like trip cancellation, lost baggage, and personal liability coverage.

Statistics Canada. “Visitor Travel Survey, Third Quarter 2024.” The Daily, February 28, 2025.